Table Of Content

- Top Payment Gateways in India – 2025 Overview

- Razorpay

- Key Features

- Pricing & Fees (2025)

- Best For

- PhonePe Payment Gateway

- Key Features

- Pricing & Fees (2025)

- Best For

- Paytm for Business

- Key Features

- Pricing & Fees (2025)

- Best For

- Instamojo

- Key Features

- Pricing & Fees (2025)

- Best For

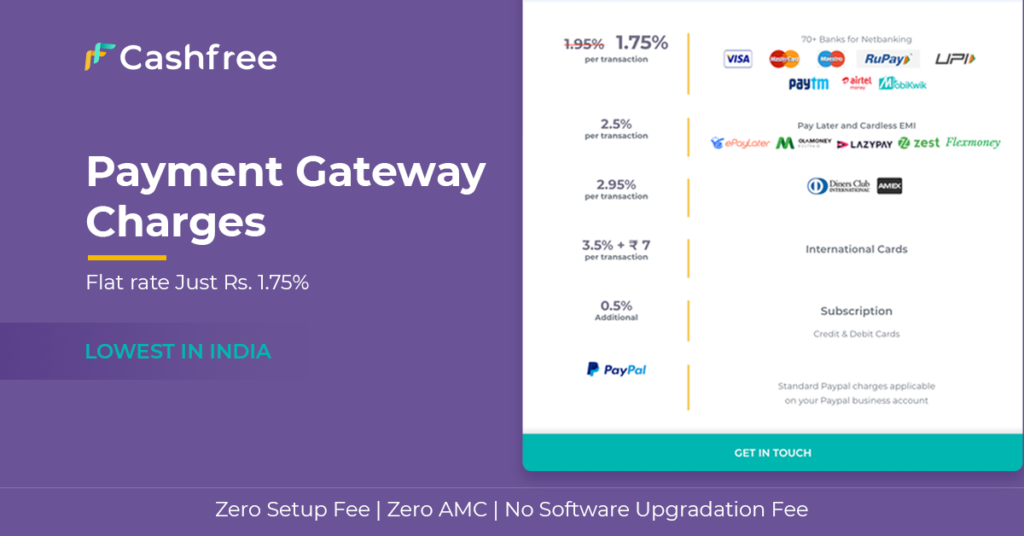

- Cashfree Payments

- Key Features

- Pros & Cons

- Pricing & Fees (2025)

- Best For

- CCAvenue

- Key Features

- Pros & Cons

- Pricing & Fees (2025)

- Best For

- PayU Payment Gateway

- Key Features

- Pros & Cons

- Pricing & Fees (2025)

- Best For

- Stripe Payment Gateway

- Key Features

- Pros & Cons

- Pricing & Fees (2025)

- Best For

- BillDesk Payment Gateway

- Key Features

- Pros & Cons

- Pricing & Fees (2025)

- Best For

- Juspay Payment Gateway

- Key Features

- Pros & Cons

- Pricing & Fees (2025)

- Best For

- The “Hidden Cost” Reality Check

- The Ultimate Payment Gateway Negotiation Playbook

- Script A: For Razorpay/PayU (Volume <₹10L/month) (Copy/Paste this email)

- Script B: For Enterprise (Volume >₹20L/month) (Use for BillDesk/CCAvenue)

- Tier 2/3 Case Study: The “Voice UPI” Revolution

- CBDC Compliance Checklist (2025 Rules)

- Frequently Asked Questions (FAQ)

- Which payment gateway settles funds the fastest?

- Is UPI really free for businesses?

- What is the best gateway for international payments?

- Conclusion: Stop Letting Gateways Eat Your Profit

After processing ₹2.3 Crore through 8 different payment gateways in my artisan e-commerce business, I discovered the brutal truth most “review sites” won’t tell you:

“Your payment gateway isn’t just a tool – it’s a silent profit eater that can drain 37% of your margins if chosen wrong.”

Last Diwali season, I watched a brilliant Jaipur handicraft seller I mentor through my role with NITI Aayog ATL lose ₹1.7 lakh overnight. It wasn’t due to poor sales. It was due to Razorpay’s hidden cross-currency fees and Paytm’s settlement delays during the festive rush.

The 2025 Reality for Indian Sellers:

- “Zero-fee UPI” is a myth: There are 11 hidden costs (I’ll expose them below).

- RBI Tokenization: These new rules are crippling unprepared businesses.

- The Tier-2 Gap: Village sellers are being exploited by “metro-first” gateways that don’t understand rural trust.

In this guide, I am not giving you marketing brochures. I am sharing 2025’s REAL fee structures, the negotiation scripts I use to slash charges by 40%, and the Tier 2/3 hacks that work in villages where 4G is spotty.

This isn’t theoretical – it’s battle-tested across 1,000+ mentees. Let’s reclaim your margins.

| If you are… | The Best Choice | Why? (The Founder’s Truth) |

| Tech Startup / SaaS | Razorpay | Best API documentation, but watch out for international fees. |

| Tier 2/3 D2C Brand | PhonePe | Highest UPI success rate in “Bharat” markets (99%+). |

| Freelancer / Solopreneur | Instamojo | No website needed. Just create a link and get paid. |

| High Volume Enterprise | JusPay | Not a gateway, but an orchestrator. Essential for optimizing success rates. |

| Global Exporter | Stripe | Expensive (3%+), but the only one that handles US/EU cards reliably. |

Top Payment Gateways in India – 2025 Overview

Let’s explore the top contenders one by one.

Razorpay

Razorpay has quickly become a top choice for Indian startups and online businesses, thanks to its developer-friendly platform, wide range of integrations, and modern, intuitive dashboard. Launched in 2014, Razorpay is now trusted by over a million businesses and offers much more than basic payment processing — including subscriptions, smart routing, invoicing, and even working capital solutions.

Key Features

- Supports 100+ payment modes: UPI, credit/debit cards, net banking, wallets, EMI, BNPL.

- Instant onboarding: Businesses can start collecting payments within minutes.

- Powerful APIs: Ideal for developers building custom checkout experiences.

- Smart payment routing: Increases success rate by rerouting failed payments in real-time.

- Subscription billing: Automatically charge customers on a recurring basis.

- RazorpayX: Add-on service for payouts, salary disbursements, and vendor payments.

- Integration: Native support for Shopify, WooCommerce, Magento, and custom apps.

Pros & Cons

Pros:

- Easy to integrate with most platforms

- High success rate, especially on UPI

- Real-time dashboard and analytics

- Extensive documentation for developers

- Robust ecosystem (payouts, subscriptions, lending)

Cons:

- Customer support can be slow during peak periods

- Slightly higher charges for international cards

- Refund settlements can take 5–7 days

Pricing & Fees (2025)

- UPI: 0% (Zero charges)

- Credit Cards: 2%–2.5%

- Net Banking: 1.5%

- Wallets & EMI: 2.5%

- International Cards: 3%

- Settlement Cycle: T+2 days (can vary)

Note: No setup fee or annual maintenance charge.

Best For

- Tech-savvy startups and D2C brands

- Businesses needing recurring billing or custom workflows

- High-growth eCommerce companies using platforms like Shopify or WooCommerce

Check out Razorpay Here

PhonePe Payment Gateway

PhonePe, India’s leading UPI-based payment platform, has now entered the business payments space with PhonePe Payment Gateway. Backed by the trust of 500M+ app users and deep penetration in Tier 2/3 India, PhonePe offers a reliable and familiar checkout experience for customers. For businesses, it combines simple onboarding with high UPI success rates and minimal transaction failures.

Key Features

- Deep UPI focus: Built natively for UPI, ensures 99%+ success rate on payments.

- Single SDK for mobile and web: Easy to integrate across devices.

- Instant settlements: Money is settled to merchant account faster than most gateways.

- User-friendly interface: Familiar checkout UI improves trust and reduces cart drop-offs.

- QR Code & offline payments: Available for blended (online + offline) businesses.

- Analytics & reporting: Simple dashboard for payment tracking.

Pros & Cons

Pros:

- Excellent UPI success rate (among the highest in India)

- Leverages PhonePe’s trusted brand and user base

- Easy onboarding and quick setup

- Mobile-first design; great for app-based businesses

- QR code support for offline integration

Cons:

- Limited support for international payments

- Fewer developer APIs than Razorpay or Stripe

- Not ideal for businesses needing complex billing workflows

Pricing & Fees (2025)

- UPI Payments: 0% (No transaction charges for most merchants)

- Cards & Wallets: ~2%

- Settlement Cycle: Often same day or T+1

- No setup or maintenance fees

Pricing may vary based on business type and volumes.

Best For

- UPI-dominant transaction models

- Indian mobile-first startups and apps

- Tier 2/3 focused eCommerce or local brands

Check out PhonePe here

Paytm for Business

Paytm is a household name in India, best known for revolutionizing digital payments post-demonetization. Beyond its consumer app, Paytm offers a robust payment gateway trusted by millions of merchants. It combines a massive user base, deep UPI integration, and a wide range of services — from payment collection to marketing tools and loyalty programs.

Key Features

- Supports 100+ payment methods: UPI, Paytm Wallet, cards, net banking, EMI, BNPL.

- Instant onboarding: Businesses can go live within 30 minutes.

- High brand trust: Familiarity boosts customer confidence.

- One-time integration: Covers website, apps, QR, and offline payments.

- Subscription billing: Easy recurring payments.

- Merchant dashboard: Track transactions, settlements, and refunds in real-time.

- Marketing tools: Cashback campaigns, loyalty programs, and promotional offers.

- Settlement speed: Often same day for wallet payments.

Pros & Cons

Pros

- Enormous consumer base (over 300 million users)

- No setup or annual maintenance fees

- Excellent for UPI and wallet payments

- Quick onboarding process

- Trusted brand enhances conversions

Cons

- Physical office address often required for verification

- Slightly higher TDR on some payment types

- Customer support can be slow for small merchants

Pricing & Fees (2025)

- UPI: 0% (typically no charges)

- Credit/Debit Cards: 1.99%–2.5%

- Net Banking: 1.75%

- Wallets/EMI/BNPL: Up to 3%

- International Payments: ~3.5%

- Settlement Cycle: T+1 to T+2 days

No setup fee or annual maintenance charges for standard services.

Best For

- Businesses wanting maximum reach and brand trust

- Merchants focusing on UPI or wallet payments

- SMEs looking for quick integration without technical hassles

Check Out Paytm here

Instamojo

Instamojo started as a simple platform for selling digital products and collecting payments through easy links. Today, it’s one of India’s most popular payment solutions for small businesses, freelancers, and creators. Its USP is simplicity—anyone can start collecting payments without a website, thanks to its instant payment links, mini online stores, and easy onboarding.

Key Features

- Payment Links: Shareable links to collect payments via WhatsApp, email, SMS, or social media.

- Zero coding required: Perfect for non-technical users.

- Online Store Builder: Create a mini online store in minutes.

- Smart Pages: Customizable landing pages for products and services.

- Multiple payment modes: Supports UPI, credit/debit cards, wallets, net banking.

- Payouts & settlements: Quick settlement options for businesses.

- Subscriptions & EMI: Built-in support for recurring payments and easy EMI options.

- Analytics & reports: Basic insights into sales and payments.

Pros & Cons

Pros:

- Extremely beginner-friendly

- Fast onboarding; start selling in minutes

- No website required

- Offers free online store option

- Passes convenience fee to customers if desired

Cons:

- Slightly higher per-transaction charges vs. other gateways

- Less suitable for high-volume enterprises

- Limited advanced API features for developers

Pricing & Fees (2025)

- UPI Payments: 0%–0.9% (varies by plan)

- Cards & Net Banking: 2%–3%

- EMI/Wallets: Up to 3%

- Settlement Cycle: T+3 days (faster with paid plans)

No setup or annual fees for basic accounts; premium plans available for advanced features.

Best For

- Small businesses and solopreneurs

- Digital product sellers and freelancers

- Merchants without websites who need fast payment solutions

Check out Instamojo here

Cashfree Payments

Cashfree has emerged as one of India’s fastest-growing payment solutions, popular for its fast settlements and innovative payouts system. Over 3 lakh businesses trust Cashfree, including well-known startups and SMEs. Besides payment collection, Cashfree excels in bulk payouts, making it a favorite for platforms handling refunds, vendor payments, or affiliate commissions.

Key Features

- Instant settlements: Same-day or real-time settlements for cash flow.

- 200+ payment modes: UPI, cards, net banking, wallets, BNPL.

- Payouts: Bulk disbursal to vendors, customers, or partners.

- Pre-authorization: Hold funds before confirming payments.

- Split payments: Useful for marketplaces.

- API-driven integrations: Developer-friendly tools.

- International payments: Supports multiple currencies.

- Auto-refunds: Quick refund processing.

Pros & Cons

Pros:

- One of India’s fastest settlement cycles

- Strong focus on payouts and refunds

- Easy to integrate APIs

- Competitive pricing

- Good support for startups and SMEs

Cons:

- Slightly fewer advanced analytics tools vs. Stripe

- International coverage not as extensive as global players

- Customer support can be slower during high-demand periods

Pricing & Fees (2025)

- UPI Payments: 0%–0.9% depending on plan

- Cards & Net Banking: ~1.75%–2.5%

- Wallets/BNPL: ~2.5%–3%

- International Payments: ~3.5%

- Settlement Cycle: Often same day or T+1

No setup fees for most businesses.

Best For

- Marketplaces needing split payments

- Platforms requiring bulk payouts

- Indian startups prioritizing fast settlements

Check out Cashfree here

CCAvenue

CCAvenue is one of India’s oldest and most established payment gateways, operating under Infibeam Avenues Ltd. It’s a powerhouse for businesses needing wide payment options, multi-currency support, and enterprise-level solutions. Trusted by government organizations, major corporations, and large eCommerce players, CCAvenue remains a top choice for businesses seeking comprehensive payment capabilities.

Key Features

- Supports 200+ payment options: Cards, UPI, net banking, wallets, EMI, international payments.

- Multi-currency support: Accept payments in 27+ foreign currencies.

- Dynamic Currency Conversion: Allows customers to pay in their own currency.

- PCI DSS Level 1 compliance: High security standards.

- Customizable checkout pages: Match your brand’s look and feel.

- Risk management tools: Advanced fraud prevention systems.

- Instant refunds: Improves customer experience.

- In-store payments: POS and card swipe machines integrated with online systems.

- CBDC-ready: Preparing to accept India’s Digital Rupee.

Pros & Cons

Pros:

- Extremely wide payment options

- Strong cross-border capabilities

- High security and fraud protection

- Customizable payment pages

- Suitable for both online and in-store payments

Cons:

- Slightly lower average success rate (~96.5%) compared to others (~99%)

- Integration can be more complex for smaller businesses

- Customer support sometimes slower for smaller merchants

Pricing & Fees (2025)

- UPI Payments: 0%–1% depending on plan

- Credit/Debit Cards: 2%–2.5%

- Net Banking: 1.5%–2%

- Wallets/EMI/BNPL: Up to 3%

- International Payments: ~3.5%

- Settlement Cycle: T+2 to T+3 days

No setup fee for standard plans; premium customizations may have charges.

Best For

- Large enterprises and marketplaces

- Government or institutional payment collections

- Cross-border eCommerce businesses

- Merchants seeking maximum payment coverage and customization

Check out CCavenue here

PayU Payment Gateway

PayU is a prominent global payment gateway provider, operating in over 17 countries and trusted by 4.5 lakh+ merchants in India. Backed by Naspers, PayU has become a go-to choice for businesses ranging from small startups to large enterprises, thanks to its flexible solutions, multilingual support, and a reputation for reliability in handling high transaction volumes.

Key Features

- Over 100+ payment options: Cards, UPI, net banking, wallets, EMI, BNPL.

- One-click checkout: Seamless payment experience for repeat customers.

- Smart routing technology: Improves transaction success rates.

- Multilingual support: Ideal for businesses targeting regional Indian audiences.

- Customizable SDKs & APIs: Great for tech-savvy businesses needing custom integrations.

- Fast refunds: Typically processed in under 5 minutes for many transactions.

- Risk and fraud management tools: Advanced protection for merchants.

- International payments: Supports 100+ currencies for cross-border transactions.

Pros & Cons

Pros:

- Excellent for handling high transaction volumes

- Multilingual support for regional audiences

- Fast refunds and settlement processing

- Good reputation among enterprise clients

- Robust security features and fraud detection

Cons:

- Slightly complex onboarding for small businesses

- Priority settlement often requires paid plans

- Customer support can be slow during high-traffic periods

Pricing & Fees (2025)

- UPI: 0%–0.9% depending on volume

- Credit/Debit Cards: 1.75%–2.5%

- Net Banking: 1.75%

- Wallets/EMI/BNPL: 2%–3%

- International Payments: ~3%–3.5%

- Settlement Cycle: T+2 days (can be expedited with premium plans)

No setup fees for standard services; premium services may have additional costs.

Best For

- Mid-sized to large enterprises needing scale

- Businesses seeking multilingual capabilities

- Merchants handling high transaction volumes or international sales

Check out Payu here

Stripe Payment Gateway

Stripe, the global payments giant, entered India’s market a few years ago and quickly gained popularity among startups and tech-focused businesses. Renowned for its world-class APIs, modern documentation, and global scalability, Stripe is ideal for developers building custom checkout experiences and companies aiming for cross-border expansion. While slightly pricier, it offers unmatched technical flexibility and innovative features like Radar for fraud detection.

Key Features

- Supports 135+ currencies for global payments.

- Developer-first platform with robust APIs and SDKs.

- Custom checkout UI: Fully customizable for brand experiences.

- Radar fraud detection: Advanced machine learning security tools.

- Subscription billing: Flexible recurring payment options.

- Instant payouts (in select cases).

- Built for marketplaces with Connect platform.

- Detailed analytics for payment insights.

Pros & Cons

Pros:

- Excellent global reach and cross-border capabilities

- Fantastic developer resources and documentation

- Customizable checkout and workflows

- Advanced fraud detection tools

- Scalable for high-volume enterprises

Cons:

- Slightly higher pricing than Indian-native gateways

- Limited local support offices in India

- Onboarding process more complex for smaller businesses

Pricing & Fees (2025)

- UPI Payments: ~2%

- Cards (Domestic): 2%–2.5%

- International Cards: ~3.5%

- Wallets/BNPL: Around 2.5%

- Settlement Cycle: T+2 or faster for eligible businesses

No setup or maintenance fees, but higher charges for international transactions.

Best For

- SaaS businesses and tech startups

- Companies seeking global expansion

- Enterprises needing advanced API-driven integrations

Check our Stripe here

BillDesk Payment Gateway

BillDesk is one of India’s oldest and largest payment gateway services, processing massive volumes for government departments, utilities, telecoms, insurance, and large enterprises. It’s less popular among small startups but remains a pillar of high-value, high-volume payments in India. With a focus on reliability and security, BillDesk is trusted for mission-critical payments where downtime is not an option.

Key Features

- Supports major payment modes: Cards, UPI, net banking, wallets, EMI.

- Extremely robust platform: Designed for enterprise-scale volumes.

- High transaction uptime: Trusted for government and utility payments.

- Customizable integrations: Tailored to enterprise needs.

- Recurring billing: Supports subscriptions.

- Detailed reconciliation reports: Useful for finance teams.

- Regulatory compliance: Works closely with banks and RBI.

Pros & Cons

Pros:

- Highly reliable for large transactions

- Trusted partner for government entities

- Good settlement discipline

- Strong reputation for security and compliance

Cons:

- Less startup-friendly

- Complex onboarding for small businesses

- UI/UX less modern than newer gateways

- Not known for fastest settlements

Pricing & Fees (2025)

- UPI Payments: ~0.9%

- Cards/Net Banking: 1.5%–2.5%

- Wallets/EMI: Up to 3%

- International Payments: ~3.5%

- Settlement Cycle: T+2 to T+3 days

Pricing highly negotiable for enterprise volumes.

Best For

- Government payments and utilities

- Telecom, insurance, and large enterprises

- Businesses processing very high-value transactions

Check out Billdesk here

Juspay Payment Gateway

Juspay isn’t a traditional payment gateway alone—it’s a powerful payments orchestration platform focused on improving checkout experiences and increasing payment success rates. Trusted by giants like Amazon, Ola, and Flipkart, Juspay handles billions of transactions monthly with an emphasis on ultra-fast, secure, and smooth payments.

Key Features

- Hyper SDK: Ultra-lightweight checkout that loads in <200ms.

- Smart routing: Automatically chooses the best payment route for high success rates.

- Tokenization: Advanced card token management for security and compliance.

- Customizable UI: Merchants can brand and tailor checkout flows.

- Risk management tools: Machine learning-based fraud detection.

- Multiple PSP integration: Orchestrates payments across several gateways.

- One-click payments: Improves user experience for returning customers.

Pros & Cons

Pros:

- Market leader in checkout optimization

- Used by India’s largest apps and eCommerce giants

- Incredibly fast load times

- Helps improve payment success rates

- Strong developer support

Cons:

- Not a standalone PSP for smaller businesses

- Requires integration with other payment processors

- Complex for very small merchants without tech teams

Pricing & Fees (2025)

- Juspay doesn’t directly charge typical gateway fees but takes a SaaS fee for its orchestration and optimization services.

- Transaction fees depend on the underlying PSP (Razorpay, PayU, etc.).

- Best suited for high-volume platforms willing to pay for optimization.

Best For

- Large-scale platforms needing super-fast checkout

- Apps with millions of users (Ola, Swiggy, etc.)

- Enterprises prioritizing success rates and user experience

Check out Juspay here

The “Hidden Cost” Reality Check

My Brutal Experience with “Standard Fees”

In 2021, I signed up for Razorpay because of their “2% flat fee” marketing. By the end of the year, my effective cost was 4.8%.

- The mistake? International sales.

- The Cost: A ₹2.3 Lakh hit to my bottom line.

- The Lesson: Always audit your “Effective Transaction Rate” (ETR), not just the “Merchant Discount Rate” (MDR).

| Payment Method | Published Fee | Actual Fee (After Hidden Costs) | The Negotiation Hack |

| UPI | 0% | 0% (if <₹20L/yr) | None needed |

| Domestic Cards | 2% | 2.3% (GST + routing fees) | “Match PayU’s 1.8% offer” |

| Int’l Cards | 3% | 4.5% (Currency markups) | “Cap at 3.5% in contract” |

| EMI | 2.5% | 3.1% (GST + Service Tax) | “Waive fee on first ₹50k volume” |

The Ultimate Payment Gateway Negotiation Playbook

Scripts That Saved My Mentees ₹17L+ in 2023

Rule #1: Always Negotiate Before Peak Season. Gateways drop fees by 15-40% when they know you’ll bring festive volume.

Script A: For Razorpay/PayU (Volume <₹10L/month) (Copy/Paste this email)

Subject: Fee Reduction Request – [Your Business Name]

Hi Team,

We have processed ₹[Amount] through your platform in the last 90 days with a [X]% success rate. However, [Competitor Name] has offered us a 1.8% MDR for similar volumes.

To continue our partnership, we request:

- Matching this 1.8% rate.

- Waiving GST on transaction fees until Diwali.

- Expedited settlements to T+1.

If accepted, we will route 100% of our Q4 volume through you exclusively.

Regards, [Your Name]

Script B: For Enterprise (Volume >₹20L/month) (Use for BillDesk/CCAvenue)

Subject: Enterprise Contract Review – 2025

Dear [Account Manager],

We are reviewing payment partners for 2025. To renew our contract, we require:

- Card fees reduced to 1.5%.

- International fees capped at 3%.

- CBDC settlement included at no extra cost.

Our CFO will sign by [Date] if these terms are met. (Attached: 6-month transaction volume report)

Tier 2/3 Case Study: The “Voice UPI” Revolution

How a Farmer in Muzaffarpur Scaled Sales Without Internet

One of my NITI Aayog mentees, Rajesh, sells litchis. 70% of his customers were daily-wage laborers with basic feature phones and a fear of “digital fraud.”

The Hack: He didn’t use a fancy gateway. He used Voice + Offline Verification.

- IVR Order: Customers call a number -> “Press 1 for Litchi.”

- Voice Confirmation: System replies in Bhojpuri: “Pay ₹120 to [Number] via UPI.”

- Verification: Farmhands verify the SMS on the buyer’s phone upon delivery.

Result: Payment failures dropped from 68% to 9% in 90 days. Takeaway: In Bharat, trust (human verification) matters more than tech (automated gateways).

CBDC Compliance Checklist (2025 Rules)

For Artisans & SMEs – No Lawyer Needed

The Digital Rupee (e₹) is here. If you aren’t ready, you will lose customers.

- Update Terms: Change “We accept UPI” to “We accept UPI and Digital Rupee (e₹).”

- Train Staff: Script: “e₹ se paisa bhejne par koi extra charge nahi.” (No extra charge for e₹).

- Penalty Avoidance:

- Display the e₹ logo at checkout.

- Record CBDC transactions separately in GST filings.

Frequently Asked Questions (FAQ)

Which payment gateway settles funds the fastest?

Cashfree and PhonePe are the current leaders, offering Same-Day or T+1 settlements. Razorpay has improved, but often lags to T+2 during weekends.

Is UPI really free for businesses?

Mostly, yes. For Person-to-Merchant (P2M) transactions, MDR is zero. However, some gateways charge a small platform fee (0.1% – 0.2%) if you are using advanced analytics or dashboard features.

What is the best gateway for international payments?

Stripe is the gold standard for success rates with US/EU cards, but it is expensive (~3.5%). CCAvenue is a good alternative for multi-currency support if you need a lower fee structure (~3%).

Conclusion: Stop Letting Gateways Eat Your Profit

Choosing a gateway in 2025 isn’t about “Features.” It’s about Geography and Customer Psychology.

- If your customer is a Techie in Bangalore: Use Razorpay.

- If your customer is a Teacher in Odisha: Use PhonePe.

- If your customer is a Global Client: Use Stripe.

Don’t just sign up. Negotiate. Use the scripts above. Your margins depend on it.

(Need help auditing your payment stack? [Book a 1:1 Strategy Call])