Table Of Content

- The Rise of Quick Commerce in India

- Why Consumers Love Quick Commerce

- he Impact of Quick Commerce on Kirana Stores in India

- Quick Commerce vs Kirana Stores: A Comparison

- Not All Kiranas Are Losing

- How Kirana Stores Can Compete

- Emotional Cost of Losing Kiranas

- FAQs: The Impact of Quick Commerce on Kirana Stores in India

- Conclusion

Quick commerce in India has exploded. Apps like Zepto deliver groceries in under 15 minutes.

But at what cost?

Many wonder about the impact of quick commerce on kirana stores in India. Are local shops being replaced by dark stores, or is there space for both to thrive?

This article dives deep into the real story behind this retail revolution.

The Rise of Quick Commerce in India

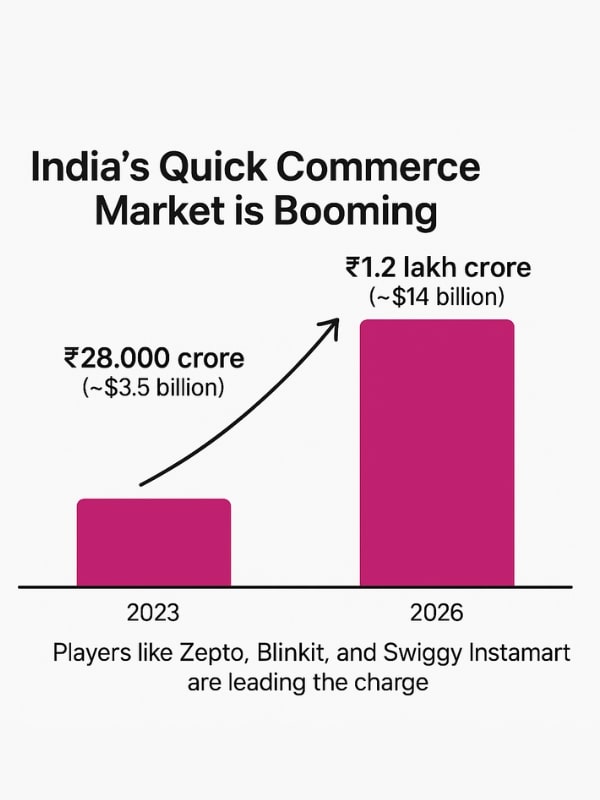

India’s quick commerce market is booming:

- Valued at around ₹28,000 crore (~$3.5 billion) in 2023.

- Projected to grow to ₹1.2 lakh crore (~$14 billion) by 2026.

- Players like Zepto, Blinkit, and Swiggy Instamart are leading the charge.

These services rely on dark stores — mini warehouses near neighborhoods to ensure ultra-fast delivery.

Why Consumers Love Quick Commerce

Consumers are choosing quick commerce because:

- Speed: Delivery in 10–20 minutes.

- Convenience: No queues, no parking issues.

- Discounts: Regular offers and cashback deals.

- Availability: Products available even late at night.

he Impact of Quick Commerce on Kirana Stores in India

While customers enjoy convenience, local kirana stores face serious challenges:

- Price Pressure: Kiranas cannot compete with deep discounts funded by VC money.

- Reduced Footfall: Young consumers prefer apps over local visits.

- Limited Variety: Kiranas have less shelf space compared to dark stores.

- Loyalty Shifts: Apps reward frequent buyers with points and deals.

“Earlier, people came to my shop even for one lemon. Now they order it online,” says Rakesh Gupta, a kirana shop owner in Delhi.

Quick Commerce vs Kirana Stores: A Comparison

Table 1: Comparison of Quick Commerce and Kirana Stores in India

| Aspect | Quick Commerce (Zepto etc.) | Kirana Stores |

|---|---|---|

| Delivery Speed | 10–20 minutes | Immediate if nearby |

| Product Variety | High | Limited by shelf space |

| Pricing | Discounts & cashbacks | Mostly MRP, minimal discounts |

| Personal Credit | Not offered | Often available locally |

| Personal Connection | None | High — personal trust |

| Minimum Order | ₹49–₹99 minimum | No minimum purchase |

Source: Webverbal analysis, 2025

Not All Kiranas Are Losing

Some kiranas are adapting:

- Partnering with delivery platforms like JioMart, Dunzo, or Swiggy Genie.

- Joining ONDC to get digital reach.

- Maintaining trust through personal relationships and local credit facilities.

How Kirana Stores Can Compete

Kirana owners can protect their businesses by:

- Using digital tools to track inventory and accept online orders.

- Offering local delivery through calls or WhatsApp.

- Joining marketplaces like ONDC for visibility.

- Focusing on customer loyalty and personalized service.

- Stocking unique products not easily found on quick commerce apps.

Emotional Cost of Losing Kiranas

Kiranas are more than shops. They’re part of community life:

- Locals gather to chat and exchange news.

- Shopkeepers know families personally.

- Elderly customers feel safer buying from familiar faces.

Without kiranas, urban life may lose a piece of its neighborhood charm.

FAQs: The Impact of Quick Commerce on Kirana Stores in India

Q1. What is quick commerce in India?

Quick commerce means delivering groceries and daily items within 10–30 minutes using dark stores and fast logistics.

Q2. How big is quick commerce in India?

The market was ₹28,000 crore in 2023 and is expected to grow to ₹1.2 lakh crore by 2026.

Q3. Will kirana stores survive Zepto and other apps?

Yes, many kiranas will survive by adopting digital solutions and maintaining strong local relationships.

Q4. Why is quick commerce so popular in India?

It’s fast, convenient, and offers discounts, making it attractive in busy urban areas.

Q5. Is quick commerce available in small towns?

Mostly in Tier 1 and parts of Tier 2 cities due to demand density and logistics costs.

Conclusion

Quick commerce has transformed how urban India shops.

But the impact of quick commerce on kirana stores in India remains significant.

Kiranas still offer trust, credit, and personal service that apps can’t fully replace. The future may belong to those who blend the best of both worlds.