Table Of Content

- The Myth of the Perfect Pitch

- The Data Behind First Impressions

- The Three Seconds That Matter

- 1. Energy in Voice and Presence

- 2. Clarity in the Opening Line

- 3. Founder–Market Fit Signals

- The Behavioral Reality in India

- Case Studies: Founders Who Nailed (or Failed) the Window

- The Yes in Seconds

- The Instant No

- The Surprising Win

- What Founders Need to Change

- Why This Matters for Bharat’s Founders

- Key Takeaways

- Founder’s Closing Lens

- Why do investors decide so quickly on startup pitches?

- What are the 3-second signals founders must master?

- How can Indian founders gain an edge in pitching?

The Myth of the Perfect Pitch

Every founder obsesses over pitch decks. Hours go into polishing slides, memorizing growth charts, and rehearsing revenue projections. Yet ask seasoned investors how they decide, and many will quietly admit: the decision starts forming in the first 3 seconds of meeting a founder.

That window — shorter than an elevator ride, shorter even than a handshake — sets the tone for everything that follows. A founder’s presence, voice, and clarity can tilt the scales long before Excel sheets are discussed.

In India’s hyper-competitive funding ecosystem, where over 90% of startups fail to raise Series A despite seed money, those 3 seconds may be the most valuable real estate in your founder journey.

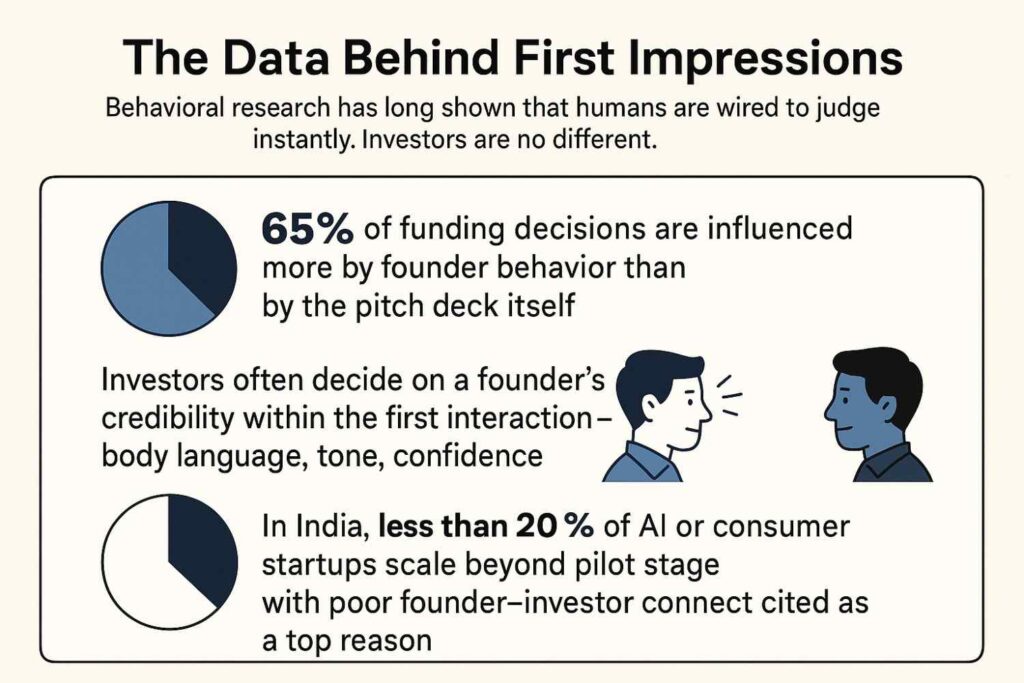

The Data Behind First Impressions

Behavioral research has long shown that humans are wired to judge instantly. Investors are no different.

- A Harvard Business Review study found that 65% of funding decisions are influenced more by founder behavior than by the pitch deck itself.

- A Stanford experiment showed that investors often decide on a founder’s credibility within the first interaction — body language, tone, confidence.

- NASSCOM data indicates that in India, less than 20% of AI or consumer startups scale beyond pilot stage, with poor founder–investor connect cited as a top reason.

This isn’t to say your financials don’t matter. They do. But they only matter after you’ve bought yourself time with an initial impression that signals conviction, clarity, and authenticity.

The Three Seconds That Matter

So what exactly happens in those three seconds that separate winners from the rest? It boils down to three signals:

1. Energy in Voice and Presence

Investors are constantly reading for belief. Do you sound like you believe in your solution more than anyone else in the room? A flat, rehearsed introduction signals insecurity. Energy doesn’t mean loudness; it means conviction that carries through tone and presence.

2. Clarity in the Opening Line

Founders often waste their opening with: “We’ve built an app that…” or “We’re targeting the XYZ market…” Strong founders lead with problem clarity:

- Weak: “We’re building a platform for food discovery.”

- Strong: “India wastes ₹90,000 crore worth of food every year. We’re fixing that.”

That first line sets the context in the investor’s brain: this founder is solving something real, not just pitching features.

3. Founder–Market Fit Signals

Investors bet on people, not products. Why are you the one to solve this? The subtle cues matter: lived experience, domain passion, authenticity. A founder from a Tier-3 town pitching a local AgriTech solution carries natural credibility that no consultant-polished deck can replicate.

Together, these signals form the 3-second impression that buys you the next 30 minutes.

The Behavioral Reality in India

Why do those 3 seconds matter even more in India than in Silicon Valley? Because Indian investors have seen hype cycles — edtech bubbles, food delivery overfunding, crypto pivots. They’ve been burned by polished decks that failed to translate into consumer traction.

That’s why investors here are hyper-attuned to behavioral signals:

- A founder who talks about real consumer truths — price sensitivity, Tier-2 behaviors, COD trust — builds instant credibility.

- A founder who mirrors Western pitch styles without local grounding often loses the room within minutes.

It ties back to the broader disconnect I’ve written about in Why Indian VCs Don’t Understand Indian Consumers. Funding misfires happen when behavior is ignored. In pitching, the same rule applies: if you don’t signal consumer reality upfront, investors won’t believe you can win Bharat.

Case Studies: Founders Who Nailed (or Failed) the Window

The Yes in Seconds

At a recent demo day, a founder walked up and said: “Every year, Indian farmers lose 30% of produce post-harvest. My startup helps them recover 20% of that loss.” In three seconds, the investor knew: big market, painful problem, clear founder–market fit. Funding followed.

The Instant No

Another founder began: “We’re the Uber for laundry.” Within seconds, investors tuned out. Why? The framing screamed “copycat,” and the founder didn’t show lived experience or authentic insight.

The Surprising Win

One Tier-3 fintech founder opened with: “In my town, 70% of people can’t get loans because they lack collateral. We’re solving that with AI-powered credit scoring.” Investors leaned in. That single sentence told a story of problem clarity, authenticity, and local insight.

What Founders Need to Change

Too many Indian founders obsess over pitch decks, valuations, and buzzwords. But winning the room starts with mastering those first moments:

- Rehearse your opening 10 seconds more than your slides.

- Lead with the problem, not the product. Investors invest in painkillers, not vitamins.

- Signal authenticity. If you’re solving an edtech problem, talk like a parent, not like a SaaS salesman.

- Practice presence. Record yourself, get feedback, fix tone and posture.

Remember: you don’t need to be charismatic. You need to be authentic, clear, and aligned with your problem space.

Why This Matters for Bharat’s Founders

In Bharat’s startup ecosystem, most founders will never have Ivy League polish or glossy decks. But that’s not a disadvantage. If anything, Bharat founders have the strongest founder–market fit stories:

- You’ve lived the consumer pain.

- You know the ₹50 vs. ₹500 price sensitivity instinctively.

- You carry cultural context that Western-styled pitches can’t fake.

If you communicate that in the first 3 seconds, you level the field against any well-funded, consultant-polished founder from metro bubbles.

Key Takeaways

- First impressions are investor currency. 65% of decisions hinge on founder behavior, not the deck.

- The 3-second signals: energy, clarity, authenticity.

- Indian investors are hyper-attuned to real consumer truths. Fake confidence won’t cut it.

- Founders must rehearse their openings as seriously as financials.

- Bharat’s edge: authentic founder–market fit beats polished but shallow pitches.

Founder’s Closing Lens

As a founder, I’ve sat on both sides — pitching for survival, and mentoring grassroots entrepreneurs. The pattern never changes: investors don’t buy your startup, they buy you.

In India’s funding rooms, that decision often starts forming in just three seconds. The posture you walk in with, the conviction in your first line, the authenticity in your story — those cues matter more than your Series A projections.

So here’s the uncomfortable truth: if you can’t win those first three seconds, the next thirty minutes won’t matter.

Why do investors decide so quickly on startup pitches?

Because human brains are wired for instant judgment. Investors rely on subconscious cues — confidence, clarity, authenticity — before diving into details.

What are the 3-second signals founders must master?

Energy in voice and presence, clarity in the opening line, and founder–market fit signals. These cues create trust and buy you time.

How can Indian founders gain an edge in pitching?

By grounding pitches in real consumer truths. Indian investors value authenticity and relevance over Western-style buzzwords and vanity metrics.