Table Of Content

- Your Complete Guide to B2B eCommerce Platforms in India

- Why B2B eCommerce in India is Booming Beyond Expectations

- Digital Adoption Accelerating Across Indian Markets

- Why Indian SMEs Were Slow to Go Online

- The Turning Point: What Changed

- The New Digital B2B Buyer

- The Leading B2B eCommerce Platforms Driving India’s Growth

- 1. IndiaMART

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 2. TradeIndia

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 3. Udaan

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 4. Alibaba.com (India Usage)

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 5. Exporters India

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 6. Amazon Business India

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 7. Walmart Vriddhi

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 8. JioMart Digital Wholesale

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 9. IndustryBuying

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 10. Power2SME

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 11. Tata Nexarc

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 12. Moglix

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 13. OfBusiness

- Key Features

- Pros

- Cons

- Pricing

- Best For

- 14. Government eMarketplace (GeM)

- Key Features

- Pros

- Cons

- Pricing

- Best For

- Comparison Table: Top 14 B2B eCommerce Platforms in India (2025)

- Legend & Key Features

- Latest Trends in B2B eCommerce in India (2025 and Beyond)

- 1. Rise of Transactional Platforms

- 2. Embedded Finance: Credit Becomes Core

- 3. MSME Digital Enablement

- 4. ONDC’s Impact on B2B

- 5. AI & Data-Driven Procurement

- 6. Sustainable Sourcing & Compliance

- 7. Regional Language Interfaces

- 8. Integration with Government Procurement

- 9. B2B SaaS + eCommerce Convergence

- 10. Export Boost via Digital Platforms

- What This Means for Businesses

- Frequently Asked Questions on B2B eCommerce in India

- Conclusion & Recommendations: Finding the Right B2B Platform for Your Business

- My Founder Takeaways

- The Future Belongs to Digitally-Enabled B2B Brands

Top B2B eCommerce platforms in India are reshaping trade faster than ever before. What once relied on handshake deals, offline catalogs, and trade shows has become a digital-first ecosystem.

From small traders in Tier-2 towns to large manufacturers in industrial hubs, businesses are using B2B eCommerce in India to source products, connect with buyers, and scale across domestic and international markets. By 2025, the B2B eCommerce in India is projected to cross USD 125 billion (Invest India) — powered by 800+ million internet users (TRAI Report), rapid UPI-enabled business payments, and MSME digitization initiatives such as the ONDC.

This transformation mirrors the Indian consumer behaviour trends shaping eCommerce and reflects how UPI adoption is driving digital India growth.

This guide compares the top B2B eCommerce platforms in India for 2025, helping MSMEs, exporters, and manufacturers evaluate features, pricing, and reach so you can choose the right marketplace for your business.

Your Complete Guide to B2B eCommerce Platforms in India

This practical, research-backed guide to the top B2B eCommerce platforms in India for 2025 is designed to help businesses cut through the noise and make informed decisions. Inside, you’ll discover how to:

- Compare features, pros, and cons of leading B2B marketplaces in India.

- Choose the right platform for your business size, sector, and growth goals.

- Understand the latest trends shaping India’s B2B eCommerce market.

- Avoid common pitfalls that slow down MSMEs, exporters, and manufacturers when selecting platforms.

Whether you’re a small supplier in Kanpur, a textile exporter in Mumbai, or a manufacturer taking your first digital step, this guide offers the clarity and confidence you need to succeed in India’s rapidly growing B2B eCommerce landscape.

Why B2B eCommerce in India is Booming Beyond Expectations

The growth of B2B eCommerce India isn’t a passing trend—it represents a structural shift. Additionally, this transformation is driven by technology adoption, pandemic-driven necessity, and government push for digitization.

In the next section, we’ll examine the exact factors fueling this surge. Specifically, we’ll explore everything from credit integration to multilingual platforms transforming B2B eCommerce platforms India.

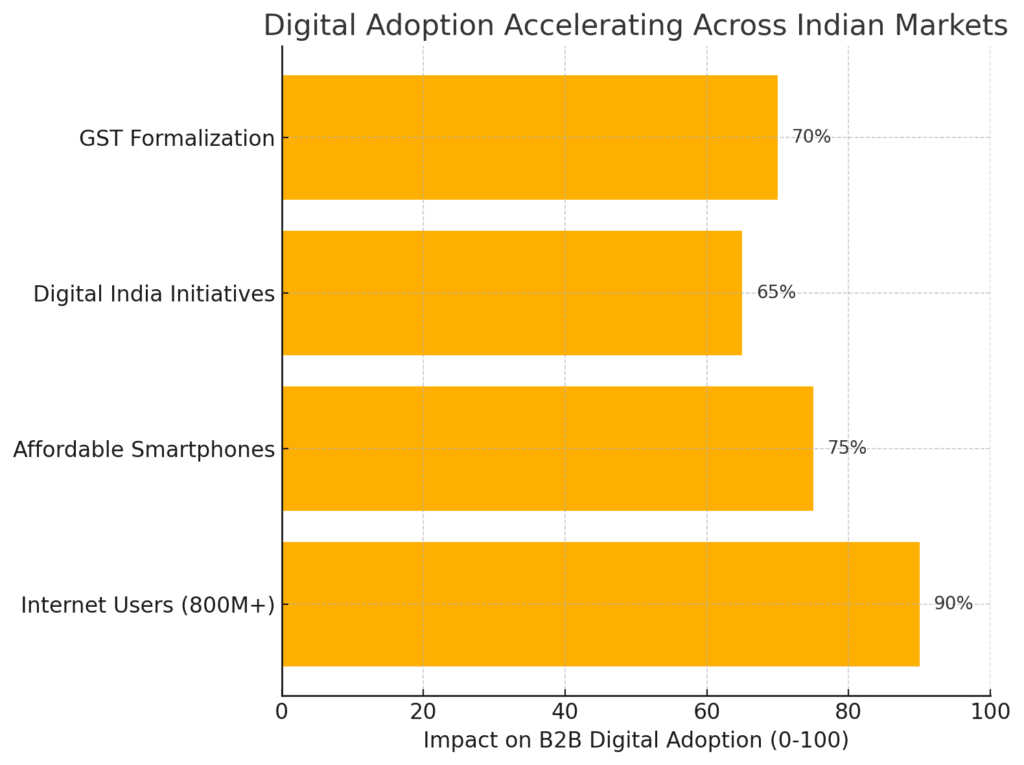

Digital Adoption Accelerating Across Indian Markets

Why Indian SMEs Were Slow to Go Online

Until recently, many Indian businesses—especially SMEs—were hesitant to use B2B eCommerce platforms in India. They feared technology, distrusted digital payments, or simply preferred face-to-face negotiations. As a result, digital adoption remained limited outside metro cities.

The Turning Point: What Changed

This mindset has shifted dramatically in the last few years. Internet penetration has now crossed 800 million users (TRAI). In addition, affordable smartphones are now common even in Tier-3 towns. Moreover, government initiatives such as Digital India and the launch of ONDC have encouraged SMEs to try online platforms. Finally, the implementation of GST forced many small businesses into formal systems, making them more comfortable with digital processes.

The New Digital B2B Buyer

As a result, India’s B2B buyers are now younger, more tech-savvy, and increasingly confident with online trade. They demand speed, transparency, and wider supplier choices—advantages that offline methods can no longer deliver. In contrast, businesses that still rely only on traditional channels risk falling behind.

The Leading B2B eCommerce Platforms Driving India’s Growth

India’s B2B digital marketplace is no longer a niche experiment—it has become the backbone of how suppliers, wholesalers, and buyers connect. From legacy pioneers to new-age disruptors, each platform brings its own strengths, challenges, and business models.

In the following sections, we break down the top B2B eCommerce platforms in India for 2025, giving you a clear view of what each one offers. You’ll find insights into their features, pros and cons, pricing models, and the types of businesses they serve best.

Let’s begin with the platform that started it all—IndiaMART, India’s largest and most recognized B2B marketplace.

1. IndiaMART

Website: www.indiamart.com

IndiaMART is practically synonymous with B2B eCommerce in India. Launched in 1996, it’s the country’s largest B2B online marketplace, connecting millions of suppliers and buyers across every imaginable industry—from industrial machinery and chemicals to textiles, electronics, and construction materials.

Key Features

- Huge buyer-seller base with over 120 million registered users.

- Supports RFQs (Request for Quotes) for bulk pricing negotiations.

- Allows custom catalogs and private listings.

- Verified supplier badges increase trust.

- Mobile app for easy management on the go.

- Payment protection services for safer transactions.

- Digital catalog and product photo services for sellers.

Pros

- Massive reach across India and globally.

- Strong brand recognition boosts buyer confidence.

- Free basic listing possible for small businesses.

- Good for both manufacturers and wholesalers.

- Effective for MSMEs wanting to expand beyond local markets.

Cons

- High competition among sellers in popular categories.

- Quality of leads can sometimes be low without paid subscriptions.

- Paid plans can get expensive for premium placement.

- Not fully transactional—often just connects buyers and sellers rather than handling payments/logistics end-to-end.

Pricing

- Free listings available.

- Paid subscriptions start around ₹6,000–₹30,000+ per year, depending on features like higher visibility, lead access, and digital catalog services.

Best For:

- SMEs looking for maximum visibility nationwide.

- Suppliers in traditional sectors (textiles, industrial goods, chemicals).

- Manufacturers seeking new B2B buyers.

IndiaMART remains an excellent starting point for any Indian business wanting to establish a B2B digital presence quickly—but be prepared to invest in premium plans for the best results.

2. TradeIndia

Website: www.tradeindia.com

Founded in 1996, TradeIndia is another pioneer in India’s B2B marketplace space, often considered IndiaMART’s closest competitor. It connects suppliers and buyers across a vast range of categories like industrial supplies, consumer goods, machinery, and raw materials.

It has carved a niche among small and medium businesses looking to reach domestic as well as export markets.

Key Features

- Over 5.5 million+ registered users.

- RFQ system allows buyers to post bulk requirements.

- Offers digital catalog creation for suppliers.

- Verified seller badges for trust-building.

- Buyer analytics and lead management tools.

- Dedicated sections for trade shows and exhibitions.

- Mobile app for sellers and buyers.

Pros

- Affordable paid plans compared to some competitors.

- Good platform for export-oriented businesses.

- Focus on both domestic and global buyers.

- Digital catalogs make it easier to showcase products.

- Provides marketing tools like trade alerts and email campaigns.

Cons

- Not always as high-traffic as IndiaMART in certain categories.

- Free listings often get lower visibility.

- Competition for leads in popular sectors can be intense.

- Transactions often happen offline rather than directly through the platform.

Pricing

- Free basic listings available.

- Paid plans range from ₹5,000 to ₹50,000+ annually, depending on visibility and features.

Best For:

- MSMEs targeting both domestic and export markets.

- Businesses seeking a more affordable alternative to IndiaMART.

- Companies looking for digital catalogs to showcase products.

- TradeIndia remains a strong choice for SMEs who want to explore both local and export opportunities without spending heavily upfront.

3. Udaan

Website: www.udaan.com

Udaan is the poster child of India’s B2B eCommerce startup boom. Founded in 2016 by former Flipkart executives, it’s grown into one of India’s biggest B2B digital marketplaces, focused on connecting retailers, wholesalers, traders, and manufacturers. Unlike traditional listing portals, Udaan handles the entire transaction end-to-end, including credit and logistics.

Key Features

- Over 3 million retailers and 25,000+ sellers on the platform.

- Mobile-first experience via Android app.

- Handles credit facilities for small retailers.

- Own logistics network covering 900+ cities.

- Supports fast-moving consumer goods, apparel, electronics, pharma, staples, and more.

- Offers deferred payment options for buyers.

- Real-time order tracking and delivery updates.

Pros

- Fully transactional platform—not just listings.

- Great for smaller retailers who want credit facilities.

- Excellent logistics coverage into Tier-2 and Tier-3 cities.

- Helps wholesalers and brands reach deep into smaller markets.

- High trust factor due to solid investor backing.

Cons

- Primarily focuses on domestic B2B trade, not exports.

- Not as useful for highly specialized industrial products.

- Still building brand awareness in certain categories outside FMCG.

- Some sellers feel margins are squeezed due to platform competition.

Pricing

- Free to join.

- Platform takes margins on transactions, varying by category.

- Credit terms may involve interest or service fees for buyers.

Best For:

- FMCG brands wanting deep reach into retail shops.

- Wholesalers needing logistics and credit solutions.

- Retailers looking for credit and competitive prices.

Udaan represents the future of digital B2B commerce in India: transactional, mobile-first, and focused on solving real pain points like credit and logistics. If you’re in fast-moving goods or consumer products, it’s absolutely worth exploring.

4. Alibaba.com (India Usage)

Website: www.alibaba.com

Alibaba.com is arguably the world’s most recognized B2B marketplace. Though headquartered in China, it’s widely used by Indian businesses both as buyers sourcing goods from overseas and as sellers looking to reach international buyers. For Indian exporters, Alibaba remains a powerful gateway to global markets.

Key Features

- Access to millions of global buyers across 190+ countries.

- Supports RFQs and custom quotations.

- Multiple language support for global communication.

- Integrated trade assurance for safer payments and transactions.

- Digital storefronts for sellers with advanced catalog tools.

- Data insights and buyer analytics.

- Logistics partnerships for international shipping.

Pros

- Huge global buyer base unmatched by any Indian platform.

- Excellent for Indian manufacturers aiming for exports.

- Strong tools for showcasing products (photos, videos, 3D images).

- Trade Assurance builds trust for first-time deals.

- Powerful keyword-based buyer analytics for sellers.

Cons

- Intense competition from Chinese and other international suppliers.

- High advertising costs for visibility in popular categories.

- Platform heavily geared toward exports—not ideal for domestic Indian B2B trade.

- Communication barriers sometimes arise due to language differences.

- Risk of counterfeit products in certain categories.

Pricing

- Free basic membership available.

- Paid Gold Supplier plans start from approx. $2,000+ per year for advanced features and better visibility.

Best For:

- Indian exporters wanting global reach.

- Manufacturers producing goods at competitive prices.

- Businesses comfortable handling international trade complexities.

Alibaba remains one of the strongest channels for Indian exporters looking to tap into foreign markets—but it’s not the best choice for purely domestic B2B transactions.

5. Exporters India

Website: www.exportersindia.com

ExportersIndia is one of the oldest and most export-focused B2B marketplaces in the country. Launched in the late ’90s, it has built a reputation for helping Indian manufacturers, traders, and exporters connect with buyers across the globe—especially in sectors like agriculture, handicrafts, chemicals, food processing, and traditional Indian goods.

Key Features

- Focus on exports from India—but supports domestic trade too.

- Over 1.2 million suppliers and a large global buyer base.

- Detailed product listings with trade-specific filters.

- Supports RFQs and business inquiries.

- Multilingual interface and country-specific access.

- SEO optimization tools to improve product discovery.

- Tools for catalogue design, company branding, and mobile access.

Pros

- Excellent for traditional Indian industries like handicrafts, spices, garments, etc.

- Strong reach in export-friendly categories.

- Free basic listing option available.

- Dedicated seller dashboard with inquiry tracking.

- Good for suppliers in Tier 2/3 cities going global.

Cons

- Limited logistics or transactional capabilities compared to modern B2B players.

- Less effective for highly industrial categories.

- Relies heavily on offline follow-ups after initial inquiry.

- Paid listings are needed for top visibility.

- Interface feels dated compared to platforms like Udaan or Amazon Business.

Pricing

- Free listings available.

- Paid premium listings and featured banners range from ₹10,000–₹50,000+ per year.

Best For:

- Indian exporters of agri-products, garments, or handicrafts.

- MSMEs in traditional categories seeking global buyers.

- Sellers comfortable managing inquiries and fulfillment independently.

ExportersIndia is a niche yet powerful B2B platform for Indian sellers in culturally strong sectors aiming to tap international markets without relying on Alibaba.

6. Amazon Business India

Website: business.amazon.in

Amazon Business entered the Indian B2B space to bridge the gap between B2C convenience and B2B complexity. Launched in India in 2017, it targets businesses of all sizes—from kirana stores and SMEs to large corporations—offering them access to a vast catalog of bulk products, competitive pricing, and business-only discounts.

Unlike traditional listing sites, Amazon Business is fully transactional, combining the familiar Amazon shopping experience with B2B features like GST invoicing and bulk ordering.

Key Features

- Access to crores of products across categories like office supplies, IT equipment, industrial tools, FMCG, and more.

- Business-only pricing and bulk discounts.

- GST-compliant invoices for tax credits.

- Approval workflows for corporate purchasing.

- Integration with procurement systems like SAP Ariba.

- Free and fast delivery options under Amazon Prime Business.

- Easy returns and reliable customer support.

Pros

- Trusted Amazon ecosystem and reliable logistics.

- Transparent pricing without negotiation hassles.

- Ideal for corporate procurement processes.

- Supports both small retailers and enterprise buyers.

- Offers advanced account management tools.

- Allows businesses to consolidate multiple buyers under a single account.

Cons

- Mostly focuses on commoditized products—not niche or highly industrial goods.

- Limited buyer-seller negotiation compared to traditional B2B models.

- Not ideal for businesses wanting customized catalogs or private listings.

- Higher costs in certain categories compared to local wholesalers.

Pricing

- Free to register.

- No subscription fees for buyers.

- Sellers pay standard Amazon marketplace commissions based on category.

Best For:

- Businesses wanting hassle-free procurement for common supplies.

- SMEs looking for GST invoices and tax credits.

- Corporates needing purchasing controls and reporting.

- Retailers or distributors seeking bulk discounts on fast-moving products.

Amazon Business India is excellent for businesses that value speed, trust, and operational efficiency—even if it’s not as personalized as traditional B2B marketplaces.

7. Walmart Vriddhi

Website: Walmart Vriddhi

Walmart Vriddhi isn’t a traditional B2B marketplace—it’s Walmart’s initiative aimed at digitally enabling India’s MSMEs. Launched in 2019, it offers training, mentoring, and access to domestic and global supply chains, helping small businesses become eCommerce-ready.

Unlike pure marketplaces, Vriddhi focuses heavily on capacity building. It’s an excellent gateway for MSMEs seeking guidance on how to scale and potentially supply to Walmart India or even Walmart’s global network.

Key Features

- Free capacity-building programs for MSMEs.

- Training in digital tools, financial literacy, compliance, and marketing.

- Connections to Walmart’s supply chains and partner networks.

- Support for selling on Flipkart Wholesale and Walmart’s sourcing channels.

- Workshops, webinars, and one-on-one mentoring.

- Certification upon program completion.

Pros

- Free resource for MSMEs to modernize their business practices.

- Direct link to Walmart’s vast ecosystem, both domestic and global.

- Hands-on mentorship rather than purely digital training.

- Helps businesses become compliant and scalable.

- Strong credibility due to Walmart’s brand.

Cons

- Not a typical B2B marketplace—doesn’t handle direct transactions like IndiaMART or Udaan.

- No immediate sales leads; it’s more about long-term growth.

- Benefits are indirect unless you plan to supply to Walmart.

- Geographical reach of physical training programs can be limited in remote areas.

Pricing

- Entirely free for MSMEs.

- No membership or subscription fees.

Best For:

- MSMEs looking to become eCommerce-ready.

- Small manufacturers wanting to connect to large retailers.

- Businesses interested in learning compliance and export requirements.

- Entrepreneurs who plan to sell via Flipkart Wholesale or Walmart sourcing channels.

Walmart Vriddhi is a unique ecosystem-builder rather than a pure B2B selling platform. For MSMEs wanting to modernize and eventually access larger markets, it’s a valuable starting point.

8. JioMart Digital Wholesale

Website: www.jiomart.com

JioMart, the retail arm of Reliance Industries, has quickly become a significant name in Indian eCommerce. But beyond its B2C operations, JioMart also offers a Digital Wholesale platform targeting small retailers, kiranas, and resellers.

Leveraging Reliance’s supply chain strength and massive retail ecosystem, JioMart Digital Wholesale aims to modernize the way India’s small businesses source inventory. It’s mobile-first, price-competitive, and designed for everyday retail trade.

Key Features

- Access to wholesale rates on FMCG, staples, personal care, and more.

- Bulk buying with significant price advantages for retailers.

- Integrated with Reliance Retail’s massive inventory and logistics network.

- Digital credit and flexible payment options.

- Order tracking and fast delivery.

- Targeted towards kiranas, local shops, and small resellers.

- Operates through mobile app and select physical distribution centers.

Pros

- Highly competitive pricing due to Reliance’s scale.

- Mobile app makes ordering easy for small retailers.

- Logistics reach into Tier-2/3/4 towns via Reliance Retail’s network.

- Supports smaller quantity purchases compared to traditional wholesalers.

- Frequent promotional offers and discounts.

Cons

- Focused heavily on FMCG and daily-use products—not industrial goods or niche B2B segments.

- Still expanding outside large urban markets.

- Smaller product variety than traditional B2B marketplaces in industrial or specialized categories.

- Not as suitable for manufacturers selling B2B.

Pricing

- Free to sign up.

- Pricing is product-based, with wholesale discounts visible after login.

- No subscription fees for buyers.

Best For:

- Kirana stores and small retailers seeking competitive prices.

- FMCG resellers looking to streamline sourcing.

- Retailers in Tier-2/3 cities who want reliable deliveries.

JioMart Digital Wholesale is quickly becoming a serious challenger in India’s B2B FMCG space, offering the power of Reliance’s supply chain to small merchants who traditionally relied on local distributors.

9. IndustryBuying

Website: www.industrybuying.com

IndustryBuying is one of India’s most prominent industrial B2B eCommerce platforms, founded in 2013. Unlike generic B2B marketplaces, it specializes in selling industrial goods, tools, MRO (Maintenance, Repair, Operations) supplies, and equipment to manufacturing, construction, automotive, and SME sectors.

Its focus is clear: bringing organized digital procurement to India’s massive industrial sector.

Key Features

- Over 1.5 million products listed across 45+ categories.

- Specializes in MRO, safety equipment, power tools, bearings, electricals, etc.

- Bulk pricing and volume discounts.

- GST-compliant invoices for businesses.

- Corporate procurement solutions with negotiated pricing.

- Buyer credit options available through partnerships with Indian fintechs.

- Logistics support for bulky and industrial shipments.

- API integrations for large enterprises.

Pros

- Excellent choice for industrial and manufacturing sectors.

- Deep inventory across technical product categories.

- Transparent pricing with easy bulk order management.

- Corporate procurement solutions save significant costs for large buyers.

- GST compliance simplifies tax credits.

- Helpful buyer support for technical product selection.

Cons

- Less suited for general consumer goods or retail products.

- Limited international reach compared to global players like Alibaba.

- Product discovery can sometimes feel overwhelming due to sheer volume.

- Smaller sellers might find listing and selling on the platform less impactful unless they operate in industrial sectors.

Pricing

- Free for buyers.

- Sellers may pay commission or marketing fees depending on listing plans and volume.

Best For:

- Manufacturing businesses and SMEs sourcing industrial supplies.

- Enterprises looking for digitized procurement systems.

- Industrial traders wanting national reach.

IndustryBuying is the go-to platform if your business deals in industrial supplies, machinery, and technical tools. It’s tailored for serious B2B buyers who want both depth and reliability.

10. Power2SME

Website: www.power2sme.com

Founded in 2012, Power2SME operates on a unique concept: it aggregates SME demand for raw materials and negotiates bulk rates directly with large manufacturers and suppliers. Essentially, it acts as a “buying club” for SMEs, helping them achieve cost savings that they couldn’t secure on their own.

It focuses primarily on industries like metals, polymers, chemicals, paints, and construction materials.

Key Features

- Demand aggregation across thousands of SMEs to negotiate lower prices.

- Strong focus on raw materials procurement.

- Credit facilities through partnerships with NBFCs and fintechs.

- Dedicated account managers for SME clients.

- Logistic solutions for timely material deliveries.

- Supports GST-compliant transactions and invoicing.

- Industry insights and price trends shared with SMEs to improve buying decisions.

Pros

- Delivers significant cost savings on bulk raw materials.

- Reduces working capital pressure for SMEs via credit lines.

- Highly specialized in industrial and manufacturing sectors.

- Helps SMEs tackle fluctuating commodity prices.

- One-stop solution for procurement, logistics, and financing.

Cons

- Not a general B2B marketplace—mainly serves raw material procurement.

- Limited relevance for retailers or businesses outside manufacturing.

- Platform depends heavily on scale; very small businesses might see less benefit if their demand is low.

- Fewer product categories than large marketplaces like IndiaMART or TradeIndia.

Pricing

- Free for buyers.

- Power2SME earns margins by aggregating purchases and negotiating bulk deals.

Best For:

- SMEs in manufacturing, engineering, and construction needing raw materials.

- Businesses seeking lower procurement costs and stable supply.

- Companies struggling with volatile commodity pricing.

Power2SME is perfect for SMEs who struggle to compete on pricing due to smaller volumes. By aggregating demand, it levels the playing field and offers significant cost advantages.

11. Tata Nexarc

Website: www.tatanexarc.com

Tata Nexarc is part of the Tata Group’s bold push into the digital B2B solutions space. Launched in recent years, it’s not just a marketplace but a full ecosystem designed to help Indian SMEs digitize and grow.

Unlike purely transactional marketplaces, Nexarc offers a suite of services—from procurement and logistics to credit, compliance, marketing, and business insights. It’s positioned as an end-to-end partner for SMEs, particularly in the manufacturing and industrial sectors.

Key Features

- Digital procurement platform with thousands of industrial products.

- Access to Tata Steel’s procurement ecosystem for industrial goods.

- Credit solutions via Tata Capital and other partners.

- Logistics and shipping support integrated into the platform.

- Tools for GST compliance and business documentation.

- Business insights, growth tools, and digital marketing support.

- Focus on simplifying supplier discovery and procurement.

Pros

- Backed by the trust and scale of the Tata Group.

- Combines procurement, finance, logistics, and compliance in one platform.

- Tailored specifically for the needs of Indian SMEs.

- Good visibility for sellers through a trusted ecosystem.

- Integrates seamlessly with traditional Tata industrial supply chains.

Cons

- Still expanding its catalog—currently smaller than giants like IndiaMART.

- Primarily focused on industrial and manufacturing sectors rather than all B2B categories.

- Newer player, so awareness is still building among smaller SMEs.

- Not ideal for retail-focused B2B businesses.

Pricing

- Free to register and browse.

- Transactional fees or commissions may apply depending on services used.

Best For:

- SMEs in industrial sectors looking for reliable procurement.

- Businesses wanting an ecosystem approach rather than just a marketplace.

- Companies preferring to work with a trusted, established brand.

Tata Nexarc represents a modern, integrated vision for Indian B2B commerce—helping SMEs go digital not just in sales, but in finance, logistics, and compliance. For businesses in manufacturing or industrial supply chains, it’s definitely worth exploring.

12. Moglix

Website: www.moglix.com

Moglix has rapidly become India’s poster child for digital industrial procurement. Founded in 2015 and backed by top investors like Tiger Global and Sequoia, it’s now a unicorn valued over $2 billion. Moglix focuses on the supply chain for manufacturing and industrial sectors, digitizing how businesses buy MRO supplies, industrial tools, safety gear, electricals, and raw materials.

Unlike marketplaces merely listing sellers, Moglix operates its own warehouses and logistics, giving it end-to-end control over procurement and fulfillment.

Key Features

- Over 500,000+ industrial products listed.

- Direct tie-ups with top brands and OEMs.

- Centralized procurement solutions for large enterprises.

- Bulk purchasing with negotiated pricing.

- GST-compliant invoicing and tax credit support.

- Moglix Credit for financing industrial purchases.

- Integrated logistics network ensuring faster deliveries.

- Analytics and spend management tools for enterprises.

Pros

- Perfect fit for industrial procurement needs.

- Trusted by large enterprises for scalable supply chains.

- Quality assurance through direct partnerships with brands.

- Helps reduce procurement costs and complexity.

- Offers flexible credit and working capital solutions.

- Owns warehouse and logistics infrastructure for reliable deliveries.

Cons

- Primarily focused on industrial products and manufacturing, not all B2B sectors.

- Less relevant for retailers or general consumer goods traders.

- High focus on enterprise-level clients—very small buyers might find it overwhelming.

- Some smaller SMEs may find pricing less competitive for very low volumes.

Pricing

- Free for buyers to browse.

- Transaction margins or fees depend on contract size and volume.

- Custom pricing for large enterprises.

Best For:

- Large manufacturers needing consistent industrial supplies.

- SMEs seeking reliability and genuine branded products.

- Companies wanting end-to-end procurement and supply chain management.

Moglix stands out as a game-changer in India’s industrial B2B landscape, offering technology-driven solutions that simplify procurement while ensuring quality and cost-efficiency.

13. OfBusiness

Website: www.ofbusiness.com

OfBusiness is a B2B commerce and lending platform that has taken India’s industrial procurement space by storm. Founded in 2015, the platform is known for its unique model: it not only facilitates the purchase of raw materials and industrial goods but also provides embedded working capital financing to buyers—especially SMEs.

Its focus lies in commodities and raw materials like steel, cement, chemicals, agri-products, textiles, and more. The company combines procurement scale, credit, and data-driven insights, making it a favorite for mid-sized manufacturers and traders across India.

Key Features

- Real-time access to raw materials like steel, polymers, cement, chemicals, etc.

- Integrated financing solutions via Oxyzo (its NBFC arm).

- Bulk discounts and factory-direct pricing.

- On-time delivery using proprietary supply chain network.

- Credit scoring based on business performance and GST data.

- Dedicated relationship managers for large accounts.

- Procurement analytics and price benchmarking tools.

Pros

- Combines B2B commerce with working capital—a rare model.

- Strong in commodities and essential raw materials.

- Financing is fast and customized based on business cash flow.

- Helps SMEs and traders scale faster with flexible terms.

- High repeat customer rate due to supply reliability.

Cons

- Focused heavily on specific sectors—not a general B2B platform.

- Best suited for mid- to large-scale buyers; very small MSMEs may find the model less tailored.

- Limited use for those outside manufacturing, infrastructure, or commodity trading.

- Digital interface is still evolving—heavily relationship-driven.

Pricing

- Free to explore products and pricing.

- Credit and procurement margins vary based on volume and category.

- Financing costs depend on tenure and buyer profile.

Best For:

- Mid-sized manufacturers and infrastructure companies.

- Commodity traders needing credit + supply reliability.

- SMEs wanting a one-stop shop for raw materials and finance.

OfBusiness has emerged as a powerful enabler of growth for India’s B2B backbone—not just through procurement, but by solving the working capital problem most MSMEs face.

14. Government eMarketplace (GeM)

Website: gem.gov.in

The Government eMarketplace (GeM) is India’s official B2G (Business-to-Government) procurement portal. Launched in 2016, GeM aims to make public procurement transparent, efficient, and accessible to businesses of all sizes, including MSMEs.

Through GeM, central and state government departments, PSUs, and other agencies can purchase everything from office supplies and vehicles to high-end industrial equipment and services.

Key Features

- Over 60,000 government buyer organizations and 50+ lakh products/services listed.

- Strict verification of sellers to ensure credibility.

- Transparent bidding, reverse auction, and dynamic pricing tools.

- Direct purchase up to certain limits, with e-bidding for larger contracts.

- Special provisions and benefits for MSMEs, women entrepreneurs, and startups.

- Integration with Udyam Registration for MSME sellers.

- GST-compliant invoicing and payment tracking.

Pros

- Direct access to lucrative government contracts.

- Eliminates middlemen, increasing margins for suppliers.

- Transparent and compliant processes ensure fair competition.

- Helps MSMEs gain visibility in the government sector.

- Supports both product and service suppliers.

Cons

- Complex registration and compliance requirements.

- Payment cycles can be delayed due to government processes.

- Highly competitive bidding environment.

- Not suitable for businesses focused solely on retail or small B2B markets.

- Learning curve for newcomers unfamiliar with government procurement.

Pricing

- Free registration for sellers.

- No upfront platform charges, but transaction charges may apply for certain services or large orders.

Best For:

- Businesses targeting government tenders and large institutional sales.

- MSMEs wanting to expand into B2G markets.

- Suppliers with the capacity to handle government compliance and larger orders.

- GeM is a powerful opportunity for businesses wanting to diversify into government sales. While it’s not a typical commercial B2B platform, it offers access to one of India’s largest and most reliable buyers—the government itself.

Comparison Table: Top 14 B2B eCommerce Platforms in India (2025)

Top B2B eCommerce Platforms in India 2025

Complete Feature Comparison & Selection Guide

| Platform | Focus Area | Best For | Transactions | Credit Support | Export Support | Pricing Model |

|---|---|---|---|---|---|---|

| IndiaMART | All categories (generalist) | MSMEs, suppliers across all sectors | Listing Only | No | Yes | Free & Paid Plans |

| TradeIndia | Similar to IndiaMART | Domestic & export-oriented SMEs | Listing Only | No | Yes | Free & Paid Plans |

| Udaan | FMCG, Apparel, Pharma | Small retailers, wholesalers | Yes | Yes | Domestic Only | Free |

| Alibaba | Global Export | Indian exporters, manufacturers | Yes | No | Global | Free & Paid Plans |

| ExportersIndia | Exports (Agri, Handicrafts, Textiles) | MSMEs in traditional sectors | Listing Only | No | Yes | Free & Paid Plans |

| Amazon Business | Retail, Office, IT Supplies | Corporate procurement, retailers | Yes | No | Domestic Only | Free |

| Walmart Vriddhi | MSME Enablement Program | MSMEs wanting to go digital | No | No | Yes (via Walmart) | Free |

| JioMart Wholesale | FMCG & retail supplies | Kiranas, retail resellers | Yes | Limited | Domestic Only | Free |

| IndustryBuying | MRO, Industrial, Tools | Factories, SMEs in manufacturing | Yes | Limited | No | Free |

| Power2SME | Raw materials, Aggregation model | MSMEs in infra, steel, polymers | Yes | Yes | No | Free |

| Tata Nexarc | Full SME ecosystem | Industrial SMEs needing 360° support | Yes | Yes (via Tata Cap) | No | Free |

| Moglix | Industrial supplies, MRO | Large enterprises, industrial SMEs | Yes | Yes | No | Free |

| OfBusiness | Raw material + credit | Manufacturing & infra companies | Yes | Yes (Oxyzo) | No | Free |

| GeM Portal | Government Procurement (B2G) | Suppliers targeting govt. contracts | Yes | Indirect | No | Free |

Legend & Key Features

Latest Trends in B2B eCommerce in India (2025 and Beyond)

India’s B2B eCommerce ecosystem is no longer just about online directories or static product listings. It’s evolving rapidly, driven by technology, policy shifts, and the changing ambitions of Indian businesses. Here’s what’s defining the future of B2B eCommerce in India right now:

1. Rise of Transactional Platforms

Platforms like Udaan, Moglix, and OfBusiness have moved beyond simple listings to handle entire transactions end-to-end:

- Integrated payments on-platform

- Real-time inventory and price visibility

- Fulfillment and logistics managed digitally

- Embedded working capital loans

This means B2B eCommerce is becoming as seamless as B2C shopping—but on an industrial scale.

2. Embedded Finance: Credit Becomes Core

Cash flow has always been the Achilles heel for Indian MSMEs. The next wave of B2B platforms isn’t just helping businesses buy and sell—they’re providing credit directly on-platform.

- OfBusiness offers working capital loans via Oxyzo.

- Udaan extends credit to small retailers.

- Moglix partners with fintechs to offer buy-now-pay-later for enterprises.

Expect embedded finance to become a crucial differentiator among B2B platforms in India.

3. MSME Digital Enablement

Government programs like Digital MSME, ONDC, and Walmart Vriddhi are pushing small businesses to adopt eCommerce and digital procurement tools. MSMEs are:

- Learning how to digitize catalogs

- Using SaaS tools for GST compliance

- Getting trained to sell online via platforms like GeM or Nexarc

This digital enablement is widening the B2B pool far beyond metro cities.

4. ONDC’s Impact on B2B

ONDC (Open Network for Digital Commerce) is India’s most ambitious digital commerce project ever. While currently focused on B2C, the government has signaled plans for B2B:

- Unified network to connect buyers and sellers across platforms

- Lower commissions than private marketplaces

- Level playing field for small sellers

Once it expands, ONDC could disrupt traditional B2B giants by creating a single open network for industrial procurement, logistics, and credit.

5. AI & Data-Driven Procurement

Platforms are increasingly leveraging AI for smarter procurement decisions.

- Price forecasting tools for commodities (e.g. Power2SME).

- Supplier quality analysis to reduce fraud risks.

- Personalized product recommendations based on purchase patterns.

Expect B2B buying to become far more predictive and personalized.

6. Sustainable Sourcing & Compliance

Corporate India is under rising pressure to meet ESG (Environmental, Social, Governance) norms. Large buyers increasingly demand:

- Eco-friendly materials

- Transparent sourcing records

- Ethical labor practices

B2B platforms are beginning to certify suppliers and highlight sustainable products. This trend is opening new markets for green manufacturing and sustainable suppliers.

7. Regional Language Interfaces

With B2B adoption growing in Tier-2 and Tier-3 cities, platforms are rolling out:

- Regional language support

- Localized customer service

- Simplified mobile apps for first-time digital users

IndiaMART, Udaan, and JioMart Wholesale are already moving toward vernacular interfaces to capture the next 100 million MSMEs.

8. Integration with Government Procurement

Government spending is huge—and GeM (Government eMarketplace) is making it accessible to MSMEs like never before:

- Digital tenders instead of offline paperwork

- Faster payments via digital channels

- Special incentives for startups and women-led businesses

B2B players are increasingly helping sellers list on GeM and manage government procurement processes.

9. B2B SaaS + eCommerce Convergence

Many B2B platforms are now bundling software services with commerce. For instance:

- Tata Nexarc offers procurement + compliance + business insights.

- IndustryBuying integrates procurement with ERP systems.

- Moglix provides spend analytics tools alongside industrial supplies.

The future of B2B eCommerce in India is platforms acting as holistic business partners, not just marketplaces.

10. Export Boost via Digital Platforms

India’s export sector is eyeing $2 trillion by 2030. Digital B2B platforms like Alibaba, ExportersIndia, and IndiaMART are:

- Helping MSMEs showcase products globally

- Simplifying documentation and compliance

- Offering freight forwarding and customs integration

Expect B2B digital exports to become a major growth engine for Indian businesses.

What This Means for Businesses

The message is clear: B2B eCommerce in India is no longer optional—it’s a competitive necessity. Whether you’re a manufacturer, trader, wholesaler, or an MSME exploring new markets, keeping up with these trends can define your business growth in 2025 and beyond.

If you’re planning to step into this space, evaluate:

- Does the platform support your specific industry?

- Can it help you reach new markets (domestic or global)?

- Does it offer credit or logistics solutions you need?

- How does it fit into India’s emerging digital ecosystem?

The B2B revolution is just getting started—and the opportunities are massive for businesses willing to ride this wave.

Frequently Asked Questions on B2B eCommerce in India

A B2B eCommerce platform is an online marketplace for business-to-business trade. Unlike B2C sites, it focuses on bulk orders, GST invoices, and business pricing. In addition, many platforms also provide credit support for MSMEs.

Platforms like Moglix, IndustryBuying, and OfBusiness are strong choices. They specialize in machinery, raw materials, and MRO supplies. For example, Moglix also offers financing and logistics, which makes it easier for manufacturers to buy.

Yes, small businesses can use them. Platforms like IndiaMART, TradeIndia, Udaan, and JioMart Wholesale are made for MSMEs. In addition, GeM also has schemes for startups, women-led firms, and small traders.

Yes, many platforms now provide credit. OfBusiness offers working capital through Oxyzo. Udaan gives credit to retailers. Moglix partners with fintechs for BNPL. Tata Nexarc links with Tata Capital. As a result, businesses can manage cash flow more easily.

Yes. ONDC (Open Network for Digital Commerce) is expected to cover B2B trade soon. This will reduce commissions and improve platform choice. Therefore, MSMEs may gain more visibility across digital marketplaces.

Exporters should try Alibaba for global reach. ExportersIndia works well for textiles, handicrafts, and agri-products. IndiaMART also helps with cross-border trade. In addition, these platforms offer catalog tools and export support services.

Yes, but the model varies. IndiaMART and TradeIndia use subscriptions. Udaan and Moglix charge commissions on sales. GeM is free to join, but compliance costs apply. As a result, sellers should compare fees before signing up.

Start by looking at your product type and target market. Next, check if you need credit or logistics support. In addition, compare costs and features. Finally, talk to other sellers in your industry. Their experience can help you choose wisely.

Conclusion & Recommendations: Finding the Right B2B Platform for Your Business

India’s B2B eCommerce sector is no longer in its infancy. It has become a thriving ecosystem, empowering millions of businesses to go digital, scale faster, and reach wider markets.

From industrial procurement giants like Moglix and IndustryBuying, to finance-integrated platforms such as OfBusiness, to export enablers like Alibaba and ExportersIndia, each platform brings something unique to the table.

However, here is the reality: there is no single “best” B2B platform. The right choice depends on:

- What you are selling

- Who you are selling to

- The scale and complexity of your operations

- Whether you need just leads, or full transactions plus value-added services like credit, compliance, or logistics

My Founder Takeaways

As someone who has spent over two decades in India’s eCommerce and B2B space, here are my practical recommendations:

- Manufacturers or industrial suppliers → Start with IndustryBuying, Moglix, or OfBusiness. They understand procurement better than generic platforms.

- Targeting government contracts → Register on GeM. It involves paperwork, but the rewards are significant.

- In FMCG, pharma, or retail distribution → Explore Udaan or JioMart Wholesale. These platforms are reshaping local supply chains.

- Aiming to export → Build a presence on Alibaba and IndiaMART Export. In addition, niche portals like ExportersIndia can open surprising opportunities.

- Small traders, startups, or MSMEs → Begin with IndiaMART, TradeIndia, or Tata Nexarc. They offer the easiest digital entry points.

The Future Belongs to Digitally-Enabled B2B Brands

Whether you are sourcing raw materials, finding government buyers, or taking your brand global, digital-first B2B platforms in India are the gateway. Therefore, do not just chase trends. Instead, choose partners that align with your long-term vision, provide scalable infrastructure, and solve your real business pain points.

If you found this guide valuable, share it with a fellow entrepreneur, trader, or MSME founder navigating the same crossroads.

Together, let’s build Bharat’s digital B2B future—one smart decision at a time.