Table Of Content

- Understanding the Indian B2B Marketplace Landscape

- Key Factors to Consider When Choosing a B2B Marketplace

- 1. Target Industry & Product Fit

- 2. Customer Base & Buyer Network

- 3. Trust & Reputation of the Platform

- 4. Technology & Ease of Use

- 5. Pricing Models & Commission Structure

- 6. Logistics & Fulfillment Support

- 7. Payment & Credit Facilities

- 8. Support & After-Sales Service

- 9. Scalability Potential

- 10. Community & Networking Opportunities

- Common Mistakes Startups Make When Selecting a B2B Platform

- Case Snapshots: Startups That Got It Right

- Case 1: SME Scaling with IndiaMART

- Case 2: Niche Success via Moglix

- Case 3: Udaan Expanding into Tier-2/3 Markets

- Step-by-Step Checklist for Founders

- Conclusion

- FAQ

- Which is the best B2B marketplace for startups in India?

- How do I evaluate whether IndiaMART or Udaan is better for my startup?

- What costs should founders consider before listing on a B2B marketplace?

- How can I identify if a B2B marketplace attracts serious buyers?

- Should a startup list on multiple B2B marketplaces at once?

- What are the most common mistakes startups make when choosing a B2B platform?

For any Indian startup, the first 12–18 months are about one thing: survival. You’re racing to validate your product, find paying customers, and scale revenue without burning through cash. In this early stage, distribution is everything — and that’s where B2B marketplaces have quietly become one of the most powerful growth levers for startups in India.

Unlike the direct-to-consumer (D2C) boom that captures headlines, the B2B commerce story is playing out in every corner of Bharat. From industrial suppliers in Pune to textile traders in Surat, from FMCG wholesalers in Patna to electronics distributors in Delhi — startups are increasingly using platforms like IndiaMART, Udaan, TradeIndia, Moglix, and Amazon Business to plug into ready-made buyer networks and expand their footprint without building distribution from scratch.

But here’s the catch: not every B2B platform is the right fit for your startup. The “best” marketplace isn’t the one with the biggest user base, lowest commission, or trendiest valuation. The right one is the platform that aligns with your industry, customer profile, margins, and growth ambitions.

In this article, we’ll break down the Indian B2B marketplace landscape, a decision framework with 10 key factors, and a step-by-step checklist to help you choose the right partner for your growth journey. Along the way, we’ll also highlight common mistakes and case snapshots from startups who got it right.

If you’re in the early stages of evaluating where your startup should list, it’s not just about knowing the top platforms but also about making the right choice. For a detailed framework on how to evaluate industry fit, buyer networks, costs, and logistics, check out our guide: How to Choose the Right B2B Marketplace for Your Startup in India.

Understanding the Indian B2B Marketplace Landscape

India’s B2B e-commerce sector is not just a mirror image of its consumer counterpart — it’s a completely different beast. While B2C marketplaces like Flipkart and Amazon compete on convenience, discounts, and delivery speed, B2B platforms solve very different problems: bulk procurement, supplier discovery, financing, and logistics for businesses.

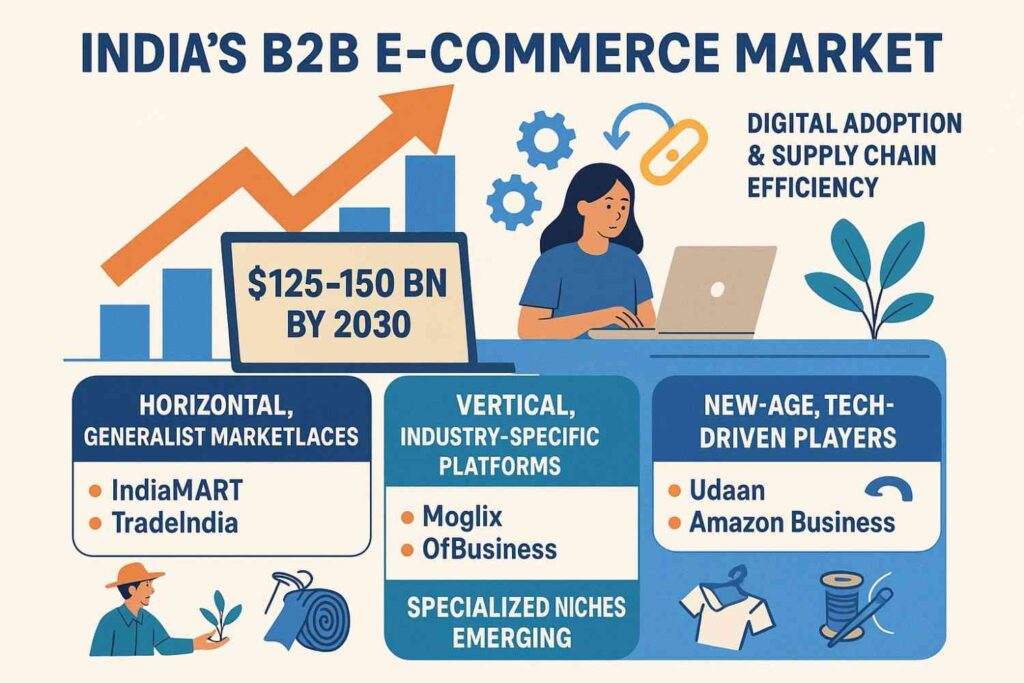

According to a report by RedSeer, the Indian B2B e-commerce market is projected to touch $125–150 billion by 2030, driven by digital adoption among SMEs and the push for supply chain efficiency. What makes it unique is its diverse player mix:

- Horizontal, Generalist Marketplaces

- IndiaMART: India’s oldest and largest B2B marketplace, connecting millions of SMEs across industries. Best for startups looking for broad exposure.

- TradeIndia: Similar to IndiaMART but with stronger presence in certain manufacturing and export categories.

- Vertical, Industry-Specific Platforms

- Moglix: Focused on industrial goods, MRO (maintenance, repair, operations), and manufacturing supply chains. Ideal for startups in industrial products.

- OfBusiness: Specializes in raw material procurement, particularly for construction, steel, and chemicals, with embedded credit offerings.

- New-age, Tech-Driven Players

- Udaan: A mobile-first platform revolutionizing FMCG, fashion, and electronics distribution, particularly in Tier-2 and Tier-3 cities.

- Amazon Business: The B2B arm of Amazon, catering to SMEs with bulk purchasing and enterprise procurement solutions.

- Specialized Niches Emerging

- Agro-focused B2B platforms connecting farmers with agri-suppliers.

- Textile and apparel-focused B2B marketplaces, catering to the fashion export ecosystem.

For a startup founder, this fragmented but rapidly growing landscape can feel overwhelming. Each platform has its own strengths, weaknesses, and buyer networks. The challenge is not about finding a marketplace — it’s about identifying the right one for your product-market fit.

Key Factors to Consider When Choosing a B2B Marketplace

Not all B2B marketplaces are built alike. Some are broad “bazaar-style” platforms where you’ll find everything from industrial pumps to plastic granules. Others are niche, tech-driven, and deeply embedded in specific supply chains. The key is to evaluate them not by size or hype, but by fit with your startup’s stage, sector, and scaling ambitions.

Here’s a 10-factor framework to guide your decision:

1. Target Industry & Product Fit

The first filter is simple: does the platform serve your industry?

- If you’re selling industrial tools or raw materials, Moglix or OfBusiness might make more sense than IndiaMART.

- If you’re in FMCG or fashion, Udaan could give you better penetration into Tier-2 and Tier-3 markets.

- For general exposure across multiple sectors, IndiaMART and TradeIndia remain strong options.

Pro tip: Instead of chasing the largest platform, prioritize the one where your buyers are already active.

2. Customer Base & Buyer Network

The strength of a B2B platform lies in its buyer ecosystem. Ask:

- Does the marketplace give you access to serious business buyers or mostly small traders browsing without intent?

- Are the buyers concentrated in metros, or do they represent the Bharat markets (Tier-2, Tier-3 towns) where growth is booming?

- Does the platform attract repeat bulk buyers or only one-time purchases?

Example: Udaan’s strength lies in penetrating smaller cities, while Amazon Business often caters to larger enterprises and institutions.

3. Trust & Reputation of the Platform

In B2B, trust isn’t a buzzword — it’s survival. Unlike B2C, where a bad product might mean one refund, in B2B a failed bulk order can destroy credibility.

- Established platforms like IndiaMART score high on visibility and trust.

- Newer platforms might offer growth potential but could lack strong dispute resolution systems.

Always check:

- Buyer/seller verification mechanisms

- Fraud protection and escrow systems

- Transparency in ratings and reviews

4. Technology & Ease of Use

A clunky platform adds friction to your sales funnel. Evaluate:

- Mobile app experience (critical if your target buyers are in semi-urban India)

- Search, filters, and product discovery — how easily can a buyer find you?

- Integration options with your ERP, CRM, or inventory system

- Analytics dashboard — does the platform give you data on buyer behavior?

Example: Udaan built its success on a WhatsApp-like, mobile-first interface that made adoption frictionless for small-town traders.

5. Pricing Models & Commission Structure

| Platform | Pricing Model | Notes |

|---|---|---|

| IndiaMART | Subscription-heavy | Pay for visibility, lead generation |

| TradeIndia | Subscription-heavy | Lower entry cost, strong in exports |

| Udaan | Commission-based | Pay per transaction, bulk orders |

| Amazon Business | Commission-based | Strong compliance, enterprise focus |

| Moglix / OfBusiness | Hybrid + Credit | Industrial procurement + financing |

Watch out for hidden costs: ads, premium listings, logistics surcharges. Always calculate net margins.

B2B marketplaces make money either through subscriptions, commissions, or both. You need to evaluate:

- IndiaMART/TradeIndia: Subscription-heavy models where you pay for visibility and lead generation.

- Udaan/Amazon Business: Transaction-based fees and margins on each sale.

- Hidden costs like premium listings, advertising, or logistics surcharges.

Founders often choose the cheapest option upfront, only to realize hidden costs eat into margins. Map your expected volume and calculate actual take-home profit before committing.

6. Logistics & Fulfillment Support

B2B commerce isn’t just about listing products — it’s about getting bulk shipments to the buyer’s warehouse on time.

- Does the platform offer integrated logistics and warehousing?

- Can it handle bulk orders, returns, or fragile items?

- Are there partnerships with reliable last-mile delivery providers?

Platforms like Moglix and Udaan are investing heavily in logistics because they know supply chain reliability is a dealmaker.

7. Payment & Credit Facilities

In India, cash flow is the lifeblood of SMEs. If a platform can help with financing, it can be a game-changer.

- Credit options: Some platforms (like OfBusiness) offer working capital credit for raw material purchases.

- Payment protection: Escrow systems or buyer-seller dispute resolution.

- BNPL (Buy Now, Pay Later) schemes: Increasingly common in Udaan-style marketplaces.

Ask yourself: will this platform improve or worsen my cash flow cycle?

8. Support & After-Sales Service

A startup founder’s nightmare is being left in the dark when something goes wrong. Strong marketplaces offer:

- Dedicated account managers

- Prompt resolution of disputes

- Training sessions on how to optimize listings and generate leads

IndiaMART, for example, is known for hands-on customer service that helps SMEs get discovered faster.

9. Scalability Potential

Think beyond today. Can the platform grow with you?

- Will it allow you to expand to new categories?

- Does it have a strong presence in international trade/export if that’s your long-term goal?

- Is it adding new features (AI matching, digital tools, financing, logistics) that can support your growth journey?

Avoid getting locked into a marketplace that solves today’s problem but caps your growth tomorrow.

10. Community & Networking Opportunities

Some B2B platforms are more than just transaction hubs — they’re ecosystems. They host events, webinars, and supplier meetups where you can network, learn, and partner. For a startup, this intangible benefit can often outweigh low commissions.

Common Mistakes Startups Make When Selecting a B2B Platform

Even with dozens of options in the market, many startups fall into predictable traps when choosing their first B2B marketplace:

- Chasing low fees instead of real buyers

Founders often get attracted to platforms with the lowest commission or subscription cost, only to discover that buyer quality is poor. Cheap visibility without conversions is wasted spend. - Ignoring long-term scalability

A platform that works for your first 100 buyers may not support your growth to 10,000 buyers. If the marketplace is too narrow or lacks advanced tools, you’ll hit a ceiling. - Overvaluing quantity over quality

IndiaMART may generate hundreds of leads, but if most are non-serious, your sales team will burn out chasing them. A smaller but more relevant buyer network is often better. - Neglecting trust and reputation signals

A single bulk-order dispute or fraudulent buyer can wipe out early gains. Choosing platforms with strong escrow and dispute mechanisms is non-negotiable.

Avoiding these mistakes requires thinking beyond short-term savings and focusing on strategic fit.

Case Snapshots: Startups That Got It Right

Case 1: SME Scaling with IndiaMART

A Pune-based manufacturer of packaging machinery listed on IndiaMART in 2019. Instead of cold-calling distributors, they used IndiaMART’s premium subscription to target verified buyers. Within two years, their lead-to-order conversion rate grew steadily, helping them secure export orders without building an on-ground sales team.

Lesson: Established platforms with broad reach are valuable for discovery and credibility.

Case 2: Niche Success via Moglix

An Ahmedabad-based industrial safety equipment startup partnered with Moglix. By leveraging Moglix’s deep integration with factory procurement networks, they bypassed traditional distributors. Their revenues doubled in 18 months, and they even secured working capital support.

Lesson: Industry-specific platforms often deliver fewer leads, but they’re highly relevant and profitable.

Case 3: Udaan Expanding into Tier-2/3 Markets

A Delhi-based FMCG brand found growth stagnant in metros due to heavy competition. By joining Udaan, they tapped into Tier-2 and Tier-3 kirana stores, reaching towns in Bihar and Madhya Pradesh. This “Bharat expansion” doubled their order volume in a year.

Lesson: Choosing a platform with geographic depth is key when scaling beyond metros.

Step-by-Step Checklist for Founders

Here’s a quick decision-making roadmap you can follow:

- Define your buyer persona

Who are you selling to — SMEs, traders, or large enterprises? - Map your industry fit

Shortlist platforms that specialize in your category (generalist vs niche). - Evaluate buyer quality

Request a demo or sample leads before paying for premium access. - Compare pricing and hidden costs

Run a small projection: If you sell ₹10 lakh worth of goods, how much will you actually take home? - Check logistics and payment reliability

Ensure the platform supports your preferred delivery and credit terms. - Start small, test, then scale

Pilot on one platform before going multi-platform. This avoids spreading yourself too thin.

By following this checklist, you’re less likely to make an emotional or hasty decision.

Conclusion

Choosing the right B2B marketplace for your startup in India isn’t about following the crowd. It’s about finding alignment between your product, your buyers, and your growth ambitions.

India’s B2B commerce sector is diverse, from giants like IndiaMART to disruptors like Udaan and Moglix. Each comes with strengths and trade-offs. The smartest founders use a structured evaluation framework, run small pilots, and then commit once they see ROI.

Remember: the goal isn’t just to be present on a platform. The goal is to use that platform to build trust, repeat business, and sustainable margins.

FAQ

Which is the best B2B marketplace for startups in India?

There is no universal “best” B2B marketplace. The right platform depends on your industry, buyer profile, and pricing model. IndiaMART works well for broad SME discovery, Udaan is strong in Tier-2/3 FMCG and fashion markets, Moglix and OfBusiness suit industrial and raw material categories, while Amazon Business is ideal for enterprises and institutional buyers. Startups should choose based on fit, not popularity.

How do I evaluate whether IndiaMART or Udaan is better for my startup?

Choose IndiaMART if your goal is wide visibility, lead generation, and reaching multi-industry SMEs. Choose Udaan if you operate in FMCG, fashion, or electronics and want deeper distribution in Bharat markets. IndiaMART brings volume of leads; Udaan brings highly active retail buyers and faster order cycles.

What costs should founders consider before listing on a B2B marketplace?

Beyond subscription or commission fees, factor in hidden costs such as premium listings, paid ads, logistics surcharges, packaging, returns, and payment settlement delays. Always calculate your net margin. A platform with low subscription but weak buyer intent often leads to high operational cost and low conversion.

How can I identify if a B2B marketplace attracts serious buyers?

Look for verified buyers, lead quality filters, repeat purchase behavior, active RFQs, sector-specific traffic, and transparent reviews. Ask the platform for sample leads or a demo dashboard. Serious B2B buyers place structured RFQs, not generic “send price” messages.

Should a startup list on multiple B2B marketplaces at once?

In the early stage, no. Start with one platform, run a 60–90 day pilot, track lead quality, conversion rate, logistics performance, and cash-flow cycle. Once ROI is proven, expand to 1–2 additional platforms. Going multi-platform too early spreads your operational resources thin and weakens listing performance.

What are the most common mistakes startups make when choosing a B2B platform?

The biggest errors include chasing low subscription fees, overvaluing lead quantity over buyer intent, ignoring logistics capabilities, choosing platforms with weak dispute resolution, and selecting marketplaces that cannot scale with category expansion. Strategic fit and long-term viability matter more than short-term visibility.