Table Of Content

- Why Your Pitch Deck Needs a Checklist

- Pitch Deck — Recommended Slide Order

- Quick Checklist (printable)

- What Investors Look For in Every Pitch

- The Fundraising Checklist: 10 Essentials

- 1. One-line Problem + Solution

- 2. Market Size & Opportunity

- 3. Product & Differentiation

- 4. Business Model & Unit Economics

- 5. Go-to-Market Strategy & Traction

- 6. Team & Hiring Plan

- 7. Financials & Forecasts

- 8. Fundraise Ask & Use of Funds

- 9. Risks & Mitigation

- 10. Ask, Next Steps & Appendix

- Recommended Slide Order

- Common Mistakes Founders Make

- Why This Checklist Works

- Tools and Resources

- Conclusion: Clarity Wins the Room

- FAQs

- What is a fundraising checklist for startups?

- Why do investors expect a pitch deck to follow a checklist?

- How detailed should financial projections be in a pitch deck?

- Can founders get professional help to prepare their pitch deck?

Why Your Pitch Deck Needs a Checklist

Raising capital is often one of the most demanding tasks a founder faces. Your idea might be disruptive, your product innovative, and your team passionate — yet without clear communication, investors simply won’t move forward. Since early-stage meetings move fast, investors expect founders to follow a coherent structure that answers their questions even before they ask them.

That’s where a fundraising checklist becomes essential. Rather than guessing what to include, you can prepare a pitch deck that covers every element: the problem, the market, your product, traction, unit economics, and the ask. Consequently, your entire narrative becomes sharper and easier to follow.

This guide distills the essentials into a clear, step-by-step structure. Think of it as both a quality-control tool and a confidence booster.

Fundraising Checklist: What Investors Expect in Your Pitch Deck

A practical, founder-first checklist to prepare a pitch deck that answers investor questions — clearly and convincingly.

Investors want clarity: a coherent problem, a defensible solution, a repeatable growth model and a clear ask. Use this checklist to confirm your deck answers each topic succinctly — then rehearse the story behind the slides.

-

1. One-line problem + solution (Traction first)

Start with a crisp 1–2 sentence problem statement and your solution. If you have users or revenue, highlight traction in the same breath — investors remember metrics more than prose. -

2. Market size & opportunity

Show TAM / SAM / SOM with sources for your estimates. Use conservative, defensible assumptions and call out data sources (industry reports, government stats, or proprietary pilot results). -

3. Product & differentiation

Explain why your product wins today and in the future. Highlight IP, distribution advantages, partnerships and key product metrics (retention, DAU/MAU, time-to-value). -

4. Business model & unit economics

Demonstrate LTV, CAC, gross margin, and contribution profit per unit. Investors expect you to know your payback period and breakeven drivers. -

5. Go-to-market & traction

Share growth channels, CAC trends, key partnerships, pilot customers and referenceable case studies. Show month-on-month or cohort growth charts where possible. -

6. Team & hiring plan

Introduce founders (one-liners), key hires, and hiring roadmap for next 12 months. Explain why this team can execute the plan. -

7. Financials & 3-year forecast

Provide topline, gross margin, EBITDA trajectory and the explicit assumptions behind the numbers. Be ready to defend growth levers and unit economics. -

8. Fundraise ask & use of funds

State the amount you are raising, the runway it buys, and the milestone plan you will achieve with the capital (e.g., 18 months to product-market fit / scale). -

9. Risks & mitigation

Acknowledge top 3 risks (market, execution, regulatory) and measurable steps you’re taking to mitigate them. -

10. Ask, next steps & appendix

Close with the specific ask, contact details, and an appendix with supporting data: unit economics, customer testimonials, and legal/IP documentation.

Pitch Deck — Recommended Slide Order

- Title & one-line pitch

- Problem (with stories or data)

- Solution / Product demo

- Market opportunity (TAM/SAM/SOM)

- Business model / unit economics

- Traction & growth channels

- Competition & differentiation

- Team

- Financials & projections

- Ask & use of funds

- Appendix (data, legal, customer letters)

Pro tip: keep decks to 12–16 slides. Use the appendix for detailed spreadsheets and metrics rather than crowding your main story.

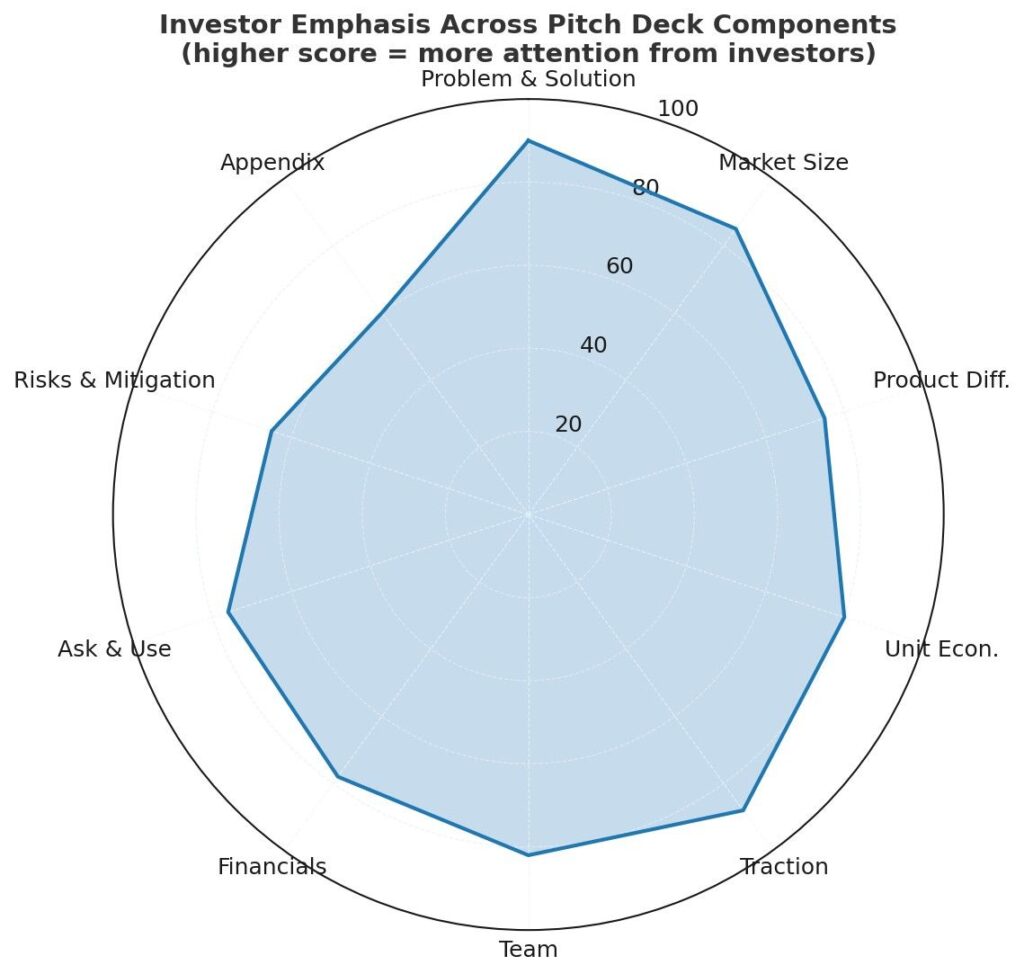

What Investors Look For in Every Pitch

Investors meet hundreds of startups every year. They can spot within minutes whether a founder is well-prepared. A good pitch deck is more than slides — it is evidence of clarity, preparation, and strategic thinking.

Here’s what most investors expect:

- A crisp one-liner that explains your problem and solution.

- Evidence of traction — metrics that show progress.

- A large and growing market opportunity.

- A defensible product with clear differentiation.

- Solid understanding of unit economics and financial forecasts.

- A well-structured ask with realistic use of funds.

If any of these elements are missing, your deck feels incomplete. That’s why founders use a fundraising checklist to make sure nothing slips through the cracks.

The Fundraising Checklist: 10 Essentials

Below is the comprehensive checklist. Each section corresponds to a part of your pitch deck and highlights what investors want to see.

1. One-line Problem + Solution

Start with a powerful one-liner: the problem you solve and how you solve it. This should be memorable, easy to repeat, and backed by evidence.

Example: “Small retailers in Tier-2 cities struggle to access affordable supply chain financing. Our digital platform provides instant working capital using AI-based credit scoring.”

2. Market Size & Opportunity

Investors want numbers, not just enthusiasm. Present your TAM (Total Addressable Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market). Use credible sources like government reports, consulting studies, or proprietary data.

Read also Statista’s global startup funding data.

3. Product & Differentiation

Your product demo should make it clear why you win. Show product screenshots, user flows, and highlight key differentiators — intellectual property, distribution partnerships, retention rates, or superior user experience.

Remember, investors aren’t just buying into what you’ve built; they’re betting on your ability to sustain differentiation over the next five years.

4. Business Model & Unit Economics

This is where founders often stumble. You must show how the business makes money and prove that the model can scale profitably.

Key metrics include:

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Gross Margin

- Contribution Profit

If you can demonstrate payback periods and breakeven points, you instantly establish credibility.

5. Go-to-Market Strategy & Traction

Investors want to see how you plan to grow. Lay out your distribution channels, early traction, and growth strategy. Include data on:

- Pilot customers and testimonials.

- Partnerships or distribution deals.

- User growth charts (month-on-month or cohorts).

- Conversion funnels and retention data.

Even small but authentic traction is more convincing than lofty projections.

6. Team & Hiring Plan

Your team slide should answer two questions: Why you? Why now?

Introduce founders with one-liners that highlight relevant experience. Show current key hires and your hiring roadmap for the next 12 months. If you have advisors or industry veterans on board, mention them.

Investors back teams more than ideas. A mediocre idea with an outstanding team is often more fundable than the reverse.

7. Financials & Forecasts

Your financial model needs to show both realism and ambition. Share a three-year forecast with topline revenue, gross margin, and EBITDA.

Most importantly, explain the assumptions behind these numbers. How will CAC change with scale? What retention rates are you assuming? How do new product launches contribute to revenue?

Transparency here builds trust.

8. Fundraise Ask & Use of Funds

Be direct about how much you are raising and what milestones this capital will unlock.

For example: “We are raising $2M to fund 18 months of runway, during which we will expand into two new markets, grow to 10,000 paying customers, and achieve $5M ARR.”

Break down the use of funds by percentage (e.g., product, marketing, hiring, operations).

9. Risks & Mitigation

No investor expects zero risk. They want to know that you’ve thought through the challenges and have a plan to address them.

List the top three risks — market adoption, execution, or regulatory hurdles — and outline your mitigation strategy. A founder who acknowledges risks appears more credible than one who ignores them.

10. Ask, Next Steps & Appendix

Conclude with your specific ask: capital amount, introductions, or strategic partnerships.

Add an appendix with detailed financials, customer testimonials, legal/IP documents, or technical architecture. This keeps the main deck sharp while providing depth for investors who want more.

Recommended Slide Order

Most successful decks follow this flow:

- Title & one-line pitch

- Problem

- Solution / Product demo

- Market opportunity (TAM / SAM / SOM)

- Business model / Unit economics

- Traction & growth channels

- Competition & differentiation

- Team

- Financials & projections

- Ask & use of funds

- Appendix

Keep it short and powerful: 12–16 slides maximum. Anything longer risks losing attention.

Common Mistakes Founders Make

Even with a checklist, many founders make avoidable mistakes:

- Overloading slides with text. Investors prefer visuals, charts, and bullet points.

- Exaggerating market size. Inflated numbers reduce credibility.

- Ignoring hidden costs. CAC, churn, and logistics are often underestimated.

- Forgetting the story. Decks are tools, but your narrative is what persuades.

Avoid these traps, and your deck will stand out.

Why This Checklist Works

The fundraising checklist is designed to mirror exactly how investors think. It helps you:

- Save time. No need to reinvent the wheel for every raise.

- Build confidence. You know you’re covering everything investors expect.

- Tell a better story. Instead of random slides, you have a clear flow.

- Increase credibility. Demonstrates preparation, discipline, and focus.

Founders who use a structured checklist typically report smoother meetings and more productive investor conversations.

Tools and Resources

To strengthen your preparation, consider complementing your checklist with practical resources:

- Fundraising Data from CB Insights – detailed market analysis of global funding trends.

- Strategic Advisory Services – for hands-on guidance with deck reviews, fundraising strategy, and investor introductions.

These resources give you both the big picture and tactical support for your fundraising journey.

Conclusion: Clarity Wins the Room

Fundraising is not about dazzling investors with buzzwords. It’s about clarity, honesty, and strategy. A well-structured pitch deck, built using a fundraising checklist, ensures you cover every base investors expect — without overwhelming them.

Your deck should be concise, data-driven, and backed by a strong story. Use this checklist, rehearse your delivery, and seek professional feedback before every major meeting.

Remember: investors don’t just invest in ideas — they invest in founders who can execute with clarity and conviction.

With the right preparation, your next fundraising meeting could be the one that unlocks your startup’s future.

FAQs

What is a fundraising checklist for startups?

A fundraising checklist is a structured guide founders can use to prepare their pitch deck and fundraising materials. It ensures all critical elements—such as problem-solution fit, market size, traction, unit economics, team, and fundraising ask—are covered before approaching investors.

Why do investors expect a pitch deck to follow a checklist?

Investors review hundreds of pitch decks every year. A structured checklist helps founders present their story clearly and makes it easier for investors to assess the opportunity quickly. Covering each point builds credibility and shows you understand the fundraising process.

How detailed should financial projections be in a pitch deck?

Financial projections should be realistic, data-driven, and backed by assumptions. A three-year forecast is standard, showing topline revenue, margins, and key unit economics. Investors don’t expect perfect accuracy, but they do expect clarity on the levers that drive growth.

Can founders get professional help to prepare their pitch deck?

Yes. Many founders work with strategic advisors or fundraising experts to refine their decks, practice storytelling, and stress-test financials. Partnering with experts can significantly increase your chances of raising capital successfully. You can explore Strategic Advisory Services for tailored support.