Table Of Content

- Gen Z vs Millennial Demographics in India {#demographics-overview}

- Demographic Profile Comparison

- Economic Power and Spending Capacity

- Geographic Distribution Impact

- Digital Shopping Behavior Differences {#digital-shopping-behavior}

- Platform Usage and Preferences

- Mobile Commerce Adoption Patterns

- Digital Payment Adoption

- Brand Loyalty and Preference Patterns {#brand-loyalty-patterns}

- Brand Loyalty Development

- Brand Discovery and Evaluation Process

- Category-Specific Brand Preferences

- Payment Method Preferences and Financial Behavior {#payment-financial-behavior}

- Financial Management Approaches

- Payment Method Analysis

- BNPL and Credit Usage Patterns

- Social Media Influence on Purchase Decisions {#social-media-influence}

- Social Media Platform Influence

- Influencer Marketing Effectiveness

- Social Proof and Reviews Impact

- Purchase Decision Timeline

- Value Perception and Price Sensitivity {#value-price-sensitivity}

- Value Definition Differences

- Price Sensitivity Analysis

- Discount and Promotion Response

- Premium Pricing Acceptance

- Product Category Preferences and Spending {#category-spending-preferences}

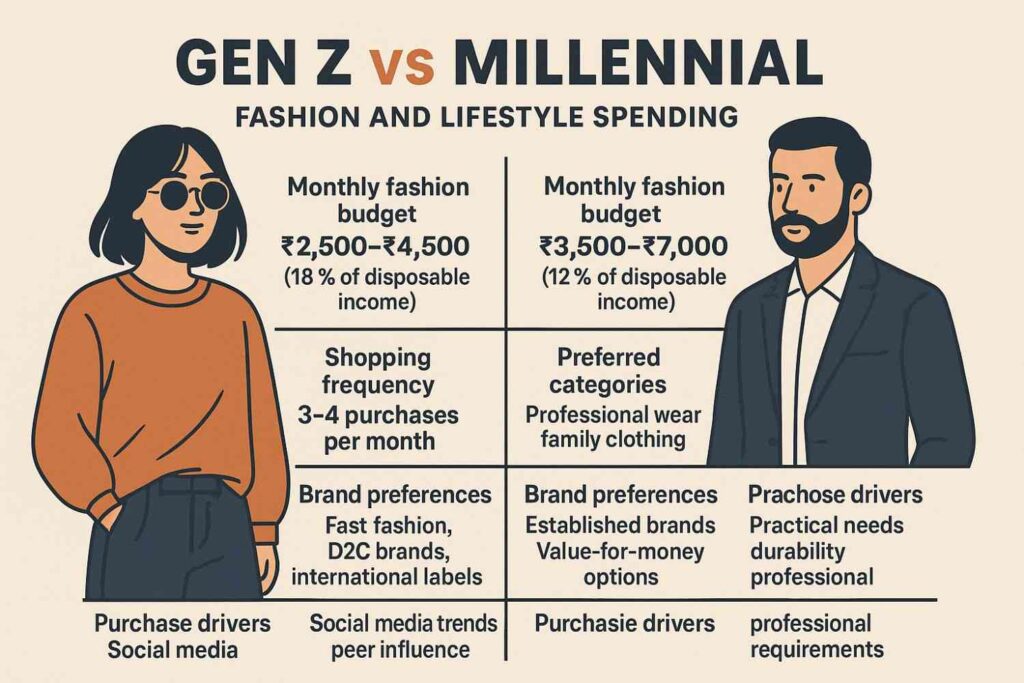

- Fashion and Lifestyle Spending

- Technology and Electronics Investment

- Health and Wellness Spending

- Food and Dining Preferences

- Home and Living Investments

- Sustainable Shopping and Ethical Consumption {#sustainable-ethical-shopping}

- Sustainability Awareness and Action

- Sustainable Product Categories

- Ethical Brand Evaluation

- Willingness to Pay Premium for Sustainability

- Circular Economy Participation

- Marketing Message Effectiveness {#marketing-message-effectiveness}

- Communication Preferences

- Content Format Effectiveness

- Brand Storytelling Approaches

- Advertising Channel Effectiveness

- Call-to-Action Effectiveness

- Future Trends and Predictions {#future-trends}

- Technology Adoption Trends

- Shopping Behavior Evolution

- Payment and Financial Trends

- Brand Relationship Evolution

- Market Implications

- Frequently Asked Questions {#faq}

- Q:What are the main differences between Gen Z and millennial buying habits in India?

- Q: How do payment preferences differ between Gen Z and millennials in India?

- Q: Which generation spends more on different product categories?

- Q: How does social media influence purchasing decisions differently?

- Q: What are the sustainability differences between Gen Z and millennial consumers?

- Q: How do brand loyalty patterns differ between these generations?

- Q:What marketing strategies work best for each generation?

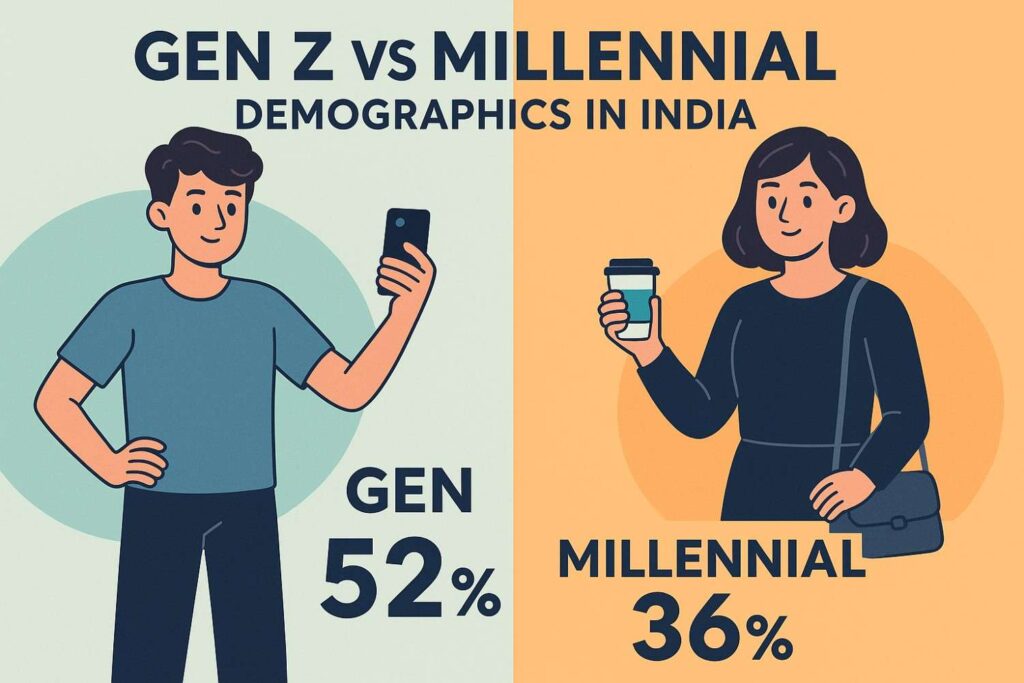

Understanding Gen Z vs millennial buying habits in India has become crucial for brands targeting the Indian market. With Gen Z accounting for 27% of India’s population and millennials representing 34%, these two generations drive over 60% of consumer spending decisions across the country.

The Gen Z vs millennial buying habits in India show fundamental differences in shopping preferences, digital adoption, brand loyalty, and purchase decision-making processes. Moreover, these generational differences are more pronounced in India due to unique cultural, economic, and technological factors that shape consumer behavior.

This comprehensive analysis examines the key differences between Gen Z vs millennial buying habits in India, providing actionable insights for brands, marketers, and businesses looking to effectively target these influential consumer segments in 2025 and beyond.

Gen Z vs Millennial Demographics in India {#demographics-overview}

Understanding the demographic foundation is essential for analyzing Gen Z vs millennial buying habits in India. These two generations have distinct characteristics shaped by different economic and technological environments.

Demographic Profile Comparison

Gen Z in India (Born 1997-2012):

- Population size: 270 million (27% of total population)

- Age range in 2025: 13-28 years

- Economic status: Early career, students, entry-level professionals

- Digital nativity: True digital natives, smartphone-first generation

- Key influences: Social media, peer opinions, global trends

Millennials in India (Born 1981-1996):

- Population size: 340 million (34% of total population)

- Age range in 2025: 29-44 years

- Economic status: Peak earning years, family builders, homeowners

- Digital adoption: Digital adapters, desktop-to-mobile transition

- Key influences: Economic stability, family needs, career advancement

Economic Power and Spending Capacity

The Gen Z vs millennial buying habits in India are significantly influenced by their different economic positions:

Gen Z Economic Characteristics:

- Average monthly income: ₹25,000-₹45,000

- Discretionary spending: 35% of income

- Primary expenses: Personal lifestyle, education, entertainment

- Financial dependency: 67% partially dependent on family income

- Spending pattern: Frequent small purchases, experience-focused

Millennial Economic Characteristics:

- Average monthly income: ₹55,000-₹1,20,000

- Discretionary spending: 28% of income

- Primary expenses: Family needs, home, investments

- Financial dependency: 89% financially independent

- Spending pattern: Planned big purchases, value-focused

Geographic Distribution Impact

Gen Z vs millennial buying habits in India vary significantly across different city tiers:

- Metro Cities: Gen Z shows higher experimental buying, millennials focus on premium quality

- Tier 2 Cities: Both generations show value-consciousness, Gen Z more brand-aware

- Tier 3+ Cities: Traditional influences stronger, family decision-making more prominent

This demographic foundation shapes all aspects of their consumer behavior, as documented by Nielsen India research on generational consumer patterns.

Digital Shopping Behavior Differences {#digital-shopping-behavior}

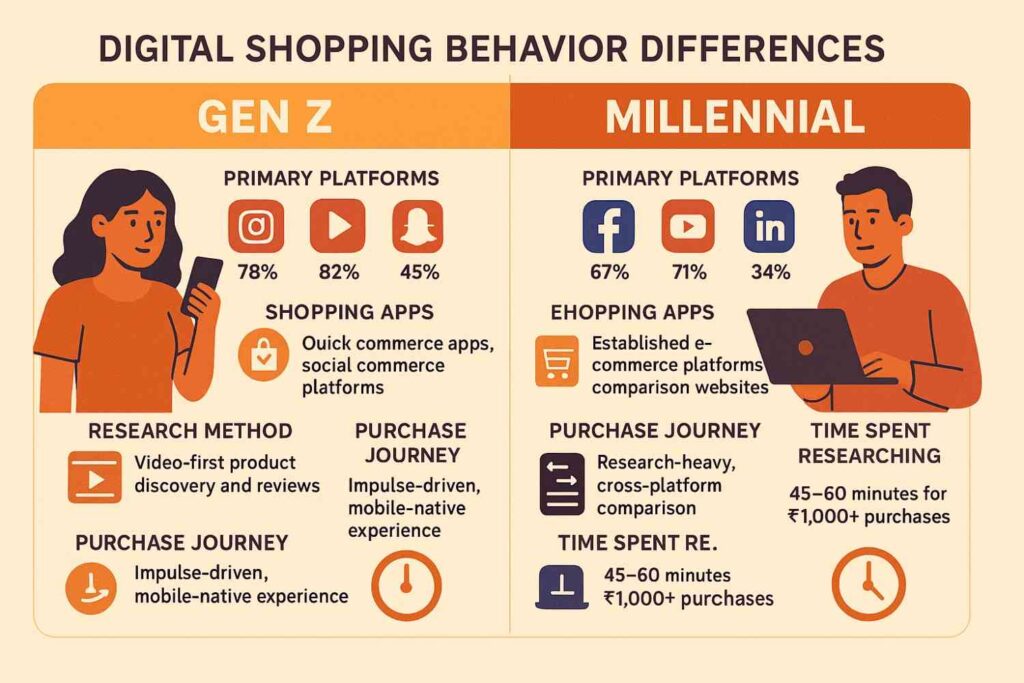

The most significant aspect of Gen Z vs millennial buying habits in India lies in their digital shopping behaviors and platform preferences.

Platform Usage and Preferences

Gen Z Digital Shopping Behavior:

- Primary platforms: Instagram (78%), YouTube (82%), Snapchat (45%)

- Shopping apps: Quick commerce apps, social commerce platforms

- Research method: Video-first product discovery and reviews

- Purchase journey: Impulse-driven, mobile-native experience

- Time spent researching: 15-25 minutes for ₹1,000+ purchases

Millennial Digital Shopping Behavior:

- Primary platforms: Facebook (67%), YouTube (71%), LinkedIn (34%)

- Shopping apps: Established e-commerce platforms, comparison websites

- Research method: Text-based reviews, detailed product specifications

- Purchase journey: Research-heavy, cross-platform comparison

- Time spent researching: 45-60 minutes for ₹1,000+ purchases

Mobile Commerce Adoption Patterns

The Gen Z vs millennial buying habits in India show distinct mobile commerce preferences:

Gen Z Mobile Shopping:

- Mobile-only shopping: 89% complete entire purchase journey on mobile

- App vs website preference: 76% prefer shopping apps over mobile websites

- Quick checkout preference: Demand one-click purchase options

- Social integration: 67% share purchases on social media platforms

- Voice search usage: 34% use voice search for product discovery

Millennial Mobile Shopping:

- Cross-device behavior: 56% research on mobile, purchase on desktop

- Security concerns: 43% prefer desktop for high-value purchases

- Detailed comparison: Use multiple tabs and comparison features

- Privacy preferences: More cautious about sharing purchase information

- Voice search adoption: 18% use voice search, primarily for basic queries

Digital Payment Adoption

Gen Z vs millennial buying habits in India reflect different digital payment comfort levels:

Gen Z Payment Preferences:

- UPI usage: 91% primary payment method

- Digital wallets: 67% actively use multiple wallet apps

- Buy now, pay later: 45% have used BNPL services

- Cryptocurrency interest: 23% interested in crypto payments

- Cash usage: Only 15% prefer cash for online purchases

Millennial Payment Preferences:

- UPI usage: 78% primary payment method

- Credit cards: 56% prefer credit cards for high-value purchases

- Net banking: 34% still use traditional banking methods

- BNPL services: 28% have tried, more cautious adoption

- Cash backup: 31% keep cash as backup payment option

This digital behavior evolution is supported by Boston Consulting Group research on generational digital adoption patterns.

Brand Loyalty and Preference Patterns {#brand-loyalty-patterns}

Gen Z vs millennial buying habits in India show dramatically different approaches to brand relationships and loyalty formation.

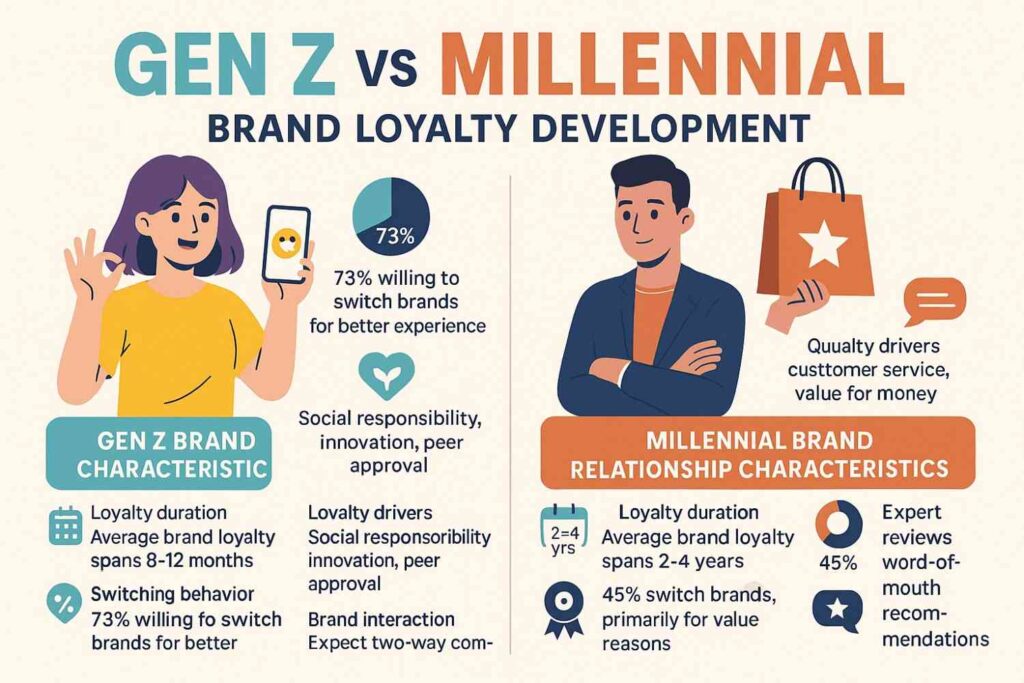

Brand Loyalty Development

Gen Z Brand Relationship Characteristics:

- Loyalty duration: Average brand loyalty spans 8-12 months

- Switching behavior: 73% willing to switch brands for better experience

- Loyalty drivers: Social responsibility, innovation, peer approval

- Brand interaction: Expect two-way communication and engagement

- Influence factors: Influencer endorsements, social media presence

Millennial Brand Relationship Characteristics:

- Loyalty duration: Average brand loyalty spans 2-4 years

- Switching behavior: 45% switch brands, primarily for value reasons

- Loyalty drivers: Quality consistency, customer service, value for money

- Brand interaction: Prefer professional, reliable communication

- Influence factors: Expert reviews, word-of-mouth recommendations

Brand Discovery and Evaluation Process

The Gen Z vs millennial buying habits in India demonstrate different brand discovery methodologies:

Gen Z Brand Discovery: Social Media Discovery (67% of new brands):

- Instagram stories and reels drive brand awareness

- YouTube influencer recommendations create interest

- TikTok trends influence brand consideration

- Peer social sharing generates trial motivation

Evaluation Criteria:

- Brand social media presence and engagement quality

- Influencer partnerships and authentic endorsements

- Social and environmental responsibility initiatives

- Innovation in products and customer experience

Millennial Brand Discovery: Traditional and Digital Mix (52% of new brands):

- Google search and comparison websites

- Professional review sites and expert opinions

- Word-of-mouth from family and colleagues

- Traditional advertising and media coverage

Evaluation Criteria:

- Product quality and performance consistency

- Customer service reputation and reliability

- Value for money and long-term benefits

- Brand heritage and market reputation

Category-Specific Brand Preferences

Gen Z vs millennial buying habits in India vary significantly across product categories:

Fashion and Lifestyle Brands:

Gen Z Preferences:

- Fast fashion brands with trendy designs

- Sustainable and eco-friendly options gaining importance

- Direct-to-consumer brands with social media presence

- International brands with local relevance

Millennial Preferences:

- Established brands with quality reputation

- Value-for-money options with durability

- Professional and work-appropriate clothing

- Mix of international and trusted Indian brands

Technology and Electronics:

Gen Z Preferences:

- Latest features and innovation-focused brands

- Gaming and entertainment-optimized products

- Social media and content creation friendly

- Affordable premium with good camera quality

Millennial Preferences:

- Reliability and long-term performance

- Professional productivity and efficiency

- Family-friendly and multi-user products

- Established brands with service support

This brand loyalty evolution is documented in Deloitte research on generational brand preferences.

Payment Method Preferences and Financial Behavior {#payment-financial-behavior}

Gen Z vs millennial buying habits in India reveal significant differences in financial management and payment preferences that impact their shopping behavior.

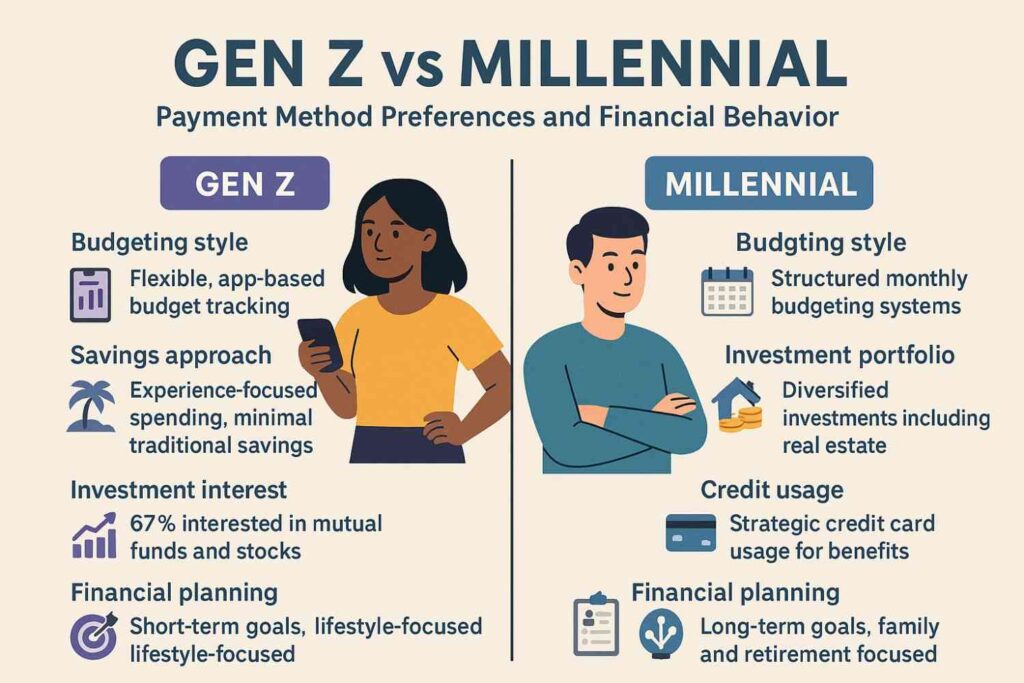

Financial Management Approaches

Gen Z Financial Behavior:

- Budgeting style: Flexible, app-based budget tracking

- Savings approach: Experience-focused spending, minimal traditional savings

- Investment interest: 67% interested in mutual funds and stocks

- Credit usage: Conservative approach, prefer debit over credit

- Financial planning: Short-term goals, lifestyle-focused

Millennial Financial Behavior:

- Budgeting style: Structured monthly budgeting systems

- Savings approach: Goal-oriented savings for major purchases

- Investment portfolio: Diversified investments including real estate

- Credit usage: Strategic credit card usage for benefits

- Financial planning: Long-term goals, family and retirement focused

Payment Method Analysis

The Gen Z vs millennial buying habits in India show distinct payment preferences across different purchase values:

Small Purchases (Under ₹500):

Gen Z Payment Behavior:

- UPI instant payments (94% preference)

- Mobile wallets for quick transactions

- Rarely use cash for online purchases

- Expect seamless one-click payment options

Millennial Payment Behavior:

- UPI payments (87% preference)

- Debit cards for budget control

- Occasional cash usage for offline purchases

- Value transaction security over speed

Medium Purchases (₹500-₹5,000):

Gen Z Payment Choices:

- UPI remains primary choice (89%)

- Buy Now Pay Later services (34% usage)

- Avoid credit cards due to debt concerns

- Prefer installment options for expensive items

Millennial Payment Choices:

- Credit cards for reward points (45%)

- UPI for convenience (67%)

- Net banking for high-security needs

- EMI options for planned purchases

High-Value Purchases (Above ₹5,000):

Gen Z Approach:

- Family consultation for payment decisions

- Prefer saving up rather than taking credit

- Use parent’s credit cards with permission

- Research financing options extensively

Millennial Approach:

- Strategic credit card usage for benefits

- EMI options for cash flow management

- Insurance and protection add-ons consideration

- Comparison of financing terms and conditions

BNPL and Credit Usage Patterns

Gen Z vs millennial buying habits in India show interesting patterns in alternative financing:

Gen Z BNPL Usage:

- Adoption rate: 45% have used BNPL services

- Primary categories: Fashion, electronics, lifestyle products

- Average ticket size: ₹2,500-₹8,000

- Repayment behavior: 92% on-time payment rate

- Future usage: 67% plan to continue using BNPL

Millennial Credit Utilization:

- Credit card ownership: 78% have at least one credit card

- Usage strategy: Rewards optimization and cash flow management

- Credit utilization: Average 35% of credit limit utilization

- Payment behavior: 89% pay full amounts to avoid interest

- BNPL adoption: 28% have tried, prefer traditional credit

This financial behavior analysis is supported by PwC India research on generational payment trends.

“Gen Z and Millennials in India pay differently. See which payment gateways match their habits: Best Payment Gateways in India 2025

Social Media Influence on Purchase Decisions {#social-media-influence}

The Gen Z vs millennial buying habits in India are significantly shaped by social media, but in markedly different ways across the two generations.

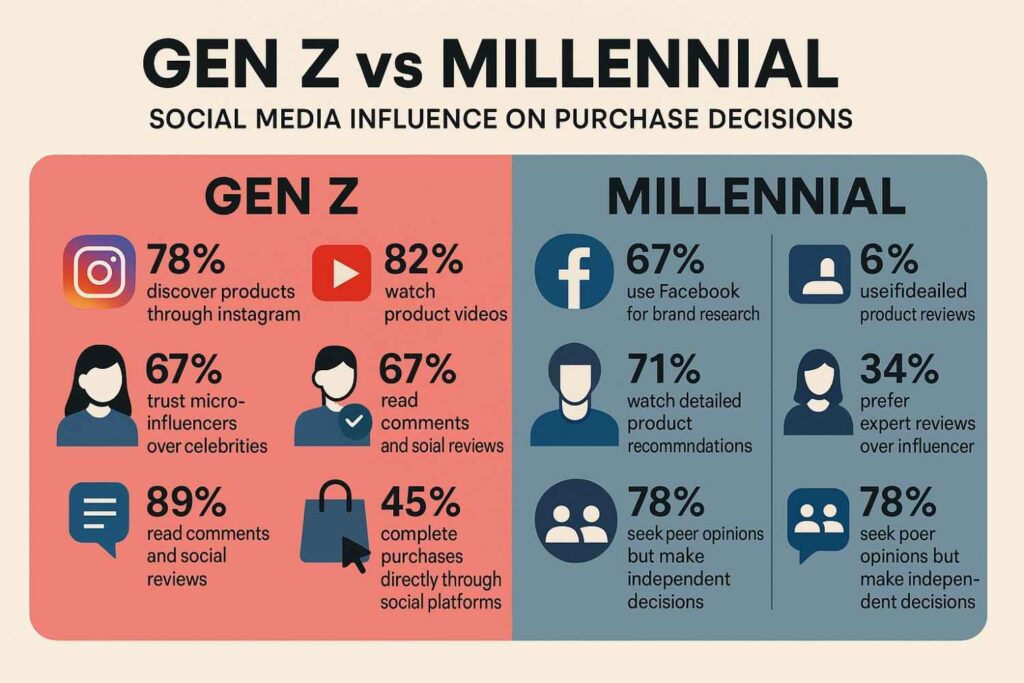

Social Media Platform Influence

Gen Z Social Commerce Behavior:

- Instagram influence: 78% discover products through Instagram

- YouTube impact: 82% watch product videos before purchasing

- Influencer trust: 67% trust micro-influencers over celebrities

- Social proof importance: 89% read comments and social reviews

- Purchase journey: 45% complete purchases directly through social platforms

Millennial Social Media Usage:

- Facebook influence: 67% use Facebook for brand research

- YouTube research: 71% watch detailed product reviews

- Professional networks: 34% influenced by LinkedIn recommendations

- Influencer skepticism: 54% prefer expert reviews over influencer content

- Social validation: 78% seek peer opinions but make independent decisions

Influencer Marketing Effectiveness

Gen Z vs millennial buying habits in India show different responses to influencer marketing:

Gen Z Influencer Preferences:

Micro-Influencers (1K-100K followers):

- Higher trust and authenticity perception

- Better engagement and interaction rates

- More relatable and accessible content

- Category-specific expertise preference

Content Format Preferences:

- Short-form videos (Instagram Reels, YouTube Shorts)

- Live streaming and real-time interaction

- Behind-the-scenes and authentic content

- Interactive polls, Q&As, and challenges

Millennial Influencer Approach:

Expert and Authority Figures:

- Industry experts and established personalities

- Professional reviews and detailed analysis

- Long-form content with comprehensive information

- Traditional celebrity endorsements still effective

Content Consumption Patterns:

- Detailed product reviews and comparisons

- Educational content and tutorials

- Professional recommendations and advice

- User-generated content from verified buyers

Social Proof and Reviews Impact

The Gen Z vs millennial buying habits in India demonstrate different social proof requirements:

Gen Z Social Proof Needs:

- Real-time social validation: Instagram likes, comments, shares

- Peer recommendations: Friends and social connections

- Influencer endorsements: Trusted social media personalities

- Community discussions: Social media groups and forums

- Visual proof: Photos and videos from real users

Millennial Social Proof Preferences:

- Detailed written reviews: Comprehensive product feedback

- Expert recommendations: Professional and industry authority opinions

- Comparison websites: Structured product comparisons

- Family and friend opinions: Personal network recommendations

- Brand reputation: Established brand credibility and history

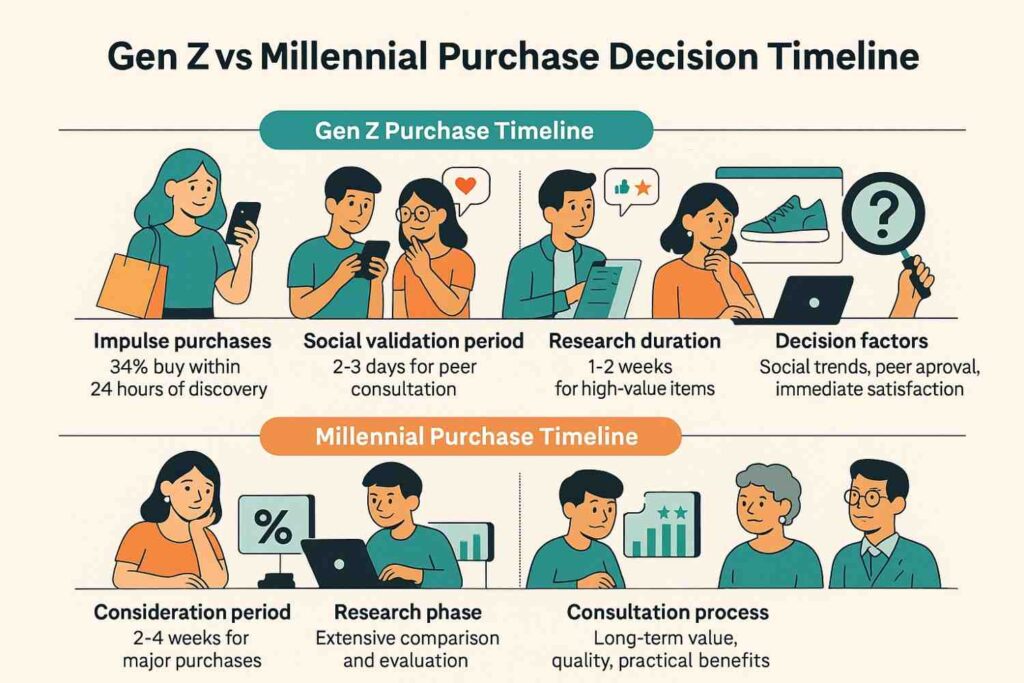

Purchase Decision Timeline

Gen Z vs millennial buying habits in India show different decision-making speeds:

Gen Z Purchase Timeline:

- Impulse purchases: 34% buy within 24 hours of discovery

- Social validation period: 2-3 days for peer consultation

- Research duration: 1-2 weeks for high-value items

- Decision factors: Social trends, peer approval, immediate satisfaction

Millennial Purchase Timeline:

- Consideration period: 2-4 weeks for major purchases

- Research phase: Extensive comparison and evaluation

- Consultation process: Family and expert opinion gathering

- Decision factors: Long-term value, quality, practical benefits

This social media influence analysis is based on Social Media Examiner research on generational social commerce trends.

Value Perception and Price Sensitivity {#value-price-sensitivity}

Understanding Gen Z vs millennial buying habits in India requires analyzing how each generation perceives value and responds to pricing strategies.

Value Definition Differences

Gen Z Value Perception:

- Experience value: Prioritize experiences and personal satisfaction

- Social value: Products that enhance social status and acceptance

- Innovation value: Latest features and technological advancement

- Convenience value: Time-saving and hassle-free experiences

- Authenticity value: Genuine brand stories and transparent practices

Millennial Value Perception:

- Functional value: Products that solve practical problems effectively

- Economic value: Long-term cost savings and return on investment

- Quality value: Durability and consistent performance over time

- Family value: Benefits for family members and household needs

- Professional value: Products that support career and personal growth

Price Sensitivity Analysis

The Gen Z vs millennial buying habits in India show different price sensitivity patterns:

Gen Z Price Behavior:

Low-Value Purchases (Under ₹1,000):

- Moderately price-sensitive (67% compare prices)

- Willing to pay premium for trendy or unique items

- Influenced by social media deals and flash sales

- Prefer smaller frequent purchases over bulk buying

High-Value Purchases (Above ₹5,000):

- Highly price-sensitive (89% extensive price comparison)

- Seek installment and financing options

- Research discount patterns and seasonal sales

- Family consultation for budget approval

Millennial Price Behavior:

Routine Purchases:

- Strategic price consciousness (78% compare prices)

- Focus on bulk buying and family pack options

- Loyalty program and cashback optimization

- Annual budget planning and expense tracking

Investment Purchases:

- Value-focused rather than price-focused

- Consider total cost of ownership

- Research resale value and depreciation

- Factor in maintenance and service costs

Discount and Promotion Response

Gen Z vs millennial buying habits in India demonstrate different promotional effectiveness:

Gen Z Promotion Preferences:

- Flash sales: 78% attracted to limited-time offers

- Social media exclusive deals: Instagram and YouTube special offers

- Influencer discount codes: Personal referral-style promotions

- Gamified promotions: Spin wheels, scratch cards, challenges

- FOMO marketing: Limited quantity and urgency-based offers

Millennial Promotion Strategies:

- Seasonal sales: Planned purchases during major sale events

- Bulk discounts: Family pack and quantity-based savings

- Loyalty rewards: Cumulative benefits and point systems

- Cashback offers: Direct monetary benefits and savings

- Annual membership benefits: Subscription-based exclusive deals

Premium Pricing Acceptance

The Gen Z vs millennial buying habits in India vary in premium pricing tolerance:

Gen Z Premium Acceptance:

Categories with Premium Tolerance:

- Fashion and personal style items (67% accept premium)

- Technology and gadgets (56% for latest features)

- Food and beverage experiences (78% for unique experiences)

- Entertainment and content (45% for exclusive access)

Premium Justification Requirements:

- Clear differentiation from competitors

- Social media buzz and peer validation

- Influencer endorsements and social proof

- Innovation and unique features

Millennial Premium Approach:

Strategic Premium Spending:

- Home and family products (89% invest in quality)

- Professional and career-related items (78% premium acceptance)

- Health and wellness products (67% prioritize quality)

- Long-term investment items (94% focus on durability)

Value Justification Process:

- Cost-per-use calculation and analysis

- Quality comparison and expert reviews

- Long-term benefit assessment

- Family impact and utility evaluation

This value and pricing analysis is informed by McKinsey research on consumer value perception in India.

Product Category Preferences and Spending {#category-spending-preferences}

Gen Z vs millennial buying habits in India show distinct preferences and spending patterns across different product categories, reflecting their life stages and priorities.

Fashion and Lifestyle Spending

Gen Z Fashion Behavior:

- Monthly fashion budget: ₹2,500-₹4,500 (18% of disposable income)

- Shopping frequency: 3-4 purchases per month

- Preferred categories: Casual wear, accessories, footwear

- Brand preferences: Fast fashion, D2C brands, international labels

- Purchase drivers: Social media trends, peer influence, self-expression

Millennial Fashion Approach:

- Monthly fashion budget: ₹3,500-₹7,000 (12% of disposable income)

- Shopping frequency: 2-3 planned purchases per month

- Preferred categories: Professional wear, family clothing, quality basics

- Brand preferences: Established brands, value-for-money options

- Purchase drivers: Practical needs, durability, professional requirements

Technology and Electronics Investment

The Gen Z vs millennial buying habits in India differ significantly in technology spending:

Gen Z Technology Priorities:

Smartphone Preferences:

- Budget range: ₹15,000-₹35,000

- Key features: Camera quality, gaming performance, social media optimization

- Upgrade cycle: 18-24 months average

- Financing: Often family-funded or installment-based

Gaming and Entertainment:

- Gaming peripherals and accessories investment

- Streaming service subscriptions (multiple platforms)

- Content creation tools and equipment

- Social media and productivity apps

Millennial Technology Focus:

Professional Technology:

- Laptop and work-from-home setup prioritization

- Smart home devices and family entertainment systems

- Health and fitness tracking technology

- Productivity and efficiency-focused applications

Family Technology Decisions:

- Household appliance upgrades and smart devices

- Educational technology for children

- Security and home automation systems

- Long-term technology investment planning

Health and Wellness Spending

Gen Z vs millennial buying habits in India show evolving health consciousness:

Gen Z Health Investments:

- Fitness apps and subscriptions: ₹500-₹1,200 monthly

- Nutrition supplements: Protein powders, vitamins, wellness products

- Mental health services: Therapy apps, meditation subscriptions

- Fitness equipment: Home workout gear, wearable technology

- Skincare and personal care: Premium and organic products

Millennial Health Priorities:

- Family health insurance: Comprehensive coverage planning

- Preventive healthcare: Regular check-ups, family doctor consultations

- Home fitness solutions: Gym equipment, family exercise programs

- Nutritional planning: Organic food, family meal planning

- Stress management: Professional services, wellness retreats

Food and Dining Preferences

The Gen Z vs millennial buying habits in India demonstrate different food consumption patterns:

Gen Z Food Behavior:

Dining Preferences:

- Cloud kitchens and food delivery (4-5 times per week)

- Experimental cuisine and international flavors

- Social dining and Instagram-worthy experiences

- Health-conscious fast food and organic options

Monthly Food Spend: ₹3,000-₹6,000 (22% of disposable income)

Millennial Food Approach:

Family-Centric Food Decisions:

- Home cooking and grocery shopping optimization

- Bulk buying and meal planning strategies

- Family restaurants and kid-friendly dining

- Health-conscious family nutrition planning

Monthly Food Budget: ₹8,000-₹15,000 (18% of household income)

Home and Living Investments

Gen Z vs millennial buying habits in India reflect different home investment priorities:

Gen Z Home Priorities (Mostly renters):

- Room decoration and personal space styling

- Affordable furniture and quick-change items

- Tech gadgets and entertainment setup

- Personal comfort and aesthetic items

Millennial Home Investments (Homeowners/Family-focused):

- Appliance upgrades and home automation

- Furniture and long-term home improvement

- Children’s room and family space setup

- Property investment and home security

This category analysis is supported by Nielsen India research on generational spending patterns.

Sustainable Shopping and Ethical Consumption {#sustainable-ethical-shopping}

Gen Z vs millennial buying habits in India show fascinating differences in their approach to sustainability and ethical consumption, with both generations showing increased environmental consciousness but expressing it differently.

Sustainability Awareness and Action

Gen Z Sustainability Approach:

- Awareness level: 89% aware of environmental issues

- Action-oriented: 67% actively seek sustainable alternatives

- Social influence: Share sustainable choices on social media

- Brand expectation: Expect brands to take environmental positions

- Purchase decisions: 78% consider environmental impact

Millennial Sustainability Perspective:

- Practical awareness: 82% concerned about environmental issues

- Family-focused: Consider environmental impact on children’s future

- Research-driven: Investigate brands’ actual sustainability practices

- Long-term thinking: Focus on durable, energy-efficient products

- Cost-conscious: Balance sustainability with family budget constraints

Sustainable Product Categories

The Gen Z vs millennial buying habits in India show different sustainable consumption priorities:

Gen Z Sustainable Shopping:

Fashion and Personal Care:

- Sustainable fashion brands and second-hand clothing

- Cruelty-free beauty products and natural cosmetics

- Eco-friendly personal care and hygiene products

- Minimalist and multi-purpose product preferences

Food and Beverage Choices:

- Plant-based alternatives and organic options

- Local and artisanal food products

- Reduced packaging and zero-waste products

- Ethical sourcing and fair-trade preferences

Millennial Sustainable Investments:

Home and Family Products:

- Energy-efficient appliances and home systems

- Non-toxic and child-safe household products

- Organic and natural family food options

- Sustainable home improvement materials

Long-term Sustainability:

- Electric vehicles and eco-friendly transportation

- Solar energy and renewable home solutions

- Water conservation and waste management systems

- Sustainable investment and retirement planning

Ethical Brand Evaluation

Gen Z vs millennial buying habits in India demonstrate different approaches to evaluating brand ethics:

Gen Z Ethical Criteria:

- Social media activism: Brands that take public stands on issues

- Influencer partnerships: Authentic collaborations with values-aligned creators

- Transparency: Open communication about supply chain and practices

- Innovation: Development of sustainable alternatives and solutions

- Community impact: Local community support and engagement

Millennial Ethical Assessment:

- Corporate responsibility: Comprehensive CSR programs and reporting

- Employee treatment: Fair labor practices and workplace equality

- Long-term commitment: Sustained environmental and social initiatives

- Industry leadership: Setting standards and driving sector change

- Measurable impact: Quantifiable results and improvement metrics

Willingness to Pay Premium for Sustainability

The Gen Z vs millennial buying habits in India show different sustainability premium tolerance:

Gen Z Premium Acceptance:

High Premium Tolerance Categories (15-30% premium acceptance):

- Personal care and beauty products (67% willing)

- Fashion and lifestyle items (56% acceptance)

- Food and beverage products (78% willing for organic)

- Technology products (34% for eco-friendly options)

Price Sensitivity Factors:

- Social media influence and peer pressure

- Brand authenticity and transparency

- Visible environmental benefits

- Influencer endorsements and social proof

Millennial Premium Strategy:

Calculated Premium Spending (10-25% premium acceptance):

- Family health and safety products (89% premium acceptance)

- Home appliances and energy efficiency (78% willing)

- Children’s products and organic food (94% acceptance)

- Long-term investment items (67% sustainable premium)

Value Justification Requirements:

- Clear long-term cost benefits

- Family health and safety improvements

- Measurable environmental impact

- Quality and durability assurances

Circular Economy Participation

Gen Z vs millennial buying habits in India show different engagement with circular economy practices:

Gen Z Circular Economy Behavior:

- Resale participation: 56% sell/buy pre-owned items online

- Subscription services: Prefer access over ownership models

- Sharing economy: Active participation in rental and sharing platforms

- Upcycling trends: Creative reuse and DIY sustainability projects

Millennial Circular Economy Approach:

- Quality focus: Buy durable items for long-term use

- Repair culture: Maintain and repair items rather than replace

- Family sharing: Pass down items within family networks

- Bulk buying: Reduce packaging waste through larger purchases

This sustainability analysis draws from KPMG India research on sustainable consumption trends across generations.

Marketing Message Effectiveness {#marketing-message-effectiveness}

Understanding Gen Z vs millennial buying habits in India requires analyzing how each generation responds to different marketing approaches and communication styles.

Communication Preferences

Gen Z Communication Style Preferences:

- Visual communication: 89% prefer image and video content

- Authentic messaging: Raw, unfiltered, and genuine brand communication

- Interactive content: Polls, quizzes, user-generated content engagement

- Real-time interaction: Live streaming, instant responses, immediate feedback

- Peer-to-peer style: Brand communication that feels like friend recommendations

Millennial Communication Expectations:

- Informative content: Detailed product information and specifications

- Professional tone: Polished, credible, and authoritative messaging

- Problem-solution focus: Content that addresses specific needs and challenges

- Expert validation: Industry expertise and professional recommendations

- Family-inclusive: Messaging that considers family needs and benefits

Content Format Effectiveness

The Gen Z vs millennial buying habits in India are influenced by different content formats:

Gen Z Content Preferences:

High-Engagement Formats:

- Short-form videos (Instagram Reels, YouTube Shorts): 94% engagement

- Interactive stories and polls: 78% participation rate

- User-generated content campaigns: 67% sharing likelihood

- Influencer collaborations and takeovers: 89% trust factor

- Live streaming and real-time Q&As: 56% active participation

Content Themes That Resonate:

- Behind-the-scenes brand stories and authenticity

- Social causes and environmental responsibility

- Personal growth and lifestyle improvement

- Trends and cultural moments integration

- Humor and entertainment value

Millennial Content Consumption:

Preferred Content Types:

- Long-form educational content: 76% completion rate

- Product comparison and review videos: 89% influence on decisions

- Expert interviews and industry insights: 67% trust building

- How-to guides and practical tutorials: 78% value perception

- Customer testimonials and case studies: 94% credibility factor

Content Priorities:

- Practical utility and problem-solving focus

- Quality information and expert perspectives

- Family benefits and household value

- Professional development and career growth

- Financial planning and investment guidance

Brand Storytelling Approaches

Gen Z vs millennial buying habits in India respond to different brand storytelling techniques:

Gen Z Brand Story Elements:

- Founder journey: Personal struggles and authentic entrepreneurship stories

- Social impact: Brand contribution to societal and environmental causes

- Innovation narrative: How products push boundaries and create change

- Community building: Stories of bringing people together

- Cultural relevance: Connection to current trends and movements

Millennial Brand Story Preferences:

- Heritage and reliability: Brand history and proven track record

- Quality commitment: Stories of craftsmanship and excellence

- Customer success: Real customer transformations and benefits

- Family values: Brand alignment with family priorities and needs

- Professional credibility: Industry recognition and expert endorsements

Advertising Channel Effectiveness

The Gen Z vs millennial buying habits in India are influenced through different advertising channels:

Gen Z Media Consumption:

Most Effective Channels (Engagement and Conversion):

- Instagram advertising: 78% brand recall, 45% conversion influence

- YouTube pre-roll and mid-roll ads: 67% completion rate

- Influencer partnerships: 89% trust factor, 56% purchase influence

- Social media stories and interactive ads: 72% engagement rate

- Gaming platform advertising: 34% reach among gaming enthusiasts

Millennial Media Channels:

Traditional and Digital Mix:

- Facebook advertising: 67% reach, 42% conversion influence

- Google search ads: 78% click-through effectiveness

- Email marketing: 56% open rates, 23% conversion

- Television advertising: 45% brand recall, family viewing context

- LinkedIn professional content: 34% B2B influence

Call-to-Action Effectiveness

Gen Z vs millennial buying habits in India show different responses to various call-to-action approaches:

Gen Z CTA Preferences:

- “Get it now” and urgency-based messaging

- “Join the community” social belonging appeals

- “Try it first” low-commitment trial offers

- “Share with friends” social sharing incentives

- “Limited edition” exclusivity messaging

Millennial CTA Responses:

- “Learn more” information-gathering approaches

- “Compare options” detailed evaluation invitations

- “Save money” value-focused propositions

- “Perfect for families” household benefit emphasis

- “Expert recommended” authority-based endorsements

This marketing effectiveness analysis is based on HubSpot India research on generational marketing response patterns.

Gen Z and Millennials are rewriting India’s 2025 consumer playbook. Discover trends, insights, and strategies to win their attention: Consumer Behaviour in India 2025

Future Trends and Predictions {#future-trends}

The Gen Z vs millennial buying habits in India are evolving rapidly, and understanding future trends is crucial for brands preparing long-term strategies.

Technology Adoption Trends

Gen Z Technology Evolution (2025-2027):

- Voice commerce adoption: Expected 60% growth in voice-activated purchases

- AR/VR shopping: 45% likely to use virtual try-on features regularly

- AI personalization: Demand for hyper-personalized shopping experiences

- Social commerce integration: 70% projected to shop directly through social platforms

- Sustainable tech: Increased demand for eco-friendly technology options

Millennial Technology Integration:

- Smart home expansion: Family-focused automation and efficiency solutions

- Health tech adoption: Wearables and health monitoring for family wellness

- Financial technology: Investment apps and family financial planning tools

- Educational technology: Children’s learning and development platforms

- Professional technology: Remote work and productivity enhancement tools

Shopping Behavior Evolution

Emerging Gen Z Shopping Patterns:

- Hybrid experiences: Seamless integration of online and offline shopping

- Community-driven commerce: Group buying and social shopping experiences

- Subscription everything: Monthly boxes and service subscriptions

- Real-time shopping: Live streaming and instant purchase decisions

- Circular economy: Increased participation in resale and sharing platforms

Millennial Shopping Evolution:

- Value optimization: Sophisticated comparison and bulk buying strategies

- Family-centric decisions: Multi-generational product research and purchasing

- Quality investment: Premium products with long-term value proposition

- Omnichannel loyalty: Integrated online-offline brand relationships

- Sustainable investing: ESG-focused purchasing and investment decisions

Payment and Financial Trends

Gen Z Financial Evolution (2025-2030):

- Cryptocurrency adoption: 35% expected to use crypto for regular purchases

- Embedded finance: In-app financial services and seamless payment integration

- Social payments: Peer-to-peer payment integration with social platforms

- Flexible credit: Increased BNPL usage and alternative credit solutions

- Investment gamification: Micro-investing through shopping and rewards

Millennial Financial Maturation:

- Wealth building: Strategic investment and retirement planning acceleration

- Family financial planning: Education savings and multi-generational wealth

- Premium financial services: Private banking and sophisticated investment tools

- Insurance optimization: Comprehensive family protection and health coverage

- Real estate investment: Property investment and home equity utilization

Brand Relationship Evolution

Gen Z Brand Expectations (Next 3 Years):

- Authentic activism: Brands must take genuine stands on social issues

- Transparent supply chains: Full visibility into production and sourcing

- Community building: Brands as platforms for community connection

- Co-creation opportunities: Customer involvement in product development

- Real-time responsiveness: Instant customer service and problem resolution

Millennial Brand Loyalty Shifts:

- Value demonstration: Brands must prove ROI and family benefits

- Professional alignment: Brands that support career and personal growth

- Legacy considerations: Brands suitable for multi-generational families

- Quality assurance: Consistent premium quality and reliability

- Expert validation: Professional endorsements and industry recognition

Market Implications

Industry Impact Predictions:

- Retail transformation: 60% increase in social commerce by 2027

- Financial services: BNPL market expected to grow 400% among Gen Z

- Sustainable products: 45% market share growth in eco-friendly categories

- Technology integration: AI-powered personalization becoming standard

- Direct-to-consumer growth: D2C brands capturing 30% more market share

This future trends analysis incorporates insights from EY India research on consumer behavior evolution.

Frequently Asked Questions {#faq}

Q:What are the main differences between Gen Z and millennial buying habits in India?

A:The primary differences in Gen Z vs millennial buying habits in India include:

Gen Z characteristics:

Mobile-first shopping with 89% completing purchases on mobile devices

Social media-driven discovery through Instagram (78%) and YouTube (82%)

Impulse buying with 34% purchasing within 24 hours of product discovery

UPI preference for 91% of transactions

Brand loyalty lasting only 8-12 months on average

Millennial characteristics:

Cross-device shopping with 56% researching on mobile but purchasing on desktop

Research-heavy approach spending 45-60 minutes on purchase decisions

Family-focused buying considering household needs and long-term value

Credit card preference for high-value purchases (56%)

Brand loyalty spanning 2-4 years with focus on quality and reliability

Q: How do payment preferences differ between Gen Z and millennials in India?

A: Payment method preferences show significant generational gaps:

Gen Z payment behavior:

UPI dominance: 91% use UPI as primary payment method

Digital wallet adoption: 67% actively use multiple wallet applications

BNPL services: 45% have used Buy Now Pay Later options

Cash avoidance: Only 15% prefer cash for online purchases

Cryptocurrency interest: 23% interested in crypto payment options

Millennial payment patterns:

UPI adoption: 78% use UPI but also rely on traditional methods

Credit card strategy: 56% prefer credit cards for high-value purchases

Net banking: 34% still use traditional banking methods

Cash backup: 31% maintain cash as backup payment option

BNPL caution: 28% have tried BNPL but show more conservative adoption

Q: Which generation spends more on different product categories?

A: Spending patterns vary significantly across categories:

Gen Z spending priorities:

Fashion and lifestyle: ₹2,500-₹4,500 monthly (18% of disposable income)

Food delivery: ₹3,000-₹6,000 monthly (22% of disposable income)

Technology and gadgets: Focus on smartphones (₹15,000-₹35,000 range)

Entertainment and experiences: Higher percentage spend on social experiences

Millennial spending allocation:

Fashion and clothing: ₹3,500-₹7,000 monthly (12% of disposable income)

Family food budget: ₹8,000-₹15,000 monthly (18% of household income)

Home and appliances: Higher investment in durable goods and home improvement

Health and insurance: Comprehensive family health coverage and planning

Q: How does social media influence purchasing decisions differently?

A: Social media impact varies dramatically between generations:

Gen Z social media influence:

Instagram discovery: 78% discover new products through Instagram

Influencer trust: 67% trust micro-influencers over celebrities

Social proof dependency: 89% read social comments and reviews before buying

Direct social commerce: 45% complete purchases through social platforms

Real-time validation: Seek immediate peer approval through social sharing

Millennial social media approach:

Facebook research: 67% use Facebook for brand research and recommendations

Expert preference: 54% prefer expert reviews over influencer endorsements

Professional networks: 34% influenced by LinkedIn professional recommendations

Independent decisions: 78% seek opinions but make autonomous final decisions

Traditional validation: Rely more on family and friend recommendations

Q: What are the sustainability differences between Gen Z and millennial consumers?

A: Environmental consciousness manifests differently across generations:

Gen Z sustainability approach:

Activist consumption: 89% aware of environmental issues, 67% actively seek sustainable alternatives

Social sharing: Share sustainable choices on social media platforms

Premium willingness: 67% willing to pay premium for personal care, 78% for organic food

Brand expectations: Expect brands to take public environmental positions

Innovation focus: Prefer sustainable alternatives and innovative eco-friendly products

Millennial sustainability perspective:

Family-focused: 82% concerned about environmental impact on children’s future

Research-driven: Investigate actual brand sustainability practices vs. marketing claims

Long-term thinking: Focus on energy-efficient appliances and durable products

Cost-conscious: 89% accept premiums for family health products, balance sustainability with budget

Investment approach: Consider electric vehicles, solar energy, and sustainable home improvements

Q: How do brand loyalty patterns differ between these generations?

A: Brand relationship approaches show fundamental differences:

Gen Z brand loyalty:

Short-term commitment: Average brand loyalty lasts 8-12 months

Experience-driven switching: 73% willing to switch brands for better experience

Social responsibility focus: Loyalty depends on brand activism and innovation

Interactive expectations: Expect two-way communication and engagement

Peer influence: Heavily influenced by influencer endorsements and social proof

Millennial brand loyalty:

Long-term relationships: Average brand loyalty spans 2-4 years

Value-based switching: 45% switch brands primarily for better value propositions

Quality consistency: Loyalty driven by reliable performance and customer service

Professional communication: Prefer established, credible brand interactions

Expert validation: Influenced by professional reviews and word-of-mouth recommendations

Q:What marketing strategies work best for each generation?

A: Marketing effectiveness requires generational customization:

Gen Z marketing strategies:

Visual content priority: 89% prefer image and video content

Authentic messaging: Raw, genuine brand communication over polished advertising

Interactive engagement: Polls, quizzes, user-generated content campaigns

Influencer partnerships: Micro-influencer collaborations with 89% trust factor

Real-time interaction: Live streaming and immediate response expectations

Millennial marketing approaches:

Information-rich content: Detailed product specifications and educational materials

Professional tone: Credible, authoritative messaging and expert validation

Problem-solution focus: Content addressing specific family and professional needs

Multi-channel presence: Integration of traditional and digital marketing channels

Value demonstration: Clear ROI and long-term benefit communication