Table Of Content

- 1. Market Overview: The $200 Billion Opportunity

- 1.1 Current Market Size (2025)

- 1.2 2030 Projections

- 1.3 The B2B vs B2C Digital Divide

- 2. Key Drivers of B2B Digital Transformation

- 2.1 Infrastructure Enablers

- 2.2 Technology Adoption

- 2.3 Pandemic-Accelerated Behavioral Shifts

- 2.4 Investor & Startup Ecosystem

- 3. Sector-Wise Adoption Analysis

- 3.1 Chemicals & Petrochemicals

- 3.2 Steel & Metals

- 3.3 Agriculture & AgriTech

- 3.4 Industrial Manufacturing & MRO

- 3.5 Pharmaceuticals & Healthcare

- 3.6 Construction & Building Materials

- 4. B2B Marketplace Models & Innovation

- 4.1 Marketplace Typologies

- 4.2 Technology Stack Innovations

- 4.3 Emerging Models

- 5. Payment Terms Evolution & Financial Innovation

- 5.1 Traditional Payment Challenges

- 5.2 Digital Payment Solutions

- 5.3 Supply Chain Financing

- 5.4 Buy Now Pay Later (BNPL) for B2B

- 6. Regulatory Landscape & Government Initiatives

- 6.1 Policy Support

- 6.2 Compliance Requirements

- 6.3 Future Regulatory Roadmap

- 7. Challenges & Barriers to Adoption

- 7.1 Operational Challenges

- 7.2 Trust & Relationship Factors

- 7.3 Technology & Digital Literacy

- 7.4 Financial Constraints

- 8. Comparative Analysis: India vs Global B2B Markets

- 8.1 China’s B2B Ecosystem

- 8.2 US & European Markets

- 8.3 India’s Unique Value Proposition

- 9. Future Outlook: 2025-2030 Projections

- 9.1 Technology Trends

- 9.2 Market Consolidation vs Fragmentation

- 9.3 Sector-Specific Growth Trajectories

- 9.4 The $200B Path: Milestones to Watch

- 10. Conclusion: The B2B Digital Imperative

- Recommendations for Stakeholders

- FAQs

- What is the current size of India’s B2B e-commerce market in 2025?

- How large will India’s B2B e-commerce market be by 2030?

- Which sectors are leading B2B e-commerce adoption in India?

- What are the main challenges for B2B e-commerce in India?

- How is UPI enabling B2B e-commerce growth in India?

- What is the difference between B2B and B2C e-commerce in India?

- Which are the leading B2B e-commerce platforms in India?

- How does supply chain financing work in B2B e-commerce?

- What government initiatives support B2B e-commerce in India?

- How does India’s B2B e-commerce compare with China and the US?

- About Webverbal Research

While India’s consumer e-commerce success story has captured global headlines, a quiet revolution is unfolding in the business-to-business segment. India’s B2B e-commerce market stands at the cusp of exponential growth, with projections indicating a remarkable journey toward $200 billion by 2030. This transformation represents not just a technological shift but a fundamental reimagining of how businesses procure, sell, and manage supply chains across the world’s fastest-growing major economy.

From traditional wholesale markets dominated by personal relationships and cash transactions to digitally-enabled marketplaces offering instant payments, transparent pricing, and supply chain financing, Indian B2B commerce is experiencing its defining decade. This comprehensive analysis explores the market dynamics, sector-wise adoption patterns, payment innovations, and regulatory frameworks shaping India’s B2B digital transformation.

1. Market Overview: The $200 Billion Opportunity

1.1 Current Market Size (2025)

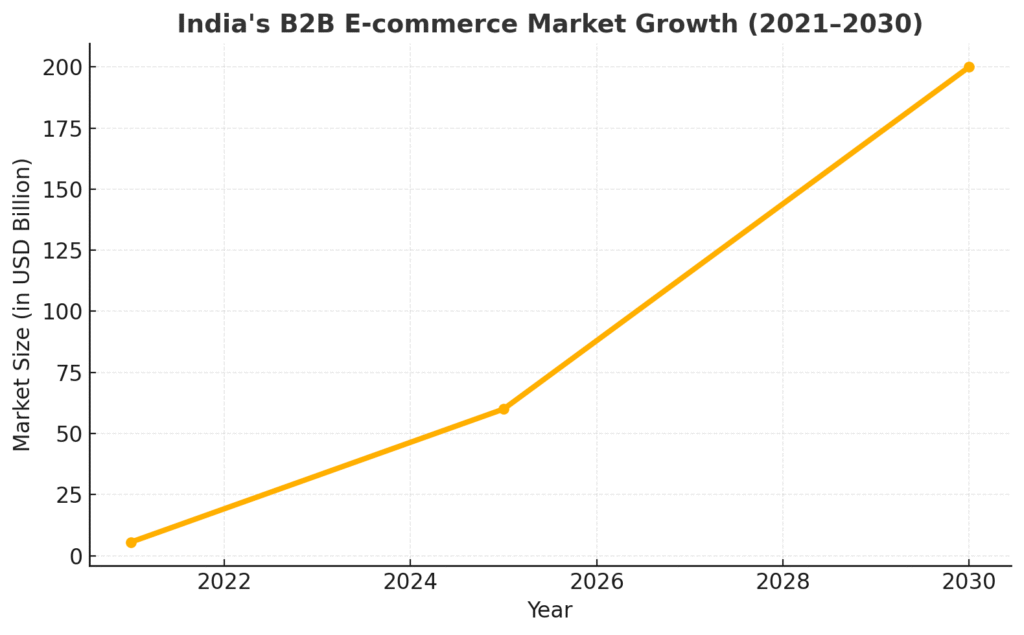

India’s B2B e-commerce market has evolved from a nascent $5.6 billion in 2021 to approximately $60 billion in 2025, representing a compound annual growth rate exceeding 75%. Despite this impressive growth trajectory, B2B e-commerce currently accounts for merely 1-2% of India’s total B2B market, which itself exceeds $4 trillion annually across manufacturing, wholesale, and industrial sectors.

This digital penetration rate starkly contrasts with B2C e-commerce, where online channels now command nearly 8-10% market share in retail. The disparity highlights both the challenges inherent in B2B digitization—longer sales cycles, complex procurement processes, relationship-driven transactions—and the enormous untapped potential awaiting structured digital intervention.

The Indian B2B landscape encompasses diverse participants: over 63 million micro, small, and medium enterprises (MSMEs), approximately 1.3 million manufacturing units, and countless traders, distributors, and wholesalers operating across 29 states and 8 union territories. This fragmented ecosystem, traditionally characterized by information asymmetry and inefficient capital allocation, presents fertile ground for digital marketplace models.

1.2 2030 Projections

Research from Bessemer Venture Partners, corroborated by analysis from Redseer Strategy Consultants, projects India’s B2B e-commerce market will reach $200 billion by 2030, growing at a CAGR of 40-45% from current levels. Even at this accelerated pace, online B2B will constitute only 4-5% of total B2B commerce by decade’s end—significantly lower than China’s 15-20% penetration and the United States’ 10-12% digital share.

This growth trajectory is underpinned by multiple converging factors: maturing digital infrastructure, generational shifts in business decision-makers, formalization driven by GST compliance, and mounting pressure on MSMEs to optimize working capital and procurement costs. The $200 billion milestone represents not merely incremental digitization but a structural transformation in how Indian businesses discover suppliers, negotiate terms, manage inventory, and access financing.

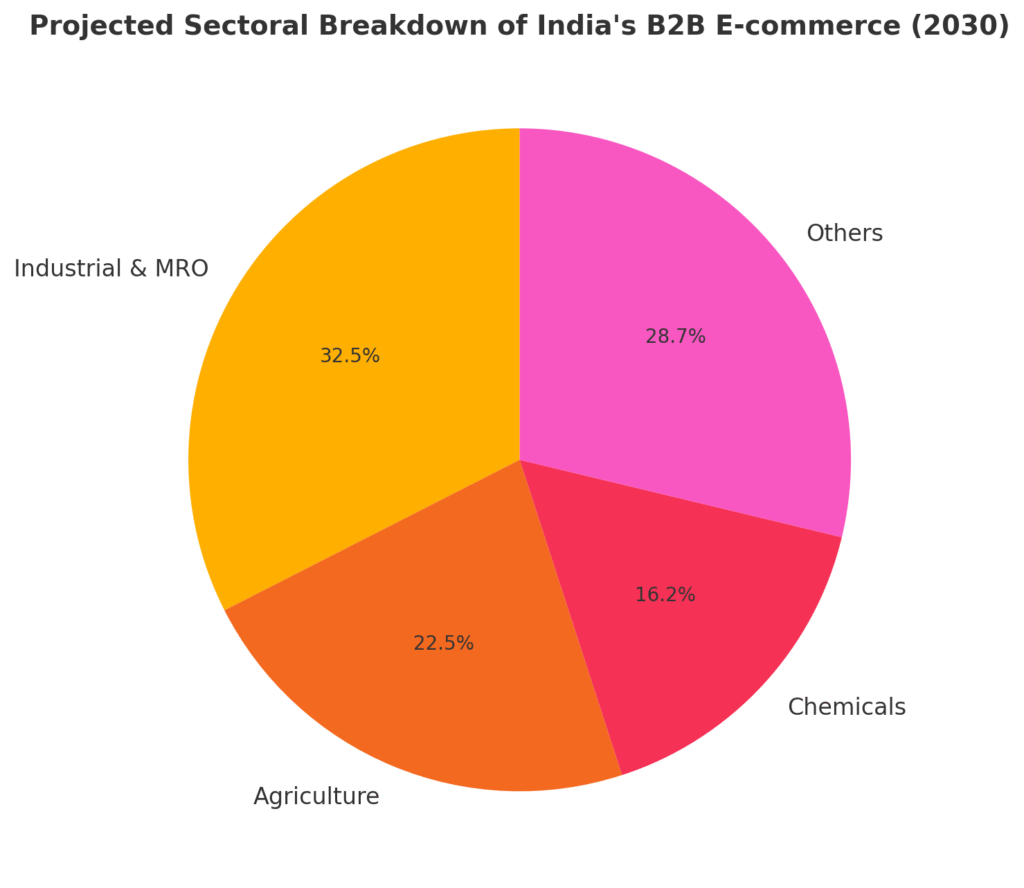

Breaking down this opportunity reveals sector-specific potential: industrial manufacturing and MRO (maintenance, repair, operations) could account for $60-70 billion, agriculture and agri-inputs $40-50 billion, chemicals and petrochemicals $30-35 billion, with steel, construction materials, and pharmaceuticals comprising the remainder.

1.3 The B2B vs B2C Digital Divide

India’s B2C e-commerce market reached approximately $136 billion in 2025, with projections toward $327 billion by 2030. This means B2C digital commerce currently outpaces B2B by more than 2:1, despite B2B’s significantly larger total addressable market.

Several factors explain this paradox. B2C transactions benefit from standardized products, impulse purchasing, individual decision-making, and ubiquitous payment infrastructure. B2B procurement, conversely, involves custom specifications, bulk ordering, multi-stakeholder approvals, credit terms extending 30-90 days, and quality verification requirements that resist simple digitization.

Moreover, B2C e-commerce enjoys network effects—each new customer enhances marketplace liquidity without dramatically increasing complexity. B2B marketplaces face “cold start” challenges in each vertical: attracting initial suppliers and buyers, establishing trust protocols, managing logistics for bulk shipments, and navigating category-specific regulations from pharmaceutical licensing to steel quality certifications.

Yet the gap is closing. As digital natives enter business leadership roles, smartphone penetration reaches rural India, and UPI enables instant high-value transactions, the behavioral and infrastructural prerequisites for B2B digitization are finally converging.

| Metric | B2B E-commerce (2025) | B2C E-commerce (2025) |

|---|---|---|

| Market Size | $60 billion | $136 billion |

| Digital Penetration | 1.5-2% of total market | 8-10% of retail market |

| Average Transaction Value | $2,500-5,000 | $25-50 |

| Transaction Frequency | Monthly/Quarterly | Weekly/Daily |

| Primary Payment Method | Credit Terms (Net 30-90) | UPI/Digital Wallets |

| Decision Cycle | Multi-stakeholder, weeks | Individual, minutes |

2. Key Drivers of B2B Digital Transformation

2.1 Infrastructure Enablers

India’s digital public infrastructure has matured into a robust foundation for B2B commerce transformation. The Unified Payments Interface (UPI), launched in 2016 primarily for person-to-person transactions, has evolved into a critical B2B payment rail. In May 2025, UPI processed 18.68 billion transactions worth $294 billion, with business-to-business payments comprising a growing share of high-value transfers.

Smart contracts now automate 12% of B2B payments via UPI, enabling time-triggered disbursements for supply chain financing and recurring procurement. The average UPI transaction value has risen to ₹2,900 ($35) in 2025, reflecting growing trust in digital channels for substantial transfers. More significantly, blockchain-enabled UPI transactions have improved processing speeds by 27%, while AI-powered fraud detection cut fraud cases by 47% year-over-year.

The Goods and Services Tax (GST) regime, implemented in 2017, has inadvertently accelerated B2B digitization by mandating digital invoicing for businesses above specified thresholds. E-invoicing requirements have pushed over 8 million businesses onto digital platforms, creating data trails that enable credit assessment, inventory tracking, and transparent pricing—prerequisites for marketplace efficiency.

Government initiatives extend beyond payments and taxation. The Open Network for Digital Commerce (ONDC), launched as a protocol-based network rather than a platform-centric marketplace, aims to democratize B2B commerce by allowing any seller to connect with any buyer through interoperable digital infrastructure. BharatNet has connected over 100,000 gram panchayats with broadband, enabling rural MSMEs to participate in digital commerce networks previously confined to urban centers.

Aadhaar-based e-KYC has simplified business verification, reducing onboarding time from weeks to hours. Digital document management, cloud-based ERP systems offered as affordable SaaS products, and API-first architecture enabling seamless integration between procurement systems, inventory management, and accounting software—all contribute to an ecosystem where digital B2B operations are increasingly frictionless.

2.2 Technology Adoption

Artificial intelligence is reshaping B2B procurement through demand forecasting, dynamic pricing, and inventory optimization. Platforms employ machine learning models analyzing historical purchase patterns, seasonal fluctuations, and market conditions to recommend optimal ordering quantities and timing, reducing inventory carrying costs by 15-25% for participating businesses.

Blockchain technology, moving beyond cryptocurrency speculation, finds practical application in supply chain transparency. Steel and chemicals marketplaces pilot blockchain-based provenance tracking, ensuring quality certifications and origin documentation are immutable and verifiable. This addresses a critical trust deficit in industries plagued by adulteration and specification misrepresentation.

According to a recent EY India report, generative AI could enhance productivity in India’s industrial sectors by 35-37% over the next five years, with 48% of businesses having initiated proof-of-concept projects. In B2B contexts, GenAI powers conversational commerce interfaces, automated RFQ (request for quotation) generation, contract analysis, and supplier discovery through natural language queries.

IoT sensors integrated with B2B platforms enable predictive maintenance and just-in-time procurement. Manufacturing units monitor equipment health through connected sensors, automatically triggering spare parts orders before breakdowns occur. Cold chain logistics, critical for pharmaceuticals and chemicals, employ IoT for real-time temperature monitoring with automatic alerts and blockchain logging for compliance.

Cloud infrastructure has democratized technology access. MSMEs previously unable to afford enterprise resource planning systems can now subscribe to affordable SaaS platforms offering procurement management, inventory tracking, and financial reporting at monthly costs under ₹10,000 ($120).

2.3 Pandemic-Accelerated Behavioral Shifts

The COVID-19 pandemic served as an inflection point for B2B digital adoption. Lockdowns forced businesses to shift from in-person negotiations at wholesale markets to remote procurement. This emergency digitization revealed unexpected benefits: reduced travel costs, faster turnaround times, price discovery spanning wider geographies, and documentation simplification.

More importantly, the pandemic introduced digital commerce to a demographic cohort previously resistant to change. Business owners in their 50s and 60s, traditionally preferring face-to-face transactions, discovered that digital platforms could replicate—and in some cases enhance—personal relationships through video calls, instant messaging, and transparent transaction histories.

Generational transition further accelerates this shift. As millennials and Gen-Z professionals assume procurement and business leadership roles, they bring inherent digital fluency and expectations formed by consumer e-commerce experiences. This demographic naturally gravitates toward platforms offering B2C-style user experiences: intuitive interfaces, instant search, transparent pricing, customer reviews, and one-click reordering.

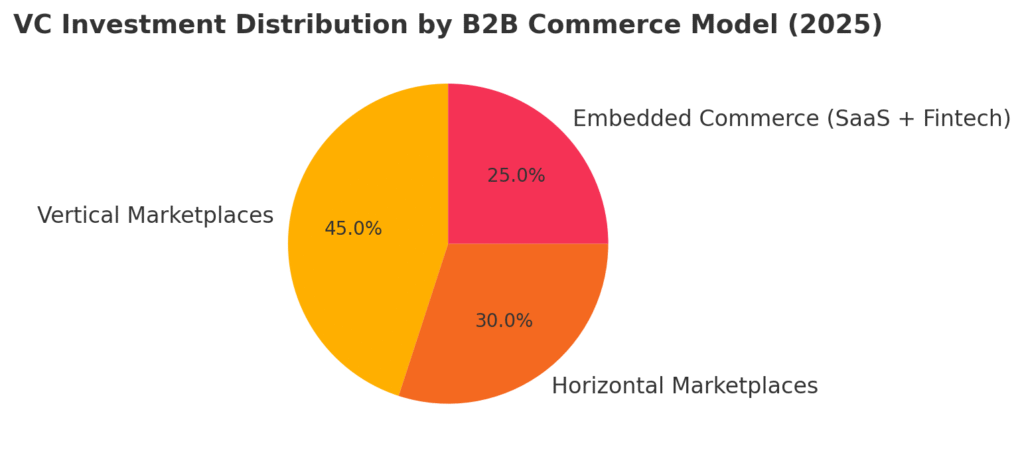

2.4 Investor & Startup Ecosystem

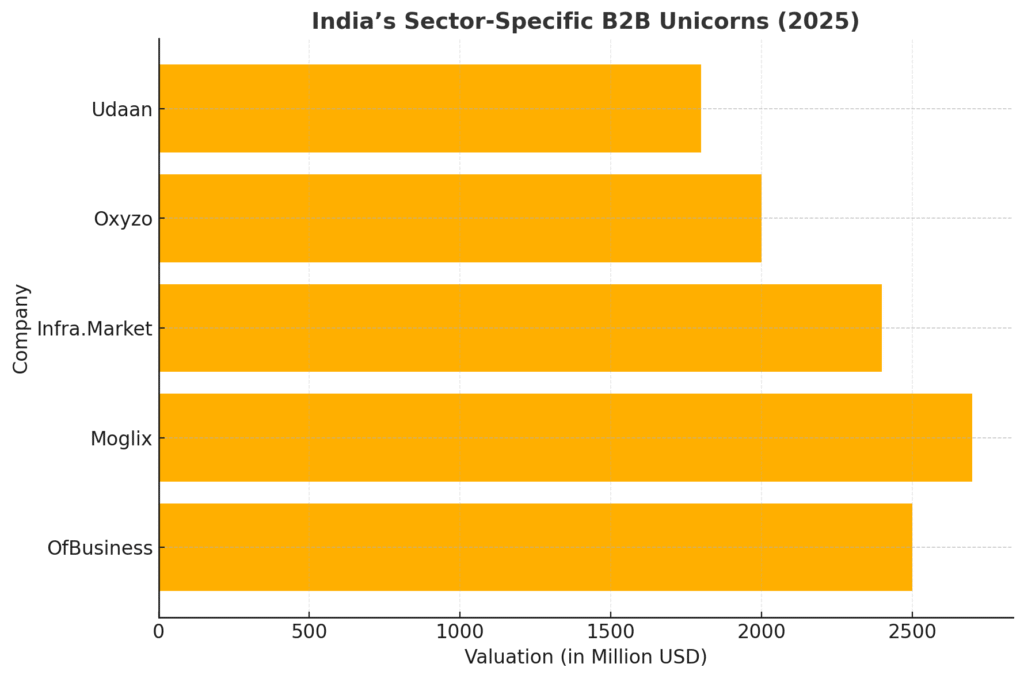

Venture capital has recognized B2B commerce potential, channeling significant capital into vertical and horizontal marketplaces. Despite challenging macroeconomic conditions in 2023-2024, B2B platforms have demonstrated resilience. In FY25, Udaan raised ₹975 crore ($114 million) at a $1.8 billion valuation, while OfBusiness achieved $2.5 billion in annual revenues, demonstrating that properly executed B2B models can achieve scale and profitability.

The emergence of sector-specific unicorns—OfBusiness in raw materials, Moglix in industrial supplies, InfraMarket in construction materials—validates diverse B2B marketplace models and attracts both domestic and international investors. This capital fuels platform development, working capital financing for buyers, and expansion into new categories and geographies.

Beyond pure-play marketplaces, embedded B2B commerce is gaining traction. SaaS companies serving SMEs are adding procurement marketplaces within their platforms, leveraging existing user relationships and data insights. This “fintech + marketplace” model, pioneered by companies like Oxyzo (OfBusiness’s lending arm), combines commerce with credit, addressing twin challenges of discovery and financing.

3. Sector-Wise Adoption Analysis

3.1 Chemicals & Petrochemicals

India’s chemicals industry, valued at $220 billion and projected to reach $300 billion by 2025 and $1 trillion by 2040, represents one of B2B e-commerce’s most promising yet complex verticals. The specialty chemicals sector, accounting for 20% of the total market, has witnessed particular digital momentum.

Traditional chemical procurement involved navigating opaque supply chains, inconsistent quality, and information asymmetry regarding specifications, prices, and sourcing. Digital marketplaces address these pain points through verified supplier networks, standardized product specifications with technical data sheets, transparent pricing based on real-time market rates, and quality assurance protocols.

Platforms like OfBusiness and emerging chemical-specific marketplaces offer catalog listings spanning industrial chemicals, agrochemicals, polymers, and specialty chemicals. Key features include batch-wise quality certificates, Material Safety Data Sheets (MSDS) integrated into product listings, compliance documentation for hazardous materials, and specialized logistics partners certified for chemical transportation.

Challenges persist: chemical products often require customization based on application requirements, quality verification demands sophisticated testing beyond visual inspection, and regulatory compliance spanning environmental clearances, transportation permits, and storage facility approvals adds complexity absent in other B2B categories.

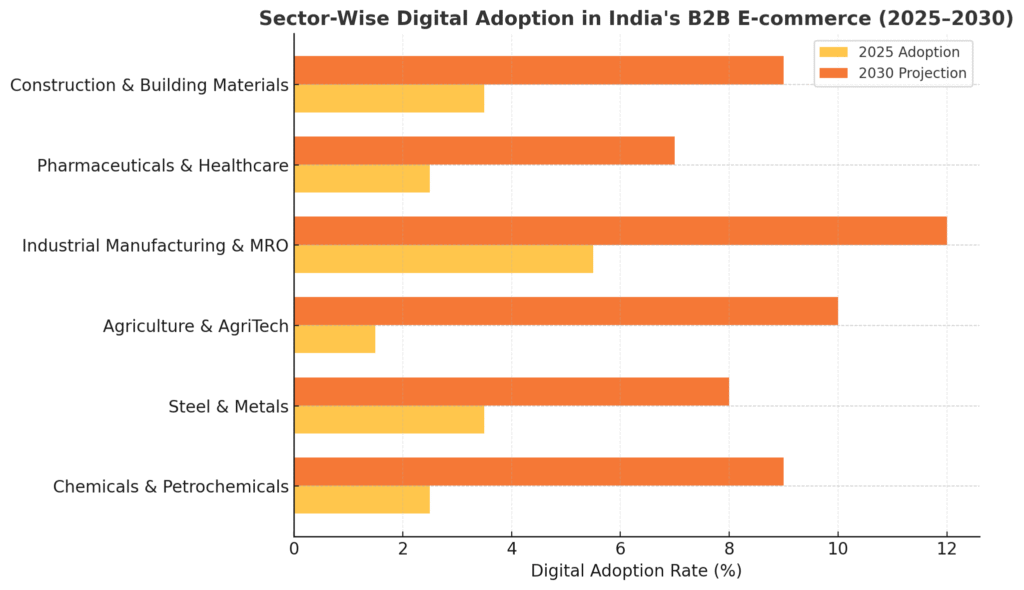

Digitization rates in chemicals currently hover around 2-3%, with significant variation between commodity chemicals (higher adoption due to standardization) and specialty chemicals (lower adoption due to customization requirements). Projection models suggest this could reach 8-10% by 2030, representing a $25-30 billion opportunity within the broader $200 billion B2B e-commerce market.

3.2 Steel & Metals

Steel and metals trading, long dominated by regional wholesale markets and relationship-based transactions, is experiencing gradual but meaningful digital transformation. Traditional pain points include price opacity (often requiring multiple phone calls to determine current rates), quality uncertainty (regarding grade specifications and mill certification), working capital constraints (typical 30-60 day payment terms), and logistics complexity (coordinating bulk transportation).

Digital platforms like Tata Nexarc (a Tata Group initiative specifically for MSMEs), SteelMint, and Metalbook aggregate demand and supply, providing real-time pricing transparency based on market indices, verified mill certifications, integration with logistics networks for bulk cargo, and channel financing programs addressing working capital needs.

The steel sector’s GMV on digital platforms reached approximately $8-10 billion in 2025, representing 3-4% of India’s $250 billion+ steel market. Construction sector demand drives significant volume, with builders and contractors increasingly comfortable procuring steel, cement, and building materials through digital channels rather than traditional dealer networks.

Key adoption drivers include GST compliance requirements creating digital audit trails, price volatility making real-time market information valuable, working capital optimization through platform-provided credit, and logistics integration reducing coordination friction for bulk orders.

Success metrics demonstrate tangible benefits: businesses report 3-8% cost savings through improved price discovery, reduced working capital cycles from 60 days to 35-40 days through platform financing, and 20-30% time savings in procurement processes through digital ordering and tracking versus phone-based coordination.

3.3 Agriculture & AgriTech

Agriculture represents both B2B e-commerce’s largest opportunity and its most complex challenge. India’s agricultural economy exceeds $400 billion annually, with input markets (seeds, fertilizers, pesticides, equipment) worth $60-70 billion and output markets (crop procurement, processing, distribution) significantly larger.

Platform models bifurcate into input marketplaces and output marketplaces, each with distinct dynamics. Input marketplaces like DeHaat, AgroStar, and BharatAgri connect farmers with seeds, fertilizers, crop protection chemicals, and farming equipment. These platforms combine e-commerce with advisory services—agronomists providing crop recommendations, soil testing, and pest management guidance through mobile apps.

Output marketplaces like Ninjacart, Waycool, and established platforms create farm-to-business supply chains, connecting farmers directly with restaurants, retailers, food processors, and export houses, bypassing traditional mandi systems. This direct connection promises better farmer realization (10-15% higher prices compared to traditional channels) and supply chain efficiency (reduced wastage through faster movement and better logistics).

Digital penetration in agri-commerce remains low—approximately 1-2% of the total market—but growth rates are exceptional. Ninjacart processes over $500 million in annual GMV, sourcing from 30,000+ farmers and delivering to 20,000+ businesses daily across multiple cities. DeHaat serves 1.7 million farmers across 11 states, offering not just inputs but complete package solutions including credit, advisory, and market linkage.

Unique challenges include fragmented demand (India has 146 million agricultural landholdings averaging 1.08 hectares), seasonal purchasing patterns creating cashflow volatility, credit access barriers (farmers traditionally rely on input dealers for credit), quality grading complexity (agricultural commodities require sophisticated grading beyond simple specifications), and regulatory fragmentation (APMC Acts, Essential Commodities Act, state-specific regulations).

Rural digital infrastructure improvements—BharatNet connecting villages, increasing smartphone penetration (now reaching 55% in rural India), vernacular language interfaces, and voice-based commerce—are gradually addressing accessibility barriers. Financial innovations like embedded insurance, crop-linked credit, and digital payment acceptance are tackling financing challenges.

By 2030, agri-commerce could constitute $40-50 billion of the B2B e-commerce market, driven by both input procurement digitization and organized farm-to-business supply chains emerging as alternatives to traditional agricultural markets.

3.4 Industrial Manufacturing & MRO

Maintenance, Repair, and Operations (MRO) procurement represents a highly fragmented market where businesses purchase industrial supplies ranging from fasteners and bearings to power tools and safety equipment. Traditional MRO procurement involves multiple vendors, inconsistent pricing, stockout risks, and administrative overhead tracking hundreds of line items.

Platforms like Moglix, Industrybuying, and Power2SME have built comprehensive industrial supply marketplaces, offering 1.5+ million SKUs spanning electrical, mechanical, safety, and consumable categories. These platforms promise enterprise-grade procurement infrastructure accessible to SMEs: consolidated catalogs from multiple manufacturers, transparent pricing with bulk discounts, inventory availability visibility, procurement automation tools, and integrated logistics.

Moglix reported $500+ million in revenue, serving 40,000+ businesses with technology-enabled supply chain solutions. The company combines marketplace operations with proprietary logistics (warehouses in multiple cities ensuring next-day delivery) and working capital solutions (credit lines up to 90 days for qualified buyers).

MRO digital adoption has reached 5-6% of the estimated $60 billion market, higher than most B2B categories due to relatively standardized products, repeat purchase patterns, and SME customer base more open to digital channels compared to large enterprises with established procurement departments.

Cost reduction metrics demonstrate value: companies report 12-18% reduction in MRO spending through improved price discovery and bulk purchasing, 40-50% time savings in procurement cycle (from requisition to delivery), inventory optimization reducing carrying costs by 20-25%, and improved compliance through automated approvals and audit trails.

3.5 Pharmaceuticals & Healthcare

Pharmaceutical B2B commerce encompasses raw materials (Active Pharmaceutical Ingredients, excipients), finished formulations (bulk hospital/pharmacy procurement), medical devices, and diagnostic supplies. This highly regulated sector faces stringent compliance requirements—drug licensing, batch tracking, temperature control for cold chain products, and documentation standards.

Digital platforms like PharmEasy (B2B arm), Medikabazaar, and Udaan’s pharma vertical facilitate hospital-to-distributor and pharmacy-to-wholesaler transactions. Key features include license verification (ensuring only licensed entities transact), batch-wise expiry tracking, cold chain logistics integration, and compliance documentation (invoices meeting pharmaceutical regulations).

Market size for pharmaceutical B2B e-commerce approximates $3-5 billion in 2025, representing 2-3% of India’s $150 billion+ pharmaceutical market. Growth drivers include hospital procurement digitization (especially corporate hospital chains), pharmacy franchise networks centralizing procurement, and government initiatives around generic medicine accessibility pushing online ordering.

Challenges specific to pharmaceuticals include regulatory complexity (multiple licenses required, frequent policy changes), margin pressures (pharma distribution works on thin 3-5% margins), supply chain integrity (fake medicines, temperature excursions), and payment terms (extended credit cycles of 60-90 days common).

3.6 Construction & Building Materials

Construction materials—cement, steel, bricks, tiles, sanitary ware, electrical fittings—constitute a massive $200+ billion market, traditionally fragmented across dealers, distributors, and direct manufacturer sales. Project-based purchasing, bulk volumes, site delivery requirements, and contractor-centric procurement create specific dynamics.

Platforms like InfraMarket, BuildSupply, and Zetwerk’s construction vertical aggregate supplier inventory, provide project management tools linking material requirements to construction timelines, integrate logistics for site delivery, and offer project financing solutions.

InfraMarket achieved unicorn status with over $2.5 billion valuation, processing $1+ billion in annual GMV across construction materials. The platform’s model combines marketplace operations with manufacturing assets (acquiring cement plants, steel rolling mills), backward integration ensuring supply reliability, and technology tools for builders and contractors.

Digital adoption in construction materials has reached 3-4% of the total market, with significant variation between organized players (larger builders, infrastructure companies) showing higher adoption and unorganized sector (individual home builders, small contractors) remaining primarily offline.

Key adoption drivers include price volatility in commodities like steel and cement making transparent pricing valuable, project capital efficiency (optimizing material procurement can reduce project costs by 5-10%), logistics complexity (coordinating multiple material deliveries to construction sites), and payment terms (builders requiring credit, suppliers needing working capital).

Success indicators show 6-12% cost reduction through marketplace aggregation, improved project timelines through reliable delivery, reduced material wastage through accurate demand forecasting, and better working capital management through platform-provided financing.

4. B2B Marketplace Models & Innovation

4.1 Marketplace Typologies

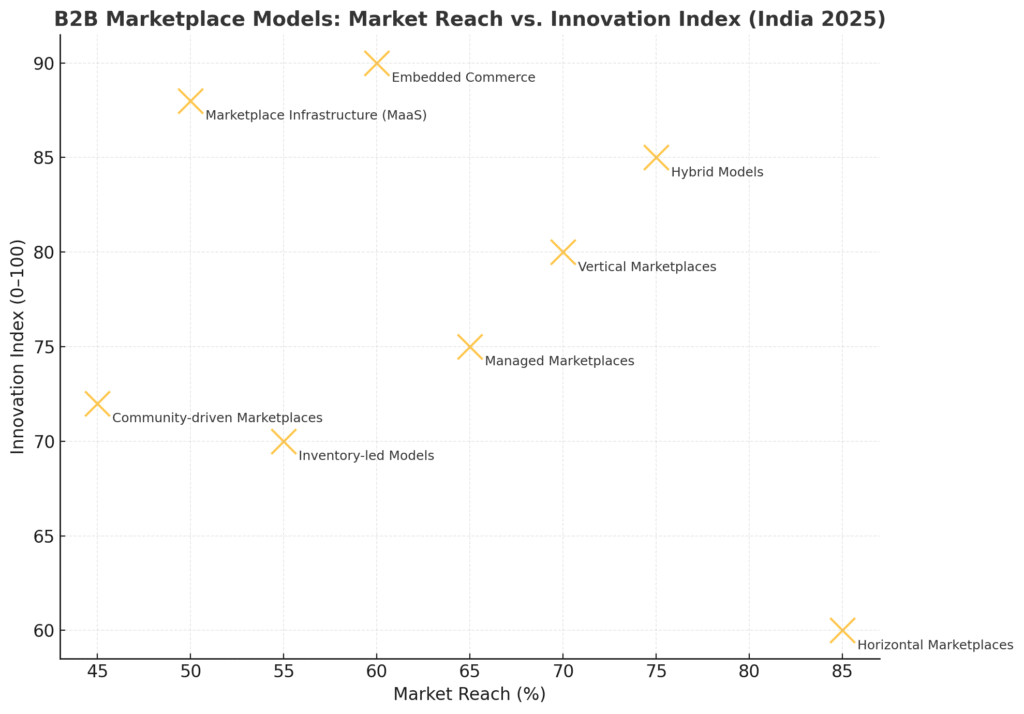

Indian B2B marketplaces have evolved diverse models addressing different market needs. Horizontal marketplaces like IndiaMART and TradeIndia aggregate products across categories—chemicals, electronics, apparel, machinery—functioning as discovery platforms connecting buyers and sellers but typically not handling transactions or logistics.

Vertical marketplaces focus on specific sectors—Moglix for industrial supplies, OfBusiness for raw materials, Ninjacart for agriculture—offering deep category expertise, specialized services (quality verification, sector-specific logistics), and often taking inventory risk or managing transactions end-to-end.

Inventory-led models purchase products from manufacturers, hold inventory in warehouses, and sell to businesses, providing supply reliability and quality assurance but requiring significant working capital. Pure marketplace models facilitate transactions without inventory ownership, lower capital intensity but less control over quality and delivery.

Managed marketplaces combine elements—curating supplier networks, standardizing processes, providing fulfillment services—while self-service platforms allow businesses to list products and manage transactions independently, prioritizing scale over control.

Hybrid models are emerging: platforms beginning as pure marketplaces progressively integrate value-added services—financing, logistics, technology tools—or selectively hold inventory in high-velocity categories while operating as intermediaries elsewhere.

4.2 Technology Stack Innovations

Modern B2B platforms employ sophisticated technology architectures. API-first design enables seamless integration with customer ERP systems, accounting software (Tally, Zoho), inventory management tools, and logistics partners. Buyers can place orders through their existing procurement systems rather than logging into separate marketplace interfaces.

Mobile-first experiences recognize that decision-makers increasingly use smartphones for business operations. Apps offer features like voice-based search in regional languages, WhatsApp-based ordering, photo-based product search (photographing a spare part to find matching items), and digital catalogs replacing physical samples.

Intelligent recommendation engines analyze purchase histories, seasonal patterns, and peer behavior to suggest relevant products, optimal quantities, and reorder timing. Demand forecasting algorithms help businesses optimize inventory, reducing carrying costs while preventing stockouts.

Digital credit scoring models assess business creditworthiness using alternative data—GST filings, digital payment histories, marketplace transaction patterns—enabling credit access for MSMEs lacking traditional collateral or credit histories.

4.3 Emerging Models

Embedded commerce sees SaaS platforms for business management adding procurement marketplaces. Accounting software includes office supplies ordering, restaurant management systems integrate ingredient procurement, retail POS systems connect to wholesale inventory.

Marketplace infrastructure startups provide white-label technology enabling manufacturers and distributors to launch branded B2B e-commerce platforms quickly. This “marketplace-as-a-service” model democratizes digital commerce beyond well-funded startups to traditional businesses seeking digital channels.

Community-driven marketplaces leverage existing business networks—trade associations, industry clusters—to build trust-first platforms where members transact. Surat’s textile cluster, Tiruppur’s knitwear industry, and Punjab’s agricultural cooperatives experiment with community-owned digital marketplaces.

5. Payment Terms Evolution & Financial Innovation

5.1 Traditional Payment Challenges

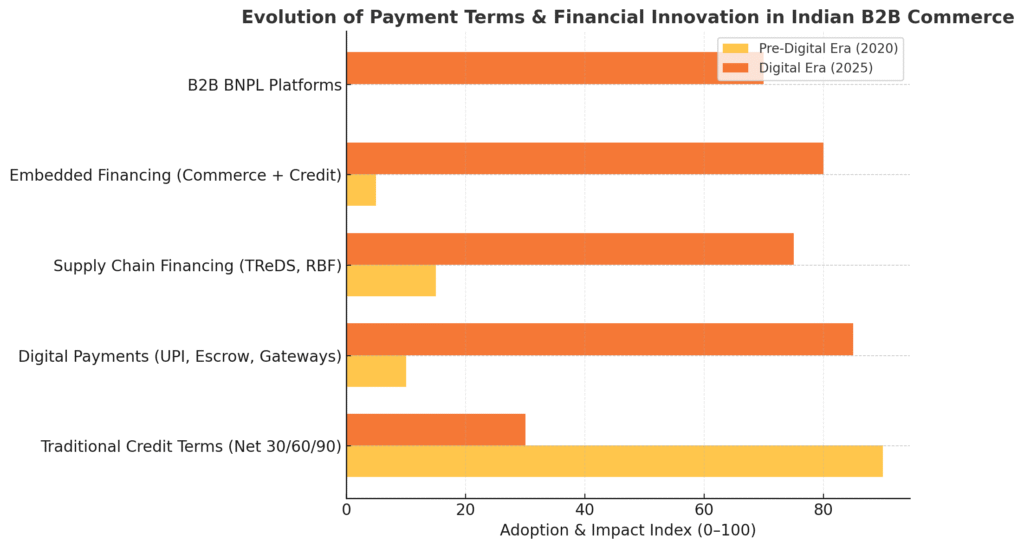

B2B transactions historically operated on credit—Net 30, Net 60, or Net 90 day terms—creating working capital constraints particularly burdensome for MSMEs. Suppliers extending credit face cash flow pressures affecting their own operations, while buyers without credit access struggle to scale.

Trust verification posed chicken-and-egg problems: new suppliers unable to secure customers without trade references, new buyers unable to access credit without transaction history. Physical documentation—purchase orders, invoices, delivery receipts—created reconciliation nightmares, while cash transactions dominated smaller-value B2B trades, limiting transparency and formalization.

5.2 Digital Payment Solutions

UPI’s evolution from consumer to business payments represents a transformative shift. In 2025, with UPI processing 18.68 billion monthly transactions worth $294 billion, business-to-business payments constitute a growing share, enabling instant settlement replacing days-long NEFT/RTGS processes.

High-value UPI transactions (above ₹2,00,000) now feature blockchain-based audit trails, addressing concerns about large-value digital transfers. Smart contracts automate recurring payments, particularly relevant for subscription-based B2B services and scheduled inventory replenishments.

Digital escrow services managed by platforms hold funds until delivery confirmation, addressing trust deficits in new buyer-seller relationships. Payment gateways like Razorpay, Juspay, and Cashfree have built specialized B2B features: invoice reconciliation, multi-currency support, and integration with accounting systems.

5.3 Supply Chain Financing

Invoice discounting platforms like TReDS (Trade Receivables Discounting System), mandated by RBI, enable MSMEs to discount invoices from corporate buyers, accessing funds immediately rather than waiting 30-90 days. TReDS saw adoption by over 5,000 MSMEs in 2024-25, though penetration remains nascent relative to potential.

Revenue-based financing models, pioneered by platforms like GetVantage and Velocity, provide capital based on digital transaction histories rather than traditional collateral. Businesses repay as a percentage of revenues, aligning payment obligations with cash flows.

Embedded financing within marketplaces sees platforms like OfBusiness (through Oxyzo), Moglix, and Udaan offering working capital to buyers and sellers transacting on their platforms. This “commerce + credit” model leverages transaction data for credit assessment while creating ecosystem lock-in—businesses remain on platforms providing not just competitive pricing but also financing access.

MSME credit gaps, estimated at $380 billion in India, represent both challenge and opportunity. Digital B2B platforms are positioning as solutions, using transaction data, GST filings, and digital payment histories to assess creditworthiness, thereby enabling financing access for businesses previously excluded from formal credit systems.

5.4 Buy Now Pay Later (BNPL) for B2B

B2B BNPL platforms like Rupifi, Capital Float, and OkCredit enable businesses to purchase supplies on credit, with platforms extending financing and assuming repayment risk. Typical terms range 15-45 days, with platforms charging merchants 2-3% transaction fees while offering buyers credit access without collateral requirements.

Risk assessment employs multiple data points: GST returns indicating business stability, digital payment histories showing cash flow patterns, marketplace ratings reflecting reliability, and social verification through business network connections.

This innovation particularly benefits businesses in seasonal industries—agriculture inputs peak during planting seasons, construction materials during favorable weather—allowing inventory building without tying up working capital months in advance.

6. Regulatory Landscape & Government Initiatives

6.1 Policy Support

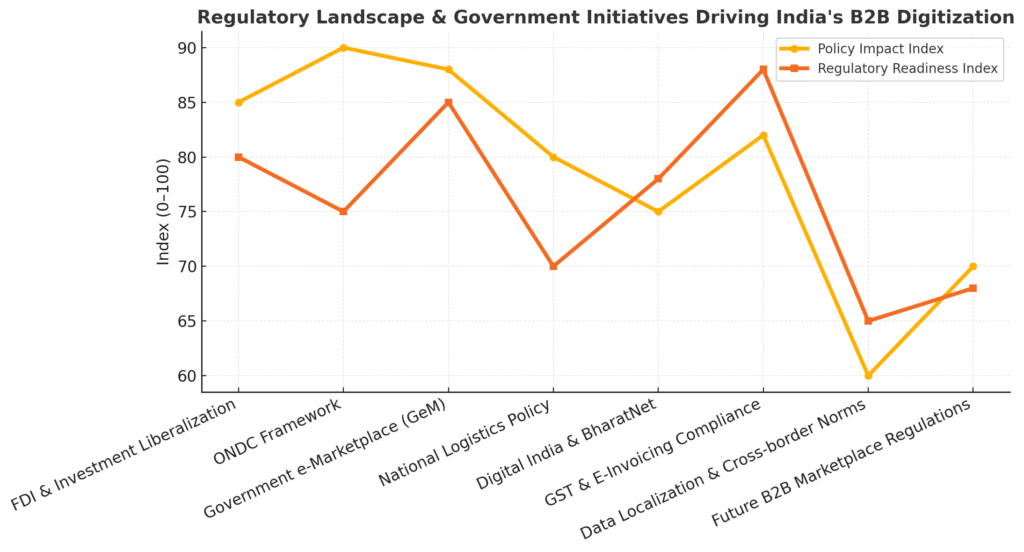

The Government of India has demonstrated commitment to B2B digitization through multiple initiatives. 100% FDI in B2B e-commerce under automatic route encourages international capital and expertise, with companies like Walmart (through Flipkart Wholesale), Amazon Business, and global logistics providers investing billions.

The Open Network for Digital Commerce (ONDC), launched as a protocol-based interoperable network, extends beyond consumer commerce to B2B applications. ONDC’s vision of “democratizing digital commerce” aims to prevent marketplace monopolies while enabling smaller players to participate without building entire platform stacks.

Government e-Marketplace (GeM) has transformed public procurement, processing over ₹2 lakh crore ($24 billion) in transactions annually. GeM’s success demonstrates digital procurement’s viability at scale, with learnings informing private sector marketplace designs around transparency, vendor verification, and payment automation.

National Logistics Policy initiatives aim to reduce logistics costs from 13-14% of GDP to single digits, directly benefiting B2B commerce dependent on efficient transportation. Logistics infrastructure improvements, digitization of documentation, and integrated multi-modal transport planning support marketplace operations requiring reliable fulfillment.

The Digital India program’s investments in broadband connectivity, particularly BharatNet’s rural penetration, enable businesses in smaller towns and villages to participate in digital commerce networks, expanding addressable markets beyond metropolitan areas.

6.2 Compliance Requirements

GST integration mandates digital invoicing for businesses above specified thresholds, inadvertently creating data trails enabling marketplace transparency, credit assessment, and logistics tracking. While compliance burdens challenged businesses initially, the formalization benefits marketplace efficiency by establishing verified business identities, transparent transaction records, and standardized documentation.

E-invoicing requirements, mandatory for businesses above ₹5 crore turnover, compel digital adoption even among traditionally offline businesses. Marketplaces facilitating GST-compliant invoicing and filing reduce compliance friction, becoming valued services beyond product listings.

Data localization norms require certain business data storage within India, affecting platforms with international operations but generally manageable for domestically-focused B2B marketplaces. However, regulatory clarity around cross-border data flows remains important for platforms facilitating international B2B trade.

6.3 Future Regulatory Roadmap

Industry stakeholders advocate for regulatory frameworks specific to B2B marketplaces, distinct from consumer e-commerce regulations. Concerns include liability provisions (marketplace versus merchant liability for product quality), pricing transparency requirements, and anti-competitive behavior prevention.

Trade receivables financing regulation needs streamlining—TReDS adoption remains limited partly due to complex onboarding and regulatory requirements. Simplified norms could accelerate supply chain financing, addressing MSME working capital constraints.

Sector-specific regulations—pharmaceutical licensing for medicine marketplaces, quality certifications for industrial materials—require harmonization across states. Unified national standards would reduce compliance complexity for platforms operating pan-India.

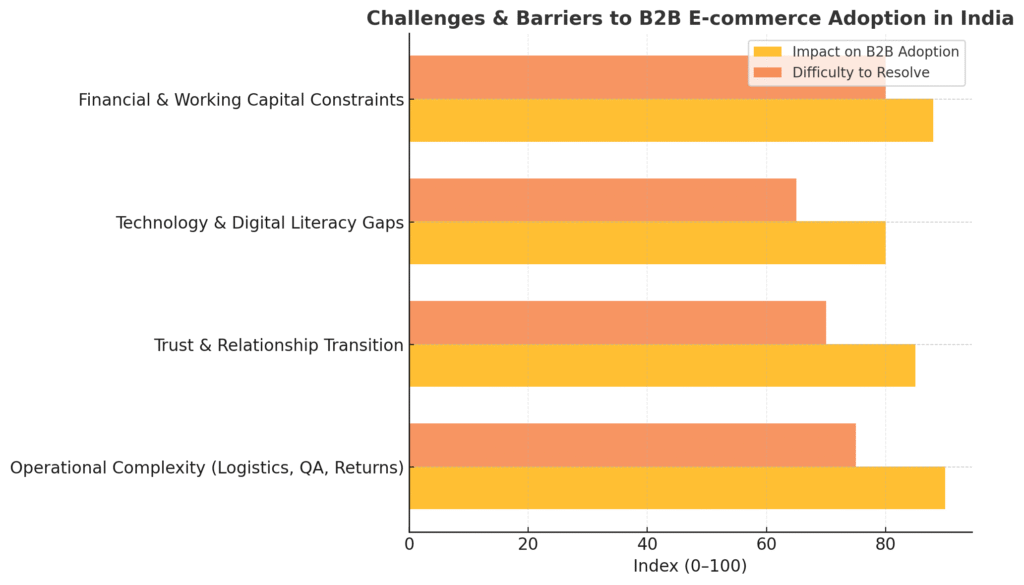

7. Challenges & Barriers to Adoption

7.1 Operational Challenges

Logistics for bulk shipments poses significantly greater complexity than consumer e-commerce parcels. Steel coils, chemical drums, agricultural inputs in tonnage quantities require specialized transportation, loading/unloading equipment, and warehouse infrastructure. Last-mile delivery to rural manufacturing units or remote construction sites tests logistics networks optimized for urban deliveries.

Quality assurance beyond visual inspection demands sophisticated verification. Chemical specifications require laboratory testing, steel grades need mill certifications, agricultural inputs must meet purity standards. Marketplaces establishing quality protocols face costs and operational complexity, yet quality guarantees are critical for buyer trust.

Returns and refunds processes barely feasible in consumer e-commerce become extraordinarily challenging in B2B contexts. Returning 10 tonnes of steel or 200 drums of chemicals involves significant logistics costs, quality degradation risks, and complex liability determinations around why products were unacceptable.

7.2 Trust & Relationship Factors

Personal relationships dominate traditional B2B transactions—decades-long supplier relationships built on trust, flexibility during payment difficulties, and informal dispute resolution. Digital marketplaces must replicate these trust mechanisms through ratings, verified supplier badges, escrow services, and responsive dispute resolution, yet intangible relationship value remains difficult to digitize.

Transitioning offline relationships online faces resistance from both parties: buyers fear losing personalized service and payment flexibility, suppliers fear customer disintermediation and margin pressures as pricing becomes transparent. Successful platforms emphasize that digitization augments rather than replaces relationships, providing tools strengthening existing partnerships while enabling new connections.

7.3 Technology & Digital Literacy

SME digital readiness varies dramatically. While urban businesses increasingly embrace technology, rural enterprises and traditional industries face skill gaps—limited experience with smartphones, hesitation around digital payments, unfamiliarity with online platforms. Vernacular language interfaces, voice-based navigation, and assisted commerce models (relationship managers helping businesses transition digital) address these barriers.

Integration with legacy systems challenges larger enterprises with established procurement software, inventory management systems, and approval workflows. Platforms must offer robust APIs enabling ERP integration, rather than expecting businesses to abandon existing systems for marketplace interfaces.

Training and onboarding costs, often underestimated, require platforms to invest in business customer education—webinars, field demonstrations, dedicated onboarding managers—especially for complex categories requiring workflow changes beyond simple product ordering.

7.4 Financial Constraints

Working capital requirements for inventory-led marketplaces demand substantial capital, limiting model viability to well-funded ventures or profitable unit economics. Pure marketplace models avoid inventory costs but struggle with supply reliability during demand spikes.

Credit accessibility for smaller players—both suppliers needing working capital to fulfill platform orders and buyers requiring credit to purchase—remains constrained despite digital lending innovations. Platforms must either provide financing themselves (capital intensive, requiring credit expertise) or partner with financiers (adding complexity, sharing economics).

8. Comparative Analysis: India vs Global B2B Markets

8.1 China’s B2B Ecosystem

China’s B2B e-commerce market, the world’s largest, exceeded $2 trillion in 2024, with digital penetration reaching 15-20% of total B2B commerce. Alibaba.com dominates with over 40 million business users globally, facilitating both domestic Chinese transactions and international trade connecting Chinese manufacturers with global buyers.

The Chinese model offers instructive lessons: early digitization beginning in the late 1990s provided a two-decade head start, manufacturing concentration in industrial clusters (Shenzhen for electronics, Yiwu for small commodities) simplified logistics and supplier aggregation, and government support through infrastructure investment, favorable policies, and integration with Belt and Road initiatives accelerated adoption.

China’s B2B platforms evolved beyond pure marketplaces into comprehensive ecosystems: Alibaba.com integrates trade assurance programs, logistics services (Cainiao network), payment infrastructure (Alipay), and trade financing, creating end-to-end solutions. This integrated approach contrasts with India’s more fragmented landscape where marketplaces, logistics, payments, and financing often involve separate players.

However, India’s opportunity differs fundamentally. China’s manufacturing-centric economy focused B2B platforms on connecting domestic producers with global buyers (export-oriented), while India’s consumption-driven economy emphasizes domestic trade—connecting Indian suppliers with Indian buyers across diverse sectors from agriculture to chemicals. India’s model must therefore prioritize domestic logistics efficiency, vernacular accessibility, and sector-specific customization over pure export facilitation.

8.2 US & European Markets

The United States B2B e-commerce market reached approximately $1.8 trillion in 2024, representing 10-12% digital penetration. Amazon Business, launched in 2015, processes over $35 billion in annual GMV, leveraging Amazon’s consumer infrastructure—warehouses, logistics, technology, Prime membership psychology—for business customers.

Traditional distributors like Grainger, Fastenal, and MSC Industrial Supply successfully defended market positions through omnichannel strategies: physical branches providing local service combined with e-commerce platforms offering convenience. This hybrid model—digital ordering with physical touchpoints—resonates with businesses valuing relationship continuity alongside online efficiency.

European markets demonstrate similar patterns with regional variations: Germany’s Mittelstand (medium-sized manufacturers) maintain strong supplier relationships yet increasingly adopt digital procurement for MRO and indirect materials, while Nordic countries exhibit higher digital adoption across all business sizes, driven by early technology infrastructure and digitally-native workforce.

Key differentiators include established business processes (mature procurement departments, standardized RFQ procedures) facilitating digital integration, payment infrastructure (corporate credit cards, ACH transfers, established net-30 terms) requiring less innovation than India’s fragmented payment landscape, and consolidated markets with fewer small suppliers compared to India’s extreme fragmentation.

8.3 India’s Unique Value Proposition

India’s B2B digital transformation presents distinctive characteristics creating both challenges and opportunities. Extreme fragmentation—63 million MSMEs, millions of tiny manufacturing units—demands marketplace models accommodating vast supplier numbers rather than consolidating around few large vendors.

Informal economy formalization remains ongoing; GST implementation is less than a decade old, digital payments achieved scale merely 5-7 years ago. This means marketplaces aren’t just digitizing existing formal processes but actively formalizing previously informal transactions, creating documentation where none existed, and establishing credit histories for businesses previously invisible to formal financial systems.

Leapfrog potential exists in multiple dimensions: mobile-first infrastructure bypassing desktop adoption, UPI enabling instant payments without credit card infrastructure buildout, and AI-powered credit scoring utilizing alternative data rather than decades of traditional credit histories. India can skip intermediate stages that characterized Western B2B digitization, moving directly to mobile, instant, and intelligence-augmented commerce.

Demographic dividend provides India with a unique advantage—hundreds of millions entering the workforce over coming decades, digital natives comfortable with smartphones and online platforms, creating natural momentum toward digital business operations as this generation assumes entrepreneurial and procurement roles.

Diversity necessitates innovation: 22 official languages demand vernacular interfaces, climatic variations from Himalayan cold to tropical heat require supply chain adaptability, and vast income disparities from subsistence farmers to billion-dollar conglomerates demand platforms serving radically different customer segments simultaneously.

9. Future Outlook: 2025-2030 Projections

9.1 Technology Trends

Artificial intelligence evolution will progress from current applications (recommendation engines, demand forecasting) toward autonomous procurement agents capable of managing routine purchasing decisions independently. Imagine AI systems monitoring inventory levels, analyzing consumption patterns, researching suppliers, negotiating prices within parameters, and executing orders—human oversight providing strategic direction while AI handles tactical execution.

Generative AI applications in B2B contexts include automated RFQ generation analyzing business needs and producing detailed specification documents, contract analysis extracting key terms and flagging unusual clauses, and conversational commerce allowing natural language interactions (“order our usual monthly steel requirement but find suppliers offering better payment terms”) rather than form-based catalog navigation.

Blockchain adoption timeline suggests mainstream implementation by 2027-2028 for supply chain transparency in high-value or regulated categories—pharmaceuticals tracking drug provenance from manufacturer to pharmacy, steel certifying quality grades and origin, and chemicals documenting handling compliance. Early pilots in 2025-2026 will demonstrate viability before sector-wide standardization.

IoT integration will become ubiquitous in B2B logistics and inventory management. Warehouses equipped with sensor networks automatically tracking stock levels, manufacturing equipment monitoring spare parts consumption and triggering reorders, and cold chain shipments with real-time temperature logging for compliance and quality assurance.

Augmented reality (AR) applications for B2B include virtual product inspection (examining industrial equipment through smartphone AR before purchase), remote installation assistance (technicians guiding equipment setup via AR overlays), and training (workers learning machinery operation through AR simulations).

9.2 Market Consolidation vs Fragmentation

The 2025-2030 period will likely witness partial consolidation through mergers and acquisitions. Well-capitalized horizontal platforms may acquire vertical specialists, gaining category expertise and customer bases. Examples include Udaan’s expansion from FMCG into pharma, electronics, and general merchandise through organic growth and potential acquisitions.

However, vertical specialization will persist and deepen. Markets like chemicals, pharmaceuticals, and agriculture have complexities resisting commodification—specialized knowledge, regulatory requirements, and industry-specific workflows favor focused platforms over generalist marketplaces. Expect niche platforms achieving scale within specific sectors rather than universal platforms dominating all categories.

Regional consolidation may emerge with platforms strong in specific geographies (Udaan in tier-2/tier-3 cities, regional players serving local business clusters) either expanding nationally or being acquired by larger competitors seeking geographic presence.

Technology consolidation around standards—payment protocols, logistics integration APIs, quality verification procedures—could enable interoperability, allowing businesses to transact across platforms seamlessly. ONDC’s vision of interoperable networks, if successful, might create winner-takes-most outcomes based on execution excellence rather than network effects alone.

9.3 Sector-Specific Growth Trajectories

Fastest digitization (15-20% penetration by 2030) expected in MRO/industrial supplies, electronics components, and office supplies—categories with standardized products, repeat purchasing, and SME buyer bases naturally comfortable with digital channels.

Moderate digitization (8-12% penetration) likely in steel/metals, construction materials, and certain agricultural inputs—categories where digitization provides clear value but logistics complexity, quality verification needs, or entrenched relationships slow adoption.

Slower digitization (4-6% penetration) expected in specialty chemicals, customized manufacturing inputs, and highly regulated categories like pharmaceuticals—where product customization, stringent compliance, or high-touch relationship requirements limit pure digital displacement.

Investment hotspots for 2025-2030 include:

- Supply chain financing platforms addressing MSME working capital constraints

- Vertical SaaS + marketplace combinations offering category-specific business management tools alongside commerce

- Logistics technology enabling bulk shipment optimization, last-mile delivery to remote locations, and cold chain management

- Rural B2B platforms connecting tier-3/4 businesses to national supply chains

- Cross-border B2B facilitating international trade for Indian MSMEs

9.4 The $200B Path: Milestones to Watch

2025-2026: Establishment phase

- 3-5 B2B platforms reaching unicorn valuations

- 50+ sector-specific vertical marketplaces achieving product-market fit

- Digital penetration reaching 2-3% across most B2B categories

- Total market size: $80-90 billion

2027-2028: Acceleration phase

- First profitable B2B marketplace IPOs demonstrating sustainable unit economics

- AI adoption in financial services and commerce reaching mainstream

- Digital penetration: 4-6% across categories

- Government policies around B2B marketplace regulation providing clarity

- Total market size: $120-140 billion

2029-2030: Maturity phase

- 10-15 large-scale B2B platforms with $1+ billion annual GMV

- Digital penetration: 6-10% depending on category

- Integration with global supply chains for import/export B2B commerce

- Embedded financing becoming standard offering across platforms

- Total market size: $200+ billion

Key indicators signaling trajectory:

- UPI B2B transaction values and volumes

- MSME credit disbursement through digital channels

- GeM growth rates as public procurement indicator

- Platform profitability metrics indicating sustainable unit economics

- Customer retention and repeat purchase rates demonstrating stickiness

10. Conclusion: The B2B Digital Imperative

India’s B2B e-commerce transformation represents far more than a technological upgrade—it’s a fundamental restructuring of how the world’s fifth-largest economy conducts business-to-business commerce. The journey from $60 billion in 2025 to $200 billion by 2030 won’t merely quantify growth; it will manifest in MSMEs accessing credit previously unavailable, manufacturers discovering suppliers across India rather than within limited local networks, farmers receiving fair prices through transparent marketplaces, and businesses optimizing working capital through efficient digital procurement.

This transformation occurs against a backdrop of broader change: India’s digital economy evolution, payment infrastructure maturation, and entrepreneurial energy in tier-2 and tier-3 cities driving innovation beyond metropolitan centers. B2B digitization both enables and depends upon these parallel transformations, creating reinforcing cycles where digital commerce generates data enabling credit, credit facilitates commerce growth, and scale drives infrastructure investment.

Recommendations for Stakeholders

For B2B platforms and startups:

- Prioritize unit economics over growth-at-any-cost; sustainable profitability validates business models

- Invest deeply in sector-specific expertise rather than horizontal breadth initially

- Build or partner for financing—commerce without capital access solves only half the MSME problem

- Design for mobile and vernacular from inception, not as afterthoughts

- Consider tier-2/3/4 markets where competition is less intense and growth potentially higher

For businesses and buyers:

- Embrace digital procurement as strategic imperative, not optional experiment

- Evaluate platforms beyond price—consider reliability, financing access, and service quality

- Invest in employee digital literacy and change management

- Start with pilot categories before enterprise-wide adoption

- Maintain relationships while leveraging digital efficiency

For investors:

- Scrutinize unit economics; GMV growth alone insufficient for valuation support

- Favor platforms with financing integration addressing working capital challenges

- Assess management teams for category expertise, not just technology skills

- Consider sector specialists over horizontal generalists in certain categories

- Evaluate logistics and quality verification capabilities as competitive moats

For policymakers:

- Continue infrastructure investments—broadband, roads, warehousing—enabling digital commerce

- Simplify TReDS and supply chain financing regulations to accelerate MSME credit access

- Harmonize sector-specific regulations across states

- Support ONDC and interoperability standards preventing monopolistic marketplace concentration

- Balance formalization benefits (tax collection, transparency) with small business compliance burden

The $200 billion opportunity is achievable, but not inevitable. Success requires coordinated effort across platforms, businesses, investors, and government—each playing their role in building infrastructure, refining business models, providing capital, and creating supportive policy frameworks.

India’s B2B digital transformation will define competitiveness for millions of businesses and determine whether MSMEs can leverage technology for growth or remain constrained by traditional limitations. The decisions made in these five critical years—2025 to 2030—will shape Indian business commerce for decades to come.

The transformation has begun. The opportunity is clear. The imperative is urgent.

About the Author

Debansh Das Sharma is a research analyst specializing in India’s digital economy, with focus on e-commerce, fintech, and technology-enabled business transformation. His work has been featured across industry publications and provides data-driven insights for businesses, investors, and policymakers navigating India’s rapidly evolving digital landscape.

Related Research:

- India E-commerce Market 2025: Growth, Trends & Projections

- Digital Payments India 2025: UPI, BNPL & Wallets

- AI in Financial Services India (2025–2030)

- India’s Digital Economy: A Data-Driven Analysis

- Tier-2 & Tier-3 Founders 2025

Sources & References:

- Bessemer Venture Partners – B2B E-commerce Market Research

- Reserve Bank of India – Payment Systems Data

- India Brand Equity Foundation (IBEF) – Industry Reports

- National Payments Corporation of India (NPCI) – UPI Statistics

- Ministry of Commerce and Industry – Trade Data

- Redseer Strategy Consultants – E-commerce Analysis

- EY India – Technology Adoption Reports

- Government e-Marketplace (GeM) – Public Procurement Data

FAQs

What is the current size of India’s B2B e-commerce market in 2025?

India’s B2B e-commerce market is approximately $60 billion in 2025, representing 1.5-2% digital penetration of the total B2B market which exceeds $4 trillion annually. The market has grown from $5.6 billion in 2021 at a CAGR exceeding 75%.

How large will India’s B2B e-commerce market be by 2030?

India’s B2B e-commerce market is projected to reach $200 billion by 2030, growing at a CAGR of 40-45%. This will represent approximately 4-5% of total B2B commerce, driven by digital infrastructure maturity, MSME adoption, and sector-specific digitization.

Which sectors are leading B2B e-commerce adoption in India?

Industrial manufacturing and MRO (maintenance, repair, operations) shows highest adoption at 5-6% penetration, followed by steel and metals at 3-4%, and construction materials at 3-4%. Agriculture, chemicals, and pharmaceuticals show 1-3% adoption but represent massive growth potential.

What are the main challenges for B2B e-commerce in India?

Key challenges include logistics complexity for bulk shipments, quality verification beyond visual inspection, trust-building in relationship-driven markets, digital literacy gaps among traditional businesses, working capital constraints, and integration with legacy systems. Payment terms (Net 30-90 days) and credit access remain significant barriers.

How is UPI enabling B2B e-commerce growth in India?

UPI processed 18.68 billion transactions worth $294 billion monthly in May 2025, with growing B2B adoption. Smart contracts automate 12% of B2B payments via UPI, blockchain-enabled transactions improve processing speeds by 27%, and high-value UPI transactions now feature blockchain audit trails, replacing traditional NEFT/RTGS processes.

What is the difference between B2B and B2C e-commerce in India?

B2C e-commerce in India reached $136 billion in 2025 with 8-10% market penetration, while B2B reached $60 billion with only 1.5-2% penetration despite a larger total addressable market. B2B involves higher transaction values ($2,500-5,000 vs $25-50), longer decision cycles, credit terms, multi-stakeholder approvals, and complex logistics compared to B2C’s individual purchases.

Which are the leading B2B e-commerce platforms in India?

Leading platforms include Udaan (general trade, $1.8B valuation), OfBusiness (raw materials, $2.5B revenue), Moglix (industrial supplies, $500M+ revenue), InfraMarket (construction materials, unicorn), Ninjacart (agriculture, $500M+ GMV), and Amazon Business. Platforms like IndiaMART and TradeIndia serve as horizontal discovery marketplaces.

How does supply chain financing work in B2B e-commerce?

Supply chain financing enables MSMEs to access working capital through invoice discounting, revenue-based financing, and embedded marketplace credit. Platforms like TReDS allow invoice discounting, while marketplace-integrated financing (OfBusiness/Oxyzo, Moglix) uses transaction data for credit assessment, offering Net 30-90 day terms without traditional collateral requirements.

What government initiatives support B2B e-commerce in India?

Key initiatives include ONDC (Open Network for Digital Commerce) promoting interoperability, GeM (Government e-Marketplace) processing ₹2 lakh crore annually in public procurement, 100% FDI in B2B e-commerce under automatic route, GST and e-invoicing mandates driving digitization, and BharatNet connecting 100,000+ gram panchayats with broadband for rural business access.

How does India’s B2B e-commerce compare with China and the US?

China’s B2B e-commerce exceeds $2 trillion with 15-20% digital penetration, led by Alibaba.com serving 40M+ businesses. The US market reached $1.8 trillion with 10-12% penetration, dominated by Amazon Business ($35B+ GMV) and traditional distributors. India at $60 billion and 1.5-2% penetration has significant catch-up opportunity but benefits from mobile-first infrastructure and UPI payment innovations enabling potential leapfrogging.

About Webverbal Research

Webverbal Research is the editorial and insights division of Webverbal, focused on producing trustworthy, data-driven analysis on India’s startup, e-commerce, and digital economy. Every report and insight published under Webverbal Research is built upon verified data sources, government reports, company filings, and on-ground market intelligence interpreted through a strategic founder’s lens.

Our editorial team combines over a decade of experience in entrepreneurship, digital strategy, and market research, ensuring accuracy, neutrality, and clarity. Each article goes through a multi-layer review process for factual consistency and interpretive integrity before publication.

Editorial Note: This publication reflects independent research and editorial judgment by the Webverbal team. While quantitative insights are based on credible industry data and official disclosures, certain interpretations or forecasts are author-driven estimates intended for informational purposes only.

For corrections, data validation, or research collaborations, please contact hello@webverbal.com.