Table Of Content

- The Funding Obsession in Indian Startups: Funding vs Profitability

- The Dark Side of Funding vs Profitability Addiction

- Profitability vs Funding: Why It Gets Ignored

- Contrarian Winners in the Indian Startups Funding vs Profitability Debate

- What India’s Startup Ecosystem Really Needs

- Conclusion & Webverbal’s Pulse

- FAQ

- Why are Indian startups so focused on funding instead of profitability?

- Which Indian startups are profitable without external funding?

- What are the risks of funding addiction for Indian startups?

- How can Indian startups balance funding and profitability?

- Is funding always bad for startups?

What makes a startup successful in India today—funding headlines or profits? The debate of Indian startups funding vs profitability sits at the heart of our ecosystem.

If you go by the headlines, the answer is obvious: how much funding it has raised. A $100 million Series B? That’s news. A bootstrapped company quietly hitting ₹100 crore in profits? That rarely trends.

Over the past decade, Indian entrepreneurship has been rebranded as a fundraising sport. Flipkart’s billion-dollar exit, Ola’s blitzscaling, Paytm’s mega IPO—all became cultural markers of what success “should” look like. Media, investors, and even family circles began equating a startup’s worth with how much external capital it could attract.

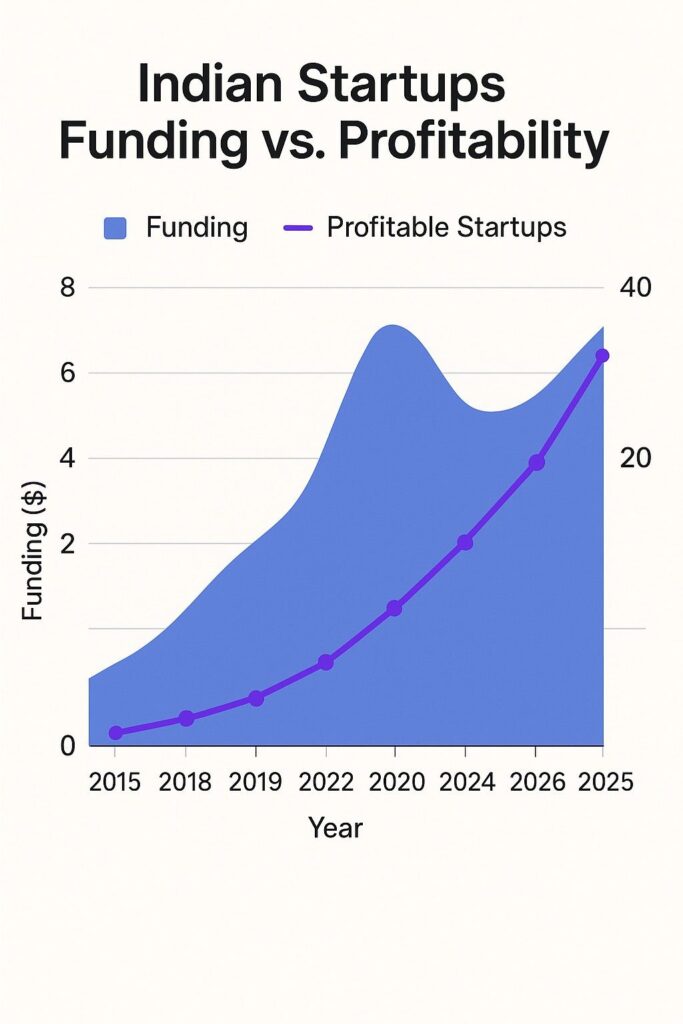

But here’s the uncomfortable truth: while according to Traxcn, India has minted over 123 unicorns, less than 10% are profitable. Funding has become more than fuel—it has become a drug. And like all addictions, it distorts the original mission.

At Webverbal, we believe it’s time to ask: Are Indian startups addicted to funding instead of profitability? And if yes, what is the cost of this addiction?

The Funding Obsession in Indian Startups: Funding vs Profitability

The Indian startup ecosystem underwent a cultural shift around 2010. Flipkart’s fundraising spree became a playbook for aspiring founders: raise fast, scale faster, worry about profits later. Ola and Zomato reinforced the same story—if you could prove “growth,” investors would line up, no matter the losses.

This mindset snowballed. Shark Tank India turned funding into primetime entertainment, where getting a cheque on TV became synonymous with validation. Startup events began celebrating “who raised what” more than “who built what.”

For founders, the psychological effect was clear: funding became a badge of legitimacy. Without it, you weren’t considered serious. Bootstrapped founders—despite strong cash flows—were often sidelined in the narrative.

The result? A generation of entrepreneurs chasing capital first, customers second.

The Dark Side of Funding vs Profitability Addiction

Every addiction has side effects. The funding-first mindset is no different.

Unsustainable burn

To justify their valuations, many startups pursued growth-at-any-cost strategies: massive discounts, cashback wars, celebrity endorsements. The idea was simple—capture market share first, figure out unit economics later. But later rarely comes.

Copycat models

Instead of original problem-solving, we saw waves of startups chasing investor-friendly trends. When food delivery was hot, everyone launched a clone. When quick commerce took off, Zepto, Blinkit, Swiggy Instamart, and others joined the fray—burning money to match each other’s discounts. The customer benefited temporarily, but the ecosystem bled cash. (Read our analysis of India’s quick commerce growth)

Founder distraction

In many cases, founders spent more time preparing pitch decks than talking to customers. Investor feedback overshadowed user feedback. In boardrooms, “monthly burn rate” got more airtime than “customer lifetime value.”

Case in point: Paytm’s IPO crash. Once celebrated as India’s poster child for digital payments, its public listing crashed spectacularly. Why? Because the company’s story was built on fundraising momentum, not profitability fundamentals. Similarly, the quick commerce frenzy is a race to the bottom—valued highly by VCs but sustained only by relentless cash burn.

This is the price of the addiction: fragile business models, inflated egos, and disappointed consumers.

Profitability vs Funding: Why It Gets Ignored

Why does this happen? Why do smart, driven founders sideline profitability?

- Investor pressure: Venture capital thrives on exponential growth. Investors push for expansion and market capture because their exit depends on scale, not on your bottom line.

- Valuation game: Founders get rewarded for raising at higher valuations. Each round validates the previous one. Profits, on the other hand, are long-term, slow, and far less glamorous.

- Cultural mindset: Indian founders often view external capital as a shortcut to scale. In Tier-1 hubs, raising money became part of founder identity. Those who didn’t raise often felt invisible, even if they were building sustainable ventures.

- FOMO: Many founders raise prematurely because of fear—“If I don’t grab funding now, someone else will get it, and I’ll be left behind.” This herd mentality traps startups in cycles of dilution and dependency.

In short, the ecosystem conditions founders to ignore profitability. And like any system, what you measure is what you get.

Contrarian Winners in the Indian Startups Funding vs Profitability Debate

But here’s where Webverbal stands apart: profitability is not only possible—it’s quietly powering some of India’s most resilient companies.

Look at Zoho: bootstrapped, profitable, global. Or Zerodha: self-funded, highly profitable, redefining India’s brokerage industry. Or Info Edge (Naukri.com): built patiently, with steady revenues, long before “unicorn” became a buzzword.

Even in Bharat’s Tier-2 and Tier-3 towns, founders without easy access to VC money are forced to prioritize cash flow. They build businesses that customers pay for from day one. Ironically, their lack of access to capital makes them more disciplined.

These companies don’t always grab headlines, but they’re healthier. They’re not addicted. They don’t depend on the next funding round to survive. They are proof that profitability-first doesn’t mean slow growth—it means sustainable growth.

What India’s Startup Ecosystem Really Needs

So what’s the way forward?

- Reframe success: Funding should be viewed as a tool, not the trophy. Success must be measured in revenues, profits, and customer loyalty—not just the size of the latest round.

- Promote patient capital: India needs more investors willing to back steady, cash-flow-positive businesses instead of just chasing the next unicorn headline.

- Founder discipline: Entrepreneurs must ask themselves—am I building for customers or for investors? The answer determines longevity.

- Ecosystem responsibility: Media, incubators, and policymakers must spotlight profit-first stories. If Shark Tank India can glamorize funding, why can’t we glamorize resilience?

Ultimately, India doesn’t just need unicorns. It needs camels—startups built to survive harsh deserts, not just sprint in fair weather.

Conclusion & Webverbal’s Pulse

India’s startup ecosystem is at a crossroads. We can either continue celebrating fundraising like a reality show or we can redefine what truly matters.

At Webverbal, our contrarian take is clear: Funding has stopped being fuel—it has become a drug. And like any addiction, it’s dangerous. It tempts founders to chase hype, dilute vision, and abandon discipline.

But there is another path—the path of profitability, sustainability, and true customer-first innovation. It’s less glamorous, but it’s far more rewarding in the long run.

To every founder reading this: funding is not your destination. It’s just a vehicle. Don’t get high on it. Build a business that can breathe on its own.

And to the ecosystem at large: let’s start asking better questions. Because the future of Indian entrepreneurship depends not on who raises the most, but on who lasts the longest.

That’s our pulse. What’s yours?

FAQ

Why are Indian startups so focused on funding instead of profitability?

Most Indian startups chase funding because investors reward rapid growth and valuations, not profits. This creates a cycle where raising capital becomes a priority over building sustainable businesses.

Which Indian startups are profitable without external funding?

Zoho, Zerodha, and Info Edge (Naukri.com) are examples of Indian startups that focused on profitability first, built on customer revenues, and scaled sustainably without relying on heavy VC funding.

What are the risks of funding addiction for Indian startups?

The risks include unsustainable cash burn, copycat models driven by investor trends, and founders spending more time pitching to VCs than solving customer problems.

How can Indian startups balance funding and profitability?

Startups can balance both by focusing on unit economics, prioritizing paying customers, and raising capital only as fuel to accelerate, not as validation.

Is funding always bad for startups?

No. Funding is a useful tool if used strategically. The problem arises when startups treat funding as the ultimate goal rather than a means to build long-term profitable businesses.