Table Of Content

₹180 crore funding. Premium positioning. Zero consumer connect. Grofers (now Blinkit) burned through massive VC money trying to sell ₹500 grocery orders to customers who think ₹200 is expensive. Meanwhile, bootstrap founders building ₹50 solutions were dismissed as “not scalable.” The pattern is clear: Indian VCs consistently fund startups that misread Indian consumers.

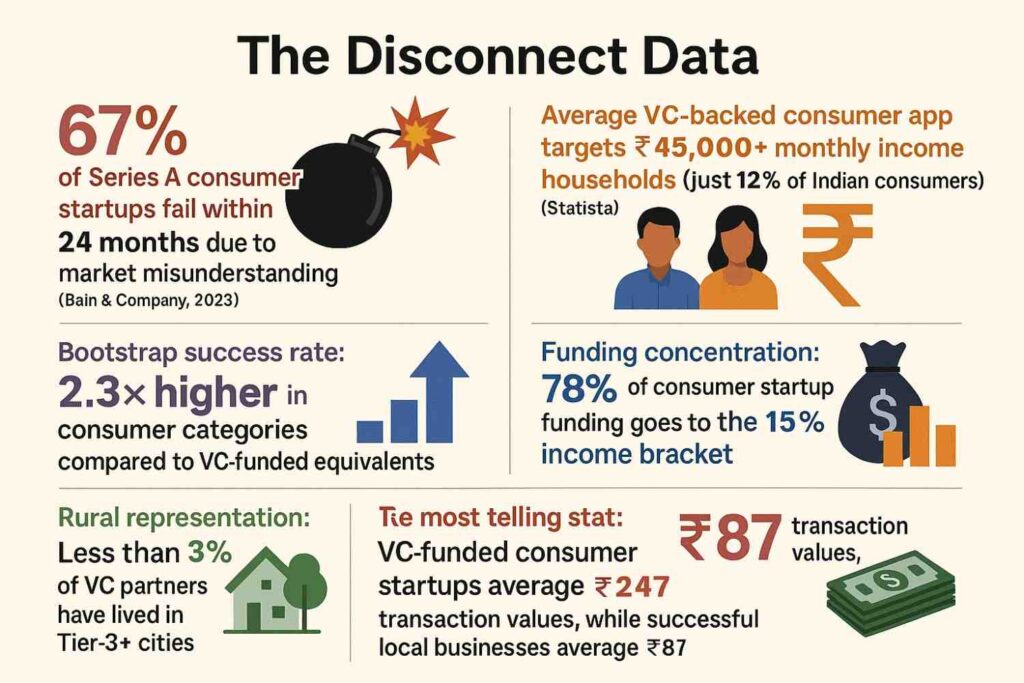

The Disconnect Data

Recent analysis reveals a staggering gap between VC backing and consumer reality:

- 67% of Series A consumer startups fail within 24 months due to market misunderstanding (Bain & Company, 2023)

- Average VC-backed consumer app targets ₹45,000+ monthly income households (just 12% of Indian consumers, Statista)

- Bootstrap success rate: 2.3x higher in consumer categories compared to VC-funded equivalents

- Funding concentration: 78% of consumer startup funding goes to the top 15% income bracket

- Rural representation: Less than 3% of VC partners have lived in Tier-3+ cities

The most telling stat: VC-funded consumer startups average ₹247 transaction values, while successful local businesses average ₹87.

For a deeper lens on how these blind spots derail founders, read our case-driven breakdown: Why Most Indian Startups Fail: A Case Study-Led Dive into Behavioral Blind Spots

The Bubble Reality

- Educational Echo Chamber: 84% of Indian VC decision-makers studied abroad or worked internationally. They know global consumers but miss Indian price sensitivity. One partner even asked why Indians won’t pay ₹199 subscriptions—the same Indians who negotiate ₹5 off vegetables.

- Geographic Isolation: Most VCs live in South Bombay or Koramangala bubbles where ₹300 coffee is normal. They fund startups for their neighbors, not the 95% earning ₹25,000 monthly.

- Thesis Trap: VCs count 400 million smartphone users as 400 million premium customers. Reality: 340 million of them spend under ₹500 monthly on digital services (NASSCOM Report).

- Class Comfort Zone: A food app charging ₹60 delivery feels fine if you’ve never eaten ₹40 meals.

Case in point: a Gurgaon D2C brand raised $20M to sell ₹1,200 shampoos. A Tier-3 herbal oil founder selling at ₹120 grew 5x without VC money. This kind of mass-market brand-building mirrors Inside PEP Brands’ 6P Engine That Turned mCaffeine & Hyphen Into Household Names.

What Needs to Change in VC Thinking

This misalignment starves affordable solutions while overfunding premium plays that burn cash against deep-rooted consumer habits. Winners? Bootstrap founders pricing for ₹50–₹100 daily spends. Losers? India’s innovation potential.

Key Takeaways

- 67% of VC-funded consumer startups fail due to misreading demand

- Premium bias skews funding toward the top 15% income bracket

- Bootstrapped founders thrive by pricing for Bharat’s wallets

- Indian VCs need ground-reality immersion, not just Excel models

The ₹2.1 lakh crore VC industry must step outside its echo chambers. Until investors spend time in ₹10,000 salary households, consumer startups will keep solving ₹1,00,000 salary problems.