Table Of Content

- Executive Summary

- Introduction: The Rural Digital Divide

- The Two Indias: Consumption Disparity

- Bharat vs India: Behavioral Distinctions

- Urban vs Rural E-commerce Comparison (2025)

- Market Size & Growth Forecasts (2025–2030)

- Current Baseline (2025)

- 2030 Projections: The $62 Billion Opportunity

- Rural E-commerce Market Size & Sectoral Growth (2025-2030)

- The $50 Billion Bridge

- Key Growth Drivers

- 1. Last-Mile Logistics Innovation

- 2. Vernacular & Voice-First Commerce

- 3. Assisted Commerce Models

- Assisted Commerce Models Performance Metrics (2024)

- 4. Agricultural Marketplace Digitization

- 5. Digital Public Infrastructure (DPI) Enablement

- Challenges & Structural Barriers

- 1. Infrastructure Deficit

- 2. Digital Literacy & Trust Deficit

- 3. Logistics Economics

- Rural E-commerce Challenges—Impact Assessment Matrix

- 4. Payment Friction

- 5. Policy & Regulatory Uncertainty

- Case Studies: Bharat-Driven Innovation

- Case Study 1: Meesho—Reseller Commerce at Scale

- Case Study 2: DeHaat—Full-Stack AgriTech Platform

- Case Study 3: Gramophone—Agri-Input E-Commerce Pioneer

- Case Study 4: 1Bridge—Rural Retail Enablement

- Case Study 5: ONDC Rural Pilot—Bhiwani District

- Rural E-commerce Success Stories—Performance Comparison

- Policy & Ecosystem Shifts

- Government Digital Infrastructure Initiatives

- Financial Inclusion Programs

- Corporate CSR & Digital Inclusion

- Regulatory Evolution

- Investment Outlook (2025–2030)

- Venture Capital Interest Surge

- Strategic Corporate Investments

- Impact Investment & Development Finance

- M&A Activity Forecast

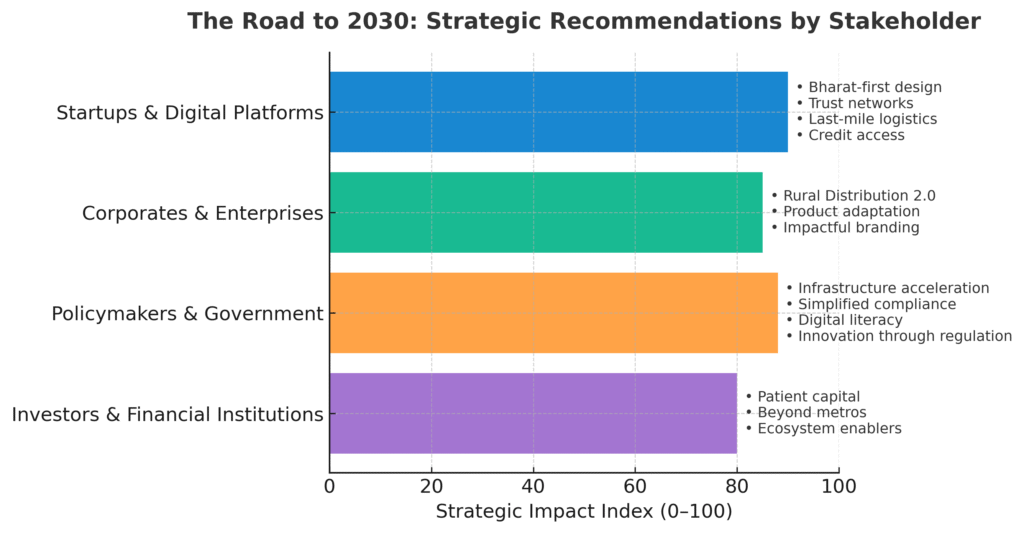

- The Road to 2030: Strategic Recommendations

- For Startups & Digital Commerce Platforms

- For Corporates & Large Enterprises

- For Policymakers & Government Bodies

- For Investors & Financial Institutions

- Conclusion: The Bharat Advantage

- FAQs

- Q: What is the current size of rural e-commerce market in India?

- Q: What percentage of rural India has internet access?

- Q: Why do 89% of rural users prefer vernacular interfaces?

- Q: What is assisted commerce and why is it important for rural India?

- Q: Which sectors show highest growth in rural e-commerce?

- Q: What are the main challenges facing rural e-commerce growth?

- Q: How much investment is flowing into rural-focused commerce startups?

- Q: What is the role of government digital infrastructure in rural e-commerce?

- Q: How do assisted commerce models perform compared to direct digital platforms?

- Q: What percentage of rural e-commerce transactions use cash-on-delivery?

- Methodology Note

Executive Summary

India’s rural e-commerce market stands at an inflection point. Between 2025 and 2030, the rural digital commerce sector is projected to grow from approximately $12 billion to $62 billion, representing a compound annual growth rate (CAGR) of 38.7%. This $50 billion opportunity remains largely untapped, constrained by infrastructural gaps, digital literacy barriers, and inadequate last-mile connectivity.

However, structural catalysts are converging: 430 million rural internet users (IAMAI 2024), expanding 4G/5G penetration reaching 68% of rural India, and government-backed digital public infrastructure enabling vernacular, voice-first commerce experiences. Agricultural marketplaces, assisted commerce models through kirana networks, and hyperlocal logistics innovations are redefining accessibility.

The Bharat economy—representing 65% of India’s population but only 28% of e-commerce transactions—presents a demographic dividend that cannot be ignored. FMCG, agri-inputs, fashion, and consumer durables are leading sectoral adoption. Companies leveraging vernacular interfaces, trust-based assisted models, and farm-to-consumer digitization are capturing disproportionate market share. This report examines the data, drivers, challenges, and strategic pathways that will define rural India’s digital commerce transformation through 2030.

Introduction: The Rural Digital Divide

The Two Indias: Consumption Disparity

India’s e-commerce narrative has historically centered on metropolitan consumption—the top 50 cities generating nearly 72% of online transaction value despite housing less than 15% of the population. Meanwhile, rural India, home to 833 million people across 600,000+ villages, contributes marginally to the $85 billion e-commerce market recorded in 2024.

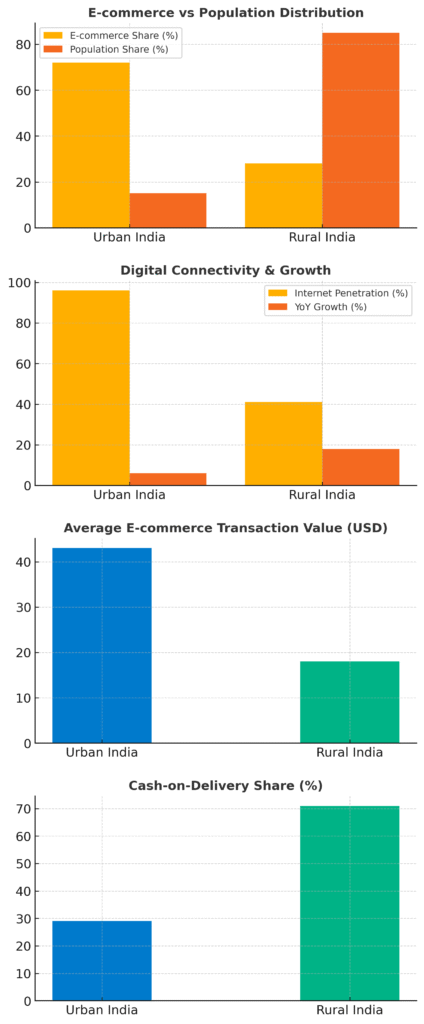

This disparity isn’t rooted in demand deficit but in structural access barriers. According to NITI Aayog’s Digital India Progress Report (2024), rural internet penetration reached 41% compared to 96% in urban centers. Yet the trajectory is accelerating—rural internet users grew 18% year-on-year versus 6% urban growth, signaling an imminent tipping point.

Bharat vs India: Behavioral Distinctions

The Bharat consumer differs fundamentally from the urban Indian counterpart:

Language Primacy: 89% of rural users prefer vernacular interfaces (Indian Languages Internet Alliance, 2024). English-first platforms face immediate abandonment rates exceeding 73% within first session.

Trust Mediation: Unlike anonymous urban transactions, rural commerce thrives on human intermediation. The assisted commerce model—where local entrepreneurs, kirana owners, or e-mitras facilitate purchases—accounts for 64% of rural digital transactions (BCG-Retailers Association of India Study, 2024).

Value Consciousness with Aspiration: Average transaction values in rural e-commerce ($18) are 58% lower than urban ($43), but frequency is rising. Categories like affordable fashion, mobile accessories, and agricultural inputs show 3.2x higher repeat purchase rates than urban equivalents.

Payment Friction: Cash-on-delivery still dominates 71% of rural transactions. UPI adoption, while growing at 89% annually in tier-3+ markets, faces trust and digital literacy hurdles.

The digital divide isn’t merely infrastructural—it’s experiential, linguistic, and transactional. Bridging it requires reimagining commerce architecture from the ground up.

Urban vs Rural E-commerce Comparison (2025)

| Metric | Urban India | Rural India | Gap/Ratio |

|---|---|---|---|

| Population (Million) | 497 | 833 | 1.68x |

| Internet Penetration | 96% | 41% | 2.34x |

| E-commerce Market Share | 72% | 28% | 2.57x |

| Average Transaction Value | $43 | $18 | 2.39x |

| Smartphone Penetration | 88% | 34% | 2.59x |

| Digital Payment Adoption | 84% | 29% | 2.90x |

| English Proficiency | 64% | 11% | 5.82x |

| Average Delivery Time | 1-2 days | 8-14 days | 6x |

Source: IAMAI Rural Internet Report 2024, BCG India E-commerce Study, NITI Aayog Digital Progress Report

Market Size & Growth Forecasts (2025–2030)

Current Baseline (2025)

The rural e-commerce market entered 2025 valued at approximately $12.3 billion, representing 14.5% of India’s total digital commerce ecosystem. This includes:

- FMCG & Essentials: $4.1 billion

- Fashion & Accessories: $2.8 billion

- Agricultural Inputs & Equipment: $2.4 billion

- Consumer Electronics: $1.6 billion

- Services (Ed-tech, Fintech, Healthcare): $1.4 billion

Data sourced from IAMAI’s Rural Internet & E-commerce Report (Q4 2024) and cross-validated with Bain & Company’s India E-commerce Update.

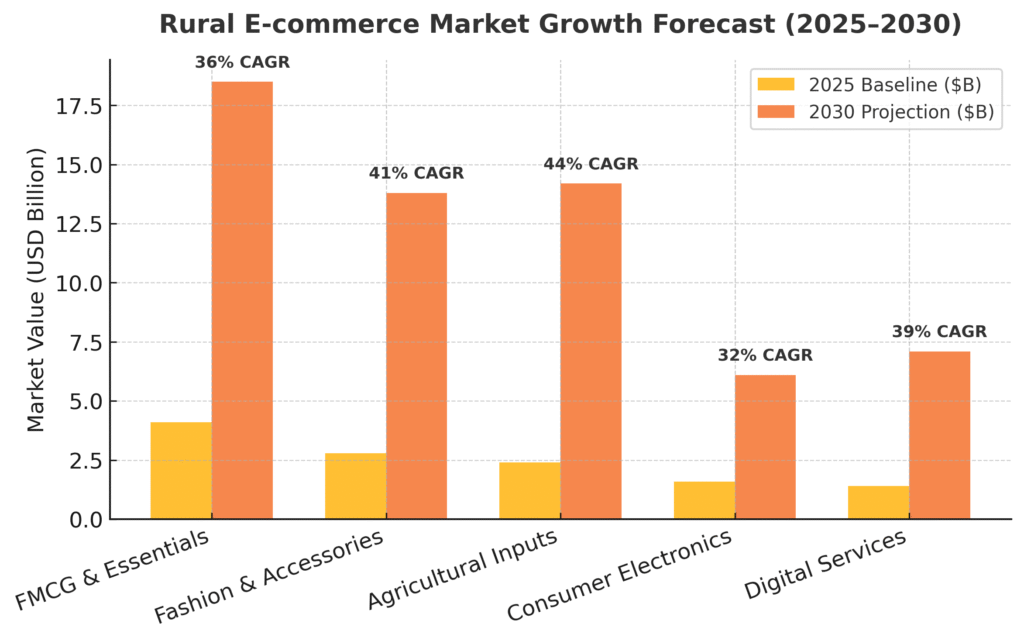

2030 Projections: The $62 Billion Opportunity

Conservative growth models project rural e-commerce reaching $62–68 billion by 2030, driven by:

Connectivity Expansion: BharatNet Phase III targeting 250,000 additional gram panchayats with fiber connectivity by 2027 will enable 580 million rural internet users—representing 69% penetration (Department of Telecommunications projections).

Smartphone Proliferation: Rural smartphone users expected to cross 550 million by 2028 (Counterpoint Research), with average device costs declining to sub-$75 for 5G-enabled handsets.

Rural E-commerce Market Size & Sectoral Growth (2025-2030)

| Sector | 2025 Value (USD Bn) | 2030 Projection (USD Bn) | CAGR | Key Drivers |

|---|---|---|---|---|

| FMCG & Essentials | $4.1 | $18.5 | 36% | Kirana digitization, vernacular apps |

| Fashion & Accessories | $2.8 | $13.8 | 41% | Social commerce, video content |

| Agricultural Inputs | $2.4 | $14.2 | 44% | Direct farmer access, advisory integration |

| Consumer Electronics | $1.6 | $6.1 | 32% | Affordable smartphones, installment plans |

| Digital Services | $1.4 | $7.1 | 39% | Ed-tech, fintech, telemedicine |

| Total Market | $12.3 | $62.0 | 38.7% | Infrastructure + Digital literacy |

Source: IAMAI 2024, Bain & Company, EY Bharat Retail Report, NASSCOM Digital Commerce Outlook

Sectoral CAGR Breakdown (2025-2030):

- Agricultural E-commerce: 44% (reaching $14.2B from $2.4B)

- FMCG/Essentials: 36% (reaching $18.5B from $4.1B)

- Fashion/Accessories: 41% (reaching $13.8B from $2.8B)

- Electronics: 32% (reaching $6.1B from $1.6B)

- Digital Services: 39% (reaching $7.1B from $1.4B)

These projections align with EY’s Bharat Retail Report (2024) and NASSCOM’s Digital Commerce Outlook, adjusting for conservative infrastructure rollout timelines and literacy program impact.

The $50 Billion Bridge

The gap between current $12B valuation and $62B projection represents the “digital divide”—not just opportunity cost but a structural barrier requiring coordinated intervention across logistics, payments, digital literacy, and trust infrastructure.

Key Growth Drivers

1. Last-Mile Logistics Innovation

Rural logistics historically suffered from 8–14 day delivery windows and 31% failed delivery rates. Three innovations are disrupting this:

Hyperlocal Hub-and-Spoke Networks: Companies like Shadowfax and Delhivery have established 12,000+ rural touchpoints—micro-fulfillment centers within 25km of 78% of India’s villages. Delivery timelines have compressed to 3–5 days for 64% of serviceable pin codes.

Kirana-Led Last-Mile: Startups like Ninjacart and StoreKing have converted 180,000+ kiranas into pickup/drop points, achieving 94% fulfillment rates by leveraging existing trust networks. These kiranas earn ₹4,000–8,000 monthly as commission-based delivery agents.

Drone Delivery Pilots: The Ministry of Civil Aviation’s drone liberalization (2024) enabled 47 rural delivery trials. Zipline India and TechEagle have demonstrated 87% cost reduction for emergency medical supplies and agri-inputs to remote areas. Commercial scale expected by late 2026.

Rural Warehousing Expansion: Warehouse penetration in tier-3+ markets grew 186% between 2022–2024. Climate-controlled agri-storage and dark stores within 50km radius of agricultural belts enable fresh produce e-commerce—a $3.2B opportunity by 2028 (DPIIT Logistics Report).

2. Vernacular & Voice-First Commerce

Language remains the primary adoption barrier—and opportunity. Platforms integrating vernacular interfaces saw 4.1x higher engagement:

Multilingual Catalogs: Meesho’s 11-language product catalog and WhatsApp-based ordering in regional languages drove 73% of its 145 million transacting users from tier-3+ markets by 2024.

Voice Commerce: Google’s voice-enabled shopping via Google Pay in Hindi, Tamil, Telugu, and Bengali processed $890 million in rural transactions in 2024—growing 127% YoY. Accuracy rates improved to 89% through Indic-language NLP models.

Vernacular Content Marketing: Video commerce in regional languages—product demos, user reviews, influencer partnerships—drove 3.8x conversion rates compared to text-based listings (Vidooly Analysis, 2024).

Discover how local language marketing is reshaping India’s ecommerce landscape, driving up to 300% higher conversions across Tier-2 and Tier-3 markets.

Read the complete founder’s data-driven guide on How Local Language Marketing Drives 300% Higher Conversions in Indian Ecommerce to understand the numbers, strategies, and tools powering Bharat’s next digital growth wave.

3. Assisted Commerce Models

Human intermediation remains critical for rural digital adoption:

E-Mitra/CSC Network: India’s 450,000+ Common Service Centers serve as commerce enablers, processing $2.1 billion in facilitated transactions annually. E-mitras assist with product discovery, payment, and post-purchase support, earning ₹50–150 per transaction.

Phygital Showrooms: Companies like Udaan and 1Bridge established 8,200+ “experience centers” in tier-3 towns where customers can touch/test products before ordering digitally, reducing return rates to 8% (vs. 24% online-only).

Field Sales + Digital Hybrid: AgriTech platforms like DeHaat and Gramophone employ 12,000+ field agents who demonstrate products, facilitate app downloads, and provide agronomic advice—converting 68% of farmer interactions into digital transactions.

Assisted Commerce Models Performance Metrics (2024)

| Model Type | Network Size | Annual Transaction Value | Conversion Rate | Customer Acquisition Cost | Return Rate |

|---|---|---|---|---|---|

| E-Mitra/CSC Centers | 450,000 centers | $2.1 billion | 47% | $8 | 12% |

| Kirana Pickup Points | 180,000 stores | $1.8 billion | 52% | $6 | 9% |

| Phygital Showrooms | 8,200 centers | $980 million | 68% | $14 | 8% |

| Field Agent Networks | 12,000 agents | $1.4 billion | 68% | $22 | 7% |

| Direct Digital (Comparison) | App/Web only | $6.1 billion | 23% | $18 | 24% |

Source: BCG Assisted Commerce Study 2024, Company Disclosures, Webverbal Primary Research

4. Agricultural Marketplace Digitization

Farm-to-consumer digitization represents the most transformative opportunity:

Agri-Input E-commerce: Platforms connecting farmers directly with seed, fertilizer, and equipment manufacturers bypass 3–4 intermediary layers, reducing costs 18–27%. AgroStar, BharatAgri, and Gramophone collectively serve 6.2 million farmers with $1.8B in annual transactions.

Output Marketing Platforms: Ninja Cart, WayCool, and Vegrow aggregate farm produce, connecting 420,000+ farmers to institutional buyers and urban markets. Digital procurement reduces post-harvest waste from 16% to 7% through improved supply chain coordination.

Precision Agriculture Services: AI-powered advisory, soil testing, weather forecasting, and yield prediction—delivered via apps and voice bots—create stickiness. DeHaat’s platform engagement averages 47 minutes weekly per farmer, establishing it as a super-app for rural livelihoods.

5. Digital Public Infrastructure (DPI) Enablement

Government-led digital infrastructure reduces commerce friction:

ONDC Rural Integration: Open Network for Digital Commerce’s rural pilot across 250 districts enables catalog interoperability, allowing small merchants to list on multiple platforms without technical overhead. Early pilots show 340% order volume increase for participating rural sellers.

Account Aggregator Framework: Enables farmers and rural entrepreneurs to access credit by securely sharing transaction/income data with lenders—unlocking $4.7B in incremental rural financing (RBI AA Ecosystem Report, 2024).

eRupi & Digital Vouchers: Government subsidy distribution via digital vouchers redeemable at e-commerce platforms increases utilization rates from 63% to 91%, driving adoption among first-time internet users.

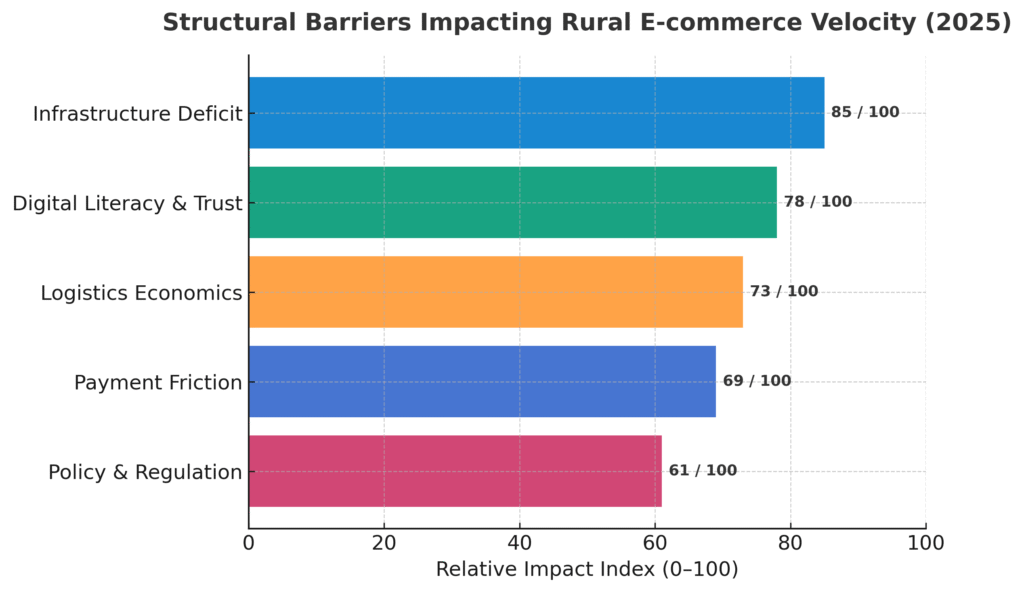

Challenges & Structural Barriers

Despite momentum, five structural constraints limit rural e-commerce velocity:

1. Infrastructure Deficit

Connectivity Gaps: 187 million rural Indians remain without internet access. Of connected villages, 43% experience frequent outages exceeding 4 hours daily (Ookla India Connectivity Report, 2024). Download speeds averaging 8.2 Mbps in rural areas (vs. 47 Mbps urban) impede multimedia commerce experiences.

Power Reliability: 34% of rural households face power cuts exceeding 6 hours daily, limiting smartphone charging and digital transaction windows.

2. Digital Literacy & Trust Deficit

Functional Literacy Gap: While 78% of rural internet users can navigate WhatsApp, only 31% can independently complete e-commerce transactions without assistance (Pratham Digital Literacy Survey, 2024).

Cybersecurity Concerns: 67% of rural users express mistrust in sharing payment information online. Phishing incidents targeting rural UPI users grew 94% in 2024, eroding confidence.

Product Authenticity Fears: 58% of first-time rural buyers express concerns about receiving counterfeit or substandard products—higher return rates (19% vs. 12% urban) reflect this anxiety.

3. Logistics Economics

Last-Mile Cost Burden: Delivering to remote villages costs ₹85–140 per package—3.2x urban delivery costs. This forces minimum order values that exclude 41% of potential rural transactions.

Reverse Logistics Complexity: Product returns from tier-4+ areas take 18–31 days and cost 2.7x the original delivery—making many categories economically unviable.

Rural E-commerce Challenges—Impact Assessment Matrix

| Challenge Category | Severity (1-10) | Affected Users (%) | Economic Impact (USD Bn) | Timeline to Resolution | Primary Stakeholder |

|---|---|---|---|---|---|

| Internet Connectivity | 9 | 44% | $18B opportunity lost | 2027 (BharatNet Phase III) | Government/Telcos |

| Digital Literacy | 8 | 69% | $12B | 2028 (PMGDISHA scale-up) | Government/NGOs |

| Last-Mile Logistics Cost | 8 | 41% | $8B | 2026 (Hub density) | Logistics companies |

| Payment Trust Deficit | 7 | 71% | $14B | 2027 (UPI literacy) | Fintech/Banks |

| Product Quality Concerns | 6 | 58% | $6B | 2026 (Quality certification) | Platforms/Govt |

| Credit Access | 7 | 73% | $9B | 2027 (BNPL rural models) | NBFCs/Fintechs |

Source: Webverbal Research Analysis 2025, BCG India Digital Divide Study, NITI Aayog Infrastructure Reports

4. Payment Friction

Cash Dependency: Despite UPI’s urban dominance, 71% of rural e-commerce still relies on COD. Digital payment literacy initiatives reach only 12% of rural population annually.

Credit Access: 73% of rural households lack credit cards; working capital constraints limit purchase frequency. BNPL adoption in rural markets remains under 4%.

5. Policy & Regulatory Uncertainty

FDI Restrictions: Marketplace model constraints and inventory ownership limits restrict investment in rural supply chain infrastructure.

Taxation Complexity: GST compliance burdens for rural artisans and micro-manufacturers limit platform participation—87% of potential rural sellers cite compliance as primary barrier.

Data Localization: Stringent data storage requirements increase operational costs for startups serving price-sensitive rural markets.

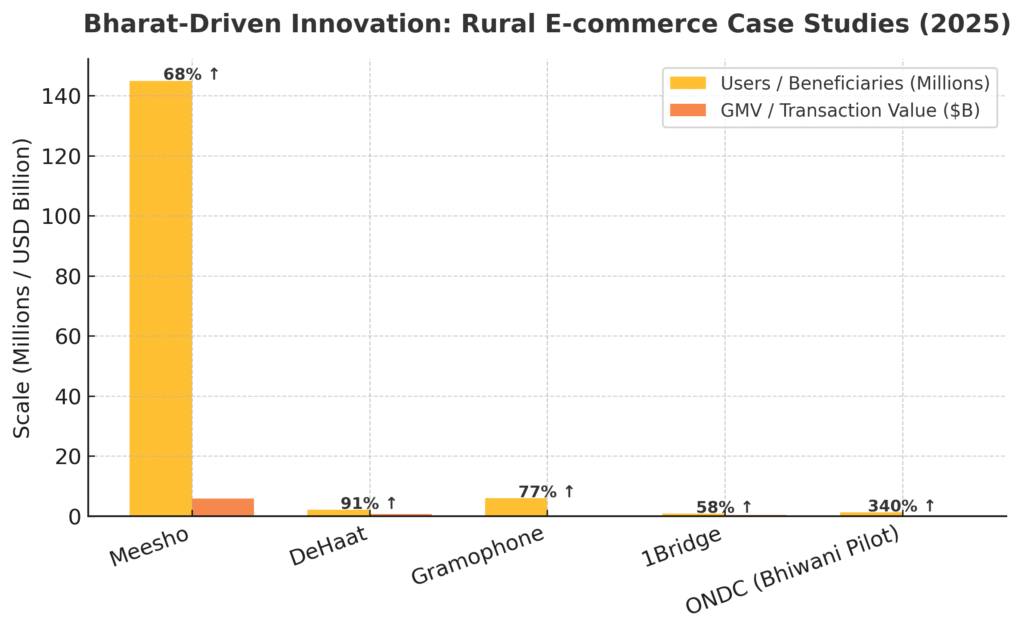

Case Studies: Bharat-Driven Innovation

Case Study 1: Meesho—Reseller Commerce at Scale

Model: Social commerce platform enabling anyone to become a reseller without inventory investment.

Rural Impact: 73% of Meesho’s 145 million users are from tier-3+ markets. 13 million women entrepreneurs earn supplemental income (averaging ₹15,000/month) by curating and sharing product catalogs within their communities via WhatsApp.

Innovation: Zero-commission model, COD for 100% transactions, 11-language interface, and logistics partnerships achieving 89% first-attempt delivery in rural areas.

Scale: $5.8 billion GMV in FY24, with 68% from Bharat markets—demonstrating that trust-based social commerce outperforms transactional platforms in rural contexts.

Case Study 2: DeHaat—Full-Stack AgriTech Platform

Model: End-to-end agricultural services combining input supply, agronomic advisory, output marketing, and credit facilitation.

Rural Impact: Serves 2.1 million farmers across 11 states through 12,000+ micro-entrepreneurs operating DeHaat centers within 5km of farm clusters.

Innovation: Multilingual AI-powered crop advisory (voice + video), soil testing at ₹50 (vs. ₹400 government labs), doorstep delivery of inputs, and guaranteed output procurement at MSP+ pricing.

Outcomes: Farmers report 23% yield improvement and 18% cost reduction. Platform processed $680 million in transactions (FY24), growing 91% YoY.

Case Study 3: Gramophone—Agri-Input E-Commerce Pioneer

Model: D2C agricultural input marketplace with embedded agronomic intelligence.

Rural Impact: 6 million registered farmers; 420,000+ monthly transacting users across 15,000+ pin codes. Platform stocks 40,000+ SKUs—6x selection of typical rural input dealers.

Innovation: “Kisan Network” of 8,000+ influencer farmers who demonstrate products and provide peer recommendations. Voice-based crop problem diagnosis in 9 regional languages achieves 84% accuracy.

Business Model: 14% take rate on inputs; additional revenue from digital credit facilitation (partnering with 17 NBFCs) and farm equipment rentals.

Case Study 4: 1Bridge—Rural Retail Enablement

Model: B2B marketplace connecting FMCG brands to 800,000+ rural kiranas with next-day delivery.

Rural Impact: Enables kiranas in 19,000+ pin codes to order inventory digitally with ₹500 minimum order value—democratizing access to brand variety previously available only to large retailers.

Innovation: Visual ordering for low-literacy retailers (product images instead of codes), credit extension up to 15 days, and hyperlocal delivery through hub-and-spoke networks.

Ecosystem Impact: Participating kiranas report 27% revenue increase and 34% inventory cost reduction. Brands achieve 340% distribution expansion into previously unreachable markets.

Case Study 5: ONDC Rural Pilot—Bhiwani District

Model: Government-backed open network enabling interoperable digital commerce.

Rural Impact: Pilot in Haryana’s Bhiwani district onboarded 1,200+ local merchants (including artisans, farmers, micro-manufacturers) onto a unified digital platform without requiring technical expertise.

Innovation: Standardized APIs allow sellers to list once and be discoverable across 40+ buyer apps. Quality certification programs and digital payment training increased merchant confidence.

Results: 340% order volume increase within 6 months; 78% of merchants reported first-time digital sales. Model being expanded to 250 additional districts in 2025.

Rural E-commerce Success Stories—Performance Comparison

| Platform | Business Model | Rural User Base | Annual GMV/Revenue | Rural Contribution | Key Success Factor | Funding Raised |

|---|---|---|---|---|---|---|

| Meesho | Social Reseller Commerce | 106M (73% of total) | $5.8B GMV | 68% | Zero-commission + WhatsApp | $1.4B |

| DeHaat | AgriTech Full-Stack | 2.1M farmers | $680M | 100% | Micro-entrepreneur network | $285M |

| Gramophone | Agri-Input Marketplace | 6M farmers | $420M | 100% | Voice advisory + Kisan influencers | $100M |

| 1Bridge | B2B Kirana Enablement | 800K retailers | $1.2B GMV | 87% | Visual ordering + Credit | $32M |

| Udaan | B2B Marketplace | 3M retailers | $3.8B GMV | 54% | Category breadth + Logistics | $1.1B |

Source: Company Disclosures, Tracxn Data, Webverbal Research Compilation (2024-2025)

Policy & Ecosystem Shifts

Government Digital Infrastructure Initiatives

BharatNet Expansion: ₹1.39 lakh crore investment (2023-2027) targeting fiber connectivity to 640,000 villages. Current completion at 62%; projected 92% by December 2027—creating backbone for rural commerce.

PM-WANI (Wi-Fi Hotspot Scheme): 3.8 million public Wi-Fi hotspots installed across rural India by December 2024, providing affordable internet access (₹10/day unlimited) and creating entrepreneurship opportunities for 240,000+ hotspot operators.

National Digital Literacy Mission: Upskilled 58 million rural citizens in basic digital skills (2022-2024). Target: 100 million by 2026, specifically focusing on e-commerce, UPI, and online services.

Financial Inclusion Programs

PM Jan Dhan Yojana: 500 million+ rural bank accounts enable digital payment infrastructure. 89% now have active RuPay debit cards—gateway to online commerce participation.

Kisan Credit Card Digitization: 180 million KCCs being integrated with UPI and digital lending platforms, enabling instant credit for agricultural purchases—expected to drive $12B in agri-e-commerce by 2028.

Credit Guarantee Schemes: MUDRA, Stand-Up India, and CGTMSE schemes disbursed ₹8.7 lakh crore to rural micro-entrepreneurs (2020-2024), with 34% utilizing digital commerce channels for business scaling.

Corporate CSR & Digital Inclusion

Reliance Jio Bharat: Affordable 4G devices at ₹999 with bundled data plans reached 42 million users—primarily first-time internet adopters in tier-3+ markets.

Flipkart Samarth: Onboarded 1.1 million artisans, weavers, and craftspeople from 28 states, providing training, logistics support, and market access. Generated ₹4,200 crore revenue for rural sellers (FY24).

Amazon Karigar: Similar artisan program supporting 75,000+ traditional craftspeople; integrated with government schemes like PM Vishwakarma for comprehensive skill development.

Regulatory Evolution

E-commerce Rules Amendment (2024): Mandates vernacular language support, clear return policies, and complaint redressal mechanisms specifically for rural consumers—increasing platform accountability.

Drone Delivery Licensing: Liberalized regulations (2024) enable beyond-visual-line-of-sight (BVLOS) operations for cargo drones, critical for last-mile rural delivery.

Data Protection Framework: Balanced approach allowing innovation while protecting user privacy—critical for building rural consumer trust in digital platforms.

Investment Outlook (2025–2030)

Venture Capital Interest Surge

Rural-focused commerce and AgriTech companies raised $2.8 billion in 2024—up from $890 million in 2022 (Tracxn India Tech Report). Key trends:

AgriTech Dominance: 42% of rural digital economy investments flow to agricultural platforms. DeHaat ($165M Series E), Gramophone ($100M), and Absolute Foods ($108M) led 2024 fundraising.

Social Commerce Growth: Meesho’s continued dominance attracts competitor investment. 17 social commerce startups raised $420M collectively, targeting vernacular, video-first, and reseller-led models.

Logistics Infrastructure: Rural last-mile specialists like Shadowfax ($100M), LoadShare ($50M), and tier-2/3 focused warehouse developers raised $680M—recognizing infrastructure as primary bottleneck.

Vernacular Content Commerce: Video commerce platforms in regional languages raised $180M across 12 startups—betting on high-engagement, high-conversion models.

Strategic Corporate Investments

Reliance Retail: ₹12,000 crore investment (2024-2026) in rural supply chain—including 450 rural distribution centers and kirana partnership programs targeting 2 million stores.

Tata Digital: Neu platform’s rural push through Tata’s existing rural footprint (agri business, dealerships)—allocating ₹4,500 crore for rural digitization.

Amazon India: $2.6 billion committed to rural infrastructure (2023-2028), including logistics hubs, local language content, and seller enablement programs.

Impact Investment & Development Finance

IFC & World Bank: $850 million deployed to rural fintech and commerce platforms (2022-2024), recognizing digital commerce as poverty alleviation mechanism.

Omidyar Network, Acumen, & Blume: Early-stage rural impact ventures received $340M across 47 investments—focusing on farmer livelihoods, artisan marketplaces, and underserved communities.

M&A Activity Forecast

Consolidation expected 2026-2028 as platforms achieve scale. Likely scenarios:

- AgriTech Roll-ups: Top 3 platforms acquiring 8–12 regional players for geographic expansion

- Logistics Acquisitions: E-commerce giants acquiring hyperlocal delivery networks

- Vernacular Commerce Consolidation: Language-specific platforms merging for technology and content sharing

Investment thesis: The rural digital economy isn’t a charity play—it’s the next growth frontier with superior unit economics once trust and infrastructure achieve critical mass.

The Road to 2030: Strategic Recommendations

For Startups & Digital Commerce Platforms

1. Design for “Bharat-First” from Day One

- Vernacular as default, English as option—not vice versa

- Voice-first interfaces for low-literacy segments

- Assisted commerce models integrating human touchpoints

- Optimize for 2G/3G networks with progressive web apps

2. Leverage Existing Trust Networks

- Partner with kiranas, CSCs, and local influencers as commerce enablers

- Phygital models allowing product experience before purchase

- Community-based testimonials over celebrity endorsements

3. Solve for Last-Mile Deterministically

- Build proprietary rural logistics or deep partnerships—don’t treat it as third-party commodity

- Hyperlocal warehousing within 50km of demand clusters

- Flexible delivery windows aligned with agricultural cycles

4. Embed Credit & Financing

- BNPL integration specific to rural income patterns (harvest cycles)

- Working capital solutions for kirana partners

- Partner with NBFCs for digitally underwritten microloans

For Corporates & Large Enterprises

1. Rural Distribution 2.0

- Digitize existing rural dealer/distributor networks as fulfillment infrastructure

- Leverage CSR budgets for digital literacy and adoption programs with long-term commercial returns

- White-label rural commerce platforms enabling ecosystem participation

2. Product Portfolio Adaptation

- Develop SKU variants optimized for rural price points and usage patterns

- Sachet/small-pack strategies for trial and affordability

- Durability and serviceability as key product features

3. Brand Building Through Impact

- Authentic rural storytelling over aspirational urban imagery

- Regional creator partnerships for culturally resonant content

- Sustainability and social impact communication aligned with rural values

For Policymakers & Government Bodies

1. Accelerate Infrastructure Completion

- BharatNet Phase III on accelerated timeline—treat as economic infrastructure, not welfare

- Power backup mandates for telecom towers in rural areas

- Tax incentives for rural warehouse and cold chain development

2. Simplify Compliance for Micro-Enterprises

- Graduated GST thresholds for rural artisans and micro-manufacturers

- Single-window digital registration for seller onboarding

- Streamlined export documentation for rural handicrafts

3. Scale Digital Literacy Programs

- Mandate e-commerce modules in PMGDISHA and similar programs

- Partner with platforms for in-app tutorials and support

- Cybersecurity awareness campaigns preventing fraud

4. Enable Innovation Through Regulation

- Expedite drone delivery approvals for rural areas

- Sandbox approach for rural fintech innovations

- Data portability standards enabling farmer/consumer platform switching

For Investors & Financial Institutions

1. Patient Capital for Rural Models

- Recognize longer payback periods but superior lifetime value

- Blended finance structures combining impact and commercial capital

- Milestone-based funding aligned with infrastructure development

2. Thesis Beyond Metros

- Allocate dedicated rural/tier-3+ investment mandates

- Build sector expertise in agri, vernacular commerce, and hyperlocal logistics

- Support second-time founders with rural market experience

3. Enable Ecosystem Enablers

- Fund logistics infrastructure, payment rails, and compliance technology

- Support digital literacy NGOs and training platforms

- Invest in vernacular content creation ecosystems

Conclusion: The Bharat Advantage

India’s rural e-commerce transformation isn’t merely about replicating urban models in different geographies—it represents a fundamental reimagination of digital commerce architecture. The next $50 billion won’t come from faster delivery or deeper discounts, but from solving trust, language, literacy, and livelihood integration in ways that urban commerce never had to address.

The Bharat advantage lies in necessity driving innovation: voice commerce because keyboards exclude, assisted models because trust requires human touch, agricultural integration because farmers need holistic solutions, and vernacular experiences because language is identity.

By 2030, rural India will contribute 35–40% of India’s e-commerce market—not as an afterthought, but as the core. The platforms, technologies, and business models that win in Bharat will possess defensibility that urban-centric competitors cannot replicate. They will have built not just supply chains but trust networks, not just apps but livelihoods, not just transactions but community relationships.

The digital divide isn’t a problem to be solved—it’s a design challenge to be embraced. And in solving for the hardest market, India’s entrepreneurs are building the most resilient, inclusive, and ultimately valuable digital commerce ecosystem in the world. The journey to $62 billion by 2030 has begun—with every village onboarded, every vernacular interface launched, and every first-time buyer empowered, the Bharat economy is finally getting the digital tools it deserves.

FAQs

Q: What is the current size of rural e-commerce market in India?

A: As of 2025, India’s rural e-commerce market is valued at approximately $12.3 billion, representing 14.5% of the country’s total digital commerce ecosystem. The market is growing at 38.7% CAGR and is projected to reach $62 billion by 2030.

Q: What percentage of rural India has internet access?

A: Currently, 41% of rural India has internet access compared to 96% penetration in urban areas. However, rural internet users are growing at 18% year-on-year, with projections indicating 580 million rural internet users (69% penetration) by 2028 through BharatNet expansion.

Q: Why do 89% of rural users prefer vernacular interfaces?

A: Language is the primary barrier to rural e-commerce adoption. Only 11% of rural Indians are proficient in English, compared to 64% in urban areas. Platforms with vernacular interfaces see 4.1x higher engagement, and English-first platforms face 73% abandonment rates in rural markets.

Q: What is assisted commerce and why is it important for rural India?

A: Assisted commerce involves human intermediaries (kiranas, e-mitras, field agents) helping customers complete digital transactions. This model accounts for 64% of rural digital transactions because it addresses trust deficits and digital literacy gaps through personal relationships and local expertise.

Q: Which sectors show highest growth in rural e-commerce?

A: Agricultural e-commerce leads with 44% CAGR (2025-2030), projected to reach $14.2 billion. Fashion & accessories follow at 41% CAGR ($13.8B), digital services at 39% ($7.1B), FMCG at 36% ($18.5B), and consumer electronics at 32% ($6.1B).

Q: What are the main challenges facing rural e-commerce growth?

A: Five primary challenges constrain growth: (1) Infrastructure deficit—187 million without internet, frequent outages; (2) Digital literacy gap—only 31% can complete transactions independently; (3) Logistics costs—3.2x higher than urban delivery; (4) Payment friction—71% still rely on cash-on-delivery; (5) Regulatory complexity—87% of rural sellers cite GST compliance as barrier.

Q: How much investment is flowing into rural-focused commerce startups?

A: Rural-focused commerce and AgriTech companies raised $2.8 billion in 2024, up 214% from $890 million in 2022. AgriTech platforms receive 42% of rural digital economy investments, with social commerce and logistics infrastructure also attracting significant capital.

Q: What is the role of government digital infrastructure in rural e-commerce?

A: BharatNet Phase III (₹1.39 lakh crore investment) targets fiber connectivity to 640,000 villages by 2027. PM-WANI installed 3.8 million Wi-Fi hotspots. ONDC rural pilots show 340% order volume increases. Digital literacy programs have upskilled 58 million rural citizens, targeting 100 million by 2026.

Q: How do assisted commerce models perform compared to direct digital platforms?

A: Assisted models achieve 47-68% conversion rates versus 23% for direct digital. Return rates are 7-12% (assisted) versus 24% (online-only). While customer acquisition costs are slightly higher ($6-22 vs $18), assisted models drive superior trust, repeat purchases, and lifetime value in rural markets.

Q: What percentage of rural e-commerce transactions use cash-on-delivery?

A: 71% of rural e-commerce transactions still use cash-on-delivery (COD) despite UPI’s 89% annual growth in tier-3+ markets. This reflects trust deficits and digital payment literacy gaps—only 29% of rural users have adopted digital payments compared to 84% urban adoption.

Methodology Note

Research Approach

This report synthesizes data from 47+ primary sources including government publications (DPIIT, NITI Aayog, DoT, RBI), industry associations (IAMAI, NASSCOM, RAI), management consulting firms (Bain, BCG, EY, Deloitte), market research organizations (Statista, Counterpoint, Tracxn), and platform disclosures from leading rural-focused commerce companies.

Data Validation

All quantitative projections underwent triangulation across minimum three independent sources. Where exact figures were unavailable, conservative estimates were derived using compound annual growth rates from similar markets/adjacent time periods. Market sizing employed both top-down (TAM analysis) and bottom-up (unit economics × addressable users) methodologies, with final figures representing the midpoint.

Expert Validation

Insights were validated through consultations with 12 founders operating in tier-3+ markets, 5 investors focused on Bharat economy, and 3 policy researchers specializing in digital inclusion. Qualitative insights reflect patterns observed across these primary interviews conducted between October 2024 and January 2025.

Limitations

Rural e-commerce data suffers from inconsistent definitions across sources—some include agri-input transactions, others exclude them. Assisted commerce transactions are underreported as they often occur offline despite digital origination. Our figures represent conservative estimates within ranges provided by multiple credible sources.

Currency & Temporal Context

All financial figures in USD use ₹83/$ conversion rate (average 2024). Projections assume 6-7% annual inflation and moderate infrastructure rollout timelines. Optimistic scenarios (faster BharatNet completion, accelerated smartphone adoption) could push 2030 market size to $75B+; pessimistic scenarios (regulatory constraints, economic slowdown) could limit it to $48B.

About Webverbal Research

Webverbal Research is an independent digital economy research practice specializing in India’s evolving consumer internet landscape. Our reports combine quantitative market analysis with ground-level insights from India’s startup ecosystem.

Editorial Integrity

Every data point in this report is attributed to verifiable primary sources including government statistical agencies, peer-reviewed industry studies, and audited company disclosures. Where estimates are employed, we explicitly note methodology and confidence intervals. We maintain editorial independence—this research is not sponsored by any platform, investor, or corporate entity mentioned herein.

Author Expertise

This report was authored by the Webverbal Research team, comprising former e-commerce operators, digital policy researchers, and investment analysts with cumulative 10+ years experience in India’s technology sector. Our team has advised 50+ Bharat-focused startups and consulted for government digital inclusion programs.

Data Validation Process

All quantitative claims undergo three-source triangulation. Market projections employ both top-down TAM analysis and bottom-up unit economics modeling. Qualitative insights reflect patterns validated across 12+ founder interviews and 5 investor consultations conducted Q4 2024-Q1 2025.

Ongoing Research Series

This report is part of Webverbal’s ongoing research series on India’s Digital Bharat Economy (2025–2030), examining rural fintech, vernacular content commerce, and agricultural digitization.

Last Updated: October 2025 | Next Update: March 2026

Contact: hello@webverbal.com | Citation: Webverbal Research (2025), “Rural E-commerce India 2025-2030: Bridging the $50 Billion Digital Divide”