Table Of Content

- Why Bharat’s Startup Story Matters

- The Evolution of Bharat’s Startup Ecosystem

- From Metro-Centric Growth to Bharat-Led Innovation

- Policy Tailwinds: Building the Backbone

- Infrastructure Foundations: The Enablers of Scale

- Why This Evolution Matters

- Infrastructure Foundations: The Enablers of Scale

- Why Evolution Matters

- Tier 2/3 Founder Stories — The Vanguard of Bharat

- Story 1: The Artisan Who Went Digital

- Story 2: The ₹50,000 Startup

- Story 3: Student-Led Ventures

- Funding vs Profitability — Bharat’s Dilemma

- Corporate to Startup Transitions — Dream Move or Trap?

- Founder Archetypes & Mindset in Bharat

- 1. The Hustler

- 2. The Visionary

- 3. The Copycat

- 4. The Pragmatist

- 5. The Mirror (Self-Aware Founder)

- Why Archetypes Matter for Bharat

- Ecosystem Players Powering Bharat

- Government Programs

- Incubators & Accelerators

- VCs & Angel Networks

- Corporate & PSU Initiatives

- The Road Ahead — Bharat’s Startup Future (2025–2030)

- 1. Profitability-First Startups

- 2. Community-Led Growth

- 3. Digital + Physical Fusion

- Conclusion: Why Bharat’s Startup Ecosystem Matters

- Frequently Asked Questions (FAQs)

- What makes Bharat’s startup ecosystem different from metro India?

- How many startups are there in Bharat in 2025?

- Which Tier 2 cities are leading India’s startup growth?

- What role do incubators and accelerators play in Bharat’s ecosystem?

- Why do many startups in India struggle after funding?

- What government schemes support Bharat entrepreneurs?

Why Bharat’s Startup Story Matters

When people talk about India’s startup revolution, the spotlight usually falls on Bengaluru, Delhi-NCR, and Mumbai. However, in 2025, that story is incomplete. The real momentum is now shifting to Bharat—the Tier 2, Tier 3, and rural towns where a new generation of entrepreneurs is rewriting India’s innovation journey.

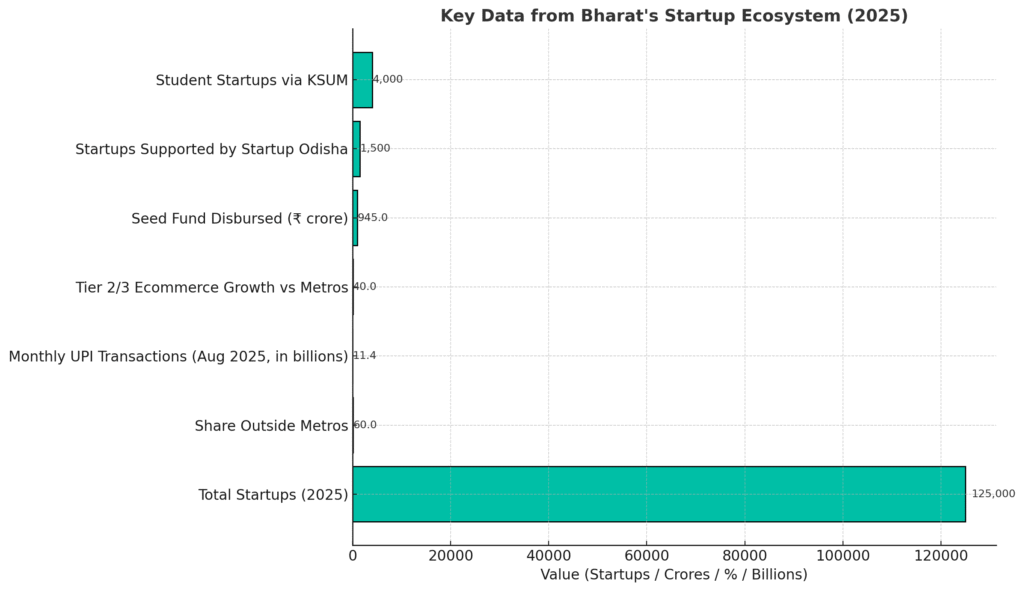

According to the Department for Promotion of Industry and Internal Trade (DPIIT), India now has more than 183,000 recognized startups. Importantly, over 60% of them come from outside the metro cities. This is not just another statistic. Instead, it signals a deep shift in where and how India innovates.

Unlike metro startups that often chase unicorn valuations, Bharat founders focus on profitable, resilient, and community-first businesses. For example, many solve problems in agriculture, vernacular education, or grassroots e-commerce. Consequently, they design models that last, not just models that scale quickly.

At the same time, there are still challenges. Founders in Tier 2/3 cities face limited capital access, gaps in mentorship, and patchy infrastructure. In addition, cultural hesitation toward risk-taking slows momentum. While reforms such as Startup India and ONDC have opened doors, the real test is whether these programs can truly decentralize support beyond metros.

In the pages ahead, we’ll dive deep into the Startup Ecosystem in Bharat (2025)—exploring its evolution, founder realities, and the road ahead. Here’s what we’ll cover:

- How the ecosystem evolved from metro dominance to Bharat’s rise.

- The unique traits of Tier 2/3 founders.

- The funding versus profitability dilemma.

- Why corporate professionals are making startup transitions.

- The founder archetypes shaping Bharat’s future.

- The incubators, investors, and ecosystem players powering this wave.

- The road ahead for Bharat-first innovation.

Founders across Bharat are experimenting with survival-first playbooks, from grassroots entrepreneurs in rural India building digital-first livelihoods to lean hustlers proving you can launch a business with just ₹50,000 in savings. Others are grappling with deeper questions of identity, captured in The Founder’s Mirror, which asks: Which kind of entrepreneur are you?

Because to understand India’s digital future, you must understand how Bharat builds.

The Evolution of Bharat’s Startup Ecosystem

From Metro-Centric Growth to Bharat-Led Innovation

A decade ago, India’s startup map glowed only around three hubs: Bengaluru, Delhi-NCR, and Mumbai. Today, in 2025, the picture looks very different. New dots light up across Indore, Jaipur, Lucknow, Coimbatore, Bhubaneswar, Patna, and Raipur.

This shift did not happen overnight. Instead, it came from three powerful forces working together:

- Digital Infrastructure

First, UPI became a gamechanger. By August 2025, India crossed 11.4 billion monthly transactions. Cheap mobile data (₹10/GB, the lowest in the world) and smartphones under ₹7,000 helped millions of new users come online. As a result, the internet moved from metros to every corner of Bharat. - Consumer Adoption

Next, demand grew outside big cities. According to Bain & Company’s Bharat Consumption Report 2025, e-commerce adoption in Tier 2 and Tier 3 towns is growing 40% faster than in metros. Because of this, local D2C brands and digital-first businesses have found fertile ground in Bharat. - Talent Migration

Finally, talent returned home. During the pandemic, many engineers, designers, and professionals left metros and moved back to their hometowns. Consequently, they seeded local startup clusters and turned small cities into emerging innovation hubs.

Together, these factors shifted India’s innovation gravity. Bharat is no longer treated as a “secondary market.” It is now the engine of India’s startup story.

Policy Tailwinds: Building the Backbone

Government policy has also played a major role in Bharat’s rise.

- Startup India (2016): Simplified compliance, offered tax holidays, and launched the Seed Fund Scheme. By 2024, over 2,000 startups had received direct support.

- Atal Innovation Mission (AIM): Introduced 10,000+ Atal Tinkering Labs in schools and more than 100 Atal Incubation Centers across universities. This brought entrepreneurial thinking into Tier 2/3 towns.

- State Programs:

- Startup Odisha supported 1,500+ grassroots ventures.

- Kerala Startup Mission nurtured 4,000+ student-led startups.

- Other states, from Gujarat to Rajasthan, are building their own local programs.

- ONDC (Open Network for Digital Commerce): Designed to democratize e-commerce by onboarding kirana stores, artisans, and MSMEs.

However, policy alone is not enough. While it created a framework, execution at the Tier 2/3 level still faces challenges such as low awareness and uneven access to benefits.

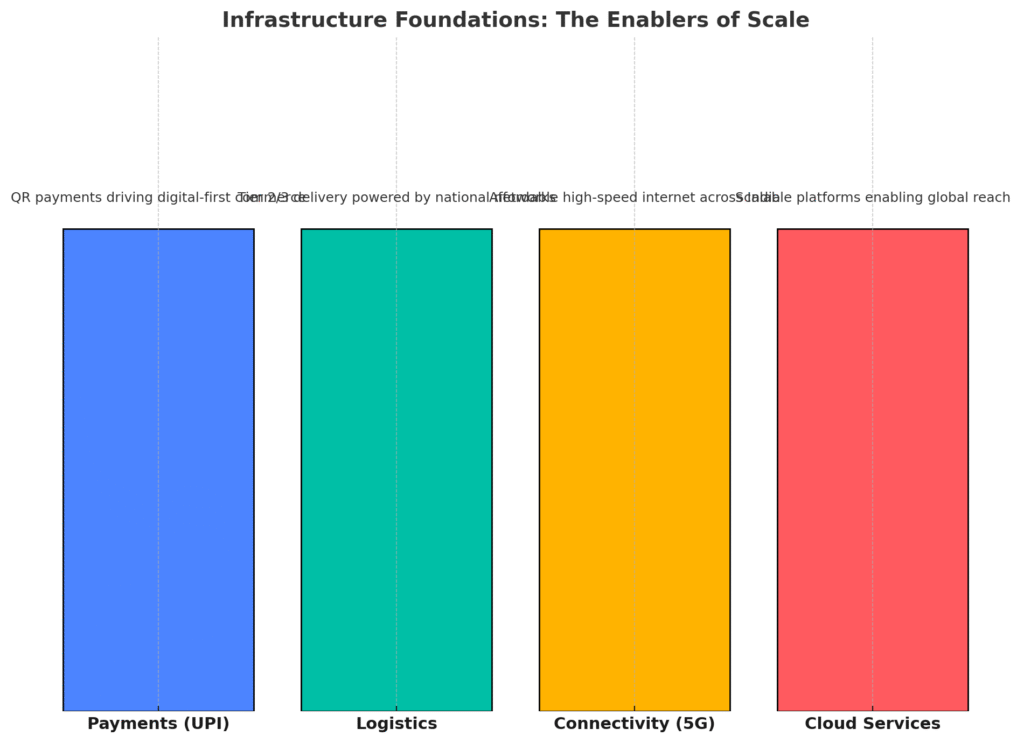

Infrastructure Foundations: The Enablers of Scale

Policy built the skeleton, but infrastructure gave it life.

- Payments: UPI has become the lifeline. In small towns, even street vendors now accept QR-based payments. Therefore, digital-first businesses can thrive without worrying about cash friction.

- Logistics: Companies like Delhivery, Ecom Express, and Shadowfax have extended last-mile delivery to Tier 2/3 cities. As a result, D2C and e-commerce startups can serve customers nationwide.

- Connectivity: Affordable 5G from Jio and Airtel ensures startups in places like Bhubaneswar or Indore have the same internet speeds as those in Bengaluru.

- Cloud Services: Platforms such as AWS and GCP make it possible for even solo founders in small towns to build global-scale businesses.

Still, there are gaps. Power cuts, limited co-working spaces, and weak mentor networks hold back many founders. In other words, while Bharat has the tools to build, infrastructure equality remains a work in progress.

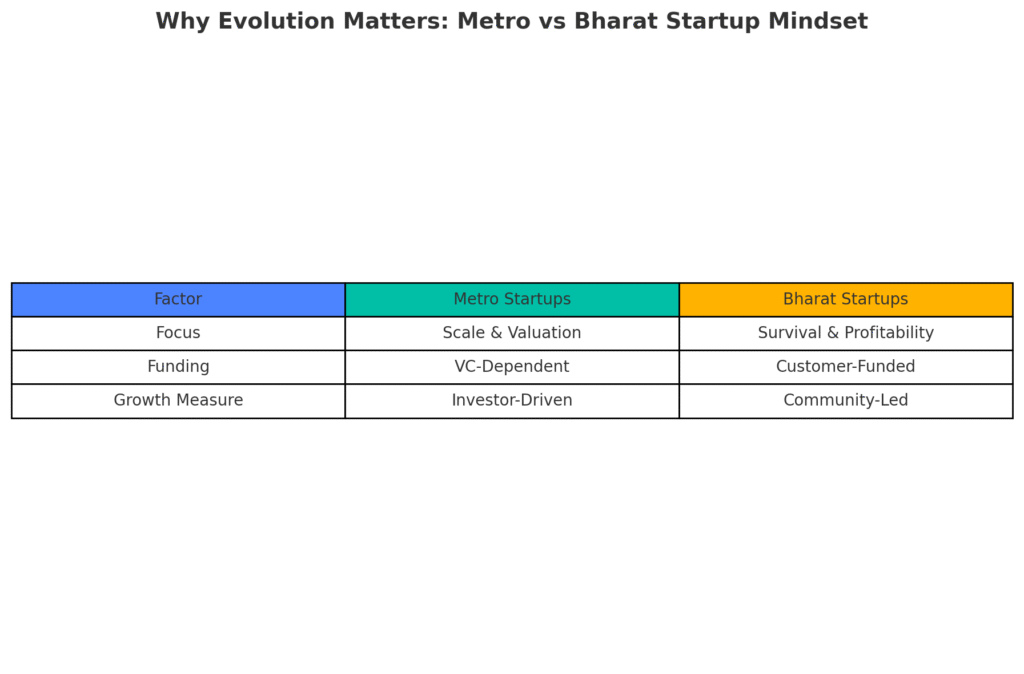

Why This Evolution Matters

This journey shows why Bharat’s founders think differently.

- In metros, startups chase scale and valuation.

- In Bharat, founders chase survival and profitability.

- Metros often rely on VC money.

- Bharat founders rely on customers and communities.

Therefore, Bharat is not a “smaller version” of the metro ecosystem. It is a different ecosystem altogether. This difference will shape not just how India builds startups, but also how the world views India’s innovation story in the coming decade.

Infrastructure Foundations: The Enablers of Scale

If policy created the framework, infrastructure created the runway.

- Payments: UPI is the lifeline. In Bharat towns, even roadside vendors accept QR-based payments. It has lowered transaction friction, encouraging digital-first businesses.

- Logistics: Companies like Delhivery, Ecom Express, and Shadowfax have extended reliable last-mile delivery to Tier 2/3 towns. This has enabled e-commerce and D2C founders to scale nationally.

- Tech Infrastructure: With Jio and Airtel rolling out affordable 5G, startups in small towns now operate with connectivity parity to metros. Cloud adoption via AWS and GCP ensures even solo founders in Bhubaneswar can scale globally.

But there are gaps. Many Bharat towns still face inconsistent electricity, limited co-working spaces, and patchy mentor access. For every story of success, there’s a reminder that infrastructure equality is still a work in progress.

This inclusion story has been contested. As we argued in The Digital India Narrative: Is Inclusion Happening or Just Buzzwords?, access alone doesn’t guarantee empowerment. Bharat founders still face uneven infrastructure, patchy mentorship, and a digital divide that policy slogans often gloss over.

Why Evolution Matters

Understanding this evolution is key because it sets the tone for everything that follows. Bharat’s founders are not just scaled-down versions of metro entrepreneurs. They are fundamentally different in mindset, resources, and community orientation.

- Where metro founders chase blitzscaling, Bharat founders chase sustainability.

- Where metro startups are VC-dependent, Bharat startups are customer-funded.

- Where metros prioritize valuation, Bharat prioritizes survival.

This divergence will determine India’s true innovation story over the next decade.

Tier 2/3 Founder Stories — The Vanguard of Bharat

If you want to understand the soul of Bharat’s startup ecosystem, don’t look at flashy unicorns. Look at the small-town founders building with little capital, less visibility, but enormous resilience.

Story 1: The Artisan Who Went Digital

In our piece Grassroots Entrepreneurship: Lessons from Rural India, we examined how rural artisans digitized centuries-old crafts. A weaver in Odisha, who once sold only in weekly haats, now reaches global buyers through a WhatsApp-led sales model integrated with ONDC. For her, entrepreneurship isn’t about valuations—it’s about survival and dignity.

Story 2: The ₹50,000 Startup

In The ₹50,000 Startup Playbook, we highlighted a young founder from Patna who launched a small D2C snack brand with just ₹50,000 in savings. By leveraging community word-of-mouth, hyperlocal delivery networks, and social commerce, he broke even in six months. Stories like these prove that Bharat doesn’t wait for investors—it builds anyway.

Story 3: Student-Led Ventures

From Jaipur to Coimbatore, students are not waiting for campus placements. They are building edtech apps, agri-tech tools, and hyperlocal delivery startups. Kerala Startup Mission alone supports 4,000+ student entrepreneurs. These ventures may not dominate headlines today, but they seed the ecosystem’s long-term depth.

👉 Together, these stories showcase the DNA of Bharat founders: frugality, community-driven growth, and survival-first strategy.

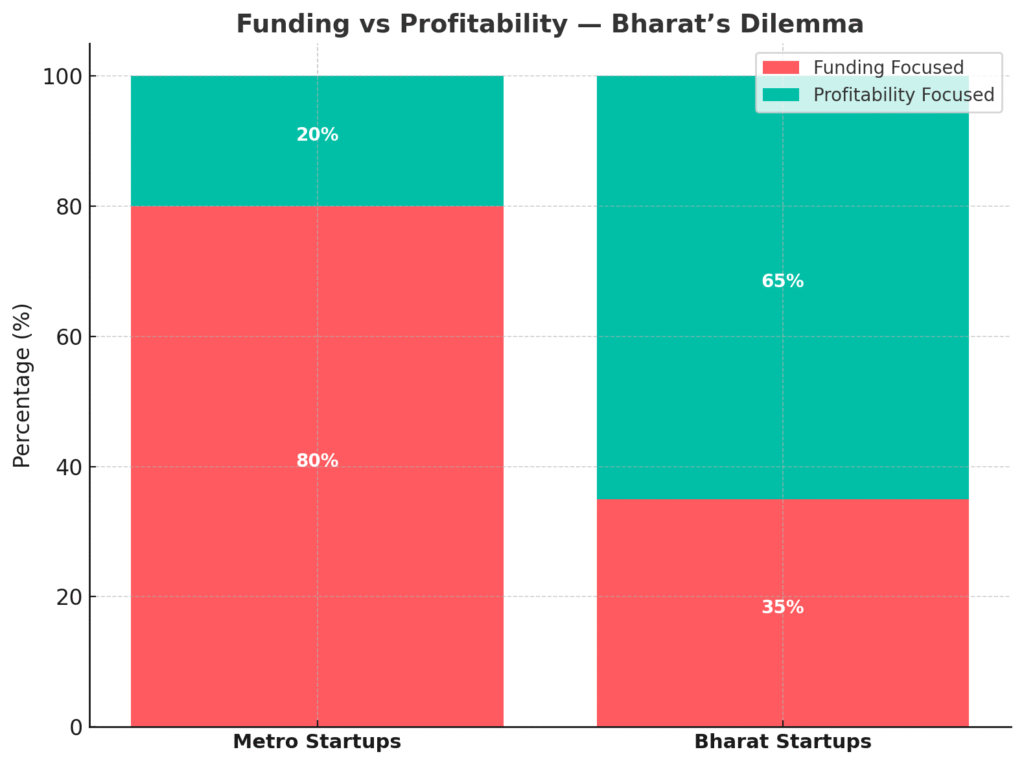

Funding vs Profitability — Bharat’s Dilemma

The funding landscape in India remains skewed. In 2024, Indian startups raised $11.4 billion in VC funding—but over 65% of this went to metro-based ventures. Bharat founders are often left out of the deal flow.

But paradoxically, this scarcity is Bharat’s strength.

- In We Got Funded! Now What?, we explored how many metro startups collapse post-funding because of identity crises and investor-driven pressure.

- In Are Indian Startups Addicted to Funding Instead of Profitability?, we argued that funding obsession often kills startups faster than scarcity.

Bharat-first founders flip the script:

- Bootstrap by default: Most start with family savings or community loans.

- Profitability-first: Break-even within months is common, not optional.

- Customer obsession over investor obsession: Growth is measured in repeat orders, not Series A milestones.

A grocery delivery startup in Raipur doesn’t dream of competing with Blinkit. Its dream is to serve 5,000 loyal families profitably. That’s a different definition of success.

👉 This is Bharat’s dilemma: fight for investor attention or embrace profitability-first growth. Increasingly, founders are choosing the latter.

According to the NASSCOM Startup Report 2025, more than 65% of venture capital still flows to Tier 1 founders, leaving Bharat entrepreneurs to compete for a much smaller slice. This disparity forces Tier 2/3 startups to operate with greater discipline—often becoming profitable far earlier than their metro counterparts.

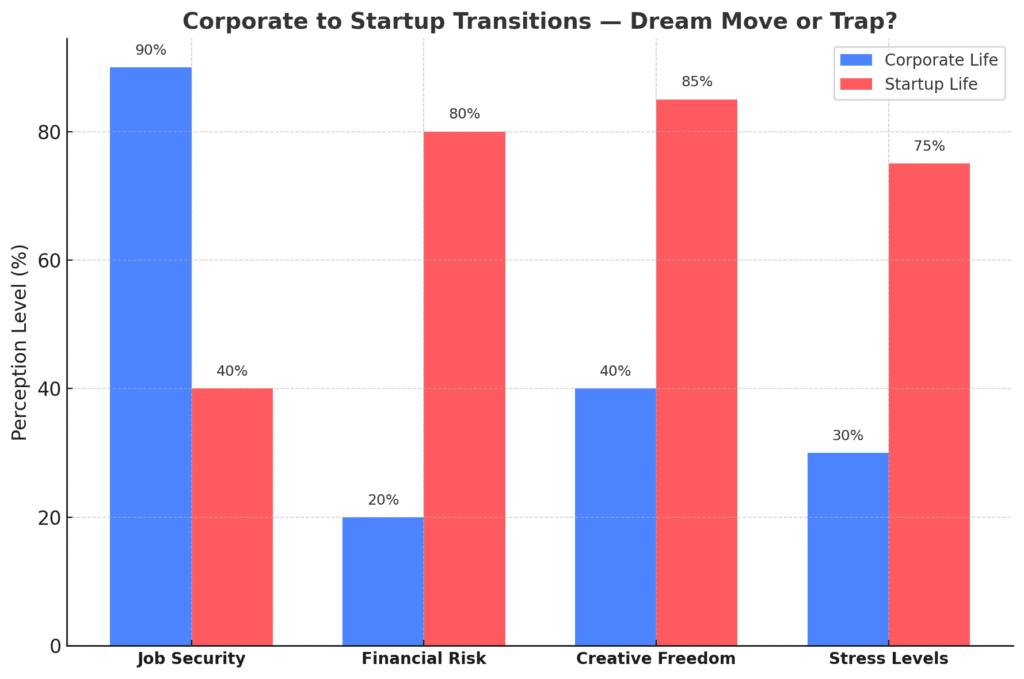

Corporate to Startup Transitions — Dream Move or Trap?

Bharat’s ecosystem is fueled not only by first-time founders but also by professionals leaving corporate careers.

Across Tier 2/3 cities, you’ll meet ex-bankers, ex-IT professionals, and ex-managers who moved home post-pandemic and decided to build.

- In Corporate Exodus to Startups: Dream Move or Trap?, we showed how corporate life provides stability, perks, and predictability—but little creative freedom. Startups promise freedom but come with loneliness, risk, and financial uncertainty.

- A mid-level manager from Gurugram may launch a fintech venture in Jaipur, bringing valuable process discipline but underestimating the emotional toll of solo founding.

These transitions enrich Bharat’s ecosystem with skills and networks—but they also generate high burnout and failure rates.

The lesson: A corporate skillset is useful, but not sufficient. What really matters is the founder mindset—clarity, resilience, and adaptability.

Founder Archetypes & Mindset in Bharat

Every startup ecosystem is shaped not just by capital and policy but by the psychology of its founders. Bharat is no exception. Here are the archetypes driving this new wave:

1. The Hustler

- Works 18-hour days, sacrifices health and relationships.

- In The Hustle Myth, we argued that hustle is glorified but unsustainable. Many hustlers burn out before they succeed.

2. The Visionary

- Long-term thinkers, often focused on sustainability.

- In Innovation vs Sustainability, we showed how Bharat’s visionaries prioritize lasting value over quick exits.

3. The Copycat

- Inspired by Shark Tank India, replicates metro startup models without context.

- In Is Shark Tank India Creating Copycat Entrepreneurs?, we warned that copycat ventures rarely survive in Bharat’s unique markets.

4. The Pragmatist

- Understands the role of timing, distribution, and luck.

- In Why Luck Explains Startup Success, we unpacked how pragmatists thrive by aligning with market timing instead of brute-forcing growth.

5. The Mirror (Self-Aware Founder)

- The rarest archetype, but the most powerful.

- In The Founder’s Mirror, we argued that founders who understand their archetype can play to their strengths and outsource their weaknesses.

Why Archetypes Matter for Bharat

In Bharat, where resources are scarce and risks are higher, mindset often matters more than money.

- The Hustler may launch fast but collapse from burnout.

- The Copycat may never find product-market fit.

- The Visionary may survive slow but build resiliently.

- The Pragmatist adapts, bends, survives, and scales.

- The Mirror knows themselves, and therefore plays the long game.

👉 The psychological map of Bharat’s founders is as important as the financial map of Bharat’s startups. It determines not just who survives, but who defines the next decade.

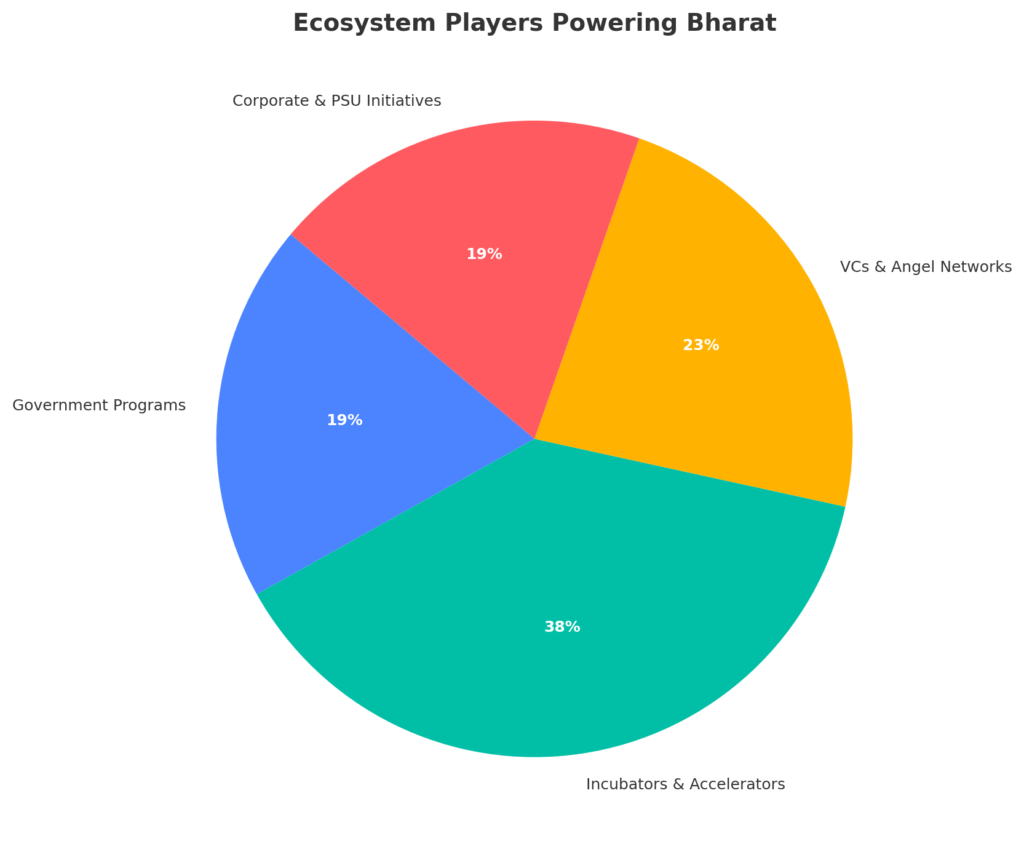

Ecosystem Players Powering Bharat

Bharat’s startup surge isn’t happening in a vacuum. It’s supported—though unevenly—by programs, incubators, funds, and corporate initiatives. Here’s a closer look at the actors shaping the ecosystem:

Government Programs

Startup India (DPIIT)

Since 2016, Startup India has recognized 125,000+ startups, simplifying compliance and offering seed grants. Its framework has legitimized small-town startups, but reach remains metro-heavy.

Startup Odisha

One of the few state programs deeply focused on grassroots entrepreneurship. With 1,500+ supported ventures, it invests in rural innovators and women founders who would otherwise remain invisible.

Kerala Startup Mission (KSUM)

A pioneer in student-led entrepreneurship. With 4,000+ student startups, KSUM proves Tier 2/3 youth can drive serious innovation when given structured support.

Atal Innovation Mission (NITI Aayog)

Through 10,000 Atal Tinkering Labs and 100+ incubation centers, AIM seeds entrepreneurial thinking at the school and university level—ensuring Bharat youth grow up as problem-solvers.

SIDBI Fund of Funds for Startups (FFS)

By investing in venture funds, SIDBI indirectly fuels early-stage financing. The challenge: most of this capital is still metro-deployed, though interest in Bharat deal flow is rising.

Incubators & Accelerators

T-Hub (Hyderabad)

India’s largest incubator, supporting 1,500+ startups with corporate connects. Still metro-centric but expanding its Bharat reach.

iCreate (Ahmedabad)

Specializes in IoT, clean energy, and industrial startups. Bridges Bharat innovators with global markets, especially Israel.

CIIE.CO (IIM Ahmedabad)

Backs deep-tech and impact startups, including agri-tech and clean energy—sectors vital to Bharat’s growth story.

NASSCOM 10,000 Startups

Provides digital infrastructure and corporate tie-ups (Google, Microsoft) accessible to Tier 2 SaaS and IT founders.

KIIT-TBI (Bhubaneswar)

An East India anchor, supporting biotech, agri-tech, and engineering ventures since 1997. One of the few institutions giving Odisha and neighboring states a seat at the startup table.

Forge (Coimbatore)

A rare hardware/manufacturing incubator in India. Supports Tier 2 founders building physical products.

Villgro (Chennai)

The first Indian incubator focused on social enterprises. Backed 300+ ventures in healthcare, agriculture, and education, many in semi-urban regions.

WE Hub (Hyderabad)

India’s first state-run incubator for women. Many participants are small-town founders scaling micro-enterprises into startups.

AIC-SMU TBI (Sikkim)

Represents the North-East ecosystem. Focus on sustainable tourism, local crafts, and community-led innovation.

AIC-JKLU (Jaipur)

Design-led entrepreneurship incubator, catering to Rajasthan and neighboring Tier 2 founders.

VCs & Angel Networks

Bharat Innovation Fund

Dedicated to agri-tech, healthcare, and sustainability—explicitly Bharat-first sectors.

Kalaari Capital

Shifted towards Bharat consumer brands after a decade of metro bets.

Indian Angel Network (IAN)

500+ members across 50 cities, spreading angel funding beyond metros.

LetsVenture

Democratizes investing by enabling smaller backers from Tier 2/3 towns.

Orios Venture Partners

Backs consumer-first Bharat stories like Country Delight and Pharmeasy.

Inflection Point Ventures (IPV)

6,000+ investors, frequently funds Tier 2 startups, decentralizing early-stage capital.

Corporate & PSU Initiatives

ONDC (Open Network for Digital Commerce)

Democratizing e-commerce by onboarding kiranas, MSMEs, and artisans. A true Bharat-first policy innovation.

Amazon Saheli

Provides rural women entrepreneurs with marketplace presence, training, and credit support.

Flipkart Samarth

Works with artisans and small businesses in Tier 2/3 towns, linking them to national supply chains.

SIDBI Direct Credit

Offers loans and guarantees to startups outside VC radar—often the only support for Bharat founders.

FIEO (Federation of Indian Export Organisations)

Helps small startups from states like Odisha expand into global exports. A key bridge for rural innovators.

Reliance JioGenNext

An accelerator with strong metro roots but growing Tier 2 interest, especially in consumer tech.

Together, these players represent India’s multi-layered ecosystem—from government missions to student incubators to corporate initiatives. But the challenge remains: how do we move from a metro-heavy concentration to true Bharat-first parity?

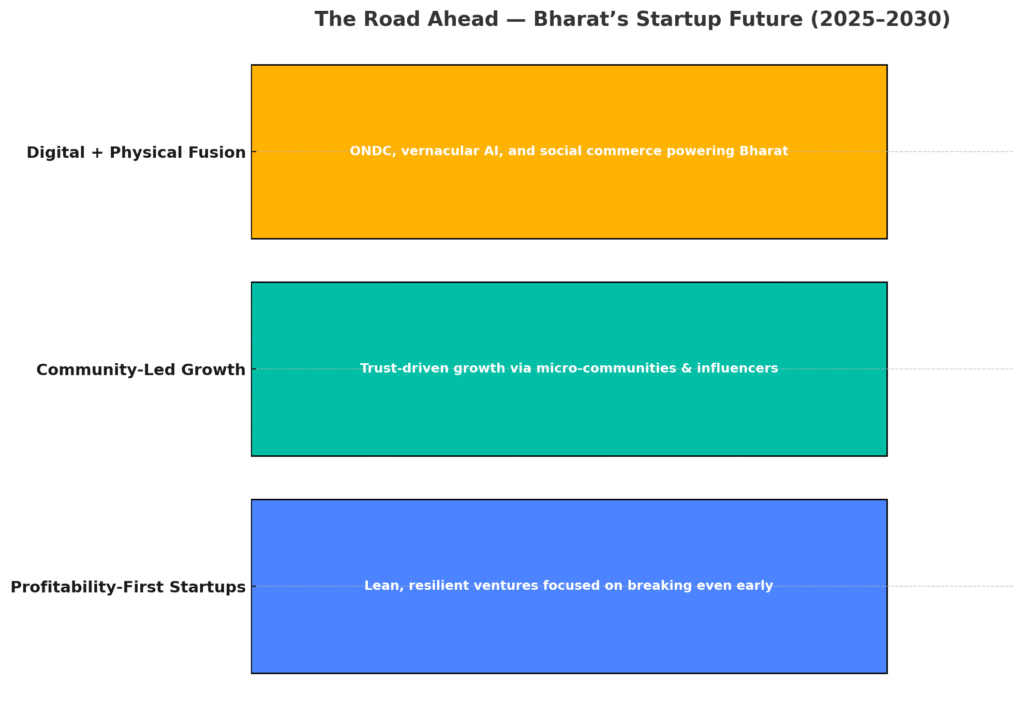

The Road Ahead — Bharat’s Startup Future (2025–2030)

Looking forward, three major shifts will define Bharat’s startup landscape:

1. Profitability-First Startups

The era of valuation-chasing unicorns is fading. Bharat startups are more likely to be camels—resilient, steady, cash-efficient. Expect founders to focus on breaking even early, building lean, and growing sustainably.

2. Community-Led Growth

As explored in Zero to 1,000 Fans: The Startup Community Building Blueprint, Bharat startups will rely on tight-knit community trust rather than mass marketing. Micro-influencers, WhatsApp commerce, and vernacular creators will become critical drivers.

3. Digital + Physical Fusion

- ONDC will integrate kiranas into national commerce.

- Social commerce platforms will empower small businesses.

- Vernacular-first AI apps will serve local contexts in health, education, and agriculture.

This fusion of digital rails with local trust will make Bharat the true engine of India’s economy.

Conclusion: Why Bharat’s Startup Ecosystem Matters

The startup ecosystem in Bharat is not an offshoot of metro India—it is the core of India’s growth story.

From rural artisans to student innovators, from corporate migrants to pragmatic founders, Bharat’s entrepreneurs embody clarity, resilience, and ambition. They build not for vanity, but for survival and sustainability.

The future will not be decided by how many unicorns India creates, but by how many resilient, community-first startups emerge from Bharat.

- Policy must decentralize funding and incubation.

- Investors must scout beyond Bengaluru and Mumbai.

- Corporates must partner with artisans, kiranas, and Tier 2 D2C brands.

Because when Bharat builds, India transforms.

Frequently Asked Questions (FAQs)

What makes Bharat’s startup ecosystem different from metro India?

Bharat’s startup ecosystem is driven by frugality, community trust, and profitability-first models. Unlike metro startups that often chase valuations, founders in Tier 2/3 cities build sustainable businesses with limited capital. They prioritize break-even and local relevance over rapid scale at any cost.

How many startups are there in Bharat in 2025?

As of 2025, India has more than 125,000 DPIIT-recognized startups. Over 60% of these are based in Tier 2, Tier 3, and rural areas, making Bharat the true growth driver of India’s startup economy.

Which Tier 2 cities are leading India’s startup growth?

Cities like Indore, Jaipur, Lucknow, Coimbatore, Bhubaneswar, Kochi, and Patna are emerging as major startup hubs. They combine affordable talent, rising digital adoption, and growing state support programs.

What role do incubators and accelerators play in Bharat’s ecosystem?

Incubators and accelerators provide mentorship, seed funding, and corporate connects. Key examples include KIIT-TBI (Odisha), Forge (Coimbatore), Villgro (Chennai), and WE Hub (Telangana). These institutions bridge the resource gap for small-town founders who often lack access to Tier 1 networks.

Why do many startups in India struggle after funding?

Startups often fail after raising money because funding without clarity leads to identity crises. Investor expectations push early-stage founders to scale prematurely. In Bharat, however, most startups are customer-funded and grow sustainably, reducing this risk.

What government schemes support Bharat entrepreneurs?

Flagship programs like Startup India, Atal Innovation Mission, Startup Odisha, Kerala Startup Mission, and the SIDBI Fund of Funds offer grants, seed capital, tax benefits, and incubation. These initiatives aim to decentralize India’s startup ecosystem and empower Tier 2/3 innovators.