Table Of Content

- The Hard Truth About Indian Startup Funding

- The ₹50,000 Foundation Formula

- Legal & Compliance (₹8,000-₹12,000)

- Technology Stack (₹15,000-₹20,000)

- Marketing Launch Fund (₹12,000-₹15,000)

- Working Capital (₹15,000-₹20,000)

- The 90-Day Launch Timeline

- Days 1-30: Foundation Phase

- Days 31-60: Validation Phase

- Days 61-90: Launch Phase

- Sector-Specific Breakdowns

- E-commerce Business (₹50,000 breakdown)

- Service Business (₹50,000 breakdown)

- Manufacturing/Handicrafts (₹50,000 breakdown)

- Digital Products/Content (₹50,000 breakdown)

- The Indian Bootstrap Advantage

- Revenue Generation Strategies

- Common Pitfalls & How to Avoid Them

- When and How to Scale Beyond ₹50,000

- Resource Directory & Vendor List

- The Philosophy: Why ₹50,000 Startups Are India’s Strength

- Is ₹50,000 enough to start a profitable business in India?

- What are the most realistic ₹50,000 business ideas for Tier 2/3 India?

- How should a beginner allocate ₹50,000 when launching a startup?

- How long does it take for a ₹50,000 startup to become profitable?

- What is the biggest mistake first-time founders make when starting with ₹50,000?

Your complete guide to building a profitable business with minimal capital in India.

Six months ago, Priya called me from a small town in Rajasthan, almost in tears. She had ₹52,000 in savings, a business idea for organic skincare products, and every “startup expert” she’d consulted told her she needed at least ₹5 lakhs to “do it properly.”

Today, her WhatsApp is buzzing with orders worth ₹85,000 monthly. Her total initial investment? Exactly ₹49,500.

Priya’s story isn’t unique—it’s the norm among the 1,500+ entrepreneurs I’ve mentored across India. While startup media celebrates billion-dollar funding rounds, the real entrepreneurial revolution is happening with entrepreneurs who start with what they have, not what they wish they had.

The numbers support this reality: There are a total of 473K startups in India, but less than 1% ever see venture capital. The rest—the overwhelming majority—bootstrap their way to success through resourcefulness, local market understanding, and what I call “constraint-driven innovation.”

Through my 11 years building Classystreet, mentoring tribal entrepreneurs through TATA Trust programs, and training 1,000+ exporters with FIEO, under India’s Ministry of Commerce, I’ve discovered that ₹50,000 isn’t just enough to start a business in India—it’s often the optimal amount. Enough to build something real, not so much that you become careless with spending.

What I’m about to share isn’t theory from business schools—it’s a tested playbook based on real entrepreneurs who’ve built sustainable businesses with minimal capital, maximum resourcefulness, and deep understanding of how commerce actually works in Bharat.

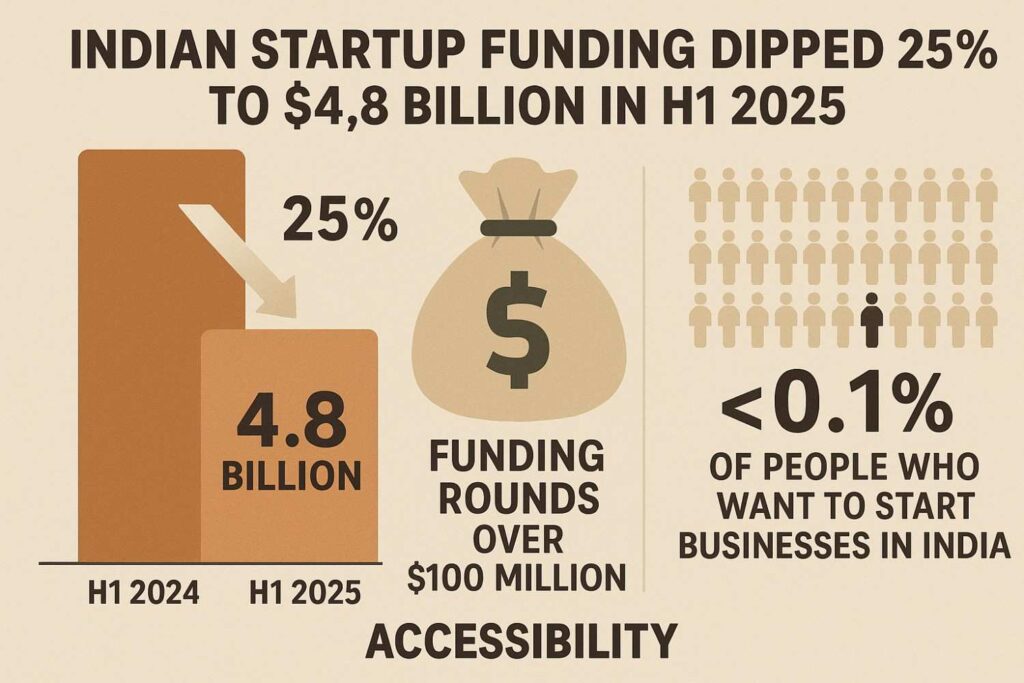

The Hard Truth About Indian Startup Funding

Before we dive into the ₹50,000 formula, let’s address the elephant in the room: the funding landscape that most entrepreneurs think they need to access but actually can’t.

Indian startup funding dipped 25% to $4.8 billion in H1 2025, and the situation is even more stark when you look at accessibility. Only five Indian startups secured funding rounds of over $100 million in H1 2025. The venture capital ecosystem, despite its media visibility, serves less than 0.1% of people who want to start businesses in India.

From my mentoring experience, I’ve observed that 99% of entrepreneurs with great ideas, solid work ethics, and genuine market understanding can’t access VC funding—not because their ideas aren’t good, but because VC funding is designed for a specific type of business (tech-enabled, rapidly scalable, with large addressable markets) that doesn’t match most real-world business opportunities.

This creates what I call the “funding mirage”—entrepreneurs waste months chasing investors instead of building businesses, believing they need external validation and capital to succeed. Meanwhile, several Indian companies are successfully bootstrapping their way to profitability by focusing on customer needs rather than investor presentations.

The bootstrap advantage isn’t just financial—it’s strategic. Bootstrapped businesses develop stronger unit economics, deeper customer relationships, and more sustainable growth patterns because they’re forced to focus on revenue generation from day one rather than burning investor money to acquire customers at unsustainable costs.

The ₹50,000 Foundation Formula

After analyzing hundreds of successful bootstrap startups from my mentoring work, I’ve identified the optimal capital allocation strategy that maximizes your chances of building a profitable business:

Legal & Compliance (₹8,000-₹12,000)

Company Registration: ₹4,000-₹6,000

- Private Limited Company through online portals: ₹4,500-₹5,500

- Proprietorship/Partnership: ₹2,000-₹3,000

- My recommendation: Start with proprietorship, upgrade to Pvt Ltd when revenue crosses ₹20 lakhs annually

GST Registration: ₹2,000-₹3,000

- Mandatory for most businesses, voluntary under ₹40 lakhs turnover

- Include professional help for correct setup: ₹1,500-₹2,000

Bank Account Opening: ₹1,000-₹2,000

- Current account setup and initial deposit

- Choose banks with digital-first approach: HDFC, ICICI, or Kotak

Basic Insurance: ₹1,000-₹1,000

- Professional indemnity or product liability depending on business type

- Start minimal, expand as business grows

Tested Vendor Recommendations:

- LegalWiz or IndiaFilings for company registration

- Local CA for GST (build long-term relationship)

- Bank: Choose based on digital infrastructure, not just fees

Technology Stack (₹15,000-₹20,000)

Domain and Hosting: ₹3,000-₹5,000 annually

- Domain registration: ₹800-₹1,200

- Shared hosting: ₹2,000-₹4,000 annually

- My tested providers: GoDaddy for domains, Bluehost or HostGator for hosting

Website/App Development: ₹8,000-₹12,000

- DIY website builders: ₹3,000-₹5,000 (Wix, Squarespace, WordPress themes)

- Basic custom development: ₹8,000-₹12,000

- My approach: Start with template, customize as you learn customer needs

Essential Software Subscriptions: ₹2,000-₹3,000

- Accounting software: ₹1,200 annually (Zoho Books or Tally)

- Email marketing: ₹600 annually (Mailchimp starter)

- Design tools: ₹1,200 annually (Canva Pro)

Mobile and Computing: ₹2,000 monthly if needed

- Smartphone upgrade or laptop rental if current setup inadequate

- My advice: Don’t buy new, upgrade existing or consider refurbished

My Tested Technology Stack:

- WordPress with Elementor for websites

- WhatsApp Business API for customer communication

- Zoho suite for business operations

- Canva for all design needs

Marketing Launch Fund (₹12,000-₹15,000)

Social Media Advertising: ₹5,000-₹8,000

- Facebook/Instagram ads: ₹3,000-₹5,000 initial testing

- Google Ads: ₹2,000-₹3,000 for local search visibility

- My strategy: Test small, scale what works

Content Creation Tools: ₹2,000-₹3,000

- Photography setup: ₹1,500 (smartphone accessories, lighting)

- Video editing software: ₹500-₹1,000

Networking and Events: ₹3,000-₹4,000

- Local business meetups, trade associations

- Industry events and exhibitions

- My insight: Personal networking outperforms digital marketing in early stages

Print Materials: ₹2,000

- Business cards, basic brochures

- My advice: Minimal print, focus on digital-first approach

My Growth Hacks That Actually Work:

- WhatsApp Status marketing (free, highly effective)

- LinkedIn organic content (builds authority)

- Local community engagement (builds trust)

- Customer referral programs (leverages satisfaction)

Working Capital (₹15,000-₹20,000)

Initial Inventory/Samples: ₹8,000-₹12,000

- Product businesses: starter inventory based on validated demand

- Service businesses: professional tools and initial project materials

Emergency Fund: ₹5,000-₹6,000

- Unexpected expenses, opportunity investments

- My rule: Never touch emergency fund for regular operations

Miscellaneous: ₹2,000

- Unforeseen setup costs, minor equipment, travel for meetings

90% of startups fail—but yours doesn’t have to. Learn the real reasons most founders burn out and the proven strategies that can help your startup succeed.

👉 Read the full guide →

The 90-Day Launch Timeline

Based on successful launches I’ve guided, this timeline maximizes your chances of generating revenue within three months:

Days 1-30: Foundation Phase

Week 1: Legal Setup and Documentation

- Day 1-2: Company registration and documentation

- Day 3-4: Bank account opening and GST registration

- Day 5-7: Basic insurance and compliance setup

Week 2: Technology Infrastructure Setup

- Day 8-10: Domain registration and hosting setup

- Day 11-12: Website/online presence creation

- Day 13-14: Essential software setup and integration

Week 3: Initial Product/Service Development

- Day 15-18: Product/service refinement based on initial market research

- Day 19-21: Pricing strategy development and testing

Week 4: Basic Marketing Materials Creation

- Day 22-24: Photography, content creation, brand materials

- Day 25-28: Social media setup and initial content planning

- Day 29-30: Launch preparation and final checks

My Mentoring Insight: The biggest mistake I see in the first month is perfectionism. Good enough to start is better than perfect but never launched.

Days 31-60: Validation Phase

Week 5-6: Customer Research and Feedback Collection

- Launch with minimal viable product/service

- Collect customer feedback through direct interaction

- Document what works and what doesn’t

Week 7-8: Product/Service Refinement Based on Feedback

- Implement customer suggestions

- Adjust pricing based on market response

- Refine value proposition

My Examples: Priya (skincare entrepreneur) discovered customers wanted larger sample sizes, not more product variety. This single insight improved her conversion rate by 300%.

Days 61-90: Launch Phase

Week 9-10: Marketing Campaign Launch

- Implement tested marketing strategies

- Scale advertising spend based on early results

- Build referral and word-of-mouth systems

Week 11-12: Sales and Customer Acquisition

- Focus on revenue generation

- Build repeat customer systems

- Plan for scaling based on demand

My Success Metrics: By day 90, aim for ₹15,000-₹25,000 monthly revenue and at least 20 satisfied customers who would refer others.

Sector-Specific Breakdowns

Different business types require different capital allocation strategies. Here are tested formulas based on successful entrepreneurs I’ve mentored:

E-commerce Business (₹50,000 breakdown)

Case Study: Rahul built a regional snacks e-commerce business in Maharashtra

- Technology: ₹18,000 (website, payment integration, inventory management)

- Inventory: ₹20,000 (initial product range based on local preferences)

- Marketing: ₹8,000 (Facebook ads, local influencer partnerships)

- Legal: ₹4,000 (registration, compliance, insurance)

Key Insight: Started with 5 products, not 50. Focused on perfect execution rather than variety.

Service Business (₹50,000 breakdown)

Case Study: Deepa launched digital marketing consultancy in tier-2 city

- Technology: ₹15,000 (professional website, software tools, communication setup)

- Marketing: ₹15,000 (content marketing, networking, case study development)

- Legal: ₹8,000 (company setup, professional insurance)

- Working Capital: ₹12,000 (emergency fund, initial project expenses)

Key Insight: Service businesses require more marketing investment to build credibility and trust.

Manufacturing/Handicrafts (₹50,000 breakdown)

Case Study: Tribal artisan cooperative in Jharkhand (my direct mentoring)

- Equipment/Tools: ₹25,000 (improved looms, quality control tools)

- Materials: ₹15,000 (raw materials for initial production run)

- Marketing: ₹6,000 (photography, basic website, social media)

- Legal: ₹4,000 (registration, quality certifications)

Key Insight: Manufacturing requires higher initial capital in tools but generates higher margins long-term.

Digital Products/Content (₹50,000 breakdown)

Case Study: Online education content creator in Bangalore

- Technology: ₹20,000 (video equipment, editing software, hosting platform)

- Content Creation: ₹15,000 (initial course development, professional materials)

- Marketing: ₹10,000 (digital advertising, influencer collaborations)

- Legal: ₹5,000 (IP protection, business registration)

Key Insight: Digital products scale infinitely but require higher initial content investment.

Planning to sell digital products in India? Explore the best platforms for 2025, from low-cost options to full-featured marketplaces that maximize your profits.

👉 Read the complete guide →

The Indian Bootstrap Advantage

Bootstrapping in India offers unique advantages that entrepreneurs in other markets don’t have:

Cultural Factors: Family support systems mean lower personal survival costs during startup phase. Community networks provide customer base and word-of-mouth marketing that’s culturally trusted. Jugaad innovation mindset helps find creative solutions with limited resources.

Economic Advantages: Lower operational costs mean longer runway with same capital. Deep local market understanding provides competitive advantage over funded startups trying to scale globally-tested models. Higher tolerance for manual processes allows bootstrapped startups to compete with automated solutions.

My Philosophy: Constraints breed creativity. Every successful entrepreneur I’ve mentored learned to see limitations as innovation opportunities rather than barriers to success.

Success Stories: Companies like Zoho, Freshworks, and hundreds of smaller businesses built sustainable operations through bootstrap funding, developing stronger business fundamentals than many venture-funded competitors.

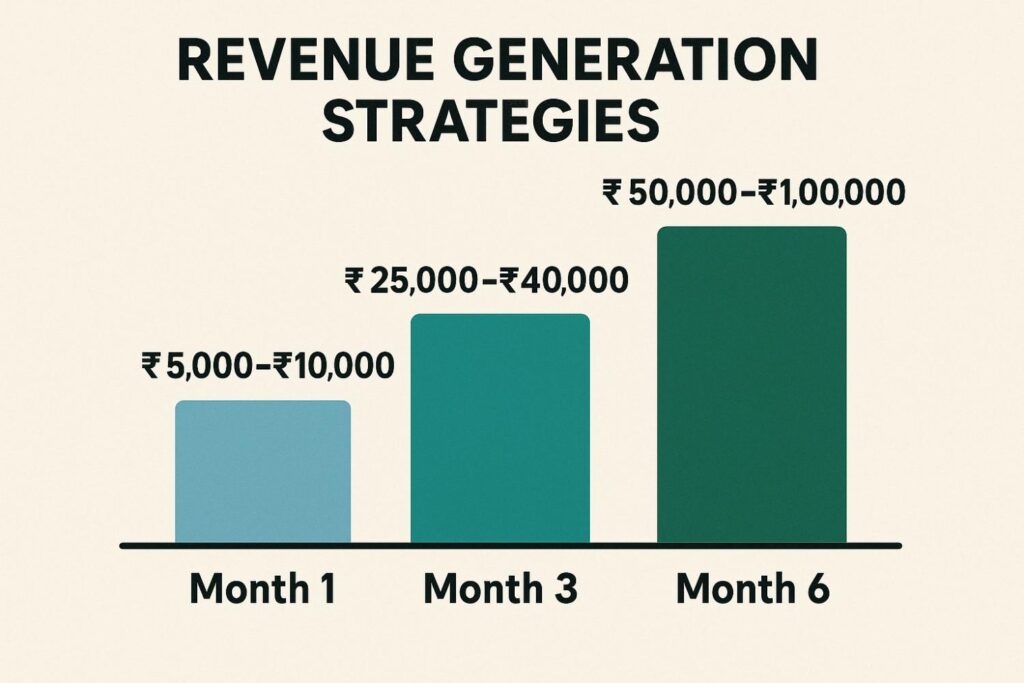

Revenue Generation Strategies

Based on successful mentees, here are realistic revenue targets and strategies:

Month 1 Revenue Targets: ₹5,000-₹10,000

- Focus on friends, family, and immediate network

- Perfect your offering based on early customer feedback

- Document testimonials and case studies

Month 3 Revenue Targets: ₹25,000-₹40,000

- Expand beyond immediate network through referrals

- Implement systematic marketing and sales processes

- Build repeat customer systems

Month 6 Revenue Targets: ₹50,000-₹1,00,000

- Scale proven marketing channels

- Develop premium offerings for existing customers

- Consider geographic expansion or product line extensions

My Proven Methods:

- Start with one perfect customer segment, not broad market appeal

- Price based on value delivered, not cost-plus calculations

- Build relationships before transactions

- Focus on customer success, not just customer acquisition

Pricing Strategies for Indian Markets:

- Test price sensitivity through small experiments

- Offer payment plans for higher-ticket items

- Bundle products/services to increase transaction value

- Use local competition as baseline, differentiate through value

Cash Flow Management:

- Maintain 3-month expense buffer minimum

- Invoice immediately, follow up systematically

- Offer incentives for early payment

- Reinvest profits gradually, not immediately

Common Pitfalls & How to Avoid Them

From observing both successes and failures, certain mistakes appear consistently:

Overspending on Technology: I’ve seen entrepreneurs spend ₹30,000 on websites before validating market demand. Start simple, upgrade based on customer feedback and revenue growth.

Underestimating Marketing Needs: Technical founders especially believe “good products sell themselves.” In India’s competitive market, visibility matters more than perfection. Allocate minimum 25% of budget to marketing.

Ignoring Legal Compliance: Skipping GST registration or proper business setup creates expensive problems later. Invest in compliance from day one—it’s cheaper than fixing legal issues later.

Not Validating Market Demand: Building what you think customers want rather than what they actually need. Talk to potential customers before building, not after.

Scaling Too Fast: Success in one city doesn’t automatically translate to other markets. Understand why something works before replicating it elsewhere.

My Framework for Customer Validation:

- Interview 20+ potential customers before building anything

- Test demand through pre-orders or waitlists

- Start with smallest viable market, expand gradually

- Measure customer satisfaction, not just sales numbers

When and How to Scale Beyond ₹50,000

Revenue Milestones for Reinvestment:

- ₹50,000 monthly: Reinvest 30% in marketing and operations

- ₹1,00,000 monthly: Consider team expansion and system automation

- ₹2,00,000 monthly: Explore external funding for accelerated growth

My Scaling Framework:

- Perfect unit economics before scaling

- Document systems and processes for team training

- Maintain customer intimacy despite growth

- Scale gradually to avoid cash flow problems

Funding Options After Bootstrap:

- Government schemes: MUDRA loans, state startup policies

- Angel investors: For businesses with proven traction

- Revenue-based financing: For steady cash flow businesses

- Bank loans: Once you have solid financial records

Maintaining Bootstrap Mindset:

- Track every rupee spent, question every expense

- Build organically rather than acquiring growth

- Focus on profitability over revenue growth

- Maintain direct customer relationships despite scale

Resource Directory & Vendor List

Legal Services:

- LegalWiz: ₹4,000-₹6,000 for company registration

- IndiaFilings: ₹3,500-₹5,500 for complete setup

- Local CAs: ₹2,000-₹4,000 for ongoing compliance

Technology Vendors:

- Website: WordPress themes ₹2,000-₹5,000

- Hosting: Bluehost ₹3,000-₹5,000 annually

- Email: Zoho Mail ₹1,200 annually

- Accounting: Zoho Books ₹1,500 annually

Marketing Resources:

- Social media management: ₹5,000-₹8,000 monthly for agencies

- Content creation: Freelancers ₹2,000-₹5,000 monthly

- Photography: Local professionals ₹3,000-₹8,000 per session

Government Schemes:

- MUDRA loans: Up to ₹10 lakhs without collateral

- Startup India: Tax benefits and faster approvals

- State schemes: Vary by location, research local programs

My Network Access:

- Connect with me on LinkedIn for ongoing mentoring insights

- Join local entrepreneur groups in your city

- Attend monthly startup meetups for peer learning

The Philosophy: Why ₹50,000 Startups Are India’s Strength

The real strength of Indian entrepreneurship isn’t in unicorn startups that dominate headlines—it’s in millions of bootstrap entrepreneurs who build sustainable businesses serving real needs with minimal capital and maximum resourcefulness.

My mission through WebVerbal and my mentoring work is democratizing entrepreneurship by showing that business success depends more on understanding customers and solving real problems than on accessing capital and copying global models.

The ₹50,000 startup model represents something deeper: economic democracy where anyone with determination, basic skills, and willingness to learn can build a business regardless of their family background, educational credentials, or network connections.

Every successful ₹50,000 startup creates employment, serves customers, and contributes to economic growth in ways that are more sustainable and socially beneficial than businesses built on speculation and external funding.

The Challenge: Start today with what you have, not what you wish you had. Perfect your offering through real customer feedback, not theoretical planning. Build relationships before transactions, systems before scale, and profitability before growth.

Community Invitation: Join the bootstrap entrepreneur movement by connecting with others who believe in building real businesses through real value creation. Share your journey, learn from others, and contribute to the ecosystem that’s making entrepreneurship accessible to millions of Indians.

The future belongs to entrepreneurs who can create value with constraints, not those who need perfect conditions to succeed. Your ₹50,000 startup journey starts with the decision to begin, not with the perfect plan.

Frequently Asked Questions (FAQ)

Is ₹50,000 enough to start a profitable business in India?

Yes. In Bharat’s real market conditions, ₹50,000 is not just enough — it is often the optimal starting capital. It forces disciplined spending, quick validation, and customer-driven execution. Thousands of bootstrapped founders across Tier 2/3 India routinely build e-commerce, service, digital, and manufacturing businesses within this budget. The key is starting small, validating fast, and scaling only after revenue begins.

What are the most realistic ₹50,000 business ideas for Tier 2/3 India?

The most viable low-capital ideas include local e-commerce (regional snacks, handmade goods), digital services (content, design, social media management), micro-manufacturing (handicrafts, food products), and skill-based services (training, repair, beauty, consulting). These models have low overheads, fast payback periods, and strong local demand — ideal for Bharat’s fast-growing consumer segments.

How should a beginner allocate ₹50,000 when launching a startup?

A founder-tested allocation strategy is:

• Legal & compliance: ₹8,000–₹12,000

• Technology & tools: ₹15,000–₹20,000

• Marketing launch: ₹12,000–₹15,000

• Working capital: ₹15,000–₹20,000

This split ensures you spend on what actually generates revenue — legal setup, digital presence, customer acquisition, and initial inventory/service delivery.

How long does it take for a ₹50,000 startup to become profitable?

Service-based ideas can become profitable within 60–90 days, while product-based businesses take 3–6 months depending on inventory cycles. Profitability depends on clear customer targeting, strong unit economics, fast feedback loops, and disciplined marketing. Most successful bootstrapped founders hit ₹25,000–₹40,000 monthly revenue within 90 days using this approach.

What is the biggest mistake first-time founders make when starting with ₹50,000?

The three most costly errors are overspending on technology, delaying sales in the name of perfection, and building products without validating demand. In Bharat’s markets, customer conversations, quick prototypes, and direct selling matter far more than polished websites or branding. Revenue-first execution beats planning-heavy approaches every time.

Ready to build your ₹50,000 startup? The playbook is complete, the resources are listed, and the community is waiting. The only thing missing is your decision to start. Connect with me to join entrepreneurs who are building the future of Indian commerce, one bootstrap startup at a time.