Table Of Content

The wire transfer hits the company bank account. The press release goes out. LinkedIn and Twitter light up with congratulations. For a glorious 48 hours, you and your team are on top of the world. You’ve validated your idea, convinced smart investors, and secured the fuel to build your dream.

Then, Monday morning arrives. The confetti settles. You stare at the dashboard, and a single, terrifying thought creeps in:

“Oh no. Now we actually have to do this.”

You are not alone. This moment of panic is one of the most common yet least discussed experiences for founders. The pressure to perform, to justify the valuation, and to suddenly become a “real” company is immense.

This isn’t a guide to celebration; it’s a playbook for what comes next. Here’s how to navigate the scary reality after the funding high wears off.

1. The First 30 Days: From Celebration to Orchestration

Do not start hiring immediately. Do not blow your budget on a fancy office. The first month is for planning and preservation.

- Secure the Runway: Your first duty is to that cash. Move it to a secure account. Set up stringent financial controls. If you don’t have a CFO, appoint a financially savvy founder to manage burn rate like a hawk. Your bank balance is now your most important KPI.

- Align with Your Board: Schedule a formal post-funding board meeting. The goal is to align on the Key Performance Indicators (KPIs) you promised to hit with this funding. Is it Monthly Recurring Revenue (MRR), customer acquisition, or product development? Get it in writing. Clarity now prevents conflict later.

- Revisit Your Cap Table: Ensure all legal formalities are completed, and all promised equity to employees and advisors is duly allocated. Use a reliable cap table management tool like Carta (outbound link) to avoid future disasters.

2. The Hiring Trap: Scaling Too Fast, Too Soon

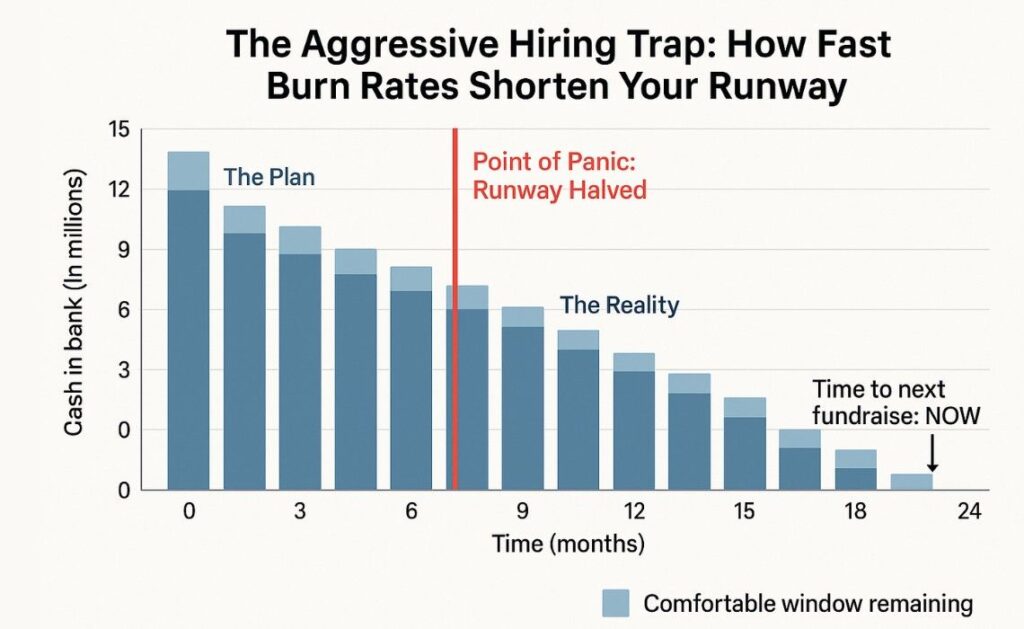

The biggest post-funding mistake is hiring 10 people in 10 days. Bad hires will sink your culture and burn cash faster than anything else.

- Hire for Execution, Not Just Ideas: Your first post-funding hires should be doers, not strategists. Prioritize roles that directly impact your core goals—a rock-solid senior engineer to build the product, or a growth marketer to own customer acquisition.

- Culture is Your Immune System: As you grow, your startup culture will be tested. Document your core values now. Hire people who not only have the skills but also genuinely believe in your mission.

3. The Burn Rate Paradox: Money in the Bank ≠ Money to Burn

A large bank balance creates a false sense of security. The market doesn’t care how much you raised; it cares about your path to profitability.

- Model Your Burn: Create a detailed financial model that projects your cash flow for the next 18-24 months. Plan for worst-case scenarios. As a rule of thumb, always assume it will take twice as long and cost twice as much to achieve your goals than you initially think.

- Spend on What Multiplies Growth: Invest in assets and channels that have a multiplier effect. This could be a key product feature that reduces churn, a content engine that builds organic traffic, or a sales hire that can directly generate revenue. Avoid vanity expenses.

4. Managing Investor Expectations: Your New Full-Time Job

Your investors are your partners, but they are also your bosses. Proactive, transparent communication is non-negotiable.

- Set the Rhythm: Establish a regular reporting cadence (e.g., monthly investor updates). Don’t just share good news; be brutally honest about challenges. Investors hate surprises. A problem shared is a problem they can often help you solve.

- Leverage Their Network: Your investors didn’t just give you money; they gave you their Rolodex. Ask for introductions to potential customers, key hires, or follow-on investors. The best founders treat their VC’s [venture capital firm] as a resource, not just a bank.

5. The Founder’s Mind: Don’t Lose the Plot

The pressure to transform into a “CEO” overnight can make you forget what got you here: building a product people love.

- Stay Connected to the Customer: Block time in your calendar to stay directly involved with customer support, sales calls, and user feedback. This is your grounding wire. It ensures the company doesn’t drift into building what investors want instead of what customers need.

- Your Mental Health is a Company Asset: The weight of responsibility is crushing. Founder burnout is a real and present danger. As we discussed in the silent mental health crisis among Indian founders, prioritizing your well-being is not a luxury; it’s a strategic necessity.

The Bottom Line: It’s Time to Execute

The funding round wasn’t the finish line; it was the starting gun. The celebration was for potential. The work that comes next is about proving it.

Embrace the fear. Channel it into focused, disciplined execution. You convinced people to believe in you. Now, go show them they were right.