Table Of Content

- How Indian Payment Gateways Fees Work

- Typical Fee Structure

- Example: How Fees Eat Into a Sale

- Hidden Costs in Indian Payment Gateways Fees You Never See

- Refunds = Double Fees

- Settlement Delays Cost Money

- Chargebacks and Dispute Fees

- Currency Conversion Costs

- GST on Fees

- How Indian Payment Gateways Fees Impact E-commerce Margins

- Real Founder Experience

- Comparing Indian Payment Gateways Fees: Razorpay vs Cashfree vs PayU

- How to Reduce Indian Payment Gateways Fees and Protect Your Margins

- 1. Negotiate Rates

- 2. Encourage UPI Payments

- 3. Avoid Instant Settlements Unless Necessary

- 4. Minimize Refunds

- 5. Shop Around

- Conclusion

- FAQs About Indian Payment Gateways Fees

- Are Indian payment gateways fees mandatory?

- Which payment gateway is cheapest in India?

- Is UPI completely free for merchants?

- Can I avoid hidden payment gateway fees entirely?

- Do I need GST for Indian payment gateways fees?

“Margins in e-commerce are already razor-thin. Indian payment gateways fees can quietly slice off whatever profits you have left.”

As an Indian e-commerce founder, you’re probably laser-focused on marketing, product sourcing, and operations. But there’s one silent cost killer few talk about: Indian payment gateways fees.

These charges might look tiny on paper—but they’re quietly eating into your margins, order after order.

In this guide, I’ll show you:

- Exactly how Indian payment gateways fees work

- Hidden charges you might be missing

- The true cost impact on small businesses

- Smart ways to protect your profits in 2025

Because I’ve lived it. And I don’t want you to bleed profits unknowingly.

How Indian Payment Gateways Fees Work

First, let’s understand what Indian payment gateways fees actually include.

A payment gateway connects your website or app to banks and card networks to process customer payments. It’s like the middleman who verifies and transfers money from your customer to your account.

But this middleman never works for free.

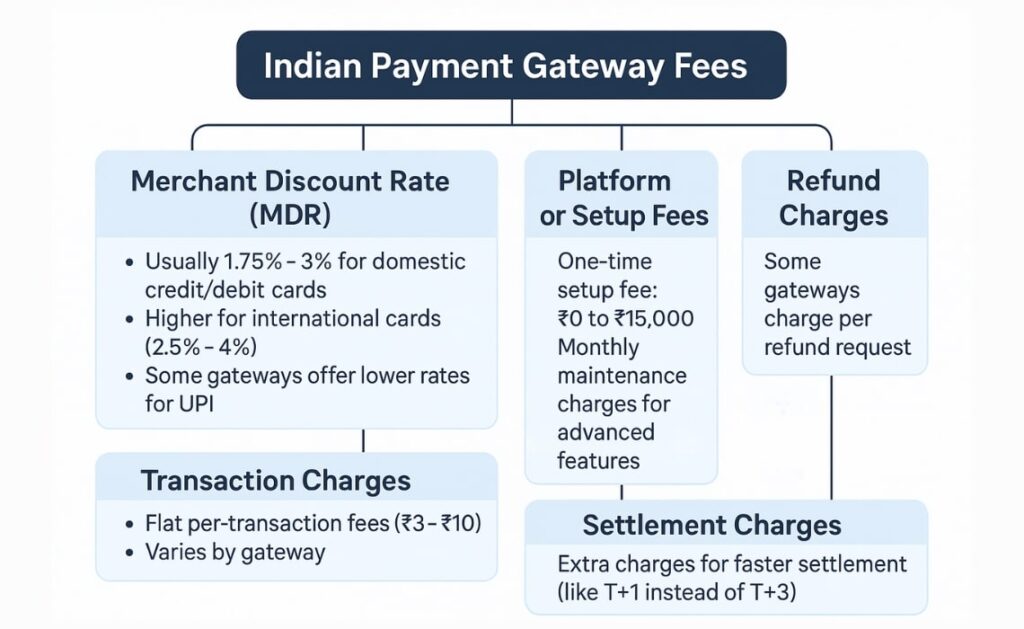

Typical Fee Structure

Here’s what’s usually included in Indian payment gateways fees:

- Merchant Discount Rate (MDR)

- Usually 1.75% – 3% for domestic credit/debit cards

- Higher for international cards (2.5% – 4%)

- Some gateways offer lower rates for UPI

- Platform or Setup Fees

- One-time setup fee: ₹0 to ₹15,000

- Monthly maintenance charges for advanced features

- Transaction Charges

- Flat per-transaction fees (₹3 – ₹10)

- Varies by gateway

- Refund Charges

- Some gateways charge per refund request

- Settlement Charges

- Extra charges for faster settlement (like T+1 instead of T+3)

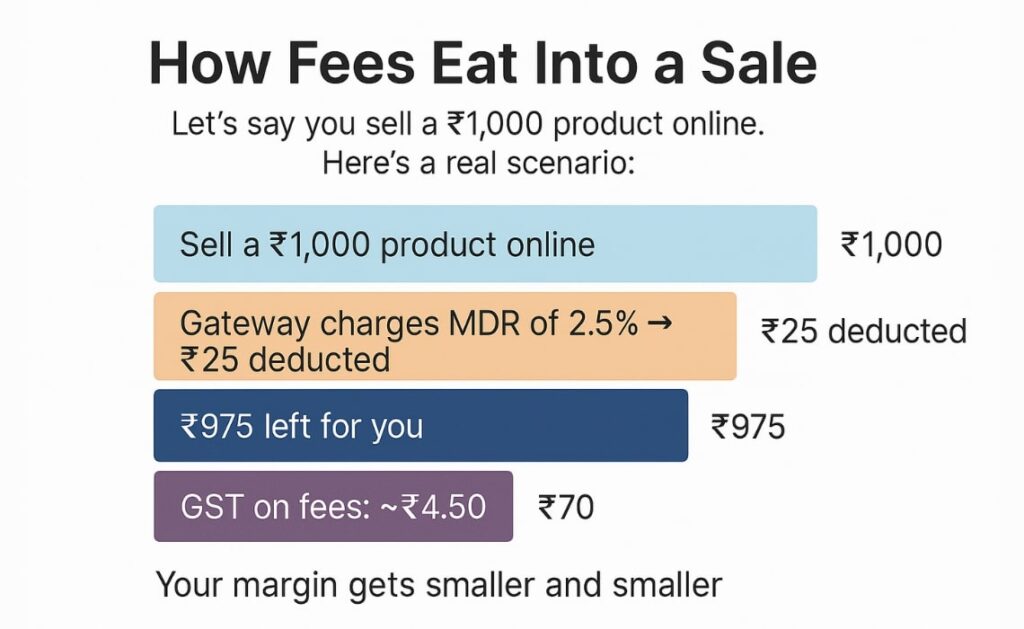

Example: How Fees Eat Into a Sale

Let’s say you sell a ₹1,000 product online. Here’s a real scenario:

- Gateway charges MDR of 2.5% → ₹25 deducted

- ₹975 left for you

- Logistics: ₹70

- GST on fees: ~₹4.50

Your margin gets smaller and smaller.

Hidden Costs in Indian Payment Gateways Fees You Never See

Here’s what most founders miss about Indian payment gateways fees. It’s not just the visible MDR.

Refunds = Double Fees

Every time you refund a customer:

- You lose the original MDR fee

- Some gateways charge you an extra refund fee

Example:

- Original transaction: ₹1,000 → ₹25 fee deducted

- Refund initiated → gateway charges another ₹5

You lose ₹30 for a ₹0 sale.

Settlement Delays Cost Money

Most gateways settle funds in T+2 or T+3 days. Some offer instant settlements—but charge extra.

Example from Razorpay Pricing:

- Standard settlement: T+2 days → ₹0

- Instant settlement: 1% fee charged additionally

Chargebacks and Dispute Fees

A customer can raise a dispute with their bank, even for legitimate transactions. This triggers:

- Investigation fees (₹300 – ₹500 per dispute)

- Money held during investigation

This eats into cash flow and your peace of mind.

Currency Conversion Costs

Selling internationally? Gateways convert currency at:

- Bank exchange rates (not mid-market rates)

- Plus 1% – 3% markup

You pay hidden fees just for the privilege of selling abroad.

See PayU India Pricing for examples.

GST on Fees

Remember: the MDR is not the only cost. You also pay 18% GST on the gateway fees.

So if your MDR is ₹25, you pay an extra ₹4.50 in tax. Small, but it adds up.

How Indian Payment Gateways Fees Impact E-commerce Margins

Let’s see how these fees add up.

Imagine you run a ₹50 lakh/year e-commerce store.

- Average MDR of 2.5% → ₹1,25,000/year in fees

- Refund costs: ₹10,000+

- Faster settlements: ₹15,000+

- GST on fees: ₹24,300

Total annual cost → ₹1.74 lakh or ~3.5% of your gross sales.

In a business where net profit is often only 8-12%, that’s a huge chunk.

Real Founder Experience

When I started, I ignored Indian payment gateways fees.

One month, I refunded ₹2 lakh worth of orders because of logistics delays. I lost over ₹12,000 in pure gateway charges—for sales that never happened.

“You never feel the cut until the refunds and GST bills arrive.”

Comparing Indian Payment Gateways Fees: Razorpay vs Cashfree vs PayU

Let’s compare three popular gateways in India. (Rates as of 2025 — always check their official pages.)

| Gateway | Domestic Cards | UPI | International Cards | Refund Fees | Settlement |

|---|---|---|---|---|---|

| Razorpay | ~2% | 0% – 1% | ~3% | ₹5 – ₹15 | T+2 standard |

| Cashfree | ~2.1% | 0% | ~3.5% | ₹5 – ₹10 | T+2 standard |

| PayU | 1.8% – 2.2% | 0% | ~3% – 4% | Varies | T+2 standard |

How to Reduce Indian Payment Gateways Fees and Protect Your Margins

All hope is not lost. Here’s how smart founders reduce Indian payment gateways fees:

1. Negotiate Rates

If your volume is above ₹5 lakh/month, approach your gateway for custom pricing.

Tell them:

- Your average monthly GMV

- Projected growth

- Why you’re considering switching

2. Encourage UPI Payments

UPI often comes with zero or minimal charges.

Example:

- Razorpay charges 0% – 1% on UPI

- Compare that to 2-3% on cards

3. Avoid Instant Settlements Unless Necessary

Instant settlements can add 1% cost. Unless cash flow is tight, wait for T+2 days.

4. Minimize Refunds

- Improve shipping timelines

- Set realistic delivery promises

- Clear product descriptions

Every refund costs you double fees.

5. Shop Around

Don’t assume the “biggest” gateway is the cheapest. Test:

- Razorpay

- Cashfree

- PayU

- CCAvenue

Even a 0.5% reduction in MDR can save lakhs annually.

Conclusion

Margins in e-commerce are tight. Indian payment gateways fees can quietly erode profits if you’re not vigilant.

Don’t just check the MDR. Dig deeper into:

- Refund charges

- Settlement fees

- GST on gateway costs

- Hidden markups

I learned the hard way that small percentages add up to big money over time.

Remember:

“Revenue is vanity. Margins keep you alive.”

FAQs About Indian Payment Gateways Fees

Are Indian payment gateways fees mandatory?

Yes. Every payment gateway charges some MDR or transaction fees for processing online payments.

Which payment gateway is cheapest in India?

No single gateway is “the cheapest.” Rates vary by:

- Volume

- Payment method

- Negotiations

Always compare multiple providers.

Is UPI completely free for merchants?

Some gateways charge 0%, while others charge up to 1%. It’s cheaper than card payments but check your gateway’s terms.

Can I avoid hidden payment gateway fees entirely?

You can reduce them—but not eliminate them. The best approach is:

- Negotiate lower rates

- Reduce refunds

- Choose cost-effective gateways

Do I need GST for Indian payment gateways fees?

Yes. Payment gateway fees are subject to 18% GST, which you can claim as input tax credit if registered under GST.