Table Of Content

- The Rise of Quick Commerce in India 2025

- Market Size and Growth of Quick Commerce in India 2025

- Growth Drivers

- Category Focus

- Table: Quick Commerce Market Estimates (India)

- Market Share Snapshot (2025 Estimates)

- Blinkit — Scale, GOV, and a Path to Break-Even

- Zepto — The Speed-First Challenger Rebalancing Economics

- Swiggy Instamart — Logistical Leverage and Cross-Sell

- Unit Economics — Why 10-Minute Is Expensive

- What This Means for Founders and Investors

- Short, Actionable Checklist for Leadership Teams

- Average Order Value vs. Delivery Cost

- Cost Structure Breakdown

- How Players Are Responding

- Sustainability Levers

- Gen Z and Millennials Driving Demand

- The Rise of the “Convenience Economy”

- Tier 2 and Tier 3 Cities: The New Frontier

- Behavioral Challenges for Quick Commerce

- Key Takeaway

- Profitability Pressures

- Regulatory and Operational Hurdles

- Customer Loyalty Challenges

- Risk Matrix: Quick Commerce in India 2025

- Key Takeaway

- Tier 2 and Tier 3 Expansion

- AI, Automation, and Predictive Commerce

- Industry Consolidation

- Global Exportability of the Model

- Trend Forecast: Quick Commerce 2025–2030

- Key Takeaway

- FAQs

- What is quick commerce in India 2025?

- How big is the quick commerce market in India in 2025?

- Which companies dominate quick commerce in India?

- What challenges does quick commerce face in India?

- Is quick commerce in India profitable?

- What is the future of quick commerce in India beyond 2025?

- About Webverbal Research

The Rise of Quick Commerce in India 2025

Quick commerce in India 2025 has moved far beyond its early days as a bold experiment. What began as a promise of “10-minute delivery” has now become a defining pillar of urban retail. Platforms like Blinkit, Zepto, and Swiggy Instamart have rewritten consumer expectations, reshaping how Indians shop for groceries, daily essentials, and impulse purchases. Convenience is no longer a luxury — it is the baseline.

The numbers underline this transformation. India’s quick commerce sector is projected to cross USD 5.5–6 billion in 2025, powered by a surge in smartphone penetration, UPI-driven digital payments, and the rise of the “convenience economy.” Consumers who once planned weekly shopping lists now expect fresh produce, snacks, or toiletries to be delivered in minutes. For a generation accustomed to instant entertainment and digital gratification, waiting even a few hours for essentials feels outdated.

But behind the speed lies a deeper question: is this model sustainable in the long run? Quick commerce has been fueled by massive venture capital inflows and aggressive discounting strategies. Yet, the underlying economics remain fragile. Logistics costs, dark store overheads, and wafer-thin margins are persistent challenges. While demand is undeniable, the path to profitability remains uncertain.

In this report, we examine the state of quick commerce in India in 2025, breaking down its market dynamics, consumer behavior shifts, competitive landscape, and future outlook. We analyze how Blinkit, Zepto, and Swiggy Instamart are battling for dominance, why Tier 2 and Tier 3 cities will be the next growth frontier, and whether the industry can find a balance between speed, scale, and sustainability.

Quick commerce is no longer a side story in India’s e-commerce narrative — it is the frontline where consumer loyalty, logistics innovation, and business endurance are being tested.

Market Size and Growth of Quick Commerce in India 2025

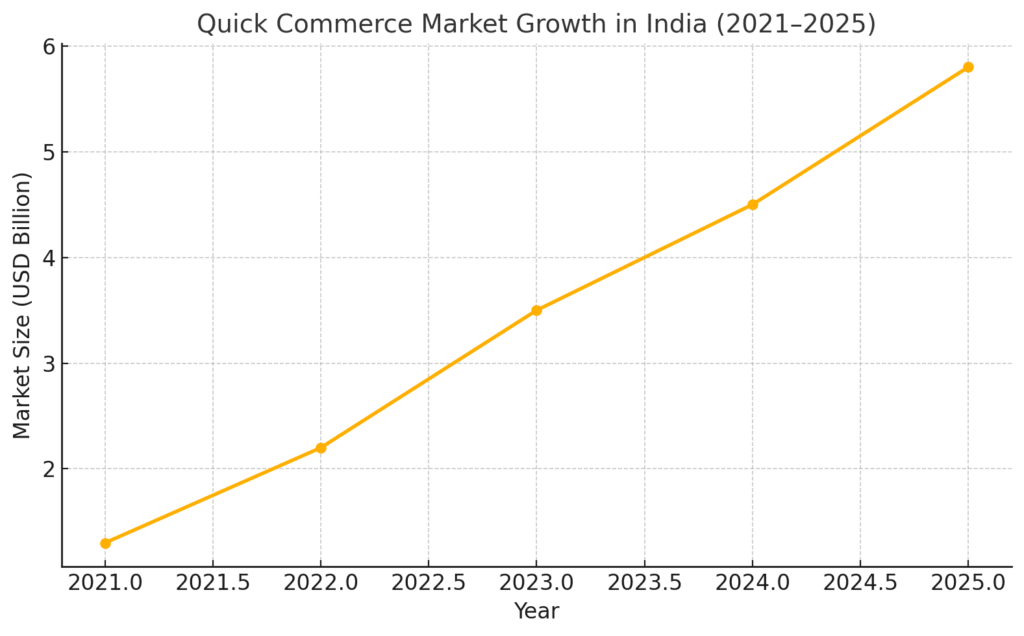

The scale of quick commerce in India 2025 reflects both consumer adoption and the aggressive expansion strategies of leading players. According to industry estimates, the sector has surged from USD 1.3 billion in 2021 to nearly USD 5.8 billion in 2025, growing at a compounded annual growth rate (CAGR) of over 40%. This makes India one of the fastest-growing quick commerce markets globally.

Source: Webverbal analysis, supported by Statista smartphone penetration data

Growth Drivers

Several factors have converged to fuel this exponential rise:

- Smartphone Penetration: India’s smartphone base is projected to cross 700 million users by 2025, creating a mobile-first consumer base.

- Digital Payments (UPI): UPI continues to dominate digital transactions, accounting for more than 83% of all online payments in 2024 (RBI Digital Payments Data). This frictionless payment system has been a backbone for quick commerce adoption.

- The Convenience Economy: Urban consumers, especially millennials and Gen Z, prefer the instant gratification offered by Blinkit, Zepto, and Swiggy Instamart.

- Tier 2 & Tier 3 Expansion: Smaller cities are driving the next wave of growth. Our recent report on The Complete State of E-commerce in India 2025 shows that Bharat shoppers now account for 65% of new online demand, and quick commerce is no exception.

Category Focus

A large portion of orders in India’s quick commerce ecosystem still comes from groceries, FMCG products, and personal care essentials. Unlike traditional e-commerce baskets that leaned towards discretionary categories, q-commerce thrives on high-frequency, low-ticket orders. For a deeper understanding of how delivery timeframes shape consumer trust, see our Blinkit 10-Minute Delivery: Hype or Smart? analysis in the Pulse section of Webverbal.

Table: Quick Commerce Market Estimates (India)

| Year | Market Size (USD Billion) | YoY Growth % | Key Driver |

|---|---|---|---|

| 2021 | 1.3 | – | Pilot launches in metros |

| 2022 | 2.2 | +69% | Smartphone adoption, UPI surge |

| 2023 | 3.5 | +59% | VC funding, aggressive discounts |

| 2024 | 4.5 | +28% | Q-commerce adoption in Tier 2 cities |

| 2025 | 5.8 | +29% | FMCG partnerships, AI logistics |

Key Players Dominating Quick Commerce in 2025

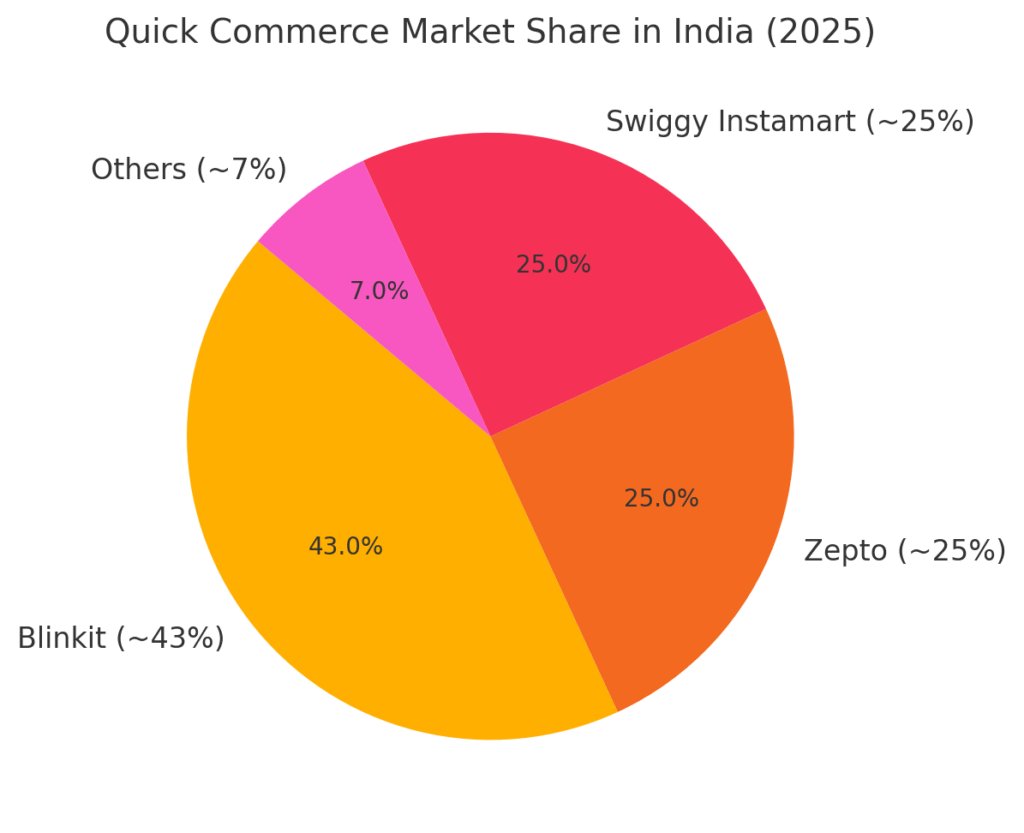

The quick-commerce battleground in India has consolidated around three visible leaders: Blinkit, Zepto, and Swiggy Instamart. Each player follows a distinct playbook—Blinkit leverages scale and supply partnerships, Zepto rode aggressive VC-fueled expansion and speed positioning, and Swiggy has leaned on its food-delivery logistics to scale Instamart rapidly. Recent market-tracking shows Blinkit leading in share, with Zepto and Instamart fighting for the next spots as players refocus on unit economics and geographic expansion. (Sources: market research reports, industry trackers.)

Market Share Snapshot (2025 Estimates)

| Player | Approx. Market Share (2025) | Notes |

|---|---|---|

| Blinkit | ~40–46% | Market leader; improving DAUs and GOV |

| Zepto | ~20–30% | Strong metro presence earlier; growth slowed in 2025 as focus shifts to unit economics |

| Swiggy Instamart | ~20–27% | Rapidly growing after deeper integration with Swiggy; overtook Zepto in some recent slices |

| Others (Dunzo, BigBasket Now, local players) | Remainder | Niche/local presences, opportunistic pockets |

Tip: Insert a pie chart here showing the 2025 market-share breakdown.

Blinkit — Scale, GOV, and a Path to Break-Even

Blinkit’s advantage in 2025 is scale. It reports materially higher Gross Order Value (GOV) and daily active users versus most rivals, and analysts are increasingly optimistic about break-even timelines. Large GOV lets Blinkit negotiate better vendor terms and experiment with margin-enhancing partnerships with FMCG brands. That said, scale alone does not eliminate last-mile cost pressure; Blinkit’s path to sustainable profitability depends on raising average order value (AOV), improving fulfillment density, and tighter inventory turns.

Key levers: vendor co-funded promotions, micro-fulfillment density optimization, subscription plans for frequent buyers.

Zepto — The Speed-First Challenger Rebalancing Economics

Zepto built the 10-minute promise into a brand and scaled quickly with heavy VC backing. By 2024–early 2025 Zepto posted rapid revenue growth, but the company has signaled a shift toward improving unit economics and deferring IPO plans amid margin pressures. Expect Zepto to tighten fulfillment footprints, reduce discounting, and push for higher AOV through bundles and private-label assortments.

Key levers: increase AOV via bundles & private labels, selective metro concentration, deeper FMCG co-marketing.

Swiggy Instamart — Logistical Leverage and Cross-Sell

Swiggy’s Instamart benefits from embedding quick commerce inside a dominant delivery network used daily for food. This gives Instamart a clear cross-sell advantage and access to an existing rider base and geographic density. Recent data shows Instamart’s share growing rapidly and in some periods overtaking Zepto in key urban markets. The strategic prize for Instamart is converting food-delivery frequency into recurring quick-commerce purchase behavior while managing the incremental cost of grocery fulfillment.

Key levers: cross-product promotions (food + grocery), shared rider routing, loyalty programs within Swiggy’s ecosystem.

Unit Economics — Why 10-Minute Is Expensive

The underlying economics remain the central industry tension: low AOVs, high fulfillment density needs, rider payouts, and dark store capex create a razor-thin margin structure. Investors are now demanding clearer paths to EBITDA breakeven rather than raw growth metrics. Some companies are reporting improved unit economics through smarter batching, dynamic pricing, and localized assortments — but these are incremental gains, not a full cure.

Tip: Insert a bar chart here comparing AOV vs. delivery cost for Blinkit, Zepto, and Instamart.

What This Means for Founders and Investors

- Winners will balance speed with yield. The brand that protects speed as a differentiator but stops subsidizing orders indefinitely will be the long-term winner.

- FMCG partnerships matter. Private labels, brand co-funded promotions, and guaranteed assortment deals materially improve AOV and margin share. For more, see our in-depth analysis: The Complete State of E-commerce in India 2025.

- Geographic strategy is crucial. Metro density favors ultra-fast promises; Tier-2/3 expansion requires relaxed SLAs (30–60 minutes) or hybrid models to be profitable.

- Tech and routing will be the operational moat. AI route optimization, predictive replenishment, and demand forecasting are the multipliers to reduce per-order delivery costs.

Short, Actionable Checklist for Leadership Teams

- Map 30-minute vs. 10-minute markets and adjust SLAs by micro-economics.

- Launch AOV-increasing bundles and subscription products within 90 days.

- Negotiate margin sharing with top 20 FMCG SKUs that drive frequency.

- Pilot shared-rider models across food and q-commerce to improve utilization.

The Economics of Quick Commerce in India

The most pressing question around quick commerce in India 2025 isn’t demand — that’s already proven. It’s unit economics. Blinkit, Zepto, and Swiggy Instamart all face the same challenge: how to make ultra-fast delivery profitable when average order values (AOVs) remain relatively low while logistics costs are stubbornly high.

Average Order Value vs. Delivery Cost

Despite strong consumer demand, the AOV for quick commerce orders in India typically ranges between ₹350–₹450. Delivery costs, however, often remain in the ₹100–₹120 per order range, creating a structural gap.

Source: Webverbal analysis. See also NASSCOM reports on Q-commerce for industry cost breakdowns.

This chart illustrates why profitability is elusive: unless AOVs rise or costs fall, the path to break-even is narrow.

Cost Structure Breakdown

| Cost Component | Share of Total Cost | Notes |

|---|---|---|

| Rider payouts & logistics | 40–45% | Payouts and last-mile costs form the largest expense. |

| Dark store operations | 20–25% | Rent, staffing, and inventory management. |

| Marketing & discounts | 15–20% | Subsidies to acquire and retain customers. |

| Technology & routing | 10–12% | AI-driven optimization, app operations. |

| Other overheads | 5–8% | Admin, compliance, misc. costs. |

Tip: Insert a stacked bar chart here showing cost structure percentages.

How Players Are Responding

- Blinkit: Leveraging scale to negotiate better FMCG terms and pushing subscription models to raise AOV.

- Zepto: Reducing discount intensity and experimenting with bundled offers (snacks + beverages, household kits).

- Swiggy Instamart: Using its cross-sell advantage with food delivery to share rider costs and improve utilization.

For a deeper consumer angle, see our Blinkit 10-Minute Delivery: Hype or Smart? article in Webverbal’s Pulse section, which examines how delivery speed shapes brand loyalty.

Sustainability Levers

To close the profitability gap, quick commerce companies are experimenting with:

- Private labels: FMCG-inspired store brands that improve margins.

- Predictive stocking: Using AI to forecast orders and reduce wastage.

- Batching deliveries: More orders per rider per trip.

- Tiered SLAs: Offering both “10-min express” and “30–60 min standard” to optimize cost per delivery.

The industry has seen this trajectory before — e-commerce in India went through a long period of cash burn before reaching operational discipline. The difference in 2025 is that investors are more cautious. They are demanding profitability sooner, not later.

For context, our broader analysis on The Complete State of E-commerce in India 2025 shows that 500 million digital shoppers are already driving FMCG and retail growth — quick commerce is simply the fastest-moving edge of that transformation.

Consumer Behavior in Quick Commerce 2025

While logistics and unit economics dominate the business conversation, the true engine of quick commerce in India 2025 is consumer behavior. For millions of Indians, the expectation of instant delivery has already become a default. What began as a novelty is now a habit woven into daily life.

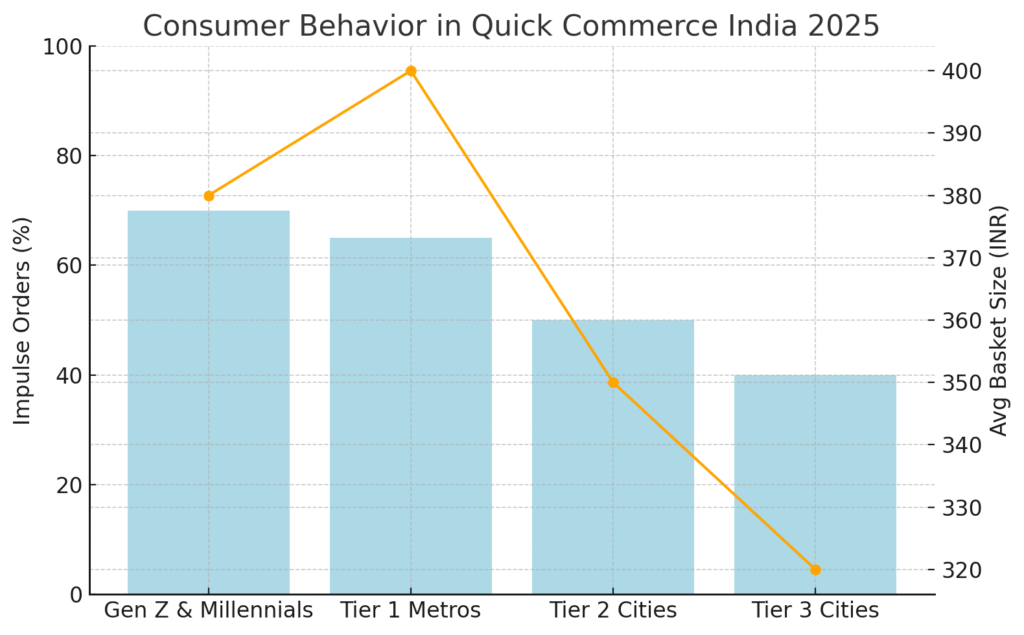

Gen Z and Millennials Driving Demand

Young, urban consumers — especially Gen Z and millennials — are the core adopters of Blinkit, Zepto, and Swiggy Instamart. Raised in a digital-first world, they see little difference between streaming a movie instantly and receiving groceries in 15 minutes. Convenience is not a luxury; it’s an expectation.

- Impulse-driven purchases: Snacks, beverages, and desserts dominate late-night and weekend orders.

- Time-shifting behavior: Instead of weekly stock-ups, consumers now shop daily, even multiple times a day.

- Tech adoption: Voice search and in-app personalization drive higher engagement among younger shoppers.

For more insights into how digital natives are redefining Indian shopping, see our The Complete State of E-commerce in India 2025 report.

The Rise of the “Convenience Economy”

Indian consumers are embracing what can be called a “convenience economy.” Price sensitivity still matters, but value now includes time saved and reliability. A customer may happily pay a small premium for knowing that fresh produce will arrive in under 20 minutes.

This shift challenges the long-standing belief that Indian consumers are purely price-driven. Instead, they are value-sensitive — balancing cost, speed, and quality.

Tier 2 and Tier 3 Cities: The New Frontier

The biggest behavioral shift in quick commerce in India 2025 is happening outside metros. Tier 2 and Tier 3 cities are emerging as growth hotspots:

- Rising disposable incomes: Smaller city consumers now match metro demand patterns.

- Improved logistics penetration: Companies are opening dark stores and local hubs in emerging markets.

- Localized demand: Regional products (snacks, spices, FMCG items) are becoming fast movers.

Our upcoming Bharat-focused analysis shows that 65% of India’s new e-commerce shoppers come from smaller towns. Quick commerce is expanding here, but with slightly longer SLAs (30–45 minutes) to balance costs.

Behavioral Challenges for Quick Commerce

Even as adoption rises, quick commerce faces unique consumer challenges:

- Loyalty is fragile — most shoppers switch apps for discounts or coupons.

- Basket sizes are small — frequency is high, but average ticket values remain modest.

- Sustainability concerns — some urban consumers are questioning the ecological impact of constant 10-minute deliveries.

For a contrarian perspective, revisit our Blinkit 10-Minute Delivery: Hype or Smart? article, which questions whether consumers really need speed at all costs.

Key Takeaway

Consumer behavior in 2025 is proof that quick commerce is not just a passing fad. The blend of digital convenience, urban youth demand, and Bharat’s expanding consumption base ensures it will remain central to India’s e-commerce landscape. The real challenge isn’t whether consumers want it — they clearly do — but whether businesses can serve this demand sustainably.

Challenges Facing Quick Commerce in India (2025)

Even as adoption grows, quick commerce in India 2025 is at a crossroads. Consumers love it, but the underlying challenges remain daunting. For Blinkit, Zepto, and Swiggy Instamart, the next phase of growth is less about speed and more about solving for profitability, regulation, and loyalty.

Profitability Pressures

The economics of quick commerce remain fragile. Thin margins, high logistics costs, and small basket sizes continue to squeeze profitability. Investors who once rewarded growth at all costs are now demanding clearer EBITDA paths.

- Blinkit is working on higher average order values (AOVs) via FMCG partnerships.

- Zepto is reducing discount intensity and tightening fulfillment.

- Swiggy Instamart is leveraging food-delivery density to cross-subsidize grocery deliveries.

(See our earlier section on The Economics of Quick Commerce in India for a detailed cost breakdown.)

Regulatory and Operational Hurdles

Governments and regulators are starting to scrutinize the model:

- Labor laws and rider safety are under review.

- Zoning restrictions on dark stores are becoming a hot-button issue in urban neighborhoods.

- Sustainability concerns around traffic congestion and packaging waste are gaining attention.

Industry groups like NASSCOM and local trade associations are already engaging policymakers to balance growth with compliance.

Customer Loyalty Challenges

Unlike traditional e-commerce, loyalty in quick commerce is fragile. Shoppers switch apps instantly for discounts, coupons, or delivery fee waivers. Loyalty programs and subscription models (such as Blinkit Gold or Swiggy One) are attempts to lock in repeat users.

Still, as highlighted in our Blinkit 10-Minute Delivery: Hype or Smart? article, speed alone cannot guarantee loyalty. Convenience matters, but cost and perceived value drive long-term retention.

Risk Matrix: Quick Commerce in India 2025

| Challenge Area | Risk Level | Impact on Industry | Notes |

|---|---|---|---|

| Profitability Pressures | High | Threatens sustainability if AOVs don’t rise | Requires partnerships, subscription models |

| Logistics & Rider Costs | High | Largest share of expenses | Dependent on density & AI routing |

| Regulatory Scrutiny | Medium | Dark store approvals, labor laws | Need proactive policy engagement |

| Consumer Loyalty | Medium | Switching is easy due to low app stickiness | Loyalty programs are still nascent |

| Sustainability Concerns | Low-Med | Growing awareness in metros | Could affect brand perception long term |

Key Takeaway

Quick commerce has passed the consumer adoption test — but the business model stress test is still underway. The companies that survive will not just deliver in 10 minutes, but also deliver unit economics, regulatory compliance, and durable consumer loyalty.

The Future of Quick Commerce in India Beyond 2025

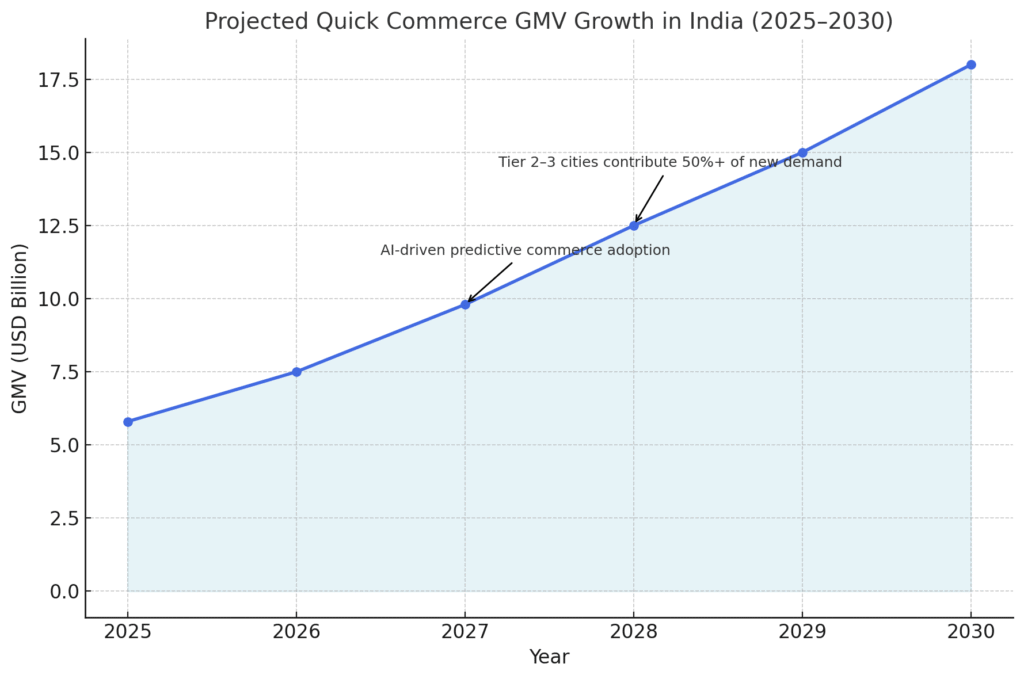

By 2025, quick commerce in India has proven its appeal — but its long-term sustainability will depend on how the sector evolves over the next decade. As the battle for consumer attention matures, several powerful trends will shape the future trajectory.

Tier 2 and Tier 3 Expansion

Metros may have pioneered q-commerce, but Tier 2 and Tier 3 cities are now the growth frontier. Rising disposable incomes, better logistics infrastructure, and a wave of new digital shoppers are reshaping consumption.

- Delivery windows may adjust to 30–45 minutes in smaller towns to optimize costs.

- Regional FMCG brands will become key partners, addressing local tastes.

- This trend mirrors what we explored in The Complete State of E-commerce in India 2025: Bharat is driving the next 500 million digital consumers.

AI, Automation, and Predictive Commerce

The next phase of efficiency will come from AI-driven personalization and automation:

- Predictive commerce: anticipating orders before customers place them.

- AI routing: reducing rider costs through smarter batching.

- Automated dark stores: robotics handling inventory and fulfillment.

This shift echoes broader digital transformation patterns across Indian retail and will determine which players scale profitably.

Industry Consolidation

Not every quick commerce startup will survive. Expect mergers, acquisitions, and partnerships as the industry matures:

- Larger players (e.g., Swiggy, Zomato) could absorb smaller rivals.

- FMCG majors may increase stakes in q-commerce firms to secure direct-to-consumer pipelines.

- Consolidation could reduce discount wars and improve pricing discipline.

Global Exportability of the Model

India’s quick commerce model — combining UPI payments, dense smartphone penetration, and a young consumer base — could become a global case study. Already, NPCI is expanding UPI abroad (RBI & NPCI Global Initiatives), opening doors for Indian-style digital ecosystems to influence other emerging markets.

Trend Forecast: Quick Commerce 2025–2030

| Trend | Likely Outcome by 2030 | Impact |

|---|---|---|

| Tier 2–3 Expansion | 50% of new demand from smaller towns | High |

| AI & Predictive Commerce | Widespread adoption in fulfillment | High |

| Consolidation | 2–3 major national players dominate | Medium |

| Sustainability Integration | Carbon-neutral delivery pilots | Medium |

| Global Influence | Export of Indian q-commerce playbook | Low–Med (early stage) |

Key Takeaway

The future of quick commerce in India lies beyond speed. The players who will dominate the next decade are those who:

- Expand into Bharat strategically with adjusted SLAs.

- Invest in AI and predictive logistics to reduce costs.

- Consolidate intelligently to avoid cash-burn rivalries.

- Integrate sustainability as a brand differentiator.

Quick commerce in 2025 is an inflection point — what comes next will define not just grocery delivery, but India’s broader digital consumption economy.

Conclusion – Can India’s Quick Commerce Sustain the Speed?

In 2025, quick commerce in India has firmly established itself as the fastest-growing arm of the e-commerce industry. Blinkit, Zepto, and Swiggy Instamart have built massive consumer bases, reshaped urban retail habits, and made 10–15 minute delivery an everyday reality. Yet, as this report has shown, the fundamental challenge is not demand but sustainability.

The economics remain fragile — low average order values, high delivery costs, and intense competition have kept profitability elusive. Regulation, customer loyalty, and environmental concerns add further complexity. Consumers clearly want quick commerce, but the industry must learn how to serve that demand without burning endless capital.

Looking ahead to 2030, the winners will be those who master three levers:

- Sustainable Economics: Raising AOV through bundles, private labels, and partnerships, while lowering last-mile costs through AI and predictive logistics.

- Bharat Expansion: Capturing the next 500 million shoppers in Tier 2 and Tier 3 cities with slightly longer delivery SLAs and localized assortments.

- Trust & Loyalty: Building real consumer stickiness through value, convenience, and loyalty programs, not just discounts.

For founders and investors, the message is clear: quick commerce is no longer a race of speed, but of endurance. The question has shifted from “How fast can you deliver?” to “How sustainably can you scale?”

At Webverbal, we believe this industry will not only redefine urban consumption but also reshape India’s digital economy playbook for the world. As our broader E-commerce 2025 analysis shows, India is already the testing ground for new business models that merge technology, convenience, and consumer resilience. Quick commerce is simply the sharpest edge of that story.

The final takeaway: Quick commerce is here to stay. But the companies that thrive will be those who slow down just enough to build sustainable economics, durable consumer trust, and scalable operations. In India’s next chapter of digital retail, speed matters — but sustainability wins.

FAQs

What is quick commerce in India 2025?

Quick commerce in India 2025 refers to hyper-fast delivery models where platforms like Blinkit, Zepto, and Swiggy Instamart fulfill grocery and essential orders within 10–30 minutes, powered by dark stores, AI-driven logistics, and UPI-enabled digital payments.

How big is the quick commerce market in India in 2025?

India’s quick commerce market is projected to reach USD 5.5–6 billion in 2025, making it one of the fastest-growing retail segments globally.

Which companies dominate quick commerce in India?

The market is led by Blinkit, Zepto, and Swiggy Instamart, which together control over 80% of the industry. Smaller players like Dunzo and BigBasket Now serve niche markets.

What challenges does quick commerce face in India?

Key challenges include high logistics costs, low average order values, fragile consumer loyalty, dark store regulations, and long-term sustainability concerns.

Is quick commerce in India profitable?

Profitability is still a challenge in 2025. While demand is strong, low margins and high last-mile costs limit profits. Companies are experimenting with higher AOVs, private labels, and subscription models to improve unit economics.

What is the future of quick commerce in India beyond 2025?

The future will be shaped by Tier 2–3 city expansion, AI-driven predictive commerce, industry consolidation, and sustainability initiatives. By 2030, 2–3 dominant players are expected to control the national market.

About Webverbal Research

Webverbal Research is the editorial and insights division of Webverbal, focused on producing trustworthy, data-driven analysis on India’s startup, e-commerce, and digital economy. Every report and insight published under Webverbal Research is built upon verified data sources, government reports, company filings, and on-ground market intelligence interpreted through a strategic founder’s lens.

Our editorial team combines over a decade of experience in entrepreneurship, digital strategy, and market research, ensuring accuracy, neutrality, and clarity. Each article goes through a multi-layer review process for factual consistency and interpretive integrity before publication.

Editorial Note: This publication reflects independent research and editorial judgment by the Webverbal team. While quantitative insights are based on credible industry data and official disclosures, certain interpretations or forecasts are author-driven estimates intended for informational purposes only.

For corrections, data validation, or research collaborations, please contact hello@webverbal.com.