Table Of Content

- Understanding Social Commerce in India {#understanding-social-commerce}

- What Makes Social Commerce Different

- The Indian Context

- Market Size and Growth Projections {#market-size-growth}

- Current Market Dynamics

- Long-term Projections

- Geographic Distribution

- Leading Social Commerce Platforms {#leading-platforms}

- Meesho: The Market Leader

- Trell: Community-Driven Commerce

- Other Notable Platforms

- Key Trends Driving Growth {#growth-trends}

- Mobile-First Shopping Experience

- Video Commerce Integration

- Vernacular Language Support

- Group Buying and Community Features

- Success Case Studies {#case-studies}

- Meesho’s Rise to Unicorn Status

- Trell’s Community-Centric Approach

- Regional Success Stories

- Consumer Behavior Patterns {#consumer-behavior}

- Discovery and Research Patterns

- Purchase Decision Factors

- Social Sharing Behaviors

- Technology Integration {#technology-integration}

- Artificial Intelligence and Machine Learning

- Augmented Reality and Virtual Try-On

- Blockchain and Digital Payments

- Challenges and Solutions {#challenges-solutions}

- Trust and Authentication Challenges

- Logistics and Delivery Infrastructure

- Quality Control and Counterfeits

- Technology and Infrastructure Limitations

- Future Outlook {#future-outlook}

- Emerging Technologies

- Market Evolution

- Regulatory Environment

- Implementation Strategies {#implementation-strategies}

- Platform Selection Criteria

- Content and Marketing Strategies

- Customer Experience Optimization

- Conclusion

- Frequently Asked Questions

- What are social commerce platforms and how do they differ from traditional e-commerce?

- Which social commerce platforms are most popular in India in 2025?

- What is the market size of social commerce in India?

- How do social commerce platforms make money in India?

- What challenges do social commerce platforms face in India?

- What is the future outlook for social commerce in India?

Social commerce platforms are revolutionizing how Indians shop online, with the market expected to reach incredible heights by 2025. The India social commerce market size valued at USD 7.2 Billion in 2024, is projected to reach USD 54.3 Billion, CAGR of 22.40% during 2025-2033.

This comprehensive guide explores how social commerce platforms are transforming Indian e-commerce, analyzing market trends, leading platforms, and success strategies that are reshaping the digital shopping landscape.

Understanding Social Commerce in India {#understanding-social-commerce}

Social commerce platforms represent a fundamental shift in how Indians discover, evaluate, and purchase products online. Social commerce involves promoting and selling products directly to social media users without them having to leave the website or app. This differs from traditional ecommerce, where transactions occur on a dedicated online store or marketplace website.

What Makes Social Commerce Different

Social commerce platforms integrate shopping experiences directly into social media environments, creating seamless user journeys that combine social interaction with commercial transactions. This approach particularly resonates with Indian consumers who value community recommendations and peer validation in their purchasing decisions.

The Indian social commerce ecosystem leverages familiar social behaviors like sharing, commenting, and group interactions to facilitate product discovery and sales. This model has proven especially effective in reaching first-time internet users and consumers in Tier 2 and Tier 3 cities who may find traditional e-commerce platforms overwhelming.

The Indian Context

India’s unique socioeconomic landscape makes it an ideal market for social commerce platforms. With over 700 million smartphone users and rapidly expanding internet penetration, the country presents massive opportunities for innovative commerce models.

The number of online shoppers in India is projected to reach 350 million by 2025, driven by the youth demographic, improved connectivity, and the proliferation of affordable smartphones. This growth trajectory creates perfect conditions for social commerce platforms to thrive.

The cultural preference for community-driven decision making aligns naturally with social commerce principles. Indian consumers often seek validation from friends, family, and online communities before making purchases, making social commerce platforms an intuitive shopping channel.

Market Size and Growth Projections {#market-size-growth}

The social commerce market in India is experiencing unprecedented growth, driven by increasing smartphone adoption and changing consumer preferences.

Current Market Dynamics

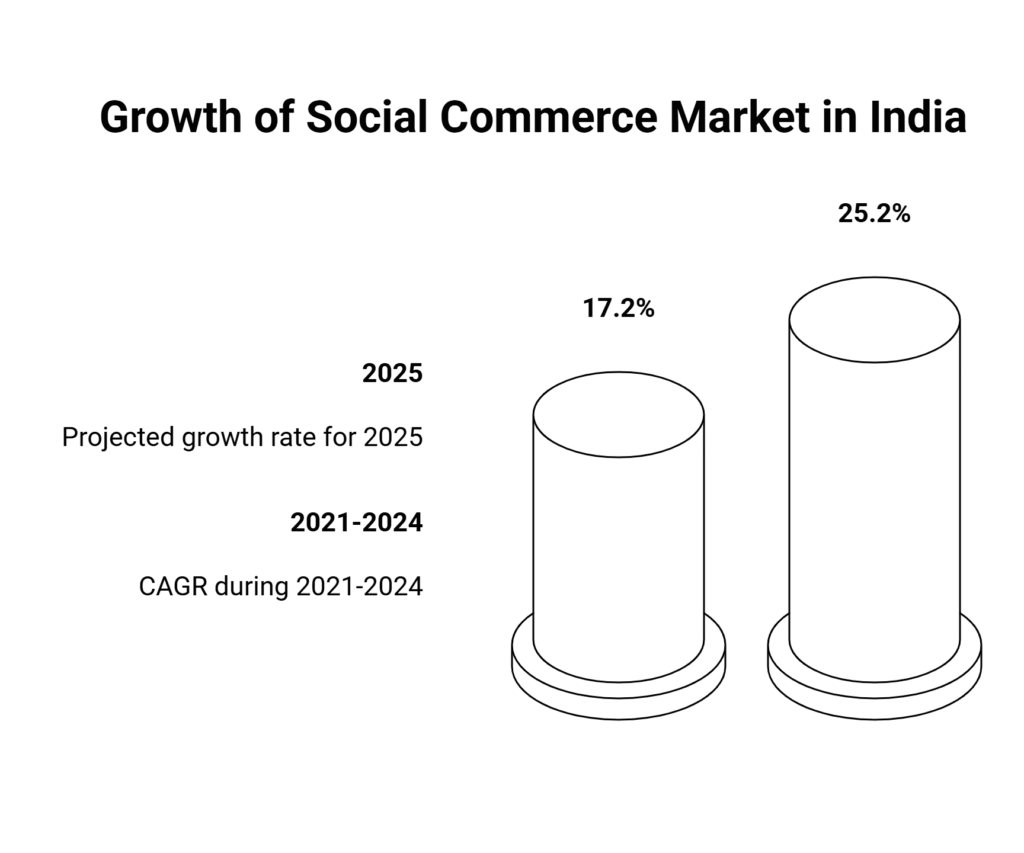

The social commerce market in India is expected to grow by 17.2% on annual basis to reach US$8.42 billion in 2025. The social commerce market in the country experienced robust growth during 2021-2024, achieving a CAGR of 25.2%.

This explosive growth reflects the maturation of digital infrastructure and the increasing comfort of Indian consumers with online transactions. The market’s expansion is supported by:

- Rising disposable incomes across urban and rural areas

- Improved digital payment systems and UPI adoption

- Growing trust in online transactions

- Expansion of vernacular language support

- Enhanced logistics and delivery networks

Long-term Projections

This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 10.3% during 2025-2030. By the end of 2030, the social commerce market is projected to reach $13.76 billion.

These projections indicate that social commerce platforms will become increasingly important components of India’s digital economy. The sustained growth rate suggests that early investments in this sector will yield significant returns.

Geographic Distribution

Social commerce growth is not limited to metropolitan areas. Tier 2 and Tier 3 cities are showing particularly strong adoption rates, driven by:

- Localized content and regional language support

- Community-based selling models

- Lower entry barriers for sellers

- Word-of-mouth marketing effectiveness

- Affordable product categories

For a broader view of the market beyond social commerce, explore our deep dive on E-commerce in Bharat 2025 — opportunities, challenges, and strategies shaping the next decade.

Leading Social Commerce Platforms {#leading-platforms}

Several platforms have emerged as leaders in the Indian social commerce space, each with unique approaches and target markets.

Meesho: The Market Leader

Meesho Private Limited doing business as Meesho (short for Meri Shop, trans. My Shop) is an Indian e-commerce company headquartered in Bengaluru. Founded by Vidit Aatrey and Sanjeev Barnwal in December 2015.

Meesho has established itself as the dominant player in Indian social commerce by focusing on:

- Reseller Network: Enabling individuals to become entrepreneurs by selling products through social media

- Zero Investment Model: Allowing resellers to start businesses without upfront investment

- Wide Product Range: Offering everything from fashion to home appliances

- Vernacular Language Support: Providing interfaces in multiple Indian languages

- Social Integration: Seamless sharing across WhatsApp, Facebook, and Instagram

Trell: Community-Driven Commerce

Influencer-based social commerce platform Trell claims to have grown 10X since last year. It is now targeting to grow 10x in the next 12 months.

Trell differentiates itself through:

- Lifestyle Focus: Concentrating on lifestyle and beauty products

- Influencer Integration: Leveraging micro-influencers for product promotion

- Content-First Approach: Emphasizing visual content and user-generated reviews

- Community Building: Creating interest-based communities around products

- Social Discovery: Enabling product discovery through social feeds

Other Notable Platforms

SimSim (Amazon-owned): Focused on video-based shopping experiences and regional language content.

DealShare: Targets group buying and community-based purchasing decisions.

GlowRoad: Emphasizes women entrepreneurs and fashion-focused social commerce.

BulBul: Focuses on vernacular content and tier 2/3 city penetration.

Key Trends Driving Growth {#growth-trends}

Several trends are propelling the growth of social commerce platforms in India, reshaping consumer behavior and business models.

Mobile-First Shopping Experience

A significant portion of e-commerce transactions in India is conducted through mobile devices, thanks to the widespread adoption of smartphones and mobile internet. Mobile commerce is not just a trend but a fundamental shift in how consumers interact with e-commerce platforms.

Social commerce platforms have capitalized on this mobile-first approach by creating:

- Intuitive mobile interfaces designed for touch interaction

- Quick checkout processes optimized for mobile screens

- Social sharing features integrated into mobile workflows

- Push notifications for personalized offers and updates

- Offline-capable features for areas with poor connectivity

Video Commerce Integration

Video content has become central to social commerce success, with platforms incorporating:

- Live streaming shopping events

- Product demonstration videos

- User-generated video reviews

- Short-form content similar to TikTok

- Interactive video features for real-time engagement

Vernacular Language Support

The expansion into regional languages has opened new markets and demographics:

- Hindi, Tamil, Telugu, Bengali, and other regional language interfaces

- Voice-based navigation for low-literacy users

- Cultural customization of product recommendations

- Regional festival and event-based marketing

- Local influencer partnerships

Group Buying and Community Features

Social commerce platforms are leveraging India’s collectivist culture through:

- Group buying discounts for bulk purchases

- Family and friend referral programs

- Community-based product recommendations

- Social proof through peer reviews and ratings

- Shared wishlist and gift-giving features

Success Case Studies {#case-studies}

Examining successful implementations provides insights into effective social commerce strategies in India.

Meesho’s Rise to Unicorn Status

On April 5, 2021, Meesho, a Bengaluru-based social commerce platform, made headlines by joining the prestigious unicorn club. This achievement came following a successful funding round led by SoftBank Group Corp. of Japan, which raised a substantial US$300 million.

Key Success Factors:

- Empowerment Model: Meesho created opportunities for individuals, particularly women, to become entrepreneurs without significant capital investment.

- Social Media Integration: The platform seamlessly integrated with existing social media behaviors, making it natural for users to share products.

- Trust Building: By enabling resellers to build personal relationships with customers, Meesho created trust networks that traditional e-commerce couldn’t replicate.

- Logistics Innovation: Developed cost-effective logistics solutions for small-scale sellers and buyers in remote areas.

- Technology Simplification: Created simple, intuitive interfaces that didn’t require technical expertise to operate.

Results and Impact:

- Over 100 million transacting users

- 600,000+ sellers on the platform

- Presence in 26,000+ PIN codes across India

- Zero commission model for sellers

- Successful expansion into grocery and electronics categories

Trell’s Community-Centric Approach

Trell’s success demonstrates the power of community-driven social commerce:

Strategy Elements:

- Lifestyle Communities: Built communities around specific interests like beauty, fashion, and home decor.

- Influencer Partnerships: Collaborated with micro-influencers who had authentic connections with their audiences.

- Content Quality: Emphasized high-quality visual content and genuine product reviews.

- User-Generated Content: Encouraged customers to share their experiences and styling tips.

- Social Features: Implemented features like following, liking, and commenting to create social engagement.

Measurable Outcomes:

- 10x growth in user base over one year

- High engagement rates compared to traditional e-commerce

- Strong retention rates due to community involvement

- Successful expansion into new product categories

- Increased average order values through social proof

Regional Success Stories

BulBul’s Vernacular Strategy: BulBul focused on tier 2 and tier 3 cities by providing content in regional languages and partnering with local influencers. This approach resulted in:

- Strong penetration in previously underserved markets

- High customer loyalty due to cultural relevance

- Effective word-of-mouth marketing

- Lower customer acquisition costs

- Sustainable growth in smaller cities

Consumer Behavior Patterns {#consumer-behavior}

Understanding consumer behavior on social commerce platforms reveals important insights for businesses and marketers.

Discovery and Research Patterns

Indian consumers on social commerce platforms exhibit unique behaviors:

Social Discovery: 67% of users discover new products through social feeds rather than active searching. This passive discovery model differs significantly from traditional e-commerce search behavior.

Peer Influence: 78% of users consider reviews and recommendations from their social network as the most trustworthy source of product information.

Visual Preference: 84% of users prefer video content over text descriptions when evaluating products on social commerce platforms.

Purchase Decision Factors

Trust Indicators:

- Personal recommendations from known individuals (89%)

- User-generated content and reviews (76%)

- Video demonstrations and tutorials (71%)

- Social proof through likes and shares (65%)

- Brand authenticity and transparency (58%)

Price Sensitivity: Social commerce users show different price sensitivity patterns:

- More willing to pay premiums for recommended products (34% vs 21% on traditional e-commerce)

- Higher sensitivity to shipping costs and delivery times

- Strong response to group buying discounts and social offers

- Increased loyalty to platforms offering consistent value

Social Sharing Behaviors

Sharing Motivations:

- Helping friends and family (67%)

- Earning referral rewards (54%)

- Building social status through product discovery (43%)

- Contributing to community knowledge (38%)

- Supporting small businesses and individual sellers (29%)

Sharing Channels:

- WhatsApp remains the dominant sharing channel (87%)

- Instagram stories and posts (64%)

- Facebook groups and pages (52%)

- Telegram groups (34%)

- Twitter and other platforms (18%)

Technology Integration {#technology-integration}

Social commerce platforms are leveraging advanced technologies to enhance user experiences and business efficiency.

Artificial Intelligence and Machine Learning

Personalization Engines: AI-driven personalization has become crucial for social commerce success:

- Product recommendation algorithms based on social behavior

- Dynamic pricing based on user preferences and social signals

- Content personalization for different user segments

- Predictive analytics for inventory management

- Automated customer service through chatbots

Social Graph Analysis: Platforms use AI to analyze social connections and behaviors:

- Friend network analysis for recommendation accuracy

- Influence mapping to identify key opinion leaders

- Trend prediction based on social signals

- Community clustering for targeted marketing

- Social commerce fraud detection

Augmented Reality and Virtual Try-On

Implementation Areas:

- Virtual try-on for fashion and accessories

- AR home decoration and furniture placement

- Beauty product simulation and color matching

- Interactive product demonstrations

- Immersive shopping experiences

Business Impact:

- 45% reduction in return rates for AR-enabled products

- 67% increase in conversion rates for virtual try-on features

- Higher customer satisfaction scores

- Reduced customer service inquiries

- Enhanced brand differentiation

Blockchain and Digital Payments

Payment Innovation:

- UPI integration for seamless transactions

- Digital wallet partnerships

- Cryptocurrency payment options (emerging)

- Buy now, pay later (BNPL) integration

- Social payment features for group purchases

Trust and Security:

- Blockchain-based supply chain transparency

- Smart contracts for seller payments

- Decentralized review systems

- Digital identity verification

- Anti-counterfeit product authentication

Challenges and Solutions {#challenges-solutions}

Despite rapid growth, social commerce platforms face several challenges that require innovative solutions.

Trust and Authentication Challenges

Problem: Building trust between buyers and sellers in a largely anonymous digital environment.

Solutions Implemented:

- Seller verification programs with identity checks

- Customer review systems with authenticity filters

- Return and refund guarantee programs

- Social proof mechanisms through network validation

- Transparent seller rating systems

Logistics and Delivery Infrastructure

Problem: Reaching customers in remote areas with cost-effective delivery solutions.

Solutions Developed:

- Hyperlocal delivery networks using local partners

- Hub-and-spoke models for tier 2/3 city coverage

- Cash-on-delivery options for trust building

- Flexible delivery time slots for working customers

- Sustainable packaging initiatives

Quality Control and Counterfeits

Problem: Ensuring product quality and authenticity across diverse seller networks.

Mitigation Strategies:

- Seller onboarding with quality standards

- Regular seller performance monitoring

- Customer feedback integration into seller ratings

- Return and replacement policies

- Partnership with authentic brand suppliers

Technology and Infrastructure Limitations

Problem: Serving users with varying levels of digital literacy and technology access.

Adaptive Solutions:

- Voice-based navigation and commands

- Offline-capable app features

- Low-bandwidth optimized experiences

- Vernacular language support

- Simple, intuitive user interfaces

Future Outlook {#future-outlook}

The future of social commerce in India looks promising, with several trends shaping the next phase of growth.

Emerging Technologies

5G Integration: The rollout of 5G networks will enable:

- High-quality live streaming shopping experiences

- Real-time AR and VR product interactions

- Instant video calls with sellers

- Enhanced mobile app performance

- IoT integration for smart shopping

Voice Commerce: Voice-activated shopping will become more prevalent:

- Integration with smart speakers and voice assistants

- Voice-based product search and recommendations

- Hands-free shopping for busy consumers

- Multilingual voice support

- Voice-enabled customer service

Market Evolution

Consolidation Trends: The market is likely to see consolidation as successful platforms acquire smaller players and expand their capabilities. This will lead to:

- Fewer but more comprehensive platforms

- Enhanced feature sets and user experiences

- Improved logistics and delivery networks

- Standardized seller and buyer protection policies

- Greater integration with traditional retail

Vertical Specialization: Specialized platforms focusing on specific categories will emerge:

- Fashion and lifestyle focused platforms

- Electronics and gadgets marketplaces

- Home and kitchen specialized sites

- Beauty and personal care communities

- Regional product focused platforms

Regulatory Environment

Government Initiatives: Government support for digital commerce will continue:

- Digital India initiatives promoting online commerce

- Startup India program supporting new platforms

- FDI policy clarity for foreign investments

- Consumer protection laws for e-commerce

- Tax policy optimization for digital businesses

Compliance Requirements: Platforms will need to adapt to evolving regulations:

- Data privacy and protection compliance

- Consumer rights and grievance redressal

- Seller registration and tax compliance

- Anti-competitive practice monitoring

- Cross-border transaction regulations

Implementation Strategies {#implementation-strategies}

Businesses looking to succeed in social commerce need comprehensive strategies that address multiple aspects of the ecosystem.

Platform Selection Criteria

For Sellers:

- Target audience alignment with platform demographics

- Commission structure and fee transparency

- Marketing and promotional support availability

- Logistics and fulfillment support quality

- Technical support and seller education programs

For Brands:

- Brand safety and reputation protection measures

- Authenticity verification and anti-counterfeiting support

- Co-marketing opportunities and brand partnership programs

- Data and analytics access for performance tracking

- Integration capabilities with existing systems

Content and Marketing Strategies

Content Creation:

- High-quality product photography and videography

- User-generated content campaigns

- Influencer partnership programs

- Educational and tutorial content development

- Community building and engagement initiatives

Social Media Integration:

- Cross-platform content sharing strategies

- Social media advertising and promotion

- Community management and customer engagement

- Viral marketing and shareability optimization

- Social listening and sentiment monitoring

Customer Experience Optimization

User Journey Design:

- Seamless onboarding and registration processes

- Intuitive product discovery and search functionality

- Simplified checkout and payment processes

- Effective customer support and service

- Post-purchase engagement and retention programs

Personalization Implementation:

- AI-driven product recommendations

- Customized content and offer delivery

- Behavioral tracking and analysis

- Social graph integration for relevant suggestions

- Dynamic pricing and promotional strategies

Conclusion

Social commerce platforms are fundamentally transforming Indian e-commerce by combining the power of social interactions with commercial transactions. The social commerce market in India is expected to grow by 17.2% on annual basis to reach US$8.42 billion in 2025, indicating massive opportunities for businesses and entrepreneurs.

The success of platforms like Meesho, Trell, and others demonstrates that understanding local consumer behavior, leveraging social networks, and providing value to both buyers and sellers are key to success in this market. As technology continues to evolve and consumer preferences shift toward more social and personalized shopping experiences, social commerce will likely become an increasingly important component of India’s digital economy.

Businesses entering this space must focus on building trust, creating authentic community experiences, and leveraging technology to provide seamless user experiences. The future belongs to platforms that can successfully bridge the gap between social interaction and commercial transaction while serving the unique needs of Indian consumers across diverse geographic and demographic segments.

The transformation of Indian e-commerce through social commerce platforms represents not just a business opportunity but a fundamental shift in how commerce operates in the digital age. Success in this space requires understanding that social commerce is not just about selling products—it’s about building communities, fostering relationships, and creating value for all participants in the ecosystem.

Frequently Asked Questions

What are social commerce platforms and how do they differ from traditional e-commerce?

Social commerce platforms integrate shopping experiences directly into social media environments, allowing users to discover, evaluate, and purchase products without leaving their social feeds. Unlike traditional e-commerce where customers visit dedicated websites or apps, social commerce leverages social interactions, peer recommendations, and community-driven purchasing decisions. In India, platforms like Meesho and Trell exemplify this model by enabling resellers to share products through WhatsApp, Instagram, and Facebook, creating trust through personal networks rather than anonymous online stores.

Which social commerce platforms are most popular in India in 2025?

Meesho leads the Indian social commerce market as a unicorn company, focusing on enabling individual resellers to start businesses without upfront investment. Trell has gained significant traction with its lifestyle and beauty-focused community approach, claiming 10x growth year-over-year. Other notable platforms include Amazon-owned SimSim for video-based shopping, DealShare for group buying, GlowRoad for women entrepreneurs, and BulBul targeting vernacular content in tier 2/3 cities. Each platform serves different market segments and demographic preferences.

What is the market size of social commerce in India?

The India social commerce market is valued at USD 7.2 billion in 2024 and is projected to reach USD 54.3 billion by 2033, growing at a CAGR of 22.40%. More specifically, the market is expected to grow by 17.2% annually to reach US$8.42 billion in 2025. This explosive growth is driven by increasing smartphone adoption, expanding internet penetration, and the cultural preference for community-driven purchasing decisions among Indian consumers.

How do social commerce platforms make money in India?

Social commerce platforms in India employ various monetization strategies. Some platforms like Meesho operate on a zero-commission model for sellers, earning revenue through advertising, logistics services, and payment processing fees. Others charge seller commissions ranging from 2-15% depending on the product category. Additional revenue streams include promoted product listings, brand partnership fees, subscription services for premium seller features, and transaction-based charges. Many platforms also offer integrated financial services like lending and insurance.

What challenges do social commerce platforms face in India?

Key challenges include building trust between buyers and unknown sellers, ensuring product quality across diverse seller networks, reaching customers in remote areas cost-effectively, and serving users with varying digital literacy levels. Platforms address these through seller verification programs, customer review systems, hyperlocal delivery networks, cash-on-delivery options, and vernacular language support. Technology challenges include optimizing for low-bandwidth connections and creating simple, intuitive interfaces for first-time internet users.

What is the future outlook for social commerce in India?

The social commerce market in India is projected to reach $13.76 billion by 2030, growing at a CAGR of 10.3% during 2025-2030. Future trends include 5G integration enabling high-quality live streaming shopping, voice commerce adoption, augmented reality features for virtual try-ons, and increased penetration in tier 2/3 cities. The market will likely see consolidation with fewer but more comprehensive platforms, vertical specialization in specific product categories, and enhanced integration with traditional retail channels.